ASAP Policy Briefing - Amazon Web Services

advertisement

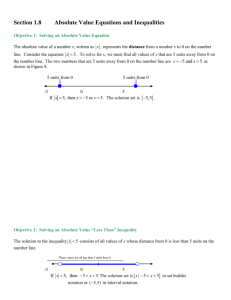

ASAP Policy Briefing LOGO Fair distribution between nations Summary: Recent decades of neoliberal globalization and deregulation of trade and finance have been characterized by an acceleration of global economic inequality. These inequalities create major obstacles to adoption of international environmental agreements, financial stability, democracy and social protection. Breaking the vicious cycles of inequality and these ecological, economic and social crises requires urgent policies to reduce greenhouse gas emissions, reforms of the global economic system and ad-hoc interventions to promote global social protection. Policy changes toward a more sustainable and fair world include a global agreement on climate change on the basis of “equal rights to pollute”, a new global financial architecture emulating the Bretton Woods System, regulations of TNCs, global taxes on carbon, currency speculations, and offshore transactions, and a global social fund to reduce poverty and promote social protection worldwide. The staggering extent of global inequality According to The United Nations University (UNU) and the World Institute for Development Economic Research (WIDER), in 2008 the richest 2% of all adults owned half of global household wealth, while poorest half of the world owned just 1%. In the same year, the Gini coefficient for global wealth inequalities, an index ranging from 0 (lowest value) to 1 (highest value), was estimated at 0.89. This is the value that would obtain in a population of ten people if one person had $1,000 and the other nine had just $1.1 Figure 1 presents data for 180 nations ranked by Gross National Income (GNI) per capita (purchasing power parity in current international $) from the World Bank’s World Development Indicators, 2012. Although some authors have argued that economic globalization reduced economic inequality between countries2 3 4 5 and created a “level playing field”, the shape representing today’s distribution of wealth still resembles a pyramid. Figure 1 The Pyramid of World Wealth Inequalities between 180 Nations ranked by Gross National Income (GNI) per capita PPP (current international $), 2009. Source: World Bank’s World Development Indicators database (2012). [Reprinted from De Vogli R. Progress or Collapse: the Crises of Market Greed. New York and London: Routledge (Taylor & Francis), 2013.] ASAP Policy Briefing LOGO Globalization has increased global inequality Recent decades global deregulation of trade and finance have been characterized by an acceleration of global economic inequalities.6 7 8 Figure 2 shows a temporal trend in global wealth inequality measured as a mean difference in GNI per capita (Atlas method, in current international $) between 88 Nations from 1960-2010. In line with previous evidence, the figure shows that after a stable period in the 1960s, global wealth inequality rapidly increased between 1970 and 2010 during the era of ‘neoliberal’ globalization. Figure 2 Trend in Global Wealth Inequality (Mean Difference in GNI per capita, Atlas method – current international $) between 88 Nations, 1960-2010. Source: World Bank’s World Development Indicators database (2012). [Reprinted from De Vogli R. Progress or Collapse: the Crises of Market Greed. New York and London: Routledge (Taylor & Francis), 2013.] One of the mechanisms explaining the rapid increase of global economic inequality relates to the rise of transnational corporations (TNCs) (mostly based in developed nations) that have accumulated a spectacular amount of wealth in the last few decades. A recent study revealed that 1,318 global companies collectively own, through their shares, the majority of the world’s largest manufacturing firms and blue chip companies, representing about 60% of global revenues. The same study also showed, however, that a “super-entity” of 147 companies, less than 1% of the total, controls about 40% of the entire wealth in the network.9 When considering global financial actors such as hedge funds, private pension funds, mutual funds, investment banks and insurance companies, concentration of wealth reached even more grotesque proportions. In 2010, 6 banks—Bank of America, JP Morgan Chase, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley—controlled about 60% of the US GDP.10 The impact of global inequality A large body of evidence indicates that excessive global inequality creates major obstacles to the adoption of international environmental agreements, financial stability, democracy and social protection (poverty reduction). ASAP Policy Briefing LOGO International environmental agreements Excessive inequalities undermine effective international cooperation for the resolution of global ecological crises,11 12 13 and long-term agreements on climate change because these