ePortfolio

advertisement

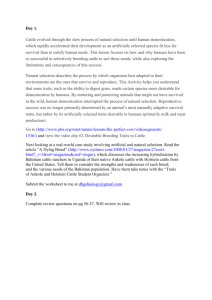

1. “Big Hat, No Cattle” is one of the concepts that was addressed in The Millionaire Next Door. It is a phrase used when people pay for things that are frivolous instead of what they need. They will buy themselves a big hat so that they can become a cattle rancher instead of buying their cattle. This was illustrated by Mr. W. W. Allen who was a self-made millionaire. He was very content to live in his three bedroom house with his wife and only drive full sized General Motor sedans. He said that there was a difference between people who wanted to be financially independent and those who wanted to look wealthy. He wouldn’t give the credit to those who wanted to look wealthy, who wanted the big hat, but no cattle, because he knew that he would never get his money back. “Go-to-hell fund” is another concept that was address in The Millionaire Next Door. This means that people have worked hard and accumulated enough to be able to sustain themselves for more than 10 years without working during those years. Most of those with a net worth of more than $1.6 million can live very comfortably without working for more than 10 years or more if they were saving their earnings properly. This means that they have no more worries for the time being if they continue to live within their means. PAW, AAW, and UAW are terms that are used to show the brackets of wealth that someone is in. PAW stands for Prodigious Accumulator of Wealth, to be a PAW you are in the Upper Class in terms of wealth. AAW stands for Average Accumulator of Wealth, an AAW is what we would call the Middle Class. Where as UAW stands for Under Accumulator of Wealth and would be considered the Lower Class. 2. Reason #1: Teddy was considered a UAW because of how he was constantly spending his money, never saving it, and using his money to just simply impress people, because of how much debt he had he was worth ¼ of what the average person his age should be at. Reason #2: Teddy was convinced that investing was a stupid thing to do. His parents could’ve made over two million dollars if they had put the money they spent on cigarettes into the stock of a tobacco company. That would’ve been putting away small amount at regular increments that could continue to increase exponentially. Reason #3: Teddy does not trust his financial planner. He chose one based on the cheapest fees. That is a foolish thing to do. When it comes to financial planners you get what you pay for, because Teddy chose the cheapest he could find he got one that wouldn’t work very hard to help him. Message from Teddy’s parents was “One earns to spend. When you need to spend more, you need to earn more.” 3. Mr. W.W. Allan would never extend credit to people who exhibited the “Big Hat, No Cattle” philosophy because he believed that they would never be able to pay him back or even really want to. These are people who wanted to earn money to look wealthy but would normally over look the most efficient way to make money. They would buy a big hat instead of investing in their cattle to help make the money. Mr. Allan declined the gift of the Rolls-Royce because he did not feel comfortable with even starting on the track of buying to impress his friends or to keep up with his new Rolls-Royce. While a Rolls-Royce is a very nice car it was not one that he could go to the lake and take fishing. He would not feel comfortable driving it to his manufacturing plant to make others feel that they needed a car like that. He did not want to even tempt himself to want more out of his life. 4. Economic Outpatient Care or EOC is a term that is used for people who are currently receiving financial support from a parent or grandparents to accommodate their lavish lifestyle. James like many other EOC receivers view themselves as “self made”, even though most of their start up money most likely came from parents. In the story of Henry and Josh there was one rule that really stuck out to me. Invest and live frugally. Henry was only a high school teacher, while Josh was an attorney. Henry lived very frugally and invested all of what his parents allocated him in cash gifts. Whereas Josh used every penny of what was allocated him from his parents. He did not think about investing or living frugally. He wanted to fit in with his crowd. This is a very bad mind set to be in financially. You want to be able to be comfortable when you retire and unfortunately Henry who has a much smaller income will have a much better retirement than his brother Josh. Laura succeeded because she had to. There was no other alternative for her. She needed to be able to support her family so she lived frugally and put everything that she could into her work. 5. The two concepts that I found most useful were the proper way to be a PAW, and “Big Hat, No Cattle”. Both of these were really enlightening to me. I had never really thought of it that way. I grew up knowing that you should avoid credit, but how this book put it was so much easier for me to understand and much more helpful than advice from my parents. I plan to use the concept of the proper way to be a PAW by starting to invest money, and living frugally. I want to be like Henry from the story of Henry and Josh. My parents currently do the living frugally to an extent. I sometimes forget how affluent my parents are until I come home from school and there is a huge toy hauler fifth wheeler. My parents do help me with school, and I do not want to end up like Josh. I want to be self-sufficient and never to rely on my parents money after graduation. I want to continue to learn more about investing and I will continue to try to live frugally. The second concept that I want to apply into my life is the reverse of “Big Hat, No Cattle”. I do not want to continue to buy things that I think that I need when I do not have the mean to purpose it or when it would be a detriment to me to purpose it. At this time I do have this problem. Since I am living off of my parents, all of my own money that I earn I can spend however I choose, I am not required to pay rent, gas, or tuition. But I do not have my own credit card. Everything that I buy I know that I can afford it, even when it is not always the most important or useful purchases. This is one that I know that I will have to be wary of my whole life. Reflective Writing: This class has helped me to think critically and to acquire substantive knowledge. I have been very impressed with this course, especially with The Millionaire Next Door is a wonderful book. It makes me wish that it was our textbook for all of the class. This class has been so helpful to me because I know that this is something that I struggle with. I have not had to worry about anything financially because my parents pay for everything, but I want to be financially self-sufficient. This class has helped me to acquire the knowledge that I need and can use to help me become financially self-sufficient quicker. It has also made me think more about my current habits, and what habits I want to change and adopt in the future. It has been a wonderful class for me. I am very excited to be able to put these concepts to use in my future life and to be able to help others to do the same with the information that I have learned.