Vessel and voyage specific factors in determination of tanker freight

advertisement

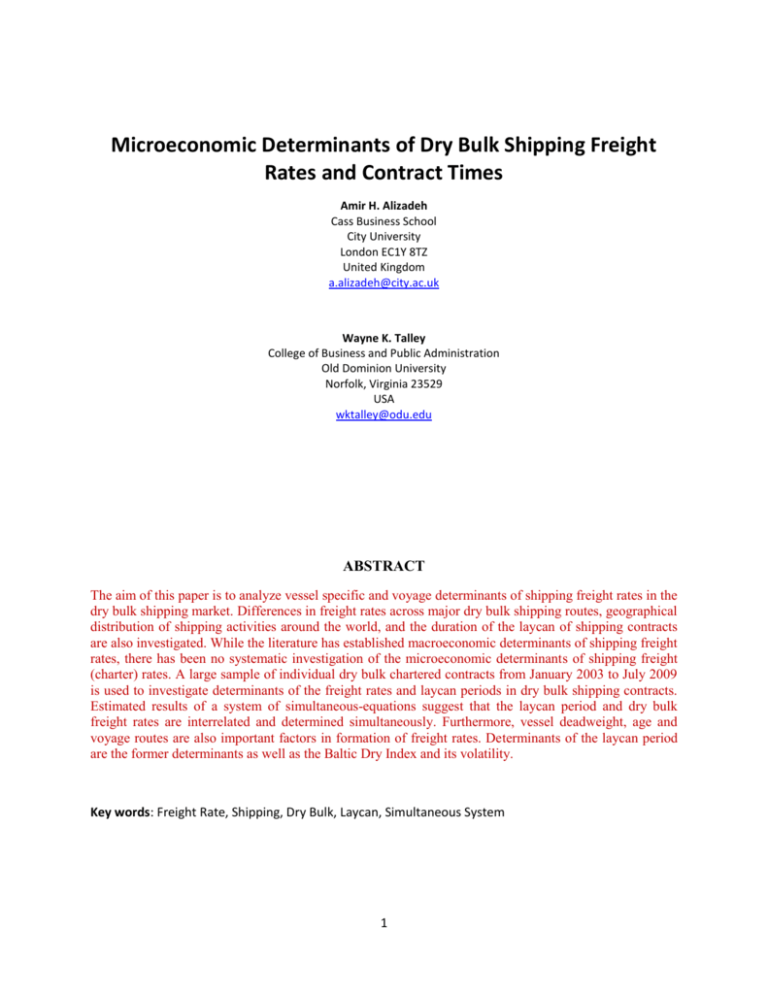

Microeconomic Determinants of Dry Bulk Shipping Freight Rates and Contract Times Amir H. Alizadeh Cass Business School City University London EC1Y 8TZ United Kingdom a.alizadeh@city.ac.uk Wayne K. Talley College of Business and Public Administration Old Dominion University Norfolk, Virginia 23529 USA wktalley@odu.edu ABSTRACT The aim of this paper is to analyze vessel specific and voyage determinants of shipping freight rates in the dry bulk shipping market. Differences in freight rates across major dry bulk shipping routes, geographical distribution of shipping activities around the world, and the duration of the laycan of shipping contracts are also investigated. While the literature has established macroeconomic determinants of shipping freight rates, there has been no systematic investigation of the microeconomic determinants of shipping freight (charter) rates. A large sample of individual dry bulk chartered contracts from January 2003 to July 2009 is used to investigate determinants of the freight rates and laycan periods in dry bulk shipping contracts. Estimated results of a system of simultaneous-equations suggest that the laycan period and dry bulk freight rates are interrelated and determined simultaneously. Furthermore, vessel deadweight, age and voyage routes are also important factors in formation of freight rates. Determinants of the laycan period are the former determinants as well as the Baltic Dry Index and its volatility. Key words: Freight Rate, Shipping, Dry Bulk, Laycan, Simultaneous System 1 1. Introduction International sea transportation has been an instrumental factor in world economic activity and international trade. Total seaborne trade in commodities reached an estimated 8,226 million metric tonnes (mmt) in 2008 – consisting of 3,060 mmt of dry bulk commodities, 3,052 mmt of liquid bulk commodities, and 2,114 mmt of other dry cargo and manufactured goods.1 The dry bulk shipping market is by far the largest sector of the world’s shipping market in terms of cargo volume and weight. In 2008 the dry bulk shipping fleet transported 843 mmt of iron ore, 794 mmt of coking and thermal coal, 314 mmt of grains, 119 mmt of bauxite, alumina and phosphate rock, and 990 mmt of minor dry bulk commodities, e.g., cement, sugar, and fertilizers. At the end of 2008 the cargo carrying capacity of the world dry bulk shipping fleet of 418 million metric tonnes was 34.7% of the total world shipping fleet, and the number of dry bulk ships exceeded 7,000.2 Therefore, it is not surprising that a large number of studies have investigated the formation and behavior of dry bulk freight (charter) rates, chartering decisions and policies, transportation strategies, and fleet deployments and operations of the dry bulk shipping industry (See section 2). The existence of different types of ship chartering contracts in the bulk shipping industry provide charterers greater flexibility to secure their sea transportation requirements, while minimizing their costs. The contracts vary depending on the terms of agreement and the type of service that shipowners agree to provide to charterers. Broadly speaking, chartering contracts can be classified into five different types: Voyage Charter (VC), Consecutive Voyage or Contracts of Affreightment (CoA), Trip Charter (TC), Time or Period Charter (PC), and Bareboat Charter (BC) contracts. The main differences among these contracts are the: duration of the contract, method of freight rate calculation, cost allocations and commercial and operational responsibilities3. Freight rates in the bulk shipping industry fluctuate considerably in the short run (Kavussanos, 1996a). Such fluctuations affect the formation of shipping policies, transactions and contracts and ship owners’ and charterers’ cash flows and costs (Brown et al. 1987 and Laulajainen, 2007). Hypothesized macroeconomics determinants of shipping bulk freight rates include the state of the general world economy, international seaborne trade, the tonnage available for trading, bunker prices, and the changes in fleet due to delivery of newbuldings and sending vessels for scrapping (Strandenes 1984, Beenstock and Vergottis, 1989). In addition, freight rates are dependent on such vessel characteristics as size and age of vessels, the route in which the vessel is employed and the terms of charter contracts. The terms and conditions of the charter contract, e.g., the loading date in relation to the contract date and the