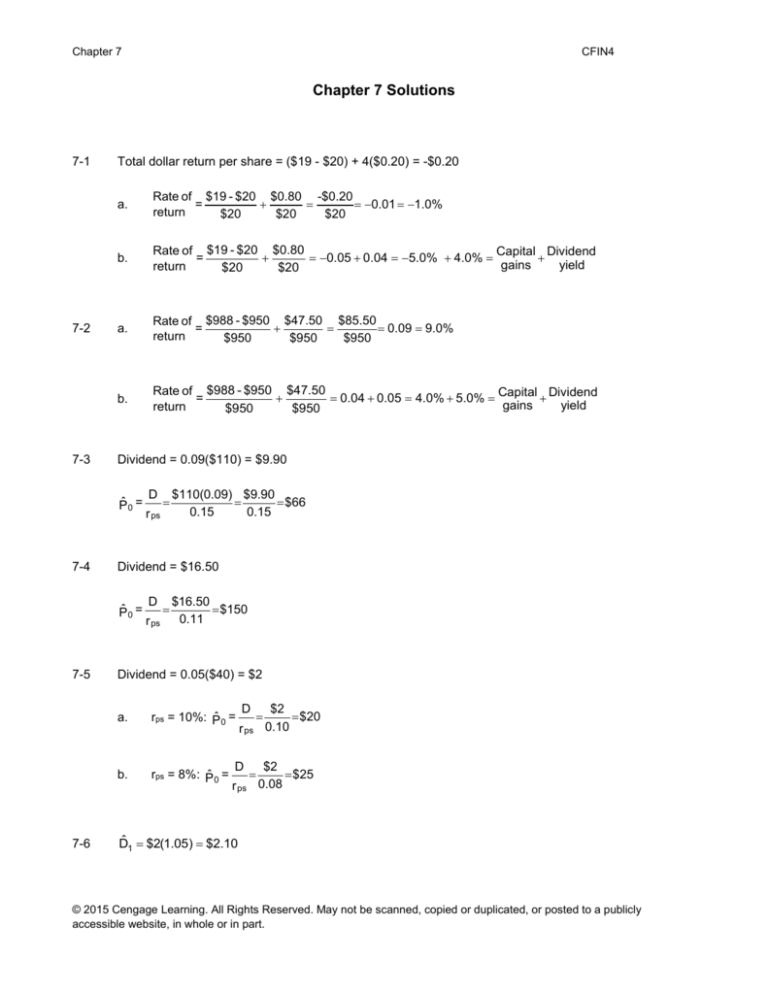

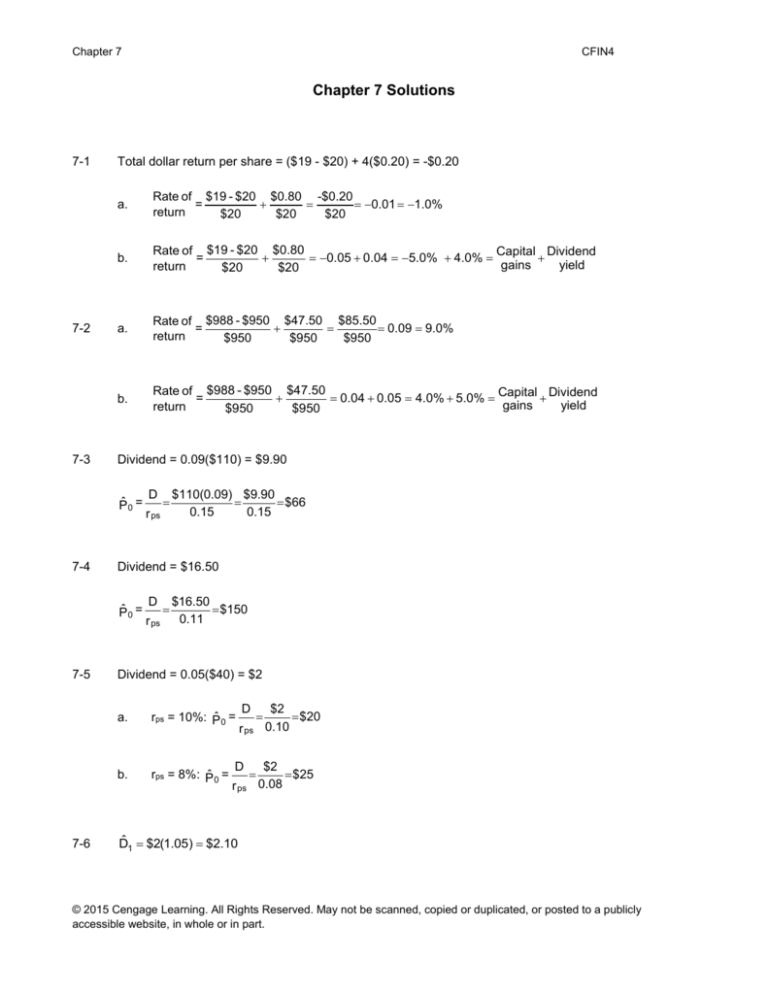

Chapter 7

CFIN4

Chapter 7 Solutions

7-1

7-2

7-3

Total dollar return per share = ($19 - $20) + 4($0.20) = -$0.20

a.

Rate of $19 - $20 $0.80 -$0.20

=

0.01 1.0%

return

$20

$20

$20

b.

Rate of $19 - $20 $0.80

Capital Dividend

=

0.05 0.04 5.0% 4.0%

gains

yield

return

$20

$20

a.

Rate of $988 - $950 $47.50 $85.50

=

0.09 9.0%

return

$950

$950

$950

b.

Rate of $988 - $950 $47.50

Capital Dividend

=

0.04 0.05 4.0% 5.0%

gains

yield

return

$950

$950

Dividend = 0.09($110) = $9.90

Pˆ 0 =

7-4

7-6

r ps

$110(0.09) $9.90

$66

0.15

0.15

Dividend = $16.50

Pˆ 0 =

7-5

D

D

r ps

$16.50

$150

0.11

Dividend = 0.05($40) = $2

a.

rps = 10%: Pˆ 0 =

b.

rps = 8%: Pˆ 0 =

D

r ps

D

r ps

$2

$20

0.10

$2

$25

0.08

D̂1 $2(1.05) $2.10

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

ˆ1

(1 + g) $2.00(1.05) $2.10

D

= D0

$30

Pˆ 0 =

0.12 .05

0.07

rs - g

rs - g

7-7

D̂1 $3(1.04) $3.12

ˆ1

(1 + g) $3.00(1.04) $3.12

D

= D0

$52

Pˆ 0 =

g

0.10 .04

0.06

rs

rs - g

7-8

D̂1 $1.20(1.025) $1.23

ˆ1

(1 + g) $1.20(1.025) $1.23

D

= D0

$9.84

Pˆ 0 =

g

0.15 .025 0.125

rs

rs - g

7-9

rs

