acnt 1303 introduction to accounting i

advertisement

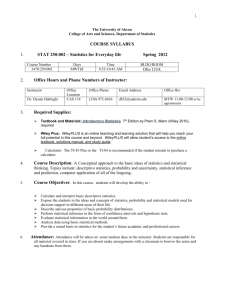

Rev 8/13 ACNT 1303 INTRODUCTION TO ACCOUNTING I Instructor Name: Rubric Number: Synonym Number: Phone Number: W. Brian Voss ACNT 1303 41788 512-223-5835 Email Address: Office Location: Office Hours: Conference Policy: bvoss@austincc.edu EVC 8311.6 MW 4:30 – 6:30pm By Appointment Course Description: The course is a study in analyzing, classifying, and recording business transactions in a manual and computerized environment. The course emphasizes the complete accounting cycle, preparation of basic financial statements, recording merchandising transactions, reviewing inventory costing methods, preparing bank reconciliation’s, and recording long-term assets. Text and Materials: Accounting Principles (10th) Ch 1-12 John Wiley & Sons, Weygandt, Kieso & Kimmel, ISBN 978-1-118-00927-7 Computer Accounting Essentials Using Quickbooks Pro 2012 with CD (6th) Yacht & Crosson, ISBN 978-0-077-63686-9 INSTRUCTIONAL METHODOLOGY: The objectives of this course will be met by incorporating a variety of instructional methods. These include videos, practice and homework assignments (with immediate feedback), online quizzes, proctored exams, narrated Power Point presentations, narrated chapter summaries, narrated practice problems, discussion board postings, preparing journals of student activities, lab assignments, spreadsheet and word processing activities, and online research. COURSE RATIONALE: The goals and objectives of this course prepare students for (1) obtaining or improving job skills, (2) qualifying for a business or accounting job, (3) achieving job advancement, (5) work as an entrepreneur, (6) fulfill degree or certification requirements and (6) fulfill personal goals. Due Dates for Exams: An extension may be granted in the case of an emergency. If this happens: (1) contact the instructor by phone or e-mail before the exam deadline and (2) submit verification of the emergency (for example, in case of personal illness, submit a statement from the doctor which shows the period of time you are unable to attend work or school; in case of death or serious illness of a close friend or family member, submit information about the nature and location of the emergency and when you will be able to take the exam; in case of work or military orders, submit a letter from the supervisor which states the dates and location of the assignment). If the verification is submitted, one extension may be granted. Stay on schedule and complete all assignments a few days early. This allows you to meet deadlines and keep from getting behind. No notes or texts can be used during all Exams. Exams are taken at any of the ACC testing centers. Students who live outside the Austin area and cannot travel to an ACC Testing Center may be able to have their exams proctored at another location through the Distance Testing procedures. The required form must be sent to W. Brian Voss by the end of the first week of the semester. The ACC Accounting Department has a secure exam policy. For this reason, exams cannot be released via Blackboard. If students need to see their exams, this must be done in person at the professor's office. Review the student testing guidelines - http://www.austincc.edu/testctr - prior to taking the first exam. Labs– These are online labs and will be submitted via the Labs section of Blackboard. Lab assignments and instructions are located in the Blackboard course. No late labs will be accepted. Attendance at the scheduled on campus lab time is optional. Due Dates:To receive credit all exams, quizzes, homework, projects and or other assignments are due on or before the dates as specified in the course outline/calendar located on the back of this page. No late exams, quizzes, homework, projects or other assignments will be accepted. There is no make-up work and no extra credit work. Assignments are usually worked in class. The instructor will indicate what assignments to submit for credit at the end of each class. If the student misses class assignments can be submitted via email on the due dates indicated by the end of class period. Exams & Quizzes: The exams will be a combination of multiple choice and problems. I