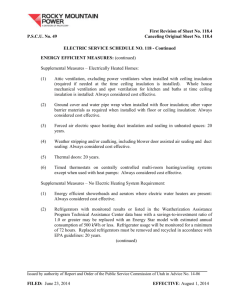

Green Deal, ECO and Insulation Levels, up to December

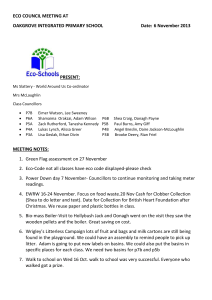

advertisement