Paper Title (use style: paper title)

advertisement

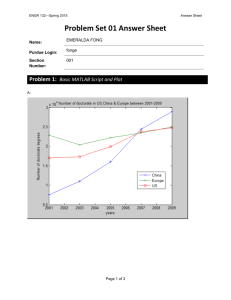

Optimal band provision by wind generation in the Spanish secondary regulation market E.Sáiz-Marín, E. Lobato, P.Linares Institute of Research and Tecnology (IIT) Comillas University, Madrid, Spain elena.saiz@iit.upcomillas.es Abstract— Participation of wind generation in the secondary regulation has both technical and economic interest. From the technical point of view, a higher wind penetration can be facilitated. From the economic standpoint, wind generators can make a profit by providing regulation that surpasses the loss by not selling the maximum possible amount of energy. The aim of this paper is determining the optimal quantity of the bid presented by the potential participation of wind generation at the secondary regulation market. The methodology proposed is illustrated using real data of forecasted and real wind power production of a portfolio of 730.58 MW for year 2008 in Spain. Keywords-component; Wind power; frequency control; monitoring system. ancillary services; I. NOMENCLATURE PBand Price of the secondary regulation band (€/MW) Prodforecasted Wind forecasted production (MW) Prodmax Maximum power of the wind portfolio (MW) BTotal Total band offered by the wind producer (MW) Qfailure Failure of the band volume (MW) of requested secondary regulation band. In accordance with the Spanish market rules all variables are hourly based. II. INTRODUCTION Controlling frequency has always been an essential role in order to guarantee the secure and reliable operation of a power system. Active power control is designed to reestablish the necessary equilibrium between generation and demand in order to keep the frequency of the power system within admissible bands, and is mainly provided by generators. Active power control includes primary, secondary (AGC) and tertiary regulation operating within different time scopes. Generators incur in an extra cost for providing frequency control that should be recovered through regulated or market–based tariffs. Within the Spanish system, primary regulation is considered a mandatory non-remunerated service, while secondary and tertiary regulations are driven by market-based mechanisms. Secondary regulation in Spain is provisioned by band and energy markets. The band market defines the power resources for the AGC and the secondary energy used by the AGC is paid in accordance with a price defined by the so-called tertiary reserve market. Wind power has experienced a wide development throughout the world due to technological advances in wind turbines and favorable policy incentives. Spain is the fourth largest country in wind power installed capacity, 20676 MW of installed capacity at the end of year 2010 [1]. The Spanish Ministry of Industry, Tourism and Commerce considers as a probable scenario 29000 MW of installed wind power capacity for the year 2016 [2]. The wind production has reached 16000 MW and during some hours it represents a 50% of the total generation [3].Within this worldwide and national framework, wind power poses increasing challenges to the planning and operation of power systems. Transmission System Operators (TSO) have often been cautious regarding massive penetration of wind energy into the grid arguing that wind power does not provide frequency and voltage control. However, nowadays technology developments enable the design of operation and control strategies of wind turbines to provide such grid services [4, 5]. Most of the literature on wind power integration into electricity markets have looked into ways to hedge uncertain wind energy bids into energy markets [6, 7, 8], forecast wind production [9], value capacity credits [10], forecast reserve requirements [11] and [12], or proposing ways of joint operation with other technologies, among other issues. Nevertheless, these studies did not consider the possibility of participating on the secondary regulation market. The participation of wind power in the secondary regulation has both technical and economic interest. From the technical point of view, a higher wind penetration can be facilitated. From the economic standpoint, wind generators can make a profit by providing regulation that surpasses the losses by not selling the maximum possible amount of energy. In [13] an economic assessment of the potential participation of wind power in the Spanish secondary regulation market is performed. It is considered that the forecasted wind production for each hour is going to be offered to the daily market. Next a bid is presented to the secondary regulation market. In case that the offered band is accepted the