inequalities erode conditions of generalized trust and promote very different views of “fair” solutions in rich and poor nations.14 15 Financial stability Economic historians have recently recognized that both the 1929 Great Depression and the 2008 Great Recession were preceded by a high concentration of wealth and income at the top of the income distribution in the US.16 IMF economists have recently argued for “restoring the bargaining power of low income groups” as the most effective strategy to prevent future financial meltdowns 17. Democracy Numerous authors have decried the loss of national sovereignty caused by the threat of short-term capital flight ad the destabilizing political effects of too large TNCs and financial powers.18 19 These organizations have acquired the ability to influence political decisions on interest rates, exchange rates, budget deficits, social security and redistributive taxation and can compel national governments to follow “fiscally responsible” policies for fear of “financial retaliation.”20 21 Social protection (poverty reduction) The distributional failures of the current global economic system are perhaps most apparent when we compare endemic poverty and indigence with the wealth of the world’s super rich. While the average pay package of a CEO in the US is about 350 times that of an average worker,22 23 24, about 5.1 billion people (75% of the world population) are not covered by adequate social security (ILO), 2.6 billion people (38% per cent of the global population) do not have access to adequate sanitation and 884 million people lack access to adequate sources of drinking water (UN-HABITAT); 925 million suffer from chronic hunger (FAO) and nearly 9 million children under the age of five die every year from largely preventable diseases (UNICEF/WHO).”25 Reducing global inequality Measures to deal with the threat of climate change provide an opportunity for a new model of globalization and cooperation to both prevent ecological collapse and reduce global economic inequality. We have therefore presented a series of proposals to tackle these problems and redistribute wealth worldwide. Contraction & convergence to tackle climate change Developed nations must lead by example by helping poor countries with new environmental technologies and committing to the principle that each world citizen has an equal entitlement to the atmosphere. “Contraction & convergence” to reduce greenhouse gas emissions enough to ensure “safe and stable” concentrations in the Earth’s atmosphere are strongly needed. Chakravarty and colleagues proposed a new framework for allocating a global carbon reduction target among nations with ASAP Policy Briefing LOGO using each country’s income distribution to estimate how its average greenhouse gas emissions are distributed across its citizens.26 Numerous authors have also proposed a global carbon tax as an alternative – or complementary – solution to address climate change, together with an aggressive pro-poor redistribution scheme that redirected large shares of tax revenues to the extreme poor to address the potentially regressive redistributive effects of a carbon tax.27 A new global financial architecture Numerous writers including John Eatwell and Lancet Taylor28 and institutions such as the UNCTAD”29 advanced a series of regulations and global rules to prevent future financial meltdowns. Several influential commentators have also proposed a new version of the Bretton Woods system designed to promote high employment and reduced vulnerability to crises through laws and regulations against speculation, inequality and excessive capital movement.30 Figure 1 shows that both the 1929 Great Depression and the 2008 Great Recession were anticipated by years of excessive capital flow, and deregulation of financial markets. More importantly, data highlight the extremely low number of banking crises during the period covered by the Bretton Woods System of capital controls, fixed exchange rates and banking regulations.31 Figure 3 From the Great Depression to the Great Recession: Index of Capital Mobility and Number of Banking Crises, 1900-2010. Data sources: Reinhart, CM and Rogoff KS. “Dates for Banking Crises for 70 countries” available at http://www.reinhartandrogoff.com/data/browse-by-topic/topics/7/ and Reinhart CM and Rogoff KS “Banking Crises: An Equal Opportunity Menace” JEL E6, F3, and N0, 2008. [Reprinted from De Vogli R. Progress or Collapse: the Crises of Market Greed. New York and London: Routledge (Taylor & Francis), 2013.] ASAP Policy Briefing LOGO Regulating transnational corporations New global agencies charged with monitoring and regulating the practices of transnational corporate powers, such as the UN Center on Transnational Corporations (UNCTC), are also necessary if we are to protect the public interest and move towards sustainable wellbeing. Numerous