Word

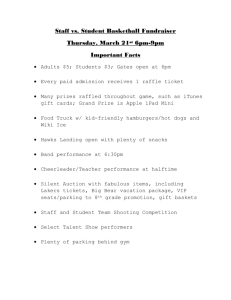

advertisement

GIFT MANAGEMENT POLICY NUMBER: SUBJECT: GIFT VALUE, DATE AND RECEIPT Effective date: July 1, 2012 Replaces policy: GM-03-2009 January 1, 2011 PURPOSE: To establish guidelines for the valuation, dating and receipting of gifts by the University of Oregon Foundation (Foundation) for the benefit of the University of Oregon (University) or the Foundation. POLICY: Upon receipt of a gift in accordance with the Gift Acceptance, Benefit University policy, the Foundation will record and value the gift and issue a gift receipt or letter of acknowledgment, as appropriate, in accordance with applicable laws and regulations. Also see separately, Gift Value, Date and Receipt; Deferred Gift, GM-11-2011. PROCEDURE: Gift Value: The Foundation, upon receipt of a gift, will record a gift value on the donor database system. The gift value will be established and recorded in a timely manner as set forth below; no subsequent adjustments will be made to the gift value. The value receipted and the value reflected in the donor’s giving history will be the gift value. The gift value may differ from the amount ultimately realized from the gift which may include gains/losses, holding charges, processing fees, etc. The gift value also may differ from the amount the donor ultimately calculates to deduct on their taxes; e.g. some gifts are subject to a cost basis deduction or to adjusted gross income limits. Cash. U.S. currency, checks and credit cards will be valued at face value on the gift date. Foreign currency, other foreign drafts and U.S. dollar drafts drawn on foreign banks will be valued at the exchange rate applicable to the time the transaction is received or processed by the Foundation’s bank. Securities. Marketable securities will be valued in accordance with IRS guidelines, Publication 561: the average price between the highest and lowest quoted selling prices on the valuation date. For this purpose, the valuation date is the gift date. Real Property. Real property will be valued in accordance with IRS guidelines, Publication 561: estimated fair market value as indicated by a detailed appraisal by a Document1 Page 1 of 4 professional appraiser. The Foundation may obtain it’s own appraisal or utilize the donor’s appraisal. Gifts in Kind and Tangible Personal Property. Upon receipt of a gift in kind or personal property by the University, the Foundation will record a gift value, for recognition credit only, on the donor database system. The gift value will be provided by the University to the Foundation. When tangible personal property is received directly by the Foundation, the Foundation will establish the fair market value through any generally accepted means. Gift Date: Cash. The date of the gift is the date the Foundation obtains control over the funds. A check sent via U.S. Mail to the Foundation is considered delivered (in the control of the Foundation) on the date of mailing. A check sent via FedEx/UPS is considered delivered on the date received by the Foundation. For cash or checks given to the University, the gift date is the date the monies are received by the Foundation. Securities. The date of the gift is the date the Foundation obtains control over the securities. When securities are transferred electronically, the gift date is the date the shares are in a Foundation account. The same U.S. Mail and FedEx/UPS rules apply as for cash. Real Property. The date of the gift is the date the Foundation obtains all rights, title and control of the property. Typically, this is the date the deed is recorded. Gifts in Kind and Tangible Personal Property. When received directly by the University, the date of the gift is provided by the University to the Foundation. When tangible personal property is received by the Foundation, the date of the gift is the date the Foundation obtains exclusive control over the property. Receipt: A gift receipt or letter of acknowledgement will be sent to the legal donor on all gifts except monthly recurring pledge payments by credit card or EFT when under $250. When a gift is received from a personal joint account, the receipt will be addressed to the legal donor and additional named person(s) on the joint account. All receipts and acknowledgments will contain the statements: “For tax deductibility, please seek guidance from your tax or financial advisor. A reasonable administrative fee may be charged to this gift. Please retain this receipt for tax records.” All receipts for gifts of securities will state: “The above values/dates are for internal gift recognition purposes.” All receipts and acknowledgments for gifts to athletics will additionally contain the statement: “Certain athletic contributions may be subject to an 80% deduction limitation.” All receipts will provide a value for any goods or services provided or state a value of $0.00 when not applicable. Goods or services provided include cash, tickets, meals, tangible property and services. The receipt must provide a good-faith estimate of the fair market value of the good or service, unless it is a “low-cost” good as determined by the IRS. Goods or services received through an auction setting are subject to the Document1 Page 2 of 4 same disclosure requirements; monies given during the auction are charitable contributions subject to the stated value on the program or other value provided by the auction sponsors; the cost to the auction sponsor should not be considered, but rather the fair market value of the goods or services received. All letters of acknowledgment and a receipt for life insurance will contain the statements: “No goods or services were provided in exchange for your contribution. For tax deductibility, please seek guidance from your tax or financial advisor.” Cash and cash equivalents. A gift receipt will be issued to the legal donor that includes a declaration as to the name of the donor, name of the fund(s) where the gift was applied, gift value, date of the gift, and value of any goods or services provided. The cash gift receipt will serve as the official charitable tax receipt for Internal Revenue Service purposes and will comply with IRS Publication 1771. Securities. A gift receipt will be issued to the donor that includes the name of the donor; name, quantity and value of stock (gift value); name of the fund(s) where the gift was applied; date of the gift; and value of any goods or services provided. The receipt will contain the additional statement: “The above values/dates are for internal gift recognition purposes.” Real Property. A letter of acknowledgment will be issued to the donor that includes the name of the donor, name of the fund(s) where the gift was applied, description of the property, and date of the gift. Life Insurance. A gift receipt will be issued to the legal donor that includes the name of the donor, insurance policy number and issuing company, face value of policy, and date of the gift. Gifts in Kind and Tangible Personal Property. A letter of acknowledgment will be issued to the donor that includes the name of the donor, name of the fund(s) where the gift was applied, description of the property, and date of the gift. Miscellaneous: The Foundation strongly urges and advises the donor to seek independent professional counsel prior to making a gift. It is not the province of the Foundation to give legal advice. It is the responsibility of the donor to secure an appraisal when appropriate. Any appraisal obtained by the Foundation is for exclusive use of the Foundation. The Foundation will seek the legal advice of counsel, when appropriate, as part of the fiduciary role of the Foundation. The Foundation will respect donor wishes in regards to publication of information or other forms of recognition. The Foundation will file all applicable IRS required filings in a complete and timely manner. Document1 Page 3 of 4 DEFINITIONS: Gift: Any transfer of personal or real property made voluntarily and without consideration. A gift is motivated by charitable intent and is irrevocable. A gift is not complete until accepted by the Foundation. Legal Donor: The last person in control of the donated assets; the donor eligible to claim a tax deduction for the gift. In general, the person whose signature is on the check, unless such person is acting as an agent for an organization, or in whose name securities or real property is registered is the legal donor. May be a person, company, donor-advised fund, foundation, estate or trust. RESPONSIBILITIES: Chief Compliance Officer: ensure no subsequent changes to gift value; establish gift value on non-cash gifts FORMS/DOCUMENTS: IRS Publication 1771: Charitable Contributions, Substantiation and Disclosure Requirements IRS Publication 561: Determining the Value of Donated Property Document1 Page 4 of 4