generation schedule must be reduced in the first intra-daily market to allow for the cleared up power band. It should be noted that with that strategy the wind power only reduces its program in case that exists a possible profit of participating in secondary regulation. In the secondary regulation market each bid has a price [€/MW] and a volume of offer [MW]. The offer price was determined in [13]. Nevertheless, in [13] the volume of the bid was considered deterministic, fixed at a constant percentage of the forecasted production. This paper expands the research evaluating which is the optimal volume of the forecasted production that should be offered as secondary band. For this propose a methodology using decision methods is proposed. The analysis is done for the Spanish system. For this purpose, historic data of forecasted and real production of a wind portfolio have been used. Although the Spanish system has some peculiarities the reached results are of a much wider interest. The paper is organized as follows. Firstly the suggested methodology for determining the optimal quantity of the secondary band bid is illustrated in section III. The results are explained in section IV. Finally, conclusions are drawn in section V. III. METHODOLOGY This paper determines the optimal volume of the band offer. This decision must be taken under risk due to the high variability of the wind forecast. Moreover, the decision must be taken the previous day and in case of being accepted it cannot be modified. If the generator fails to comply with commitments acquired in the secondary regulation market, it will be penalized. In the Spanish market, if the requested band is not provided, the band remuneration has to be returned plus a penalty factor. The actual penalty factor is established as 50% of the band price for each hour. Thus, the total cost of an error on the band estimation is: –1.5PBandQfailure (1) In order to determine the quantity of the bid, this paper presents the following methodology depicted in Figure 1. Sorted values of the forecasted production 0 10% 20% 30% 40% 50% -3 x 10 60% 70% 80% 8 Density 6 Level of utilization of the wind portfolio (Prodforecasted/Prodmax) 4 2 50 100 150 200 Wind production [MW] 250 The decision maker is risk neutral BTotalPBand – 1.5PBandQfailure (2) It must be taken into account that instead of maximizing the additional profit explained in [13] only the band profit is maximized. This fact is due to the bid price [€/MW] assessed in [13] guarantees that each MW presented at that price provides an additional profit. Nevertheless, increasing the volume of the offer affects the probability failure of the band requirements. Thus, it is important to determine the percentile that should be offered evaluating just the band profit. From a technical point of view, the maximum percentage that this technology can provide as band reserve without incurring in dynamic instability is 40% of its production. In addition, the case study (Spain) considers the rule that in order to participate in the market, the offered band must be greater than 5 MW [14]. The total band is split in upward and downward band, in accordance with the hourly TSO requirements. Under the second hypothesis the strategy followed will consist on choosing the percentile that maximizes the expected value, using the utility function that represents the risk aversion of the agent. In this paper the utility function is obtained by 50%-50% lotteries. These lotteries are performed asking the decision maker what is his expected value between two possibilities with 50% of probabilities. Consequently, the question that should be asked to the decision maker is the following one. What do you prefer, Z € with 100% of probability, or a lottery between X € and Y € with 50% of probabilities each case. It should be noted that Z should be a value between X and Y. Moreover, in case that the decision maker is risk neutral Z is computed as Z=0.5X+0.5Y. IV. RESULTS 300 The decision maker is risk averse Maximizethe themean band band profitprofit [€] taking into Maximize [€] taking into account penalization account thethe penalization consist on choosing the percentile that maximizes the mean band profit [€], computed as: Maximize the mean expected thefunction utility Maximize the expected value value using Utility function OPTIMAL PERCENTILE THAT SHOULD BE OFFERED AS SECONDARY BAND 10 20 30 40 50 60 70 80 100 Percentile Figure 1. Graphical representation of the methodology Firstly, the forecasted production data are classified in eight groups. Each group means a level of utilization of the wind portfolio (Prodforecasted /Prodmax). The first group