= Dividend yield + Capital gains yield

=

8%

+

6%

= 14%

ˆ1

$1.06

D

=

$13.25

Pˆ 0 =

g

0.14

0.06

rs

Alternative solution:

Dividend D̂1

yield

P0

0.08

P0

7-10

$1.06

P0

$1.06

$13.25

0.08

rs = 16%

g = ?, but we know the price of the stock is P0 = $19.50

D̂1 $2.34

We can solve for g as follows:

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

P0

$19.50

D̂1

rs g

$2.34

0.16 g

Solving for g, we find the growth rate to be 4 percent:

$19.50(0.16 – g) = $2.34

$3.12 – $19.50g = $2.34

g = ($3.12 - $2.34)/$19.50 = 0.04 = 4%.

The next step is to use the growth rate to project the stock price five years hence:

P̂5

D0 (1 g)6 D1(1 g)5

rs g

rs g

$2.34(1.04)5 $2.847

$23.72

0.16 0.04

0.12

Therefore, Ocala Company’s expected stock price five years from now, P̂5 , is $23.72.

Alternative solution: Because the growth rate will remain constant at 4 percent, the stock price should

increase by 4 percent each year. Thus, the stock price in Year 5 can be computed as:

P̂5 $19.50(1.04)5 $19.50(1.21665) $23.72

7-11

D0 = D̂1 = $0

D̂ 2 = $0.50; this actually is the first dividend that is affected by constant growth (g norm = 6%), thus it can

be used to compute the price of the stock at the end of the non-constant growth period.

