Figure 2: The brute force method of aggregate

advertisement

Aggregate modeling

A common problem in risk analysis is the modeling of the sum of a number of independent random

variables each following the same distribution. For example, determining:

The total insurance claim amount for a policy in a year across all policy holders;

The total sales (or profit) from a number of clients;

The total time or person-hours required to complete a number of identical tasks (like laying

railway sleepers, segments of pipeline, or installing TV systems);

The total amount of a chemical ingested by an individual as a result of consumer some

product; or

The total bed-days required in a year in a hospital ward

The distribution of the number of individuals being summed is often called the frequency

distribution, and the distribution of the variables being summed is called the severity distribution. A

common error in risk modeling is to simply multiply the frequency and severity distributions. For

example, if we believed that there may be Poisson(1250) new cancer cases in a year, and that a

random cancer patient will stay Lognormal(30,20) days in hospital, one might try to model this as:

Poisson(1250)*Lognormal(30,20)

The formula is incorrect in a Monte Carlo model because it will only generate scenarios where each

patient stays the same length of time. For example, sample values of 1300 and 35 for the Poisson

and Lognormal respectively give a total of 1300*35 = 45,500 bed-days, but this scenario assigns each

patient the same 35 days stay. In reality some will stay a shorter time, and some longer.

The correct method is as follows:

1. First sample from the frequency distribution (e.g. the Poisson(1250) distribution – let’s say it

generates a value of 1300)

2. Next take 1300 independent samples from the severity distribution (the Lognormal(30,20))

and add them up. This represents one possible scenario for the total bed-days required

3. Repeat steps 1 and 2 to generate the distribution of total bed-days required.

The effect of using the incorrect model is to exaggerate the spread of the distribution of the total as

shown in Figure 1. In this example, the incorrect model would leave managers unnecessarily

concerned that the ward size is grossly insufficient to meet demand.

Correct

Incorrect

Correct

Aggregate results

1

0.9

Cumulative probability

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

0

50000

100000

150000

Bed-days

Figure 1: The incorrect aggregate simulation produces a far greater right tail so that, for example, it estimates that one

should budget for nearly 70,000 bed-days to be 90% confident of staying within budget, whereas the correct value is

around 50,000 bed-days.

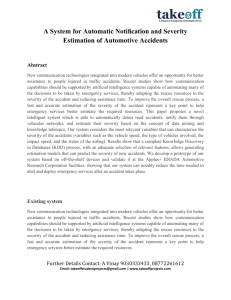

Implementing the correct method in a spreadsheet model could be quite onerous. One needs to

write a range of cells each holding a random generating function for the severity distribution, which

can be very large. Moreover, the number of these severity distributions required depends on the

value sampled from the frequency distribution. Figure 2 shows an example:

A

1

2

3

4

5

6

7

8

9

2004

2005

2006

B

Number of patients

Total bed-days (output)

Patient #

1

2

3

4

1999

2000

C

1285

37588.81601

Length of stay

4.274241864

63.01579133

13.6852622

20.09998397

0

0

D

E

F

Formulae table

C2

=VosePoisson(1250)

C3

=VoseOutput()+SUM(C6:C2005)

C6:C2005 =IF(B6>$C$2,0,VoseLognormal(30,20))

Figure 2: The brute force method of aggregate modeling

The approach of Figure 2 is very inflexible: for example, an increase in the Poisson mean value of

1250 to 2000 would require extending the table and rewriting the summation formula in cell C3.

Moreover, this approach can be very slow to simulate. The model above takes 201 seconds to

complete 10,000 iterations.

G

ModelRisk incorporates a variety of functions to make aggregate modeling much simpler to

implement, and greatly speed up simulation time. For example, the same model can be written in

just three cells, as shown in Figure 3:

A

1

2

3

4

5

6

7

8

9

10

B

C

Number of patients

Length of tay

Total bed-days (output)

D

1286

VoseLognormal(30,20)

39063.6832

Formulae table

=VosePoisson(1250)

=VoseLognormalObject(30,20)

=VoseOutput()+VoseAggregateMC(C2,C3)

B2

B3

B4

Figure 3: Reproducing the model of Figure 3 using the VoseAggregateMC function

This version of the model takes just 27 seconds to finish 10,000 iterations: a 7.4-fold increase in

simulation speed. The VoseAggregateMC function also recognizes any probability identities that

would speed up simulation: for example, if the severity distribution followed a Gamma distribution,

the simulation takes under 3 seconds because the function knows that the sum of identical Gamma

distributions is also a Gamma distribution. That means it will take under 3 seconds to run no matter

how large the frequency values are. More importantly, the model is easily changed by simply editing

the cells C2 and C3. Note the use of the function VoseLognormalObject, which defines a variable that

will be used many times in the model – Object functions are a critical advantage that ModelRisk

offers over any of its competitors, as will be demonstrated below.