corresponds with data of forecasted power between 0% and 10% of the maximum wind portfolio power, the second group contains data between 10% and 20% and so on. For each defined group of forecasted production, a probability density function (PDF) of the real production is assigned. For each level of power forecasted, this paper will evaluate which percentile of the real production density function to offer. This analysis will be performed under two hypotheses. The first hypothesis considers that the decision maker is risk neutral whereas the second hypothesis considers that the decision maker is risk averse. Under the first hypothesis, the strategy followed will This section presents the results obtained applying the methodology explained in section III. The section is organized as follows. Firstly, the decision of the band that should be offered is computed considering that the decision maker is risk neutral. Secondly, the decision is taken assuming risk aversion. The results have been obtained for a wind portfolio consisting of an aggregation of several wind farms with the following features: 29 farms 1125 wind mills 730.58 MW of total installed power In addition, in order to perform the study, the 2008 hourly data of real production and forecasted production (the day before) have been used. The characteristics of this production are: Annual production: 1.829 GWh Equivalent hours: 2503 h A. The decision maker is risk neutral The first step consists of determining the real production distribution for each forecasted level of utilization of the wind portfolio. In order to simplify, Figure 2 shows these distributions for levels of utilization of 10%-20%, 30%-40% and 60% -70% of the maximum power of the wind portfolio respectively. It can be appreciated how the normal distribution suits best the data when the forecasted production is between 30% and 40%. On the contrary, when the level of utilization is high or small the distribution that best suits the data is the Weibull. The mean profit is obtained integrating in the probability density function the profit obtained when the decision maker offers a certain percentile. Figure 4 presents the band profit obtained depending on the band offered at the secondary band for the three probability distributions depicted in Figure 2. -3 x 10 60%-70% Weibull 60%-70% 30%-40% Normal 30%-40% 10%-20% Weibull 10%-20% 9 8 7 5 4 3 Percentile that should be offered 70% 700 600 Mean Profit [€] Density 6 800 500 forecasted production 10%-20% 400 forecasted production 60%-70% 300 200 forecasted production 30%-40% 2 100 1 0 100 200 300 Production [MW] 400 500 600 Figure 2. Probability distribution of the real production for a day before forecast between 10%-20%, 30%-40%, 60%-70% of the maximum power respectively. In case of being risk neutral, the strategy followed will consist on choosing the percentile that maximizes the mean profit. For the particular case of probability distribution calculated for forecasted production values between 10%-20%, Figure 3 presents the band profit (2) depending on the percentile of the real production distribution offered. It must be taken into account, that the band offered [MW] is a percentage of the percentile of the real production. In this paper the percentage of the percentile offered as secondary band is fixed to 10%. This percentage could change in order to adjust the program in future markets. Nevertheless, this fact is a future research that it is not presented in this paper. It can be appreciated how in case of offering the 10% of the percentile 10% the profit obtained is constant. In this case the agent never fails to comply with the commitments acquired. However the profit is low. In case of offering 10% of the percentile 80%, if the real production is less than this value the agent will pay the penalty. Nevertheless, if the production is higher than the value offered, the profit is considerable. In Figure 3, for the particular case of offering 10% of the percentile 40%, the region in which the agent pay the penalty and the region in which the agent complies with the band offered is depicted. BTotalPBand – 1.5PBandQfailure BTotalPBand 90 300 250 Band Profit [€] 80 70 60 50 40 30 20 PENALIZATION 200 150 10 100 Percentile offered as secondary band 350 50 0 -50 440 6 60 8 80 10 100 12 120 Band [MW] 14 140 16 160 18 180 Real production [MW] Figure 3. Band profit depending on the percentile of the real production distribution offered 0 20 40 60 80 100 Percentile [%] Figure 4. Band profit obtained depending on the band offered at the secondary band market. In all the cases, the maximum profit is obtained when the bid corresponds to the 