retain the completed exams and keep them for one semester. There are no re-test. The quizzes consist of 10 multiple choice questions. Quizzes are taken via Blackboard online with a 20 minute time limit. One point is deducted for each minute (or fraction thereof) over the 20 minute time limit. There are no retests. Make-up exam policy – You must contact me within one week after the missed exam to schedule an exam in the testing center. If you have not taken the exam within one week from the scheduled exam date 15 points will be deducted from your exam grade for each class meeting date until the exam is taken. There is no curve available for the make-up exams. Only one make-up exam may be taken during the semester. The make-up exam may consist entirely of multiple-choice questions and cover any topics included in the chapters – not just the topics listed on the exam review sheet. If there is a conflict, you may take an exam early with no penalty. Please discuss this with me as soon as you are aware of a conflict. Withdrawal Policy: November 21st is the last day to withdraw from this class and receive a grade of “W”. If you wish to withdraw, complete a withdrawal slip and turn it into the admission’s office. Do not assume I will withdraw you. Attendance Policies: Austin Community College does not have an established attendance policy. The Business Studies Area has determined that absences in excess of 10 percent of the scheduled class periods are the basis for an instructor to withdraw a student from class. While I may withdraw a student for excessive absences, I have no obligation to do so. The policies, learning outcomes and SCANS objectives on the Master Syllabus are considered part of this syllabus. Click here: http://www.austincc.edu/accting/syllabi.php Grading: Activity Exams Quizzes (drop 2 of 11) Assignments (drop 4 of 31) QuickBooks Assignments Orietation & Student Communication TOTAL Number 4 9 27 4 2 Pts Each 100 10 3 15 10 Total 400 90 81 60 20 651 Percent 61% 14% 12% 9% 3% 100% Points 586 to 521 to 456 to 391 to Below 651 585 520 455 391 Grade A B C D F Course Outline / Calendar Rev 8/13/13 INTRODUCTION TO ACCOUNTING I ACNT 1303 Syn 41788 DIL Your Start Date Accounting Text Assignments ACCOUNTING TEXT TOPIC Text Assignment Due Date Accounting Text Quiz Due Dates QuickBooks Assignments 8/26 Ch 1 - Accounting in Action P1-1A 9/4 Ch01 8/28 Ch 1 - Accounting in Action P1-2A 9/4 Ch01 9/2 Labor Day Ch01 9/4 Ch 1 - Accounting in Action P1-4A 9/4 9/9 Ch 2 - The Recording Process P2-2A 9/16 Ch 2 - The Recording Process & Review P2-3A 9/16 9/11 9/16 Ch 2 - The Recording Process & Review 9/18 Exam 1 9/23 Ch 3 - Adjusting the Accounts 9/25 QuickBooks Due Date P2-5A 9/16 Ch01 Quiz 9/9 Ch01 Ch01 Ch01 Ch01 Quiz 9/17 Ch01 Pg 19 9/18 Ch02 P3-1A & P32A 9/23 Ch02 Ch 3 - Adjusting the Accounts P3-3A 9/25 Ch02 9/30 Ch 4 - Completion of the Accounting Cycle E4-7, P4-1A & P4-2A 9/30 10/2 Ch 4 - Completion of the Accounting Cycle P4-4A 10/2 Ch02 10/7 Ch 4 - Completion of the Accounting Cycle P4-5A 10/7 Ex 2-2 10/9 Exam 2 10/9 Ch03 Ch03 Ch03 Ch02 10/14 Ch 5 - Accounting for Merchandising Operations E5-9 & P5-1A 10/14 10/16 Ch 5 - Accounting for Merchandising Operations P5-2A 10/16 10/21 Ch 5 - Accounting for Merchandising Operations P5-4A 10/21 10/23 Ch 6 - Inventories (Including Appendix) P6-1A 10/23 Ch06 Ch03 10/28 Ch 6 - Inventories (Including Appendix) P6-3A 10/28 Ch07 Ch03 10/30 Ch05 9/16 10/7 Ch03 Ch03 Ch 6 - Inventories (Including Appendix) P6-8A 10/30 11/4 Ch 7 - Accounting Information Systems & Review E7-10 & P7-4A 11/4 Ch08 Ch03 11/6 Exam 3 11/6 Ch09 Ch03 Ex 3-1 & Ex 32 11/11 Ch 8 - Internal Control and Cash P8-4A 11/11 Ch04 11/13 Ch 9 - Accounting for Receivables P9-4A 11/13 Ch04 11/18 Ch 9 - Accounting for Receivables E9-2 & E9-3 11/18 11/20 Ch 10 - Plant Assets, & Intangibles Assets 11/20 Ch04 11/25 Ch 10 - Plant Assets, & Intangibles Assets & Review P10-3A E10-9 & E1010 11/25 Ch04 11/27 Ch 11 - Current Liabilities & Payroll Accounting E11-1 & E11-3 11/27 Ch04 12/2 Ch 11 - Current Liabilities & Payroll Accounting P11-4A 12/2 Ch04 12/4 Exam 4 12/9 QuickBooks Ch04 12/11 QuickBooks Ex 4-2 Ch10 10/16 Ch04 Ch04 THIS SCHEDULE SUBJECT TO CHANGE November 21st Is The Last Day To Withdraw 12/11