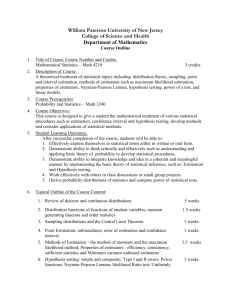

Course description

advertisement

Project Management Essence of project and a design cycle. Problems, functions, methods of management of projects in view of specific characteristics of separate projects. Approaches and methods of management of a team of the project. Kinds, methods and principles of estimation of efficiency in investment projects in conditions of risk and uncertainty. Features of modern information technologies of management of projects. Required texts: 1. Manual to the Arch of knowledge on management of projects. Management Institute. Pennsylvania. The USA, 2004 2. FL « About the investment activity which is carried out investments ». 3. Blank I.A. Investment's form management: training course. 2006. - 552 p. 4. Vilenski P.L., Livshits V.N., Smoljak S.A. « Estimation of projects ».-, business, 2004. – 888p. Methodical recommendations according to efficiency of investment 2000. The third edition. Project in the form of capital К.: Elga-Н, Nika-center, efficiency of investment projects. М.: Economy, Course Outline Total Learning Hours I The project as social and economic system. Life cycle of the 7 project. The basic concepts of project management. Preconditions and prospects of development of project management methods. Classification of projects. Functions, subsystems and controlled parameters of the project. Participants of the investment project. Specificity of polytypic investment project management. The perspective market of investment projects. The business environment of the investment project. The traditional form of project management. The progressive form of project management. The concept of life cycle of the investment project. Phases and stages of the project. Structurization of the project cycle from positions of system approach. Estimation of influence of the environment on the project life cycle duration. The measures taken on the project’s design stage. Pre-investment phase. Investment phase. The phase of operation. The phase of the project liquidation. The factors influencing the life cycle of the project. II Structurization as the tool of project management 9 Issues on the structure of project management. The primary goals of structurization of the project. Algorithmization of the process of project structurization. Special models of investment project structurization: the tree of the purposes; the tree of decisions; the tree of works; organizational structure of executors; the matrix of responsibility distribution; network model; the structure of consumed resources; the structure of expenses. Organizational structures of investment project III IV V realization. The principles of building of organizational structure of project management. Types of organizational structures of project management. Sequence of development and creation of organizational structures of project orientation. Modern methods of designing and the tendencies of development of organizational management structure. Management of the project team. Models of development of the project team. Creation of highly effective teams: situational factors of influence and efficiency estimation. Project meetings as the tool of project team management: rules, procedures, conducting technologies. Formation of the team culture. Motivation of the project team: formation of the encouragement system. Estimation of project efficiency with regard for risk factors and uncertainty. The main problems being solved during the analysis and estimation of investment projects. Initial conditions of project estimation for various economic systems. Principles of investment projects estimation: structural and contextual aspect. The problem of investment projects efficiency estimation. The concept of investment attractiveness of the project. Necessity of calculation of estimation parameters. Provision of calculations with methodical basis. The principal criteria of capital investment efficiency in investment projects of various levels. The basic criteria of profitability of capital investments. Methods of estimation of investment projects commercial effectiveness. The results of commercial estimation of the project, the tasks of commercial estimation, the problems arising at the evaluation stage of commercial effectiveness of the project. The estimation scheme of commercial effectiveness of the project: finding rational opportunities of the investment project in terms of profitability and solvency, the choice of project financing scheme. The main directions of calculation results analysis. The basic criteria of investment efficiency: the method of integral effect or net profit value (NPV), the method of internal return rate (testing discount) or internal revenue rate (IRR), the index of profitability of investments (PI), the method of investment return term (the period of a recoupment). Peculiarities of projects efficiency estimation with regard for risk factors and uncertainty. The essence of investment risks in regional aspect. Types and classification of investment risks. Methods of estimation of risks in investment projects. The analysis of methods of risks reduction in investment contracts. Information technologies of projects management. The retrospective analysis of development of information technologies of management of projects. Information managing systems of development and realization of projects. Use of the software of project management. Requirements to the software of project management. Criteria of the comparative analysis of the software of projects efficiency 9 7 4 estimation. Brief characteristic of the basic software products of investment projects efficiency estimation. Total Contact: Nikitaeva Anastasia,nikataeva@yandex.ru 36 (1 ECTS)