P̂1

D̂2

$0.50

$6.25

rs gnorm 0.14 0.06

Thus, the current price of the stock is

P0

ˆ Pˆ

D

1

1

(1 rs )

1

$0 $6.25

(1.14)1

$6.25(0.87719) $5.4825 $5.48

Cash flow time line for this scenario:

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

0

1

2

…

3

rs = 14%

gnorm = 6%

0.00

0.50

6.25 Pˆ1

5.4825

6.25

0.53

∞

0.50(1.06)∞-2

D̂2

0.50

rs gnorm 0.14 .06

Alternative Solution:

Students might solve the problem by computing the price at the end of Year 2, because they believe

that the first year of constant growth is in Year 3. The solution in this case would be:

D̂ 3 = $0.50(1.06) = $0.53

P̂2

P0

D̂3

$0.53

$6.625

rs gnorm 0.14 0.06

ˆ

D

1

(1 rs )

1

ˆ Pˆ

D

2

2

(1 rs )

2

$0

1

(1.14)

$0.50 $6.625

(1.14)2

$0 $7.125(0.76947) $5.4825 $5.48

Cash flow time line for this scenario:

0

1

2

3

rs = 14%

gnorm = 6%

0.00

P0

7-12

0.50

0.53

6.625 Pˆ2

D̂2

0.53

rs gnorm 0.14 .06

7.125

5.4825

7.125

(1.14)2

…

∞

0.50(1.06)∞-2

5.4825

D0 = $0

ˆ D

ˆ D

ˆ $0

D

1

2

3

D̂4 = $3.00; this actually is the first dividend that is affected by constant growth, which equals 0 percent

(g = 0%), thus it can be used to compute the price of the stock at the end of the nonconstant growth period.

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

P̂3

D̂4

$3.00

$30.00

rs gnorm 0.10 0

Thus, the current price of the stock is

P0

P̂3

(1 rs )

3

$30.00

(1.10)3

$30.00(0.751315) $22.5394 $22.54

Cash flow time line:

0

1

2

3

4

rs = 10%

0.00

0.00

0.0000

0.00

3.00

…

gnorm = 0%

∞

3.00

D̂4

3.00

30.00 Pˆ3

rs gnorm 0.10 0

30.00

22.5394

22.5394

Alternative Solution:

Students might solve the problem by computing the price at the end of Year 4, because they believe

that the first year of constant growth is in Year 4. The solution in this case would be:

D̂4 = $3.00

P̂4

P̂0

7-13

D̂5

$3.00

$30

rs gnorm 0.10 0

ˆ Pˆ

D

4

4

(1 rs )

4

$3.00 $30.00

(1.10)4

$33(0.68301) $22.5394 $22.54

D0 = $1.00

D̂1 = D̂ 2 = $1.00

D̂ 3 = $1.00(1.08) = $1.08; this is the first dividend that is affected by constant growth (g norm = 8%), thus it

can be used to compute the price of the stock at the end of the non-constant

growth period.

P̂2

D̂3

$1.08

$1.08

$12.00

rs gnorm 0.17 0.08 0.09

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

Thus, the current price of the stock is

P0

ˆ

D

1

ˆ Pˆ

D

$1.00 $1.00 $12.00

2

2

1

2

(1 rs ) (1 rs ) (1.17)1

(1.17)2

$1.00(0.85470) $13.00(0.73051)

$0.8547 $9.4966 $10.35

Cash flow time line:

0

1

2

…

3

rs = 17%

gnorm = 8%

0.8547

9.4966

1.00

1.00

1.08

12.00

ˆ

P

2

13.00

∞

1.00(1.08)∞-2

D̂3

1.08

rs gnorm 0.17 .08

10.3513

7-14

D0 = $0

D̂1 = $0

D̂ 2 = $2.00

Because the $2 dividend actually represents the first constant-growth dividend, the constant growth

model can be used to compute the value of the stock at the end of Year 1 as follows:

P̂1

D̂2

$2.00

$20.00

rs gnorm 0.15 0.05

The PV of $20 one year from today is: PV = P0 = $20/1.15 = $17.39

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

Cash flow time line:

0

1

2

…

3

rs = 15%

gnorm = 5%

0.00

0.0000

17.3913

2.00

2.10

21.00

Pˆ2

23.00

∞

2.00(1.05)∞-2

D̂3

2.10

rs gnorm 0.15 .05

17.3913

Alternative solution:

D̂ 3 = $2.00(1.05) = $2.10; Because this is affected by constant growth (g norm = 5%), it can be used to

compute the price of the stock at the end of Year 2.

P̂2

D̂3

$2.10

$2.10

$21.00

rs gnorm 0.15 0.05 0.10

Thus, the current price of the stock is

P0

ˆ

D

1

ˆ Pˆ

D

$0

$2.00 $21.00

2

2

1

2

1

(1 rs ) (1 rs ) (1.15)

(1.15)2

$0(0.86957) $23.00(0.75614) $17.39

7-15

D0 = $0

D̂1 = $1.50

D̂ 2 = $2.00

D̂ 3 = $2.00(1.05) = $2.10; Because this is affected by constant growth (g norm = 5%), it can be used to

compute the price of the stock at the end of Year 2.

