OSC Drilling Case Neg - Open Evidence Project

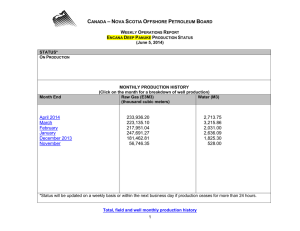

advertisement