cargo size in relation to vessel’s capacity, are also determinants of freight rates. There are two important dates in any vessel charter contract. The day on which negotiations between the ship owner and the charterer are completed and the charter party contract is signed, i.e., the fixture date or the hire date and the day that the ship must present herself at the loading port ready for the loading of cargo (or the delivery day to be delivered to the charterer) known as the layday. The time window within which the vessel must be presented for loading or be delivered to the charterer is also known as the layday/cancellation (or laycan) period. If the vessel is presented ready for loading cargo after this time 1 Statistics are from Clarksons Research Services (Shipping Intelligence Network). Statistics are from Clarkson Research Services Limited for dry bulk carriers greater than 10,000 deadweight tonne capacity. 3 See Stopford, 2009, and Alizadeh and Nomikos, 2009, for more details on differences among shipping contracts. 2 2 window, then the charterer has the option to cancel the contract, and potentially claim compensations. Thus, the time period between the fixture date and the layday is the laycan period. Once the loading or lifting day (layday) of the cargo has been determined, the trader (vessel charterer) will enter the market to find and charter the most suitable ship for transportation of the cargo from the loading port to the destination port. Depending on the nature of the trade, the layday may occur anytime from one day to couple of months after the fixture date. Hence, assuming vessels are available in the market at all time and at a constant flow, the trader has the option to enter into the freight market and hire a vessel anytime until the very last minute (as long as it is practical) before the layday. Therefore, it is the trader’s decision for all practical purposes as to when to enter the market and charter (or hire) a ship. For instance, if the conditions are not favorable and there is enough time before the layday, the trader may wait and not inform the shipbroker about the need for a ship. The charterer’s decision of when to charter a ship i.e., the fixture date, is dependent on such market conditions as current and expected freight (charter) rates, the volatility of freight rates, and the cost to be incurred of not being able to find a ship to charter if the decision to hire a ship is delayed. Although numerous macroeconomic studies on the formation and behavior of shipping freight (charter) rates exist, there has been little investigation of microeconomic determinants, such specific vessel and voyage determinants, of shipping freight (charter) rates. Moreover, there is no study in the literature that investigates determinants of the laycan period in shipping contracts. This paper attempts to fill this gap not only with respect to shipping freight (charter) rates but also with respect to the laycan period of ship charter contracts. In addition, the paper analysis, for the first time the relationship between freight rate and the laycan period of shipping contracts. The purpose of this paper is threefold: (1) investigate vessel and voyage determinants (e.g., vessel age, hull type, deadweight size of the fixture and route) of individual dry bulk shipping freight (charter) rates; (2) investigate vessel and voyage determinants of the individual delivery times of chartered ships (laycan periods); and (3) investigate the relationship between dry bulk shipping freight (charter) rates and laycan periods of individual charter contracts. To the knowledge of the authors, this paper is the first to appear in the literature to undertake such investigations, i.e., to investigate microeconomic determinants of dry bulk shipping freight rates and laycan periods. When charterers enter the market to fix vessels, their decision may affect market demand and consequently freight rates. However, waiting for more favorable freight rates may be risky as freight rates tend to move very sharply in a very short period of time. From the shipowners’ point of view, information on the role of vessel and voyage specific factors in the determination of freight rates can be used in their shipping investment, operations, and deployments strategies. The following section of the paper presents a review of the literature on determinants of bulk shipping freight (charter) rates. Section 3 presents the methodology (i.e., econometric equation specifications) for investigating vessel and voyage determinants of individual freight (charter) rates and laycan periods for bulk shipping contracts. The data are described in section 4, while section 5 presents the empirical results. Finally, conclusions are presented in section 6. 