P̂2

D̂3

$2.10

$2.10

$35

rs gnorm 0.11 0.05 0.06

Thus, the current price of the stock is

P0

ˆ

D

1

(1 rs )

1

ˆ Pˆ

D

2

2

(1 rs )2

$1.50

(1.11)1

$2.00 $35.00

(1.11)2

$1.50(0.90090) $37.00(0.81162) $31.38

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

Cash flow time line:

0

1

2

…

3

rs = 11%

gnorm = 5%

1.3514

1.50

2.00

2.10

35.00 Pˆ2

30.0300

37.00

∞

2.00(1.05)∞-2

D̂3

2.10

rs gnorm 0.11.05

31.3814

Alternative solution: Because the $2 dividend actually represents the first constant-growth dividend (the

starting basis for constant growth), the constant growth model can be used to compute the value of the

stock at the end of Year 1 as follows:

P̂1

D̂2

$2.00

$33.33

rs gnorm 0.11 0.05

Thus, if the stock is sold in one year, the investor would have received one dividend payment equal to

$1.50 and the $33.33 stock price. The PV of $34.83 one year from today is: PV = P0 = $34.83/1.11 =

$31.38

7-16

D̂1 = $0.60

D̂ 2 = $0.90

D̂ 3 = $2.40

D̂4 = $3.50

D̂ 5 = $3.50(1.04) = $3.64; Because this is affected by constant growth (g norm = 4%), it can be used to

compute the price of the stock at the end of Year 4.

P̂4

D̂5

$3.64

$3.64

$22.75

rs gnorm 0.20 0.04 0.16

Thus, the current price of the stock is

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

P0

ˆ

ˆ

ˆ Pˆ

D

D

D

3

2

4

4

1

2

3

4

(1 rs ) (1 rs ) (1 rs ) (1 rs )

ˆ

D

1

$0.60

1

(1.20)

$0.90

2

(1.20)

$2.40

3

(1.20)

$3.50 $22.75

(1.20)4

$0.60(0.83333) $0.90(0.69444) $2.40(0.57870) $26.25(0.48225) $15.17

Cash flow time line:

0

1

2

3

4

5

rs = 11%

gnorm = 4%

0.5000

0.6250

1.3889

0.60

0.90

2.40

3.50

…

3.50(1.05)∞-4

3.64

22.75 Pˆ 4

∞

D̂5

3.64

rs gnorm 0.20 .04

26.25

12.6591

15.1730

Alternative solution: Because the $3.50 dividend actually represents the first constant-growth dividend

(the starting basis for constant growth), the constant growth model can be used to compute the value of

the stock at the end of Year 3 as follows:

P̂3

D̂4

$3.50

$21.875

rs gnorm 0.20 0.04

Thus, if the stock is sold in three years, the investor would have received three dividend payments equal

to $0.60, $0.90, and $2.40, respectively, and the $21.875 stock price at the end of Year 3. The PV of

this cash flow stream is:

P0

ˆ

D

1

(1 rs )

1

ˆ

D

2

(1 rs )

2

ˆ Pˆ

D

3

3

(1 rs )

3

$0.60

1

(1.20)

$0.90

2

(1.20)

$2.40 $21.875

(1.20)3

$0.60(0.83333) $0.90(0.69444) $24.275(0.57870) $15.17

7-17

P0 19 x $3.70 = $70.30

7-18

Price range: 28 x $4 = $112 to 30 x 4 = $120

7-19

NI = $65,000

T = 35%

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 7

CFIN4

Interest expense = $40,000

Invested capital = $800,000

Cost of funds = 12%

Net income = $65,000 = Taxable income(1 - 0.40)

Taxable income = ($65,000)/(1 - 0.35) = $100,000

EBIT = $100,000 + $40,000 = $140,000

EVA = (EBIT)(1 - T) – (Cost of funds)(Invested capital)

EVA = $140,000(1 – 0.35) – 0.12($800,000) = $91,000 - $96,000 = -$5,000

7-20

Net income = $1.2 million = Taxable income(1 - 0.40)

Taxable income = ($1.2 million)/(1 - 0.40) = $2.0 million

EBIT = Taxable income + Interest

= $2.0 million + $1.5 million

= $3.5 million

EVA = EBIT(1 - T) - (WACC x Invested capital)

= $3.5 million(1 - 0.40) - (0.10 x $8.0 million)

= $2.1 million - $0.8 million

= $1.3 million

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly

accessible website, in whole or in part.