optional assignment

advertisement

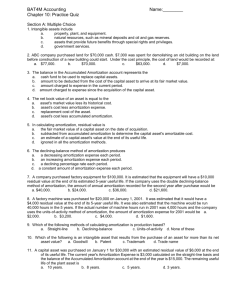

BAT4M Units 1 – 4 Summative Name: _______________ Periodic Inventories (9 points) Singh Company uses the periodic inventory method and had the following inventory information available for the month of November. Date 11/1 11/5 11/12 11/18 11/25 11/30 Transaction Beginning inventory Purchase No. 1 Sale No. 1 Purchase No. 2 Sale No. 2 Purchase No. 3 Units 400 500 400 500 700 600 Unit Cost $3 $5 $6 $7 A physical count of units on November 30 revealed that 900 units were on hand. Answer the following independent questions and show calculations supporting your answers. 1. Assume that the company uses the average cost method. What is the dollar value of the ending inventory on November 30? 2. Assume that the company uses the FIFO inventory method. The dollar value of the ending inventory on November 30 is: 3. Assume that the company uses the LIFO inventory method. What is the dollar value of the cost of goods sold during November? Journal Entries (15 points) Antonio Company uses the allowance method to account for uncollectible accounts and the perpetual inventory method to account for inventories. Prepare the appropriate journal entries to record the following transactions during 2001. You may omit journal entry explanations. Jan. 3 Paid freight on goods purchased on December 30, $500, Jan. 5 Sold merchandise, which cost $11,000, to Bob Taborio for $19,000 on account. Credit terms: n/30. Jan. 14 Received balance due from Bob Taborio. June 20 The account of Jeff Short for $1,500 was deemed to be uncollectible and is written off as a bad debt. Dec. 31 Use the following information for year-end adjusting entries: The balance of Accounts Receivable and Allowance for Doubtful Accounts at year end are $131,000 and $3,900, respectively. It is estimated that bad debts will be 5% of accounts receivable. Correcting Entries (9 points) An inexperienced accountant for Brennen Company made the following incorrect entries. 1. Notes Receivable ................................................................................................... Accounts Receivable ................................................................................... Interest Revenue ......................................................................................... 10,800 10,000 800 Facts: Accepted a $10,000, 1 year, 8% note from John Tan Company for balance of A/R on July 1. 2. Accounts Receivable—American Express .............................................................. Sales ............................................................................................................ 35,000 35,000 Facts: Accepted American Express credit card for $35,000; the service fee is 4%. 3. Allowance for Doubtful Accounts .......................................................................... Notes Receivable ......................................................................................... Interest Revenue ......................................................................................... 18,450 18,000 450 Facts: M. Bailey dishonoured an $18,000, 10%, 3-month note because of bankruptcy. Bailey is expected to pay. No interest had been accrued on the note. Instructions Prepare entries to correct Brennen Company's books based on the facts given. Do not reverse out incorrect entries that were recorded above, but rather correct the account balances so that they reflect the proper amounts. If any adjustments would be required on December 31 (year end), prepare those as well. Notes Receivable (12 points) Instructions Prepare journal entries to record the following events: Jul. 1 Kiner Company accepted a 12%, 3-month, $4,000 note dated July 1 from Fox Company for balance due. Jul. 31 Oct. 1 Collected Fox Company note in full. Assume interest was correctly accrued on August 31 and September 30. Oct. 1 Assume instead that the note is dishonoured and that no interest has been accrued. Fox Company is expected to eventually pay the amount owed. Kiner accrued interest on the above note for the month of July. Adjusting Entries (15 points) The following information for Sarajevah Company is available on February 28, 2002, the end of a monthly accounting period. You are to prepare the necessary adjusting journal entries for Sarajevah Company for the month of June for each situation given. Appropriate adjusting entries had been recorded in previous months. You may omit journal entry explanations. 1. Sarajevah Company purchased a 2-year insurance policy on February 1, 2002 and debited Prepaid Insurance for $1,800. 2. On January 1, 2002, a tenant in an apartment building owned by the Sarajevah Company paid $5,700 which represents six months' rent in advance. The amount received was credited to the Unearned Rent account. 3. On February 1, 2002, the balance in the Office Supplies account was $200. During February, office supplies costing $480 were purchased. A physical count of office supplies at February 28 revealed that there was $240 still on hand. 4. On January 1, 2002, Sarajevah Company purchased a delivery van for $30,000. It is estimated that the annual amortization will be $6,000. 