2014-09-01-Care-at-Home

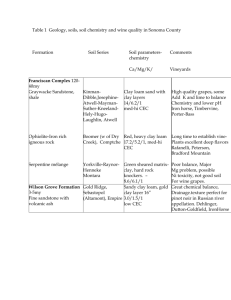

advertisement

Note of Care at Home Meeting Lyceum Theatre, 1st September 2014 Slide 1 – Help. Only growth market in foreseeable future in terms of growing ts business. What is stopping organisations entering this area of work? What help is needed to facilitate market entry? Must remember active older citizens who just need a smaller amount of help, and perhaps don’t need a traditional care at home service but need contact/small amounts of assistance. Edinburgh approaching full employment, which is an increasing problem in the case of employee supply. Also, there are groups that previously wouldn’t have lived into old(er) age: Veterans (psychological disorders) People with learning disabilities Continue to shift the balance of care to help people stay at home, or in communities rather than in institutions. Focus on localities in the future. Slide 5 – RVH redesign underway reducing the number of traditional Boarding Beds. Step-up/Stepdown beds also now on stream: Period of six weeks to reflect and also experience intensive rehab, successor to BBs. However, pressure is such that even these new initiatives are full. Slide 6 – bed closure programme means 2014 demand up 12%. Still lots more to feed through. Slide 7 – acknowledgement that procurement issues have been a barrier, and CEC’s past interpretation of procurement law has been unhelpful. £60m spend. Slide 8 – 312 people. Stuck in step-down, or at home with no support and are likely to end up in hospital. Optimum economical number for a provider is 3-4000 hours per week. Slide 9 – SDS provides enormous potential for individuals to approach providers to provide care. This is outside the contracts that CEC are re-organising and what we are discussing today (ie SDS option 3). Don’t forget direct payments either - £16m out of £140m of third party contract spend (was £13m in 2013). Launch of Individual Service Contract agreements in October. All current providers on CEC’s contract offer SVQs, pay for travel and are well above minimum wage. Plan to separate smaller packages of care from current larger generic packages. System generates acute anxiety (for older people, their families and carers) and the subsequent political pressure. Slide 10 – Market share is 25/75 CEC/Third party – would dearly love to reduce direct CEC provision even more, but in the current market conditions this is not possible. Slide 11 – Much more skilled workforce required that can provide intensive support. For instance, people with dementia or higher medical need (e.g. changing dressings) moves away from generic community care assistants to a more specialist skill-set. On current contract there have been 6 sectors with 3 providers in each. Hasn’t worked that well. Intend to redesign with 12 localities, with a key provider picking up the largest proportion of work in their area, but partnerships within those localities with smaller players contributing. Slide 12 – Contract is for Option 3 clients. Flexibility is key – CEC needs to let go as providers know an individual and can better meet needs, so discretion will be built in allowing a package to flex ~up to 50%. Visibility within communities is going to be key (providers generally are hidden away in anonymous business parks) – much better customer services and will help recruitment too if based on the high street for example. Slide 13 – Following consultation with all existing providers. Inflationary increase mechanism will be built-in, but this is the current fixed-price for the start of the contract. Discussion Registration with the Care Inspectorate is mandatory. Grades 1-6, must be at least a 3. Expensive (c.£4,000) and long-drawn out over 6-8 months. Sits alongside the business planning stage and then recruitment etc. Sector willing to share knowledge/experience. Contracts will be 3+1+1 years. Set-up costs: Location, recruitment, registration – persuasion of Board can be hard. Solution might be borrowing to recoup with the cost. CEC would be interested if they are convinced that a solution is likely to work, to enter into a conversation. Open to anything. Could there be a minimum number of hours offered to help with this and mitigate the risk? 12 localities with 3-4,000 hours each, so this work will be guaranteed. CEC likely to move people to fit new contract, as Option 2 is available now if any person wants to stay with their existing staff/org. All contracts are on a framework basis and happy to look at a block contract to get started. What about partnership working? Consortium bids? Yes. Would be welcome. Cumbria example – meeting re smaller packages of care on 24 Sep. EVOC happy to arrange. Will the hours be graded in terms of the service needed? Not at first. But over time, e.g. 6 months after first meeting a client, then personalisation of the package could be accommodated. Providers’ judgement will be much more valued. Issue of incentives for providers to communicate reduction in need and therefore fewer hours for a client. Need to look at this to incentivise the right support, including a migration of support away from what might at first be intensive personal support, but moves toward a preventative personalised service over time – or take them through Option 2. The level and complexity of care however must be ‘substantial or critical’ to meet eligibility criteria. The £15.50 is the price that includes staff travel. Not client transport to an activity or service. That would be at their cost. Telehealth/care into housing is often being blocked at the moment by GPs. Can there be pressure put on NHS to facilitate and welcome these initiatives? Heather Laing at CEC might be the right contact to take up such issues. Day service providers – would welcome approaches for the same provider to do day service and care at home. New neighbourhood model will be based on ‘natural neighbourhoods’ so that this can be facilitated. Care for where people live. Maps likely to be published very soon. Key provider in each of the twelve. They will bid to ‘take on a locality’ and assessed on the quality of the bid. Smaller providers will not need to bid under a key provider. Organisations can bid for no more than two localities as key provider (3-4,000 hours x 2). What’s stopping private sector developing and growing to take up the slack? We have two big national providers, and many family businesses who have met their ambition, or the owners themselves are ageing and don’t want more work. Seen some consolidation amongst the small ones. Reputation is an issue for the nationals – working very hard on image, especially since as employers there were issues with t&cs in the past. Joining up together, where a registered provider works with third sector orgs who aren’t registered to divide up work that’s appropriate to elements that do/do not need to be registered would be a suitable arrangement. Third sector providers are likely to worry that they can’t provide a service that meets people needs – wouldn’t want to offer ‘private sector’ style in-out sausage factory provision. Consortium model might get round this market entry barrier. The current culture needs to be more balanced as much as the dividing-up of work. Opening-up an assessment for different organisations with different approaches has to be a good thing. Want to work to solve these issues. Third Sector elsewhere in Scotland is engaged – but not in Edinburgh. Timeline: Lots of detail to attend to, as well as simply talking with one another. Where are we at? Locality providers in place in August/September CEC have to consult on the change of service specification during the winter (either 6 or 12 weeks depending on scale of final changes) Tendering will be Spring Option 2 (SDS) business is out there now – a consortium could pick this up straight away, and CEC want to help in any way to help get this arranged Marketing and culture change within/by third sector key to getting Option 2 business. Alz Scotland example of providing registered service to Option 2 service users. Rated 5/6 by Care Inspectorate. This is a specialist pathway for CEC’s new framework. How do contracts get evaluated? Key that CI do the statutory inspections, CEC do a risk-based evaluation. So CEC staff focus on non-compliance/poor providers. Providers have fallen-away for a number of reasons, often around quality. Recruitment – offer of support from JUFJ/Employability Pipeline at CEC Economic Development to assist and offer induction/training etc. Chris’s contact details: chris.whelan@edinburgh.gov.uk 0131 553 8362