An important aspect of any modelling software is to provide the user with some flexibility in how

they wish to build their models. ModelRisk allows the user to build the above model in any number

of different ways, some of which are shown in Figure 4:

A

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

B

Set-up 1

38153.84

C

D

E

F

G

H

I

Set-up 2

Set-up 3

Set-up 4

VosePoisson(1250)

VoseLognormal(30,20)

37724.76

VoseLognormal(30,20)

36000.83

Mean # patients

Mean days in ward

Stdev days in ward

38399.07

Formulae table

Set-up 1: Single formula

B4

=VoseOutput()+VoseAggregateMC(VosePoisson(1250),VoseLognormalObject(30,20))

Set-up 2: frequency and severity distributions defined as Objects for greater visibility

D4

=VosePoissonObject(1250)

D5

=VoseLognormalObject(30,20)

D6

=VoseOutput()+VoseAggregateMC(VoseSimulate(D4),D5)

Set-up 3: severity distribution only separated out

F4

=VoseLognormalObject(30,20)

F5

=VoseOutput()+VoseAggregateMC(VosePoisson(1250),F4)

Set-up 4: parameter values separated out

H7

=VoseOutput()+VoseAggregateMC(VosePoisson(J4),VoseLognormalObject(J5,J6))

Set-up 5: both distributions separated out and severity distribution fitted to data

L4

=VosePoissonObject(1250)

L5

=VoseLognormalFitObject(O3:O228)

L6

=VoseOutput()+VoseAggregateMC(VoseSimulate(L4),L5)

J

K

L

Set-up 5

1250

30

20

VosePoisson(1250)

VoseLognormal(28.758700,18.094306)

35357.26

M

Figure 4: Examples of different ways in which the aggregate model can be built with ModelRisk

It is also important to provide checks so the user can verify exactly what it is they are doing, and

where the problems lie in any mistakes they have made. For example, selecting on any one of the

cells in Figure 3 or 4 containing the AggregateMC function, and then clicking the ModelRisk ‘View

function’ icon will display the window shown in Figure 5:

Figure 5: visualizing the AggregateMC function in ModelRisk. The frequency and severity distributions are plotted above,

and a histogram of (in this case 1000) Monte Carlo generated samples of the aggregate distribution shown below. Statistics

for the sample (labeled ‘MC’) and the theoretical (labeled ‘exact’) moments (mean, variance, etc), which can be derived

from the properties of the frequency and severity distributions, are compared in the table as a numerical check that the

function is working well.

Other aggregate functions available in ModelRisk

Aggregate modeling is such an important component of risk analysis that ModelRisk provides a

whole range of aggregate functions:

VoseAggregateMC – as used in the examples above, this uses pure Monte Carlo sampling to sum

severity variables

VoseAggregateMultiMC – similar to VoseAggregateMC except the function will aggregate multiple

{frequency,severity} pairs, and allow correlation between frequency distributions. One might use

this, for example, to look at the bed-days needed across all wards of a hospital.

VoseExpression – this function allows the user to specify a severity variable of essentially any

required complexity. For example, one could describe a cost-sharing above a certain level of severity

or make the severity distribution different for men and women, or young and old.

VoseAggregateDeduct – which allows one to model the aggregation of insurance claims where the

policy has a deductible and/or a limit on the amount paid out in a single claim

Insurance aggregate functions – specialized functions for the insurance industry that utilize

advanced methods of aggregate claim calculations like fast Fourier transform, de Pril’s and Panjer

methods as well as multivariate aggregation methods. These are available in a separate Insurance

and Finance module.

ModelRisk competitors

Some competing Monte Carlo Excel add-ins have attempted to copy the simplest aggregate

functions in ModelRisk: namely VoseAggregateMC and VoseAggregateDeduct. Unfortunately, their

functions do not work correctly and contravene Excel’s convention on how functions should interact.

The reason that they don’t work correctly is that the competing products have not incorporated

Objects. Their tools only produce functions that sample from random variables, which means that

they have no means of differentiating between sampling from a distribution and defining a

distribution that is to be used in some algorithm (the Object concept).