3 2. Review of literature Like any market, dry bulk freight (charter) markets are characterized by the interaction of supply and demand – for this market the supply and demand for charter dry bulk ships (Stradenes 1984, Beenstock and Vergottis 1993, and Tsolakis 2005). The demand for charter dry bulk ships is a derived demand which depends on the economics of the commodity markets and international seaborne trade, world economic activity such as imports and consumption of energy commodities (see Stopford 2009). The supply of charter dry bulk ships, on the other hand, depends on the size of the shipping fleet, the fleet’s tonnage that is available for trading, shipbuilding activities, bunker fuel prices, the scrapping rate of the fleet and the productivity of the shipping fleet at any point in time. Heretofore, studies analyzing, modeling and forecasting freight (charter) rates have done so from a macroeconomic perspective. Studies by Hawdon (1978), Strandenes (1984), and Beenstock and Vergottis (1989, 1993), among others, argue that the shipping freight (charter) rate is determined through the interaction between supply and demand for sea transportation. They find that world economic activity, the growth in industrial production, seaborne trade in commodities, oil prices, availability of tonnage or stock of fleet, new vessel buildings on order, and shipbuilding deliveries and scrapping rates determine freight rates for sea transportation. More recent studies by Dikos et al. (2006) and Randers and Göluke (2007) also use macroeconomic variables in a system dynamic setting to model and forecast freight (charter) rates. Other studies have examined the time series properties of shipping freight (charter) rates such as their dependence on past values; further, they use univariate or multivariate time series models to capture the dynamics of freight rates. These models are then used to forecast shipping freight (charter) rates and their volatilities (Veenstra and Franses, 1997, Kavussanos and Alizadeh, 2002, Adland and Cullinane, 2005 and 2006, Lyridis et al., 2004, and Batchelor et al., 2007). Moreover, studies such as Kavussanos and Alizadeh (2001) investigate the seasonal behavior of dry bulk shipping freight (charter) rates and explain how seasonal production, trade and transportation of commodities impact ship charter rates. These studies utilize macroeconomic economic data in an attempt to capture the dynamics and fluctuations in shipping freight (charter) rates; however, their performance in predicting shipping freight rates has been poor and inaccurate at best. The poor and underperformance of structural and time series models using macroeconomic variables for forecasting shipping freight (charter) rates may be attributed to an aggregation bias. In addition to macro forecasts of shipping freight rates, ship owners and charterers also use micro forecasts for cash flow analyses, budgeting, and making operational decisions, e.g., micro forecasts of shipping freight (charter) rates for specific routes. Micro vessel variables as determinants of shipping freight (charter) rates are found in studies by Tamvakis (1995) and Tamvakis and Thanopolou (2000). Tamvakis and Thanopolou (2000) investigate vessel age as a determinant of a two-tier dry-bulk ship charter market. The empirical results based upon the time period 1989 to 1996 (that covered different stages of the shipping cycle), however, found no significant difference between freight (charter) rates paid for newer versus older vessels. Laulajainen (2007) has investigated differences in shipping freight rates and operational profitability for different shipping routes. He concludes that the ratio of demand to available ship tonnage, weighted by sailing distance to a discharging/loading region, is an important factor in explaining dry bulk freight rates for individual routes. 