70% percentile of the real production distribution. For the rest of levels of utilizations, also the percentile that should be offered is 70%. This fact means that economically it is profitable to pay the penalty. Figure 4 presents the band that should be offered by the agent in MW depending on the forecasted production. The secondary band that corresponds to the three probability distributions presented in Figure 2 are depicted with solid bars whereas the other distributions are depicted with dotted bars. Forecasted production [%] 0 70%-80% 60%-70% 50%-60% 40%-50% 30%-40% 20%-30% 10%-20% 0%-10% 0 10 20 30 40 50 60 Secondary band offered [MW] Figure 5. Band offered [MW], depending on the forecasted production. Following the same analysis, Figure 6 presents how if the penalty factor becomes higher the percentile that should be offered will be lower, if the penalty factor is – 2PBand, the percentile offered should be the 50% and if the is penalty factor –3PBand the percentile offered reduces to 30%. Although Figure 6 corresponds to forecasted production values between 10%20%, the results for the rest of probability distribution are quite similar. 1 Y=350€ The decision maker is averse to risk The decision maker is neutral to risk The decision maker likes the risk 0.9 0.8 0.7 Utility value 0.6 0.5 0.4 Y=350€ 50% 0.3 0 1 2 3 4 5 6 Penalty factor Figure 6. Percentile that should be offered depending on the penalization factor, considering a forecasted production of 10%-20%. Nevertheless, it is not reasonable to pay the penalty the majority of the hours. In case of following this strategy the TSO (Transmission System Operator), may not allow the agent to provide this service. B. The decision maker is risk averse The level of non-fulfillment obtained in the previous section is not admissible for the TSO. Thus, the agent could be excluded from participating in the secondary regulation market. This section analyzes the decision avoiding this risk. The most common way of modeling the risk adversity is by the utility function. Instead of determining the percentile offered by maximizing the mean economic profit, this percentile is obtaining by maximizing the expected utility value. In Figure 7 the utility functions for different cases are presented, (neutral to risk, averse to risk, and when the decision maker likes the risk). The process followed in order to obtain the utility function independent of the behavior of the decision maker is next explained. Firstly, the utility value 1 is assigned to the highest profit that could be obtained (that corresponds to 350 € in Figure 7) and the utility value 0 is assigned to the worst profit (that corresponds to -80 € in Figure 7). Then, the utility values that are between 0 and 1 are obtained asking the decision maker what his expected value is. The first expected value that is calculated is the one that corresponds to a utility value of 0.5. This fact is due to the values that are already known and needed to build the lotteries are the ones that corresponds to utility values of 0 and 1. Then, the next values that are calculated are the ones that correspond to a utility value of 0.25 and 0.75 and so on. The expected value for a utility of 0.5 is outlined in Figure 7. The question that is asked to the decision maker is the following one. What do you prefer, Z € with 100% of probability, or a lottery between -80 € and 350 € with 50% of probabilities each case. It can be appreciated that when the decision maker is neutral to risk his expected value is 135€=0.5·(-80€)+0.5·350€. Thus, the utility function for a decision neutral to risk is linear. When the decision maker is risk averse, he prefers a lower certain profit. This fact is due to the decision maker gives more value to the possible loss of profit than to the possible gain 20€ ~ 0.768· (80€)+0.232·350€. On the contrary when the decision maker likes the risk gives more value to the possible gain than to the possible loss 220€~0.3·(-80€)+0.7·350€. 50% 0.2 Z=20€ 0.1 0 -100 -50 0 50 X=-80€ Z=135€ 100 150 Band profit [€] Z=220€ 200 X=-80€ 100% 250 300 Z 350 Figure 7. Utility function of the band profit if the decision maker is neutral adverse or likes the risk. With these utilities functions, the percentile that should be offered is calculated by maximizing the mean utility. In Figure 8 can be seen that in case that the decision maker is adverse to risk (in accordance with the utility function depicted in Figure 7), it will offer as secondary band 10% of the 50% percentile. On the contrary, if the decision maker likes the risk, he will offer 10% of the 80% percentile. These results were obtained for the particular case of probability distribution calculated for forecasted production values between 10%-20%. 