project information document (pid) - Documents & Reports

advertisement

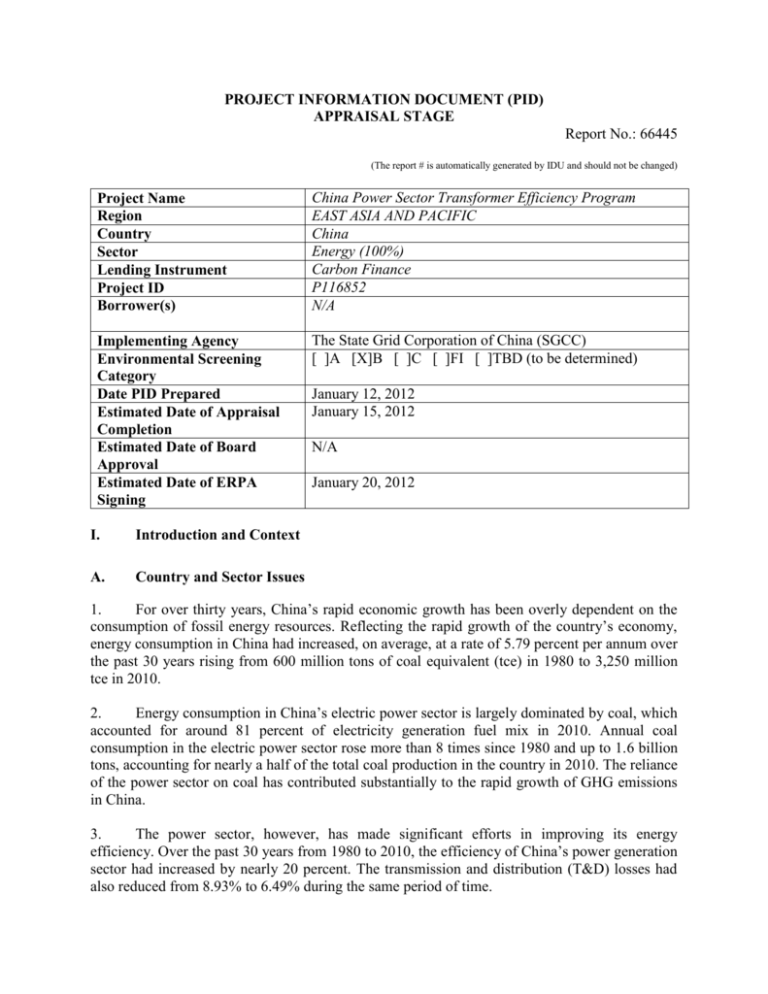

PROJECT INFORMATION DOCUMENT (PID) APPRAISAL STAGE Report No.: 66445 (The report # is automatically generated by IDU and should not be changed) Project Name Region Country Sector Lending Instrument Project ID Borrower(s) China Power Sector Transformer Efficiency Program EAST ASIA AND PACIFIC China Energy (100%) Carbon Finance P116852 N/A Implementing Agency Environmental Screening Category Date PID Prepared Estimated Date of Appraisal Completion Estimated Date of Board Approval Estimated Date of ERPA Signing The State Grid Corporation of China (SGCC) [ ]A [X]B [ ]C [ ]FI [ ]TBD (to be determined) I. Introduction and Context A. Country and Sector Issues January 12, 2012 January 15, 2012 N/A January 20, 2012 1. For over thirty years, China’s rapid economic growth has been overly dependent on the consumption of fossil energy resources. Reflecting the rapid growth of the country’s economy, energy consumption in China had increased, on average, at a rate of 5.79 percent per annum over the past 30 years rising from 600 million tons of coal equivalent (tce) in 1980 to 3,250 million tce in 2010. 2. Energy consumption in China’s electric power sector is largely dominated by coal, which accounted for around 81 percent of electricity generation fuel mix in 2010. Annual coal consumption in the electric power sector rose more than 8 times since 1980 and up to 1.6 billion tons, accounting for nearly a half of the total coal production in the country in 2010. The reliance of the power sector on coal has contributed substantially to the rapid growth of GHG emissions in China. 3. The power sector, however, has made significant efforts in improving its energy efficiency. Over the past 30 years from 1980 to 2010, the efficiency of China’s power generation sector had increased by nearly 20 percent. The transmission and distribution (T&D) losses had also reduced from 8.93% to 6.49% during the same period of time. 4. The State Grid Corporation of China1 (SGCC) owns and operates most of the power transmission and distribution networks in China. Its service area covers 88 percent of the national territory. Currently, the losses of SGCC’s T&D network are about 6.1 percent 2 of electricity sold, higher than the average T&D loss rate of developed countries in Europe which is estimated at around 4 percent. While this difference in loss rates may seem small, as the total electricity sold by the SGCC is huge, the electricity losses incurred in the SGCC’s T&D systems are significant. In 2008, SGCC sold 2,124 TWh of electricity. With a loss rate of 6.1 percent, the total T&D losses were estimated at around 136 TWh4, more than the total electricity sold annually in most of the developing countries. 5. According to the SGCC’s statistics, most of the T&D losses incurred in the distribution systems where hundreds and thousands of inefficient distribution transformers with obsolete technologies are still operating. Most of these transformers were installed in 1980s and 1990s. The loss rates of these transformers are usually at least 30 percent higher than those of the most efficient transformers currently available in the market. As most of these inefficient distribution transformers still have 5 to 10 years of technical life and are embedded in hundreds of distribution networks almost all over the country, without a programmatic intervention and proper financial incentives, it is very difficult for the SGCC to early retire these transformers for efficiency improvement of its T&D systems. B. Rationale for World Bank Involvement and Contribution to Sustainable Development 6. As part of the Bank’s efforts to assist the Government of China (GoC) in improving energy efficiency and reducing GHG emissions in China, the proposed project was initiated and