4 3. Methodology The model’s dependent variable for investigating determinants of shipping freight (charter) rates is defined as the difference between an individual shipping freight rate and the value of the Baltic Index freight rate for that specific class of vessel on the fixture date. Since Capesize and Panamax fixtures are considered, the Baltic Capesize Average Four Trip-Charter and the Baltic Panamax Average Four TripCharter Rates are used. These freight indices are used by the industry to monitor the overall shipping market movements, to trade and settle freight derivatives4, and to benchmark operating performance of a vessel or a fleet. Therefore, it can be argued that the Baltic Average 4TC Rates reflect the movement of the ship freight charter market with respect to changes in macroeconomic factors. Consequently, the difference between the freight rate for a particular charter contract and the Baltic 4TC Rates, at any point in time, should reflect the factors specific to the vessel or the voyage under which the vessel is contracted to operate. In other words, the difference between a single fixture rate and the benchmark index rate should be a function of the route over which the vessel operates, RT, the laycan period of the fixture, LC, the size of the vessel, SZ, the age of the ship, AG, and the volatility in the market, VOL. Thus, the determinants of freight rates for dry bulk trip charter contracts are investigated using the following hypothesized freight (charter) rate regression model: K dfri ,t 0 1 LCi ,t 2 SZ i 3 AGi 4 AGi2 5VOLt j RTi , j vi ; j 1 vi ~ iid(0, 2 ) (1) where dfri ,t fri ,t bfit is the difference between the log of fixture rate for contract i at time t, fri,t,, and the log of Baltic benchmark freight rate (Baltic Average 4TC Rates) at time t, bfit=ln(B4TCt). The variable, age-squared, appears in equation (1) since the operational performance, technological efficiency and quality standard of ships decline, as they get older, and consequently their hire rate is assumed to be a nonlinear function of age. The dummy variables for individual routes, RTi,j, also appear in equation (1). Determinants of charterers’ decisions on the timing of trip-charter hires are investigated by regressing the fixture laycan period on the hypothesized explanatory variables: route, dry bulk market condition, and vessel characteristics such as vessel size and age. The laycan regression model is specified as follows: K LCi ,t 0 1dfri ,t 2bfit 3 SZ i 4 AGi 5VOLt 1 j RTi , j i ; j 1 i ~ iid(0, 2 ) (2) Since during the process of hiring a vessel, freight rates and other terms of shipping contracts are negotiated and agreed at the same time, it might be the case that freight rates and laycan periods are interrelated and should be modeled as a system of simultaneous equations. If so, individual estimations of the above two equations using the Ordinary Least Squares (OLS) method will yield biased and inconsistent parameter estimates. Whether a simultaneous relationship exists between freight (charter) 4 See Alizadeh and Nomikos (2009) for more detail on Baltic Indices and freight derivatives trading. 5 rates and laycan periods can be investigated by using the Hausman (1978) test for simultaneity. The Hausman test is performed using the two step method of Davidson and Mackinnon (1993), i.e., by first estimating freight equation (1) and then using the estimated residuals as observations for the explanatory variable (vˆi ) in the laycan equation. The significance of the coefficient of residuals of the freight equation in the laycan equation is an indication that there is a simultaneous relationship between the laycan period and freight rate of shipping contracts. In addition, the test can be performed by first estimating laycan equation (2) and then using the estimated residuals as observations for the explanatory variable (ˆi ) in the freight equation. Again, significance of the coefficient of residuals of the laycan equation in the freight model can be evidence of the existence of a simultaneous relationship between the two variables. If a simultaneous interrelationship exists between the freight rate and the laycan period of a shipping contract, then equations (1) and (2) must be re-specified to reflect this simultaneous interrelationship – i.e., by including LCi,t as an explanatory variable in the dfri,t equation (1) and including dfri,t as an explanatory variable in the LCi,t equation (2). Therefore, we define the following system: K dfri ,t 0 1 LC i ,t 2 SZ i 3 AGi 4 AGi2 5VOLt 1, j RT j ,i 1,i j 1 LC i ,t 0 1 dfri ,t 2 bfit 3 SZ i 4 AGi 5VOLt K j 1 2, j RT j ,i 2,i 1,i ε i ~ (0, Σ) 2 ,i (3) where i is the vector of residuals which follows a bivariate distribution with zero mean and variancecovariance matrix, . When specifying a system of simultaneous equations, there are two main points that should be considered. The first issue is the problem of identification, which arises when parameters of the structural equation cannot be deduced using the parameters of the reduced form model. Therefore, for a system of simultaneous equations to be identified, both