Creating a Company Code of Ethics

advertisement

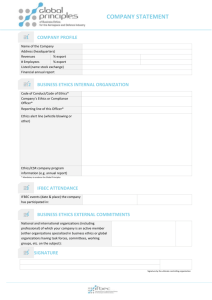

Creating a Company Code of Ethics Whether you call it a Code of Ethics, a Fraud Policy, an Ethics Policy, or some other name, it's important to define the expectations management has for employees as it relates to honesty and ethics at work. It is imperative to outline expected behaviors for employees so that they are clear about what is allowed and what is not. The best ethics policies address general employee conduct and promote an ethical corporate culture. A good code of ethics should provide a small number of examples as needed to demonstrate the application of the rules. It’s not possible to create a rule for every situation that may arise, so an ethics policy should not be aimed at specifically defining each and every ethical dilemma that may occur. The following general issues and topics should be addressed by your company's code of conduct: General employee conduct while at work - What is expected in terms of ethical behavior and giving an employee's best efforts to the company. Conflicts of interest - Define conflicts of interest and give clear examples so that employees are sure of the types of things that fall under this guideline. Distinguish between acceptable conflicts of interest (those that are disclosed and monitored) as opposed to those that are unacceptable. Confidentiality - Address issues within the company (sharing information with other employees or departments) as well as issues connected with sharing information with people outside the company, Relationships with customers and suppliers - What types of professional and personal relationships are acceptable? Should they be disclosed? Will employees be reassigned in the event of such relationships? Gifts - Are employees allowed to receive gifts, and how large may the gifts be? Are there any types of gifts that are forbidden? Entertainment - Define the types of entertainment activities that are allowed, and how often they may occur. Unethical behavior - Define ethics in general and outline which behaviors are strictly prohibited, such as taking kickbacks or bribes, giving out confidential information, and falsifying employment documents. Using the organization’s assets for personal activities - Are employees allowed to use any company resources for personal purposes? Consider things like Internet access, office supplies, copiers, and vehicles. Reporting fraud or unethical behavior - Encourage employees to report suspicions of fraud and outline the process followed when a complaint is received. Stress an open-door policy and the availability of the fraud hotline, the supervisors, and the managers going up the chain of command. Antifraud training must include education on the ethics policy. The code of conduct must be explained and demonstrated, and employees should be given a chance to ask questions both publicly and in private. It is dangerous to assume that an employee can read the code of conduct and automatically understand all of its provisions. Examining the code of conduct during fraud awareness training is time well spent. Employees should affirm their receipt and understanding of the policy with an annual acknowledgment. It is a good idea to repeat the ethics policy training each year when these acknowledgments are due, in order to point out any changes or enhancements to the policy and to make employees aware of the new provisions. Finally, the code of ethics must be enforced in order for it to be a valuable tool. Implement and enforce consistent and fair consequences for violations of the code. Evaluating Your Company's Ethics Program and Fraud Hotline EthicsLine, a high-quality provider of cost-effective anonymous hotlines for corporations, has put together a checklist to help companies evaluate their ethics programs. This questionnaire asks management to evaluate the company’s training regarding ethics and their internal promotion of the fraud hotline. A section of the questionnaire dedicated to a company’s anonymous fraud reporting process points out some of the critical aspects of making such a program work. The following questions are asked, and the ideal answer to each is “yes”: Has your organization established an anonymous reporting mechanism? Does your organization ensure confidentiality for those who wish to remain anonymous? Ensuring accuracy and detail: Do Interviewers ask probing questions to ensure pertinent information is uncovered? Do interview questions change according to the type of unethical behavior being reported? Is the hotline available free of charge to all employees? Is there a well-defined process for immediate notice of time-sensitive issues, such as impending illegal activity? Is the hotline available 24/7/365? Does the hotline enable reporting in the native languages of all employees? Is there a process for maintaining ongoing communication with anonymous parties? The EthicsLine questionnaire also points out some key elements of creating an ethical corporate culture. The questions point out the importance of consistently reinforcing the message that management is committed to ethical behavior by all employees. Attention is also given to the process of handling ethics complaints and completing investigations. Namely, a company should have a case management system that requires documentation of all key elements of a fraud report, and the established process of investigating those complaints should be documented and consistently followed. Companies that have not instituted an anonymous fraud hotline should seriously consider doing so. It is an effective fraud prevention tool, and even the smallest of companies can implement one at a reasonable cost, thanks to companies like EthicsLine that outsource these functions. Note: I am not in any way affiliated with EthicsLine, nor have I been asked or encouraged to promote their product. They are simply a company that has an established relationship with the Association of Certified Fraud Examiners, and has developed a good reputation.