identified by several rounds of discussions between the Bank team and the management of the SGCC. It provides the Bank a unique opportunity to: Support the largest inefficient power distribution transformer early retirement program in the world with a programmatic carbon finance program. The major objective of the program is to improve the energy efficiency and reduce GHG emissions; Assist SGCC to design and implement a programmatic carbon finance program to support a large number of small and decentralized energy efficiency improvement sub-projects in power sector. If implemented successfully, the project would be first nation-wide programmatic Clean Development Mechanism (CDM) activity in China. Add a new dimension of the Bank’s assistance program in improving energy efficiency by re-engaging the power sector, which the Bank had large and successful lending and technical programs in 80s and 90s. SGCC’s core business is to build and operate power grids and sell electricity to consumers in 26 provinces, and large municipalities. It has 1.5 million employees and serves over 1 billion people in China. 2 SGCC’s T&D loss rate is slightly lower than the national average. 4. Losses of Electricity Energy =[ electricity sold/ ( 1- loss rate%) ] x loss rate% 1 7. The Bank, as the trustee of various Carbon Funds, is a world leader in mitigating climate change via market-based emission reduction purchase transactions through the CDM. The Bank’s successful and close working relationship with China’s power sector in the past and its proven track records in conducting CDM based carbon transactions have uniquely positioned the Bank as the best partner of the SGCC in preparing and implementing the proposed project. 8. The proposed program falls under the small-scale CDM Program of Activities (PoA) and applies the approved methodology of AMS II.A: Supply side energy efficiency improvements – transmission and distribution. The PoA, titled “SGCC In-advance Distribution Transformer Replacement CDM Programme” (hereinafter referred to as SGCC DT PoA, or the PoA) was registered at the CDM Executive Board on February 12, 2011. This arrangement allows subprojects, individually or as groups, to be added as CDM Program Activities (CPAs) under the PoA on a rolling basis, upon submission of adequate documentation. Monitoring data for activities under each of the programs will be verified periodically by a Designated Operational Entity (DOE) and subsequently undergo certification and issuance by the CDM Executive Board. II. Proposed Development Objective(s) 9. The objective of the China Power Sector Transformer Efficiency Program (the Project) 3 is to mitigate greenhouse gas emissions of China’s power industry by reducing distribution system losses. This will be accomplished through the expanded adoption of non-mandatory energy efficient transformers as part of sector modernization in distribution networks of SGCC. To ensure adequate scale for national impact and to place the carbon finance transaction on a financially viable footing, the Carbon Finance Operation will pool a number of replacement activities under the distribution networks of 15 provincial subsidiaries of SGCC in a single agreement and SGCC as intermediary is responsible for managing the carbon finance transaction. 10. The key project performance indicator is the actual Emission Reduction (ERs) induced by the replacement of more efficient transformers and verified by an independent verification entity. III. Project Description 11. SGCC has identified about 53,000 inefficient Type 7 and 8 distribution transformers to be replaced with more efficient Type 11 and Type 15 transformers from 2011 to 2016, which are covered by the PoA. Of which about 37,000 transformers will be implemented from 2011 to 2013 and are included in the Project. These transformers are operated at 6 kV and 10 kV, a low voltage level managed by SGCC. The yearly implementation plan is illustrated in Table 1. The Project is implemented from 2011 to 2013, covering part of the PoA, titled “SGCC In-advance Distribution Transformer Replacement CDM Programme” which was registered at the CDM Executive Board on February 12, 2011. 