the order and the rank conditions should be satisfied.5 The system of equations presented in (3) satisfies both the order and the rank conditions. The second issue is the estimation method. Because of the correlation among explanatory variables and error terms in each equation as well as cross correlation between error terms, the OLS estimation method is not an appropriate estimation technique for estimating parameters of a system of simultaneous equations. An appropriate estimation technique is the Three Stage Least Squares (3SLS) estimation technique, since it yields unbiased, consistent and efficient estimates of the parameters of the system in the presentence of heteroskedasticity and contemporaneous correlation in the errors across equations (Gujarati 2002). 5 There are two conditions which must be satisfied for the system of simultaneous equation to be identified. These are the order and the rank conditions of identifications. The order condition, which is a necessary but not sufficient condition for identification of simultaneous system of equations, requires the number of excluded and predetermined variables in each equation to be at least less than the number of endogenous variables minus one. The two equations in the system defined in (3) satisfy this condition; that is, the freight equation is exactly identified and the laycan equation is over-identified. The over-identification is not a major problem because we use the 3SLS estimation method, which yield efficient, unbiased and consistent estimates. 6 4. Description of Data The world’s dry bulk fleet of ships is broadly differentiated into five size classes: Handysize (20,000 to 35,000 dwt), Handymax (35,000 to 45,000 dwt), Supramax (45,000 to 55,000 dwt), Panamax (60,000 to 80,000 dwt) and Capesize (more than 80,000 dwt, normally 120,000 to 180,000 dwt).6 Capesize bulk carriers are almost exclusively involved in transportation of major dry bulk commodities, i.e., iron ore and coal, between exporting and importing regions. Panamax vessels are also involved in transportation of iron ore and coal in addition to grain. Midsize dry bulk carriers, using Supramax and Handymax vessels, are involved in transportation of grain, bauxite and alumina, and phosphate rock, in addition to minor bulk commodities. Handysize and smaller bulk ships are usually equipped with cargo handling gears (cranes) and transport small-shipment-size bulk commodities between ports with relatively shallow water depths. The data for this study were collected from Clarkson’s Research Services Ltd website, Shipping Intelligence Network (SIN), and comprise information on Panamax and Capsize trip-charter fixtures over the period January 2003 to July 2009. The larger-sized Panamax and Capsize ships were selected for the study, since the trading routes for these ships are distinct and their trading activity is concentrated in a number of major shipping routes – thereby simplifying the empirical analysis of this paper. The trading routes for smaller bulk ships are very scattered, since the market for these vessels are quite fragmented, e.g., their trade routes utilize almost any combination of seaports. Around 45% of spot market activities in the Capsize sector are trip-charter with the remaining contracts being voyage charter contracts. In the Panamax sector, more than 90% of the spot fixtures are based on trip-charter contracts. The data include information on vessel characteristics, voyage characteristics, shipowners, and charterers. After filtering the data for missing values, omitted information, and other unusable observations, a total of 3,039 and 9,076 fixtures observations remain for Capsize and Panamax dry bulk ships, respectively.7 Specifically, the information on each fixture consists of the vessel’s name, size, age, type, dwt, and the owner of the vessel as well as the delivery and redelivery locations or regions, the freight rate for the fixture, the fixture’s date, the layday, the cargo type and size, and the charterer. The Baltic Capesize and Panamax freight indices (earnings) were also collected from Clarkson’s Research Services Ltd website. These two freight series, which are compiled and reported by the Baltic exchange, are based on the average of reported trip-charter fixtures on a daily basis on four major routes. These routes are the most active Baltic trade routes and cover most of the Baltic fixtures (see Table 1). The detail and definition of these series can be found in the Baltic Exchange website. The trade routes for Capsize and Panamax dry bulk carriers utilized in the empirical analysis are found in Table 2. The first four routes listed for both Capsize and Panamax carriers are Baltic trade 6 In January 2009, the dry bulk fleet was comprised of 820 Capesize (142.5 million dwt), 1,556 Panamax (114.51 million dwt), 1708 Handymax (82.93 million dwt), and 2,927 Handysize (78.14 million dwt), vessels. The Supramax fleet is relatively small as this a new class of dry bulk carriers. The percentage of dry bulk fleet in terms of cargo carrying capacity is Capesize 34.1%, Panamax 27.4%, Handymax 19.8%, and Handysize 18.7%. 