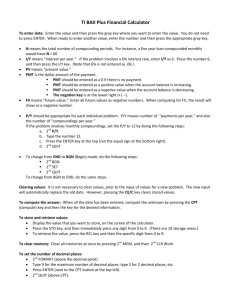

Financial Formula Syntax:

advertisement

PRACTICE PROBLEM 8.1 FINANCIAL FUNCTIONS PRACTICE SOLUTION 1. You are investing $5000 into a savings plan today and will make quarterly contributions of $100 per quarter. The plan pays 6% interest per year compounded quarterly. Write an Excel formula to determine how much your savings will be worth in 5 years. =FV(.06/4, 4*5, -100, -5000) 2. Write an Excel formula to determine the yearly interest rate being charged by the bank on your $175,000 30- year mortgage. You make a monthly mortgage payment of $2000 and the value of the loan at the end of thirty years is zero. Interest is compounded monthly. = RATE(30*12, -2000, 175000,0,0) *12 (Last 2 arguments are optional) 3. Write an Excel formula to determine the value today of $1000 invested 2 years ago at 12% per year compounded quarterly. =FV(.12/4, 2*4, 0, -1000,0) (Last argument is optional) 4. Write an Excel formula to determine the monthly car payment that will be required to take a $10,000 loan over 4 years. The rate of loan is %15 compounded monthly = PMT(.15/12, 4*12, 10000,0,0) (Last 2 arguments are optional) 5. (a) Write an Excel formula to determine the amount of money I need to invest today at 6% per year compounded monthly to have $5000 in three years. I plan on making additional monthly payments of $25 into the account each month. =PV(.06/12, 3*12, -25, 5000,0) (Last argument is optional) (b) Rewrite the formula to determine how much I would need to invest if I do not plan on making additional monthly payments. =PV(.06/12, 3*12, , 5000,0) also =PV(.06/12, 3*12,0 , 5000,0) 6. Write an Excel formula to determine the number of years it would take you to pay off a loan for the following: You are buying a Jeep for $23,500 with a $2000 down payment. The rest you are borrowing from the bank at 6.5% annual interest compounded monthly. Your monthly payments are $350. =NPER(.065/12, -350, 23500-2000,0,0)/12 (Last 2 arguments are optional) 7. When expressing CASH FLOW in EXCEL financial formulas - Cash out of your pocket is expressed as a NEGATIVE (negative/positive) 8. Sometimes these financial functions have a “type” argument at the end of the formula What does “type” mean? What are the different types? TYPE 0 – INTEREST PAID/ACCRUES AT THE END OF THE PERIOD TYPE 1 – INTEREST PAID/ACCRUES AT THE BEGINNING OF THE PERIOD 9. You found a cookie jar with a bank note in it from 1900. The value in 1900 was $100 and the bank which is still in existence promises to pay 3% per year compounded annually. What is it worth now? = FV(.03, Current Year - 1900, 0, -100,0) (Last argument is optional) 10. You decided to take a mortgage with a balloon payment – the mortgage is $100,000 at 6% annual interest compounded monthly for 20 years. The amount I have to pay (balloon) in 20 years is $10,000. What is the payment I can expect each month? =PMT(.06/12, 20*12, 100000, -10000,0) (Last argument is optional) 11. You have a student loan for $5000 at 4.5% interest. No payment is required for 2 years but the loan accrues interest monthly. Once you begin paying the loan you have 10 years to finish payments. Calculate the monthly payment. (Hint: try nesting your financial functions) =PMT(.045/12, 10*12, -FV(.045/12, 2*12,,5000,0),0) (Last 2 arguments are optional) **Note – Since we are making payments the PMT function should return a negative value. Depending on how you look at the problem. To do this a negative value will be needed as the PV argument of the PMT function. Since this PV argument is the nested FV formula, one way to do this is to put a negative sign in front of FV(.045/12,2*12,,5000). PV-YR 0 FV - YR 2 PV – YR 0 YR 12-FV YR 10