5. Sarajevah Company has two employees who earn $80 and $100 per day, respectively. They are paid each Friday for a five-day work week that begins each Monday. February 28 is a Thursday in 2002. Closing Entries (13 points) The end of the period account balances after adjustments of the Chan Cleaners and Laundry are as follows: Cash Cleaning Supplies Prepaid Rent Equipment Accumulated Amortization—Equipment Accounts Payable J. Chan, Capital J. Chan, Drawings Dry Cleaning Revenues Laundry Revenues Cleaning Supplies Expense Amortization Expense Rent Expense Salaries Expense Utilities Expense Account Balances (After Adjustments) $ 9,000 3,500 3,600 128,000 20,000 8,500 106,400 8,000 25,000 4,000 5,000 3,000 900 2,400 500 Instructions Prepare the end of the period closing entries for the Chan Cleaners and Laundry. Journal Entries—Perpetual Inventory System (29 points) Prepare the necessary general journal entries for the month of October for Trout Company for each situation given below. Trout uses a perpetual inventory system. Oct. 5 Paid cash of $12,000 for operating expenses that were incurred and properly recorded in the previous period. Oct. 8 Purchased merchandise for $20,000 on account. Credit terms: n/30; Freight term: FOB Shipping Point. Oct. 10 Paid freight bill of $470 for merchandise purchased on October 8. Oct. 12 Borrowed $10,000 from British Columbia Bank, signing a 6%, 3-month note. Oct. 15 Paid for merchandise purchased on October 8. Oct. 20 Sold merchandise for $16,000 to Ted Freidberg on account. Credit terms: n/30. The cost of the merchandise sold was $10,000. Oct. 22 Purchased a 2-year insurance policy for $2,400 cash. Oct. 25 Issued Credit Memo No. 151 to Ted Freidberg for $500 for merchandise damaged. The cost of the merchandise was originally $300. Oct. 29 Purchased office equipment for $15,000 paying $4,000 in cash and signing a 3-month, 5% note for the remainder. Amortization Methods (12 points) The following information is available for Richards Company, which has an accounting year end on December 31, 2001. 1. A delivery truck was purchased on June 1, 1999, for $40,000. It was estimated to have a $4,000 salvage value after being driven 60,000 kilometres. During 2001, the truck was driven 15,000 kilometres. The units-of-activity method of amortization is used. 2. A building was purchased on January 1, 1974, for $6,000,000. It is estimated to have a $60,000 salvage value at the end of its 40year useful life. The straight-line method of amortization is being used. 3. Store equipment was purchased on January 1, 2000, for $60,000. It was estimated that the store equipment would have a $6,000 salvage value at the end of its 5-year useful life. The double declining-balance method of amortization is being used. Instructions Complete the table shown below by filling in the appropriate amounts. —————————————————————————————————————————— Accumulated Amortization Amortization Expense for Assets 1/1/01 2001 —————————————————————————————————————————— Delivery truck $ 17,100 $ $ —————————————————————————————————————————— Building $4,009,500 $ $ —————————————————————————————————————————— Store equipment $ 24,000 $ $ —————————————————————————————————————————— Net Book Value at 12/31/01 Generally Accepted Accounting Principles (7 points) Fill in the necessary words to complete the following statements: 1. The going concern assumption assumes that an enterprise will continue in operation long enough to carry out its existing __________________ and __________________. 2. Recognizing revenue at the point of sale is an example of the ______________________ principle. 3. The matching principle dictates that __________________________ be matched with ____________________ whenever it is practicable to do so. 4. The _________________________________ principle dictates that circumstances and events that make a difference to financial statement users should be reported. Financial Statements Prepare a multi step income statement and classified balance sheet using the trial balance below. The trial balance was prepared at year end. Pens Gear Adjusted Trial Balance June 30, 2011 Cash 87,000.00 Accounts Receivable 66,000.00 Allowance for Doubtful Accounts Notes Receivable Inventory Supplies 12,000.00 23,000.00 196,000.00 4,000.00 Prepaid Insurance 15,000.00 Land 93,000.00 Building 148,000.00 Accumulated Amortization - Building Equipment 61,000.00 28,000.00 Accumulated Amortization - Equipment Trademark 5,000.00 16,000.00 Accounts Payable 42,000.00 Bank Loan (due in 9 months) 60,000.00 Notes Payable (due in 14 months) 10,000.00 Mortgage Payable 97,000.00 M. Lemew, Capital 375,200.00 M. Lemew, Drawings 66,000.00 Sales Sales Returns Purchases 457,000.00 1,500.00 200,000.00 Purchases Returns Freight In 10,000.00 500.00 Advertising 17,000.00 Insurance 25,000.00 Interest 15,000.00 Salaries (sales staff) 48,000.00 Salaries (office staff) 60,000.00 Utilities 19,000.00 Telephone 1,200.00 1,129,200.00 Inventory on hand at June 30 was $187 000 1,129,200.00