Section 13.1 Problem 4. The reward matrix is computed to be: Noble

advertisement

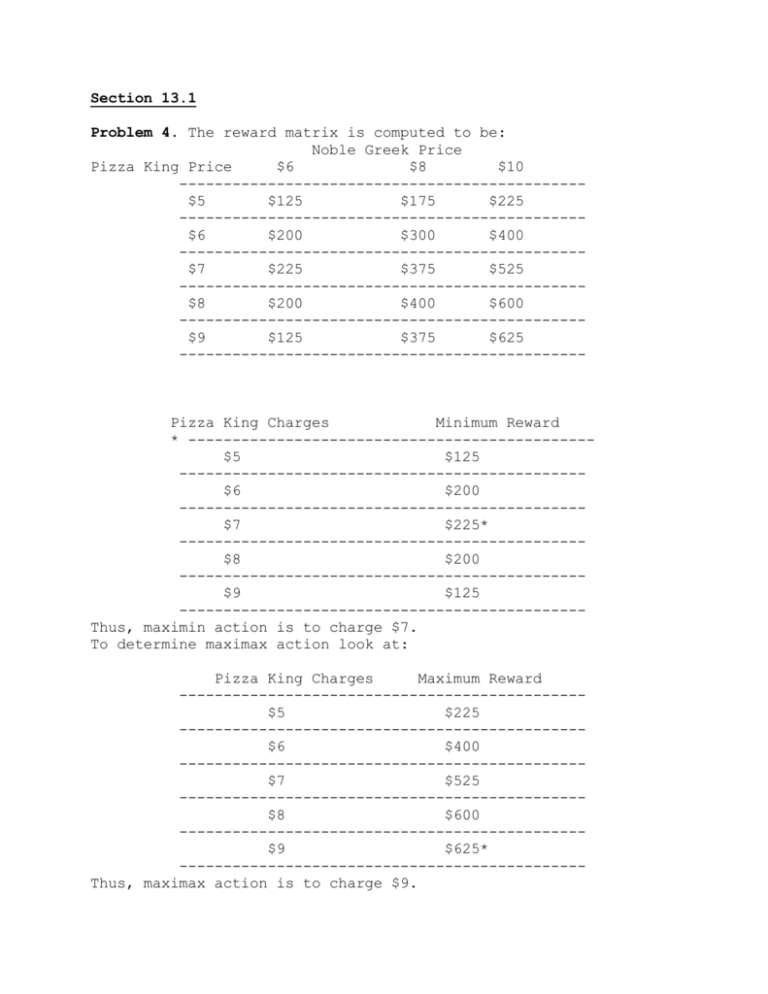

Section 13.1

Problem 4. The reward matrix is computed to be:

Noble Greek Price

Pizza King Price

$6

$8

$10

---------------------------------------------$5

$125

$175

$225

---------------------------------------------$6

$200

$300

$400

---------------------------------------------$7

$225

$375

$525

---------------------------------------------$8

$200

$400

$600

---------------------------------------------$9

$125

$375

$625

----------------------------------------------

Pizza King Charges

Minimum Reward

* ---------------------------------------------$5

$125

---------------------------------------------$6

$200

---------------------------------------------$7

$225*

---------------------------------------------$8

$200

---------------------------------------------$9

$125

---------------------------------------------Thus, maximin action is to charge $7.

To determine maximax action look at:

Pizza King Charges

Maximum Reward

---------------------------------------------$5

$225

---------------------------------------------$6

$400

---------------------------------------------$7

$525

---------------------------------------------$8

$600

---------------------------------------------$9

$625*

---------------------------------------------Thus, maximax action is to charge $9.

The regret matrix is

Pizza King Price

Noble Greek Price

---------------------------------------------$6

$8

$10

Maximum Regret

---------------------------------------------$5

$100

$225

$400

$400

---------------------------------------------$6

$25

$100

$225

$225

---------------------------------------------$7

$0

$25

$100

$100

---------------------------------------------$8

$25

$0

$25

$25*

---------------------------------------------$9

$100

$25

$0

$100

---------------------------------------------Thus, minimax regret action is to charge $8.

Expected reward for

for

for

for

for

$5

$6

$7

$8

$9

=

=

=

=

=

$175

$300

$375

$400

$375

Thus, Pizza King maximizes their expected reward by charging $8.