authors have also advanced new rules such as the UN Code of Conduct for TNCs (and the revocation of corporate charters and expulsion of a corporation when corporate powers grossly violate public interests) to regulate the abuses of large companies on human rights, workers and the environment.32 33 34 35 36 A global fund for social protection A promising tool for redistributing income and reducing poverty worldwide is the development of a global fund for social protection as proposed by the International Labor Office (ILO), WHO and other multilateral organizations. According to the designers of the fund, the “social protection floor” is “a set of social policies that include guarantees of: a) basic income security, in the form of various social transfers (in cash or in kind) such as pensions for the elderly and persons with disabilities, child benefits, income support benefits and/or employment guarantees and services for the unemployed and working poor; b) universal access to essential affordable services in health, water and sanitation, education, food security, housing, and others defined according to national priorities.25 Global taxation to fund global social protection A key obstacle to the development of a global fund for social protection is often thought to be the difficulty of identifying sources of revenue to support such a fund. Here we propose two major mechanisms to recover public revenues for the fund: global taxes and financial sanctions on tax havens. Jacques Cossart estimated the potential of global taxation of $1,175 billion, a figure fairly close to that of the Landau Report in 2004 which found that the revenue potential of global taxes is $956 billion. Cossart proposed to tax: a) speculative transactions at 0.1%; b) stock exchange transactions at 0.01%; c) profits of TNCs; d) assets; e) carbon emission tax; f) plutonium and g) air transport. Recently, a coalition of civic society organizations that are supported by UNICEF and 350 economists has re-popularized the idea proposed by Tobin in 197238 and called it the Robin Hood Tax, a package of financial transaction taxes on speculative dealings in foreign currencies, shares and other securities of 0.05%. Taxing offshore transactions to fund global social protection Another way of accumulating funds for environmental and social justice programs worldwide would be to recover the taxes unpaid by corporations and wealthy individuals using offshore centers. A congressional study estimated that, in 2000, about 63% of US corporations paid no taxes and 6 out of 10 reported no tax liability throughout the years from 1996 to 2000.42 A recent report by the Tax Justice Network estimated that the global super-rich have between $21 and $32 trillion hidden in tax havens. The author estimated that this amount of unreported wealth would have generated income tax revenues of between $190-280 billion a year. ASAP Policy Briefing LOGO Inspited by Tobin, that proposed that, in order to avoid a shift of transactions to tax havens after the implementation of a financial transactions tax, was necessary to tax activities performed at offshore havens,47 numerous authors proposed actions against offshore havens. Smith and colleagues proposed to discourage the development of tax havens by imposing a punitive tax on transactions between those in tax havens and those outside tax havens.45 Arestis and Sawyer46 also envisaged the possibility of applying transaction taxes at penalty rates to funds that are transferred to or from tax havens. Annex References & bibliography 1. Davies J. Personal Wealth from a Global Perspective. Oxford, UK: Oxford University Press, 2008. 2. Dollar D, Kraay A. Trade, growth, and poverty. The Economic Journal 2002;114(493):F22F49. 3. Wolf M. Doing more harm than good. Financial Times 2002 May 8, 2002. 4. Sala-i-Martin X. The world distribution of income: Falling poverty and…convergence, period. Quarterly Journal of Economics 2006;121(2):351-97. 5. Giddens A. Globalisation: Good or Bad? London School of Economics. London, 2000. 6. Dorling D, Shaw M, Davey-Smith G. Global inequality of life expectancy due to AIDS. BMJ 2006;322:662-64. 7. Birdsall N. The World is not flat: Inequality and Injustice in our Global Economy. WIDER Annual Lecture 2005. Helsinki: World Institute for Development Economics Research. , 2006. 8. Wade RH. Winners and losers: The global distribution of income is becoming more unequal: That should be a matter of greater concern than it is. The Economist. London: The Economist Group, 2001:93-97. 9. Coghlan A, MacKenzie D. Revealed – the capitalist network that runs the world New Scientist. London: Reed Business Information Ltd, 2011. 10. Edsall T. Alan Greenspan: The oracle or the master of disaster? The Huffington Post 2009 March 22, 2009. 11. Baer P, Harte J, Haya B, Herzog A, Holdren J, Hultman N, et al. Equity and greenhouse gas responsibility. Science 2000;289(5488):2287. 