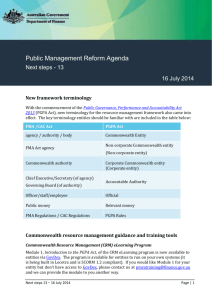

corporate Commonwealth entities

advertisement