The danger of attempting to get around the need for Objects is easily illustrated with a few

examples:

@RISK from Palisade Corporation

With @RISK version 5.0, Palisade Corporation introduced the RiskCompound function, which takes

four parameters:

Frequency distribution

Severity distribution

Deductible (optional)

Limit (optional)

The last two parameters would be used for insurance modeling, and reflect the analysis being

evaluated by ModelRisk’s VoseAggregateDeduct function. Thus, using this function to solve the

hospital problem above, one would write:

=RiskCompound(RiskPoisson(1250),RiskLognorm(30,20))

In a normal model, the RiskLognorm function is used to sample random values from a Lognormal

dist. However, within the RiskCompound function it needs to be interpreted differently: as an

Object, rather than a function generating values. The Excel convention for user-defined functions is

that the parameters within the function are evaluated first, but if that were done here we would get,

for example (remembering the common error example at the beginning of this paper):

=RiskCompound(1300,35)

which would logically then give the value 45,500. Thus, @RISK has to suppress the evaluation of the

severity variable, contravening Excel’s rules, with disastrous and unpredictable results, as shown in

the following examples (where RiskNormal in these examples could be replaced by any other @RISK

distribution function):

=RiskCompound(n, A1): where A1 contains “=-RiskNormal(,)” the minus sign is ignored

=RiskCompound(n, -RiskNormal(,)): “#VALUE!” is returned

=RiskCompound(n,k+RiskNormal(,)): “#VALUE!” is returned, no matter whether k is a cell

reference, an @RISK distribution or a fixed vale. However, place ‘=k+RiskNormal(,)’ in a

cell (eg A1) and =RiskCompound(n,A1) generates values

=RiskCompound(n,k): where k is a constant, now k is no longer ignored

=RiskCompound(n,k): where k is a RiskCompound function, the error “#NUM! is

generated

=RiskCompound(n,RiskNormal,)^2): where k is a RiskCompound function, the error

“#NUM! is generated

If n > 1,000,000 the RiskCompound function returns #VALUE!

If n is not an integer the RiskCompound(n, …) function rounds down to the nearest integer

value (so, for example, 1.999 is interpreted as 1) which systematically underestimates the

aggregate value with no warning. ModelRisk’s VoseAggregateMC function, by contrast,

returns the error message: “Error: N should be an integer value or discrete distribution

object”

None of these errors are possible with ModelRisk. Moreover, ModelRisk can handle the

combinations you are interested in. For example, the equivalent of:

=RiskCompound(n,RiskNormal,)^2)

(if it worked) in ModelRisk is:

=VoseAggregateMC(n,VoseExpression(“#1^2”,VoseNormalObject(,))

where the “#1^2” string tells the function what it must do with this variable and it does work.

You can also build more complex expressions. For example, there might be a 60% probability that

someone entering a shop spends Lognormal(20,5) dollars, and a 40% probability they spend nothing.

If Poisson(500) people enter the shop, the total revenue is given by:

=VoseAggregateMC(A1,VoseExpression("IF(#1=1,#2,0)",A2,A3))

with

A1:=VosePoisson(500)

A2: = VoseBernoulliObject(0.6)

A3: =VoseLognormalObject(20,5)

Crystal Ball from Oracle

Crystal Ball does not offer any aggregate functions.

FinRisk from Cranes Software

FinRisk includes a RandSum function to aggregate random variables, but the function requires that

one know and follow very specific rules. Unfortunately these rules are not apparent and when the

rules are not followed, errors are returned with no explanations, making it very hard to understand

why a certain combination is not working.

The RandSum function takes two parameters:

Severity distribution

Frequency distribution

A first rule that one should know about, and which is not obvious from the function’s interface or

from the help file, is that the Frequency distribution can be entered in the formula directly, but NOT

the Severity distribution. This means that the function to solve the hospital problem mentioned

earlier could not be entered as a formula without linking to an external cell:

=FinRandSum(A1,FinPoisson(1250)),

where A1 refers to the Severity distribution. Other examples which show the very specific rules one

has to follow include:

=FinRandSum(A1,n) where A1 contains “=-FinNormal(µ,σ)”: “#VALUE!” is returned

=FinRandSum(A1,n) where A1 contains “=k + FinNormal(µ,σ)”: “#VALUE!” is returned, no

matter whether k is a cell reference, another distribution or a fixed value

In the same vein that it is not allowed to enter the Severity distribution directly in the

RandSum function, it is also not allowed to enter a fixed value directly. Even when linking to

a fixed value for the Severity distribution, the function returns “#VALUE!”

=FinRandSum(k,n) where k is a FinRandSum function: “#VALUE!” is returned

Just like with the @RISK errors, none of the errors above are possible with ModelRisk. In addition to

this, ModelRisk does a far better job than FinRisk when it comes to handling large numbers for the

Frequency distribution. When setting n to 1,000,000 it takes FinRisk about 30 seconds to generate a

single random number from the RandSum function where the Severity distribution is just a

Normal(0,1). ModelRisk’s VoseAggregateMC(1000000,VoseNormal(0,1)) generates random numbers

instantaneously. As a final note, when n is not an integer, the RandSum(… ,n) function returns

“#FinError”, which is fine, but it doesn’t tell you why this is an error. ModelRisk’s VoseAggregateMC

function returns the error message: “Error: N should be an integer value or discrete distribution

object”.

RiskSolver from Frontline Systems, inc

RiskSolver does not offer any aggregate functions.