1 The decision maker is averse to risk The decision maker is neutral to risk The decision maker likes the risk 0.9 0.8 Utility value Percentile that should be offered 80 70 60 50 40 30 20 10 0 0.7 0.6 0.5 0.4 0.3 0.2 10 20 30 40 50 60 Band profit [€] 70 80 90 Figure 8. Utility function of the band profit if the decision maker is neutral adverse or likes the risk. It is important to take into account that the utility function will depend on the decision maker. This paper depicts two examples of utilities functions that were obtained for two different secondary regulation market expert decision makers. Both decision makers are risk averse when the band profit is higher than 100€. In addition, the first decision maker gives utility value equal to cero when the band profit is negative. On the contrary, the second decision maker gives utility value different than zero when the band profit is negative. In addition, both decision makers like the risk until achieving a certain band profit (~100€). The decision that each decision maker should make is as follows. The decision maker 1 should offer the 30% percentile. On the contrary the decision maker 2 will offer the percentile 40%. In both cases decision makers are risk averse and they would offer a percentile lower than the identified in subsection IV A.1 (percentile 70%). 1 1,2 1 1 0,8 0,8 Utility function Utility function [4] 2 1,2 0,6 0,4 Utility function [6] [7] 0 0 -0,2 Utility function 0,4 0,2 0 -100 Risk neutral 0,6 Risk neutral 0,2 -200 [5] 100 200 300 400 -200 -100 0 100 200 300 400 Band profit [€] Band profit [€] Figure 9. Utility functions of the band profit for two different decision makers [8] V. CONCLUSIONS [9] This paper has proposed two methodologies for determining the volume of the secondary band bid of wind generation. The first methodology maximizes the band profit whereas the second one maximizes the expected utility value. In case of using the first methodology it has been proven that the agent assumes a high risk due to the penalty is not well calculated. On the other hand, in case of maximizing the expected value the agent will assumes a risk in accordance with his utility function. [10] [11] [12] REFERENCES [1] [2] [3] Global Wind Energy Council, "Global Wind Energy 2010 Report," Available: www. gwec.net. Ministerio de Industria, Turismo y Comercio, "Planificación de los sectores de electricidad y gas, 2008-2016. Desarrollo de las redes de transporte." Madrid, 2008. K. Elissa, “Title of paper if known,” unpublished. REE, "System Operator Information Website," Available: http://www.esios.ree.es. [13] [14] G. Ramtharan, N. Jenkins and J. B. Ekanayake, "Frequency support from doubly fed induction generator wind turbines," IET Renewable Power Generation, vol. 1, pp. 3-9, 03/12, 2007. R. G. de Almeida and J. A. Peças Lopes, "Participation of Doubly Fed Induction Wind Generators in System Frequency Regulation," IEEE Trans. Power Syst., vol. 22, pp. 944-950, 08, 2007. G. N. Bathurst, J. Weatherill and G. Strbac, "Trading Wind Generation in Short-Term Energy Markets," Power Engineering Review, IEEE, vol. 22, pp. 54-54, 2002. J. M. Morales, A. J. Conejo and J. Perez-Ruiz, "Short-term trading for a wind power producer," in Power and Energy Society General Meeting, 2010 IEEE, 2010, pp. 1-1. J. Matevosyan and L. Soder, "Minimization of imbalance cost trading wind power on the short-term power market," Power Systems, IEEE Transactions on, vol. 21, pp. 1396-1404, 2006. G. Giebel, R. Brownsword, and G. Kariniotakis, "State of the art on short-term wind power prediction, ANEMOS Report D1.1," 2003. Available: http://anemos.cma.fr. P. Luickx, W. Vandamme, P. S. Perez, J. Driesen and W. D'haeseleer, "Applying markov chains for the determination of the capacity credit of wind power," in Energy Market, 2009. EEM 2009. 6th International Conference on the European, 2009, pp. 1-6. M. A. Ortega-Vazquez and D. S. Kirschen, "Estimating the Spinning Reserve Requirements in Systems With Significant Wind Power Generation Penetration," Power Systems, IEEE Transactions on, vol. 24, pp. 114-124, 2009. M. Zima-Bočkarjova, J. Matevosyan, M. Zima and L. Söder, "Sharing of Profit From Coordinated Operation Planning and Bidding of Hydro and Wind Power," Power Systems, IEEE Transactions on, vol. 25, pp. 16631673, 2010. E. Sáiz-Marín, J. García-González, J. Barquín, E. Lobato, "Economic assessment of the participation of wind generation in the Spanish secondary regulation market," sent on April 2011 to IEEE Transaction on Power System. IIT-11-089A, . REE, "Operating Procedures: P.O 7.1, 7.2 and 7.3," .