Accounting I Syllabus - Mount Olive Township School District

advertisement

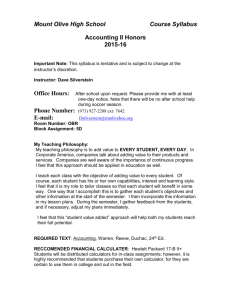

Mount Olive High School Course Syllabus Accounting I 2015-16 Important Note: This syllabus is tentative and is subject to change at the instructor’s discretion. Instructor: Dave Silverstein Office Hours: After school upon request. Please provide me with at least one-day notice. Note that there will be no after school help during soccer season. Number: (973) 927-2208 ext: 7642 Phone E-mail: Dsilverstein@mtoliveboe.org Room Number: B115 My Teaching Philosophy: My teaching philosophy is to add value to EVERY STUDENT, EVERY DAY. In Corporate America, companies talk about adding value to their products and services. Companies are well aware of the importance of continuous progress. I feel that this approach should be applied in education as well. I teach each class with the objective of adding value to every student. Of course, each student has his or her own capabilities, interest and learning style. I feel that it is my role to tailor classes so that each student will benefit in some way. One way that I accomplish this is to gather each student’s objectives and other information . I then incorporate this information in my lesson plans. During the semester, I gather feedback from the students, and if necessary, adjust my plans immediately. I feel that this “student value added” approach will help both my students reach their full potential. REQUIRED TEXTS: Glencoe Accounting, First-Year Course 4th Ed. Students are to bring this text to class each day. Mount Olive High School Course Syllabus COURSE DESCRIPTION/COURSE OBJECTIVES: This course serves as an introduction to basic bookkeeping and accounting principles. As such, it is designed for anyone wanting to better understand how money, personal finance and business work. A major goal of this class is to enlighten students to the powerful financial advantage their accounting education will afford them- now and in the future! When students appreciate how a worthwhile subject can improve their lives, comprehension is dramatically increased, as desire to learn becomes a driving force. Therefore, below is a partial list of course topics that are intended to motivate students to excel in accounting: Teach students how to use accounting strategies to manage their allowances and/or earnings Teach students how the basic workings of the federal tax system. Thereafter, students will learn to employ tax minimization and/or deferment strategies Inform students that the Free Application for Federal Student Aid (FAFSA) is used to measure financial need for college. Thereafter, students will learn how each FAFSA line item is used in the Federal Needs Formula. Finally, students will learn legal strategies that can reduce their Expected Family Contribution (EFC) so to qualify for more financial aid. Students will learn many investment options that are tailored to teenagers. Students will explore accounting techniques that will help them to choose a college that offers the best Return on Investment (ROI). Students will learn the “real” accounting behind credit cards. Since most people receive credit card offers soon after their eighteenth birthday, it is essential that Mount Olive’s student body is exposed to the advantages and dangers of credit card use; especially with the new bankruptcy laws . Students will learn how accounting can be used to manage and expand any type of business venture. This course will also teach students how to utilize computer technology in order to expedite and simplify financial calculations. Page 2 Mount Olive High School Course Syllabus TEACHING METHODOLOGIES: 1. Lectures 2. Assigned Reading 3. Hands on cooperative or individual problems 4. Class Discussions 5. Computer Simulations 6. Real life Business and Personal Finance Simulations 7. Homework Assignments 8. Exams Advice on learning Accounting: Accounting is difficult to learn solely from a textbook. It is extremely important that you attend class in order to master the concepts and practices. Of course, if a student misses a class, (s)he is expected to submit any past due assignments. See the rules and procedures handout. If you want to succeed in this course, remember that Accounting is not spectator sport. Many students are able to ace other classes by memorizing facts and restating them on an exam. This strategy will not work with Accounting. Think of Accounting as a system that compiles business events. The system then goes to work by applying generally accepted accounting principles to these events. The end result is relevant financial information. No two businesses have the exact same events. It would be impossible to memorize how to account for every single business event. The only way to learn Accounting is to work with and master the system. When you understand the system, you can handle any event, and you will do well in this class. You Can’t expect to learn Accounting without doing Accounting, any more than you could learn to swim without getting in the water. You have to take an active role, making use of your chief resources: Your instructor, your fellow students, your textbooks, your financial calculators, and the Internet. I wish you well with your venture into Accounting. EVALUATION: Exams Business Simulations And Computer Projects Homework 40% 45% 15% Page 3 Mount Olive High School Course Syllabus Although I do not grade on attendance, excessive unexcused absences will have a negative impact on a student’s class participation grade. Students who are absent the day a homework is due are expected to hand in the assignment the day they return to school or e-mail it to me. Barring excused absences, late homework will not be accepted, resulting in a grade of zero for that assignment. COURSE CONTENT/TENTATIVE COURSE SCHEDULE: Note: Computer Activities, Practice Sets, Business Simulations, Accounting Games, and Related Reading will be infused throughout the curriculum the year. Topic 1 Topic Class Introduction Assessing Student Needs and Lifestyle Goals How Accounting Can Help you to reach your goals Accounting Career Opportunities 2 Introduction to Business and Accounting 3 Reflecting business transactions in the Accounting Equation 4 Transactions that affect assets, liabilities and owner’s equity 5 Transactions that affect Revenues, Expenses and Withdrawals 6 Recording Transactions in the General Journal 7 The General Ledger Posting Process 8 Preparing a Preliminary Trial Balance Page 4 Mount Olive High School Course Syllabus Preparing a Six-Column Worksheet 10 Financial Statements for a Sole Proprietorship 11 Completing the Accounting Cycle for a Sole Proprietorship 12 Introduction to the Special Journals 13 Cash Control and Banking Activities 14 Taxes and YOU! 15 Investing for a comfortable future 16 The Time Value of Money 17 The accounting behind credit card interest and penalty calculations 18 Using Accounting to start and run your own Business 19 Selected Personal Finance Topics that stem from Accounting 20 Review for Final Exam 21 Final Exam Class Assessment- Did this class meet your expectations? Page 5