12. Huntingford C, Gash J. Climate equity for all Science 2005;309:1789. 13. Athanasiou T, Baer P. Dead Heat: Global Justice and Global Warming. New York: Seven Stories Press, 2002. 14. Roberts J, Parks B. A Climate of Injustice: Global Inequality, North-South Politics and Climate Policy. Cambridge: MIT Press, 2006. 15. Harris P. Fairness, responsibility and climate change. Ethics and International Affairs 2003;17(1):149-56. 16. Philippon T, Resheff A. Wages and human capital in the US financial industry: 1909-2006. NBER Working Paper No. 14644. Cambridge, MA: National Bureau of Economic Research, 2008. 17. Kumhof M, Ranciere R. Inequality, leverage and crises. IMF Working Paper. Washington, DC: International Monetary Fund, Research Department, 2011. ASAP Policy Briefing LOGO 18. Sassen S. Immigration tests the new order. Losing Control? Sovereignty in an Age of Globalization. New York: Columbia University Press, 1996:67-86. 19. Schrecker T. The power of money: Global financial markets, national politics, and social determinants of health. In: Kay A, Williams O, editors. Global Health Governance: Crisis, Institutions and Political Economy Houndmills: Palgrave Macmillan 2009:16081. 20. Gray J. False Dawn: The Delusions of Global Capitalism. London: Granta Books, 1998. 21. Rodrik D. Has Globalization Gone Too Far?: Institute for International Economics, 1997. 22. Frydman C, Saks R. Historical Trends in Executive Compensation, 1936-2003. Working Paper. Boston, MA: Harvard University, 2005. 23. Hacker A. The rich: Who they are; the upper tail. New York Times Magazine. New York: Arthur Ochs Sulzberger, Jr., 1995:70-71. 24. Frydman C, Saks S. Historical Trends in Executive Compensation, 1936-2003. Working Paper. Boston, MA: Harvard University, 2005. 25. Bachelet M. Social Protection Floor For A Fair and Inclusive Globalization. Geneva: International Labour Office (ILO), 2011. 26. Chakrabarty D. The climate of history: Four theses. Critical Inquiry, 2009:221. 27. Davies J, Shi X, Whalley J. The possibilities for global inequality and poverty reduction using revenues from global carbon pricing. Ontario: EPRI Working Paper Series, 2012. 28. Eatwell J, Taylor L. Global Finance at Risk: the Case for International Regulation. New York: The New Press, 2000. 29. UNCTAD. The Global Economic Crisis: Systemic Failures and Multilateral Remedies. New York and Geneva: United Nations Conference on Trade and Development (UNCTAD), 2009. 30. Moss D. An ounce of prevention: Financial regulation, moral hazard and the end of "too big to fail". Harvard Magazine. Cambridge, MA, 2009. 31. Kaminsky C, Reinhart K. Banking crises: An equal opportunity menace. Working Paper 14587. Cambridge, MA: National Bureau of Economic Research, 2008. 32. Sogge D. Give and Take: What's the Matter With Foreign Aid? London: Zed Books, 2002. 33. Danaher K, Mark J. Insurrection: Citizen Challenges to Corporate Power. New York: Routledge, 2003. 34. Speth JG. Red Sky at Morning: America and the Crisis of the Global Environment. New Haven: Yale University Press, 2005. 35. White AL. Transforming the Corporation. GTI Paper Series n°5. Boston: Great Transition Iniative and Tellus Institute, 2006. 36. White AL. Transforming the Corporation. GTI Paper Series n°5. Boston: Great Transition Iniative and Tellus Institute, 2006:7-8. 37. Tobin J. A currency transactions tax, why and how? Open Economies Review 1996;7(1):493-99. 38. O'Grady S. Hundreds of economists call for tax on currency speculation The Independent 2010 Monday, 15 February 2010. 39. Kohonen M, Mestrum F. Introduction. Tax Justice: Putting Global Inequality on the Agenda. London: Pluto Press, 2009:14. 40. Reich R. The Work of Nations. New York: Alfred A Knopf, 1991. ASAP Policy Briefing LOGO 41. Institute on Taxation and Economic Policy. State Corporate Tax Disclosure: Why It's Needed. Policy Brief # 16. Washington, DC: Institute on Taxation and Economic Policy 2005. 42. General Accounting Office. Comparison of the Reported Tax Liabilities of Foreign and USControlled Corporations, 1996-2000: General Accounting Office (GAO), 2004. 43. (The)-Economist. Rupert laid bare. The Economist, 1999. 44. Brittain-Catlin W. Offshore: The Dark Side of the Global Economy. New York: Farrar, Strauss and Giroux, 2005. 45. Smith J. A New Bretton Woods: Reforming the global financial system. In: Michie J, Smith J, editors. Global instability: The political economy of world economic governance. . London: Routledge, 1999. 46. Arestis P, Sawyer M. The Tobin Tax. In: Michie J, Smith J, editors. Global instability: The political economy of world economic governance. London: Routledge, 1999. 47. Tobin J. Adjustment responsibilities of surplus and deficit countries. In: Fellner W, et-al, editors. Maintaining and restoring balance in international payments. Princeton: Princeton University Press, 1966.