Course description

advertisement

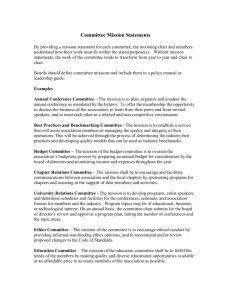

Corporative Management The maintenance of corporate management. Functions of participants of corporate management and « the conflict of interests ». Features and critical estimations of Anglo-American, German and Japanese models of corporate management. Specificity of corporate management in Russia and the basic participants of model. The bases and forms of the corporate control: joint-stock, administrative and financial. The order of formation, power and structure of agencies, board of directors, function of committees of board of directors of the open joint-stock company. Essence of corporate conflicts, application of the basic means of protection in practice and an estimation of their efficiency. Required texts: 1. Code of Corporative Policy.- Moscow: “Economica”, 2003 2. Corporative management/ E.I. Ivanova, L.V. Shishkina; edited by professor B.U. Nalivaiskii.- Rostov-on-Don.: “Feniks”,2007 3. Management: examination answers. A series “Taking an examination”/ edited by I.U. Soldatova, M. A. Chernishev.- Rostov-on-Don: Feniks, 2002 4. Corporative management.- Moscow: “Alpina Business Books”, 2004 5. Board of directors in the system of corporative management of the company/ Edited by Kostikova I.V. Moscow: Flinta, 2002 6. Management of modern company/ Edited by B. Milner, F. Liis. Moscow: INFRA-M, 2001 7. Federal law “Joint-Stock companies” 8. Federal law “securities market” 9. Research of corporative management in Russia: comparative analysis at 2003-2005 http://www.rid.ru/research.php?id=5962 10. Data of national rating of corporative management http://nrcm.rid.ru/page.php?id=324 Data of corporative management Standard & Poor's http://www.sandp.ru/page.php?path=compgovlist. Course Outline Total Learning Hours I Corporate Management: evolution, definitions, the main 9 participants a. The history of corporate management. The essence and principal causes of corporate management occurrence. b. Definitions and the participants of corporate management. Sources of corporate management principles. c. The advantages of effective corporate management. Urgency and modern tendencies. d. Corporate management as the factor of increase of the company’s investment attractiveness. II Models of corporate management: Anglo-American, German, 12 Japanese and the specificity of corporate management in Russia a. The Anglo-American model: key features, participants of the model realization, the structure of stock ownership, the market of corporate control, the level of payment, criticism. b. The German model: two-level structure of board of directors, representation of the interested sides, universal III IV V VI VII banks, cross stock ownership. c. The Japanese model: the system of main banks, the network organization of external interactions, the system of lifelong hiring of personnel. d. Specificity and peculiarities of the Russian model of corporate management Board of directors: rights and functions. Rules for independent director a. The role and competence of the board of directors. b. The structure of the board of directors. The international practice and recommendations on the structure of the board of directors. c. The criteria of independent director identification. The classification of independent directors. d. The terms of office, quantitative structure and rewarding of independent directors. Rules for independent director. The board of directors committees a. Foreign practice of committees formation b. The legal status. c. Powers of committee members of the board of directors d. The tasks, purposes and the formation of the committees. e. Functions of the committees on audit, strategic planning, settlement of corporate conflicts, on the staff and rewarding, on risks, on ethics. Agencies of a joint-stock company a. Agencies: the order of formation, the competence and duties. b. Restrictions of the agencies competence on transactions. c. The procedure of taking the office and leaving the post of the general director. d. The responsibility of agencies members. The preparation and publication of the joint-stock company annual report a. The criteria of the annual report estimation. b. The plan of preparation, approval and publication of the annual report. c. The annual report in the system of information disclosing. Value and new tendencies. The cover and the basic sections. Mergers and takeovers: means of corporate protection, efficiency estimation a. The forms of reorganization: merger, joining, making branches, division, and transformation of the company. b. The classification of types of mergers and takeovers. Foreign practice of merges. c. Methods of protection before and after the public announcement of the deal. d. The key factors assisting present day mergers and takeovers. e. Advantages and disadvantages of merges and takeovers as the company business strategy f. The basic methods of collection and analysis of the 12 8 8 8 5 information for efficiency estimation of merges and takeovers. VIII Ratings of corporate management: urgency, estimation techniques a. Urgency and corporate management ratings definition. b. Advantages of conferring rating to the company. c. Techniques of corporate management level estimation: a CORE-rating, Expert RА, Standard and Pours, Brunswick Vyborg UBC, Prime - TASS. Total Contact Pogrebshikov Uriy, pogrebshikov@gmail.com 2 72 (3 ECTS)