summary of the Physicians Payment Sunshine Act

advertisement

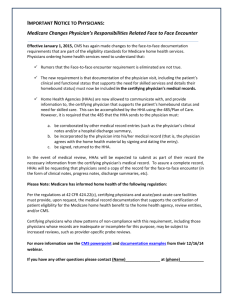

To: All Washington University Physicians: Re: Physician Sunshine Act The Centers for Medicare and Medicaid Services (CMS) recently announced final regulations implementing the Physician Payment Sunshine Act, legislation included in the Affordable Care Act. The Sunshine Act requires manufacturers of drugs, devices, biological and medical supplies covered by Medicare, Medicaid and the State Children’s Health Insurance Program to report to CMS annually all payments and transfers of value that are made to physicians and teaching hospitals. The Secretary of Health and Human Services is required to publish the reported data on a public website. The following summarizes key elements of the law. Who Reports to CMS? Manufacturers of “covered” products must report data to CMS. An entity that manufactures covered products for internal use or for its own patients is not required to report to CMS. Physicians and teaching hospitals have no reporting obligations. What is Reported? All direct and indirect payments or transfers of value provided by a manufacturer to a physician are reported to CMS, including payments made at the “request of or designated on behalf of” a physician, regardless of whether the payments were related to a covered product. The report to CMS includes: the physician’s name; address; specialty; National Provider Identifier; state professional license number; amount and date of the payment (or transfer of value); nature of payment (e.g., consulting/speaking fees, royalties, honoraria, gifts, charitable contributions, food, entertainment, etc.); the name of the covered product, if related to the payment. Also reported is the form of payment or transfer of value (i.e., cash, cash equivalent, in kind items or services, stock, stock options, any ownership interest, dividends and return on investments); payments to third parties; payments to physician owners or investors; research-related payments and, if applicable whether the payment is eligible for delayed publication. Research The reporting obligation applies to a broad range of research activities, including pre-clinical trials, trials under FDA phases I-IV and investigator-initiated trials. The law allows reporting of all payments made under a single research agreement or protocol as a single transaction, listing both the research institution that received the payments and the principal investigator. Delayed Publication of Certain Research Payments Payments or transfers of value associated with research may be eligible for delayed publication if the payment is made in connection with research regarding, or development of, a new drug, device, biological, or medical supply or a new application of an existing drug, device, biological, or medical supply. Publication can be delayed until the earlier of FDA approval or clearance of the covered product, or four years after the payment is made. Physician Ownership Manufacturers and group purchasing organizations (GPOs) are required to report direct or indirect ownership and investments interests held by physicians and their immediate family members. “Ownership or investment interest” includes stock, stock options (except as paid as compensation until exercised), partnership and LLC interests, and loans secured with property or revenue. Reporting is not required for ownership of publicly traded securities, ownership that the reporting entity is not aware of, and ownership or investment interest held through a retirement plan. CME Exemption Payments or transfers of value made as compensation for speaking at continuing medical education programs are exempt from the reporting obligation provided the following conditions are met: The CME event is certified or accredited by one of the following: o The Accreditation Council for Continuing Medical Education; o The American Academy of Family Physicians; o The American Dental Associations’ Continuing Education Recognition Program; o The American Medical Association; o The American Osteopathic Association; The manufacturer does not pay the speaker directly; and The manufacturer does not select the speaker or provide the third party (such as the CME vendor) with a distinct, identifiable set of individuals to be considered as speakers for the CME program. Other Exclusions Several types of payments made by manufacturers are excluded from the reporting requirement, including: Educational materials and items that directly benefit patients or are intended to be used with patients; Loans for not more than 90 days of a covered device or a device under development or a limited quantity of medical supplies; Product samples and coupons/vouchers intended for patient use without charge; Meals, snacks, soft drinks, coffee, or items under $10 made available to all participants of a large-scale conference; Transfers of value of less than $10, unless the aggregate amount exceeds $100/calendar year; Items or services under contractual warranty. Review and Correction CMS will provide physicians access to a secure website for review and correction of the payments and transfers of value attributed to them. The burden is on the manufacturer/GPO to resolve any disputes and submit revised data to CMS. If a dispute is identified by a physician within 45 days following the manufacturer’s submission of the data to CMS and resolved within 60 days of the submission, the revised data will be posted; otherwise, the data submitted by the manufacturer will be posted with a notation indicating the data is subject to dispute and any revised data, if accepted by the manufacturer, will be posted as of the next reporting period. Physicians are encouraged to register with CMS to receive notification that the data is available for review. Registration will open in 2014. Implementation Dates Manufacturers and GPOs are required to commence data collection on August 1, 2013, with reports due to CMS on March 31, 2014. Reports to CMS are submitted annually. For questions about the CME requirements contact: Douglas W. Hanto, M.D., Ph.D. Associate Dean for Continuing Medical Education Washington University School of Medicine 314-362-6891 hantod@wusm.wustl.edu Vicki Tegethoff Director, Continuing Medical Education Washington University School of Medicine 314-362-6938 tegethov@wusm.wustl.edu For questions about other aspects of the Sunshine Act, contact: Patty Hart Assistant Vice Chancellor & Associate General Counsel Office of the Executive Vice Chancellor & General Counsel Washington University in St. Louis 314-362-6558 patricia_hart@wustl.edu For more information about WUSM’s clinical conflict of interest policies, go to: http://fpp.wusm.wustl.edu/fpppolicies/Pages/ConflictofInterestClinical.aspx http://fpp.wusm.wustl.edu/fpppolicies/Pages/Conflict%20of%20Interest%20%28Clinical%29%20%20PharmaceuticalMedicalDeviceIndustry.aspx Resources Physician Payment Sunshine Act of the Affordable Care Act, Final Regulations http://www.gpo.gov/fdsys/pkg/FR-2013-02-08/pdf/2013-02572.pdf CMS OpenPayments Program: http://www.cms.gov/Regulations-and-Guidance/Legislation/National-Physician-PaymentTransparency-Program/index.html Association of American Medical Colleges/Conflict of Interest https://www.aamc.org/initiatives/coi