Section 13.2

Problem 3. Since u''(x) = 0, I am now risk neutral.

E(U for L1) = 2(19,000) + 1 = 38,001

E(U for L2) = 0.1(20,001) + 0.9(40,001) = 38,001

Thus, I am indifferent between L1 and L2. (This is because a risk

neutral decision maker chooses between lotteries on basis of

expected value and L1 and L2 have same expected value. Let

x = CE(L2). Then 2x + 1 = 38,001 or x = $19,000. Thus

RP for L2 = 19,000 - 19,000 = $0.

Problem 7. Let u(A) = 1 and u(D) = 0. Then u(C) = .25,u(B) = .70

and OR course has expected utility of

0.10(1) + 0.4(0.70) + 0.5(0.25) = 0.505

Statistics course has expected utility of

0.7(0.70) + 0.25(0.25) + 0.1(0) = 0.5525. Thus, Statistics course

should be taken.

Problem 10. Hiring CPA has expected utility of

0.2u(35,500) + 0.8u(31,500) =

0.2(35,500)1/2 + 0.8(31,500)1/2 = 179.7

while Not Hiring CPA has expected utility of

(32,000)1/2 = 178.9. Thus, the CPA should be hired.

Problem 16.

(a) Let b = buying price of lottery. Then I am indifferent between

1/2 10,000 + 1,025 - b

----1/2 10,000 – 199 - b

----and

1

10,000

-----Then 100 = 1/2(11,025 - b)1/2 + 1/2(9801 - b)1/2.

(b) Let s = minimum selling price. Then I am indifferent between

1/2 11,025

-----1/2 9,801 and

------1

10,000 + s or

-------(10,000 + s)1/2 = 1/2(11,025)1/2 + 1/2(9,801)1/2

= 1/2(105 + 99) = 102

or 10,000 + s = 10,404 and s = $404

(c) Now we are indifferent between

1/2 2,025

---1/2

801

____

and

1

1,000 + s

----Thus, (1,000 + s)1/2 = 1/2(2025)1/2 + 1/2(801)1/2

= 1/2{45 + 28.30}

Therefore, 1000 + s = 1,343.22 and s = $343.22. Thus, the selling

price of the lottery (and indeed, the buying price for the

lottery) depends on our current asset position.

(d) Let a = asset position, b = buying price of lottery and s =

selling price of lottery. Then I am indifferent between

1/2

-----

a - b + 1,025

1/2

a - b - 199

-----and

1

a

.

-----I am also indifferent between

1/2 a + 1,025

------1/2 a - 199

-------

and

1

a + s

------Thus we have that 1/2(1 - eb-a-1025) + 1/2(1-eb-a + 199) = 1 – e-a

or -1/2(eb-a[e-1025 + e199] = -e-a.

Thus, eb = 2/(e-1025 + e199) and for all asset positions

b = ln {2/(e-1025 + e199))

We also know that

1/2(1 – e-a-1025) + 1/2(1 - e199-a) = 1 – e-a-s.

Thus,

-e-a(e-1025 + e199)/2 = -e-a-s or

e-s = (e-1025 + e199)/2 and

s = ln {2/(e-1025 + e199)}.

Thus, both the buying and selling price for the lottery are

independent of current asset position and are equal!

Section 13.4

Problem 1. Hire geologist. If favorable report, we drill; if

unfavorable report, do not drill. Expected net profits = $180,000.

EVWSI = $190,000 EVWOI = $170,000. EVSI = $190,000 - $170,000 =

$20,000. Since EVSI is greater than the cost of geologist, we

should hire geologist.

Section 13.5

Problem 3. P(cold forecast) =0.9(0.4) + 0.2(0.6) = 0.48,

P(warm forcast) = 1 -0.48 = 0.52.

P(cold

P(warm

P(cold

P(warm

year|cold

year|cold

year|warm

year|warm

forecast) = 0.36/0.48 = 0.75,

forcast) = 0.12/0.48 = 0.25,

forecast) = (0.1)(0.4)/0.52 = 1/13,

forecast) = (0.8)(0.6)/0.52 = 12/13.

Thus, test should not be taken and either wheat or corn can be

planted.

EVWSI = 6620 + 600 = 7220

EVSI =7220 – 6800 = 420

EVWPI = 7400, EVWOI = 6800, and EVPI = 7400 – 6800 = 600.