Medical clinical guidelines

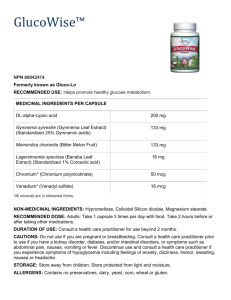

advertisement