Introduction to the Managed Care Annual Filing Process

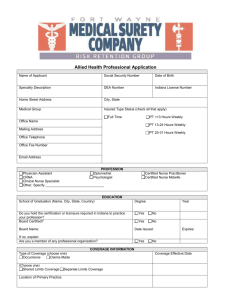

advertisement