3 Table 1. Replacement Plan by SGCC under the PoA 2011 1,100 5,094 the Project 2012 2013 Subtotal 1,100 17,876 13,067 5,834 2014 CPA #1 CPA #2 12,782 CPA #3 13,067 CPA #4 5,834 CPF etc. 5,888 Total 6,194 25,849 5,834 5,888 37,877 Cost Estimate (US$ million) 48.2 251.2 64.4 65.2 363.9 Note: Implementation period of the PoA is from 2011 to 2016. Source: SGCC post-2013 2015 2016 Subtotal 4,742 4,742 5,256 5,256 15,886 15,886 51.7 58.0 174.9 12. Total investment: This Project involves early retirement of around 37,000 low efficiency Type 7 transformers in 15 provincial distribution networks of the country. On average the total investment (inclusive of purchase of equipments, installation, and pre-operative expenses) ranges from about US$ 3,676 for a Type 11 transformer to around US$ 5,882 for a Type 15 distribution transformer. The cohort of high efficiency transformers to be included in the program is expected to mainly comprise type 11 and type 15. The total capital investment of the Project is estimated at US$ 363.9 million. 13. Sources of Funding: The SGCC is responsible for arranging the source of financing of the subprojects. Program financing is derived 100 percent from equity financing. The financing for the first CPA of 1,100 high efficiency distribution transformers had been secured from the SGCC by the end of 2009 and the replacement of the first 1,100 high efficiency transformers in CPA#1 was completed by November 2011. The emission reductions from the implementation in 2011 will be credited on retroactive basis. 14. Purchase of Emission Reductions. The PoA arrangement allows subprojects, individually or as groups to be added as CPAs under the program on a rolling basis, upon submission of adequate documentation. Total four CPAs are planned under the Project. Monitoring data for CPAs under the program will be verified periodically by a Designated Operational Entity hired by the Bank, and subsequently undergo certification and issuance by the CDM Executive Board. The World Bank, acting as Trustee of the Spanish Carbon Fund (SCF), will purchase the successfully Certified Emission Reductions (CERs) through a single Emission Reduction Purchase Agreement (ERPA). The quantity of CERs to be contracted is estimated to be 85,000 tons of carbon dioxide equivalent (tCO2e). generated from 2011 to 2013. The estimated value of the purchase is approximately US$ 0.91 million. IV. V. Safeguard Policies Triggered Safeguard Policies Triggered Environmental Assessment (OP/BP 4.01) Natural Habitats (OP/BP 4.04) Forests (OP/BP 4.36) Pest Management (OP 4.09) Cultural Property (OPN 11.03) Indigenous Peoples (OP/BP 4.10) Involuntary Resettlement (OP/BP 4.12) Safety of Dams (OP/BP 4.37) Projects on International Waterways (OP/BP 7.50) Projects in Disputed Areas (OP/BP 7.60) Yes X No X X X X X X X X X Project Financing Source Project Proponents IBRD/IDA Financing Plan (US$ million) Local Foreign 363.9 0.0 0.0 0.0 Total (US$ million) 363.9 0.0 VI. Contact point World Bank Contact: Ximing Peng Title: Senior Energy Specialist Tel: 5788+7752 / 86-10-5861-7800 Email: xpeng1@worldbank.org Location: Beijing, China (IBRD) Borrower/Client/Recipient: People's Republic of China Represented by Ministry of Finance Implementing Agency: The State Grid Corporation of China (SGCC) Contact: Mr. Li Zengbin Tel: 86-10-66597065 Fax No.: 86-10-66597762 Email: zengbin-li@sgcc.com.cn For more information contact: The InfoShop The World Bank 1818 H Street, NW Washington, D.C. 20433 Telephone: (202) 458-4500 Fax: (202) 522-1500 Web: http://www.worldbank.org/infoshop