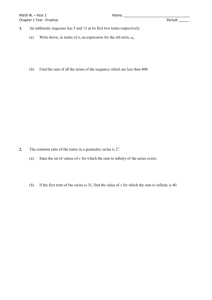

Lecture 9 Problems

advertisement

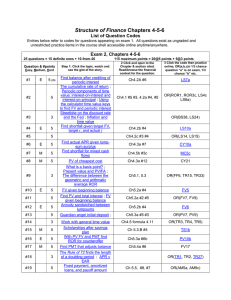

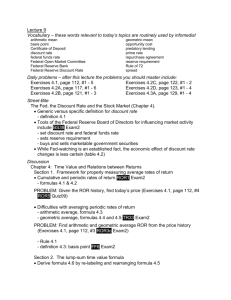

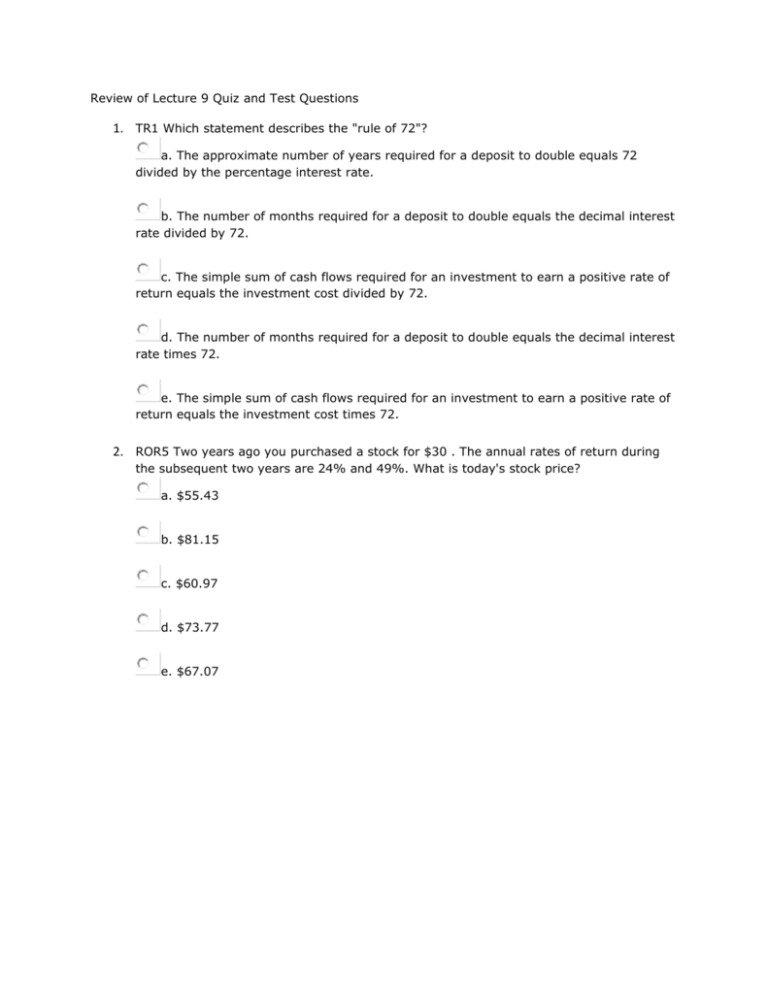

Review of Lecture 9 Quiz and Test Questions 1. TR1 Which statement describes the "rule of 72"? a. The approximate number of years required for a deposit to double equals 72 divided by the percentage interest rate. b. The number of months required for a deposit to double equals the decimal interest rate divided by 72. c. The simple sum of cash flows required for an investment to earn a positive rate of return equals the investment cost divided by 72. d. The number of months required for a deposit to double equals the decimal interest rate times 72. e. The simple sum of cash flows required for an investment to earn a positive rate of return equals the investment cost times 72. 2. ROR5 Two years ago you purchased a stock for $30 . The annual rates of return during the subsequent two years are 24% and 49%. What is today's stock price? a. $55.43 b. $81.15 c. $60.97 d. $73.77 e. $67.07 3. LS10a In exactly 23 months a bill of $10,920 is due. Today you deposit money such that if the account earns a target rate of return of 1.38% per month, the bill is perfectly financed. Unfortunately, your account earns 30 basis points less than your target. When the bill is due, how much money do you lack? a. $654 b. $720 c. $791 d. $871 e. $958 4. BS38 The Federal Reserve Board of Directors uses three significant tools to influence market activity. Which of these statements is the most accurate description of one of these Fed tools? a. The official government "federal funds rate" is the interest rate charged by Federal Reserve District banks to member public and private banks. b. The reserve requirement on member bank accounts regulates the amount of loans that banks may lend to business and individual borrowers. c. Buying and selling currencies and government securities in the global financial marketplace causes widespread panic and capital flight. d. Two choices, A and B, are correct e. The three A-B-C choices are all correct 5. ROR1 A venture capitalists provides a company equity financing of $19.0 million. After 6 years the company repurchases the equity for $58.2 million. There are no other cash flows between the two. Find the average annual geometric rate of return, and also find the cumulative rate of return. a. the average annual geometric ror is 20.5% and the cumulative ror is 206.1% b. the average annual geometric ror is 15.5% and the cumulative ror is 179.3% c. the average annual geometric ror is 20.5% and the cumulative ror is 179.3% d. the average annual geometric ror is 15.5% and the cumulative ror is 206.1% e. the average annual geometric ror is 17.8% and the cumulative ror is 206.1% 6. TR33 From a series of periodic rates of return there are two procedures for computing the average rate of return per period: the arithmetic average and the geometric average. Is the following statement about these two statistics TRUE or FALSE: The arithmetic average periodic rate of return always is greater than or equal to the geometric average periodic rate of return. True False 7. ROR3c Two years ago you purchased a stock for $37 . One year ago the price had moved to $14. Today it is at $45 . Which one statement about the annual average rate of return is correct? a. The geometric average return is 7.8% and the arithmetic average return is 79.6%. b. The geometric average return is 8.9% and the arithmetic average return is 91.6%. c. The geometric average return is 10.3% and the arithmetic average return is 91.6%. d. The geometric average return is 10.3% and the arithmetic average return is 79.6%. e. The geometric average return is 7.8% and the arithmetic average return is 91.6%. 8. FF6 By how many basis points does 4.4% differ from 9.2% ? a. 550 b. 320 c. 420 d. 480 e. 360 9. LS6a A savings account was established with $47,000 exactly 9 years ago. The account earns 5.6% compounded annually. Otherwise, the account has been left alone. When the annual interest is credited to the account today, how much interest is credited? a. $3,364 b. $3,058 c. $3,700 d. $2,780 e. $4,070 10. LS4c A deposit exactly 14 years ago of $2,300 earns 9.5% annual interest compounded annually. There have been no other deposits or withdrawals. As of today, how much total interest-on-principal has accumulated? a. $3,365 b. $2,528 c. $3,059 d. $2,781 e. $3,701 11. TR2 For the simple time value lump-sum relation with monthly compounding find the most accurate statement. For all cases, hold everything constant except the stated variables. a. When the interest rate doubles then the total interest less than doubles. b. When the term doubles then the total interest exactly doubles. c. When the beginning wealth doubles then the total interest exactly doubles. d. Two choices, A and B, are correct e. The three A-B-C choices are all correct 12. LS7a An account was established 9 years ago with an initial deposit. Today the account is credited with annual interest of $406 . The interest rate is 6.8% compounded annually. No other deposits or withdrawals have been made. How much is the end-of-day balance? a. $6,381 b. $8,494 c. $7,721 d. $7,020 e. $9,343 13. CY10a In exactly 20 years a bill of $28,920 is due. Today you deposit money such that if the account earns a target rate of return of 7.40% per annum, compounded semiannually, the bill is perfectly financed. No other deposits or withdrawals have been made. Your account actually accumulates $36,427 . What was the actual average annual percentage rate? a. 7.82% b. 9.46% c. 6.46% d. 8.60% e. 7.11% 14. LS14 Today your account was credited with its annual interest of $3,390 . The account was established some time ago with a $37,250 initial deposit. No other deposits or withdrawals have been made. The account earns 5.8% annual interest. How many years ago was the account established? a. 11 b. 10 c. 8 d. 12 e. 9 15. LS15 Some time ago a $103,800 initial deposit opened an account. No other deposits or withdrawals have been made. Today the annual interest was credited to the account. Total lifetime interest now equals $251,813 . The account earns 8.0% annual interest. How many years ago was the account established? a. 16 b. 15 c. 14 d. 13 e. 17