7 The data used here is dry bulk trip charter contracts by observations every day. Therefore, although the structure of the data can be considered both cross sectional and time-series, the difference here is that the number of observations every day may vary depending on the number of actual fixtures reported. 7 routes. The non-Baltic routes for Panamax carriers are: Mediterranean to Far East, PG - Indian Ocean to Far East, Far East to PG-Indian Ocean, Continent to PG-Indian Ocean, and PG-Indian Ocean to Continent. See the Appendix for further description of these routes. The routes identified represent about 86.8% of the observed trip-charter fixtures; the remaining fixtures are for numerous minor routes with less trading activities, while the four main Baltic routes represent 67% of the trip-charter fixtures, thus indicating how concentrated the market is. Table 22 also presents descriptive statistics for these routes via vessel type with respect to the number of fixtures and the laycan period. It is interesting to note that the average (or mean) and the standard deviation of the laycan period are directly related to vessel size. For instance, the average and standard deviation of laycan periods for Capesize fixtures are 7.5 and 6.7 days, respectively, while the average and standard deviation of the laycan period for Panamax fixtures are 4.4 and 4.6 days, respectively. The average laycan period for the Baltic routes (first 4 routes) also seems to be longer for Capesize vessels compared to Panamax ships. In addition, the most liquid route seems to be the Trans Pacific Round Voyage route for both vessel types, with 54% and 35% of the activity in the Capesize and Panamax sectors, respectively. The descriptive statistics for the variables – vessel age, vessel size, Laycan period, freight rate and the Baltic Average 4TC Rates – are reported in Table 32. The results reveal similar average ages and standard deviations for both Capesize and Panamax fleets. As expected, the average Capesize vessel has a deadweight capacity of 165,000 mt, with standard deviation of 14,900 mt, while the average deadweight capacity of Panamax vessels is 72,300 mt, with a standard deviation of 3,900 mt. The largest Capesize vessel fixed over the sample period has a 301,800 dwt capacity. The average Capesize trip-charter rate over the sample was 66,964 $/day, with a standard deviation of 47,611 $/day. The maximum Capesize trip-charter rate was 303,000 $/day, and the minimum rate was 1,000 $/day. The average trip-charter rate for Panamax ships was 32,001 $/day, with a standard deviation of 20,877 $/day. The maximum freight rate was 125,000 $/day, and the minimum rate was 1,000 $/day. These statistics illustrate the existence of very high volatility in the dry bulk shipping markets that has been documented in the literature. The descriptive statistics of the Baltic Average 4TC Rates reveal an average earning of 72,451 $/day with a standard deviation of 46,378 $/day for Capesize vessels and an average earning of 32,506 $/day with a standard deviation of 20,189 $/day for Panamax vessels. Finally, the Jarque and Bera (1980) tests indicate that distributions of all variables are significantly different from the normal distribution. 5. Empirical Results The data described above are used to estimate the parameters of equation 1 and 2 independently of each other for the purpose of investigating determinants of freight (charter) rates and the laycan period of dry bulk shipping fixtures. This investigation is also undertaken by simultaneously estimating the parameters of the simultaneous equation set (3) assuming that the laycan period and freight rates of drybulk fixtures are interrelated. The Baltic Average 4TC rates for Capesize and Panamax vessels are used as measure of the freight rate levels, while volatility of these indices (VOL) are estimated as exponentially weighted average variances of Capesize and Panamax freight rates (average 4TC) over the sample period. 8 5.1 Determinants of freight rates Separate OLS estimates of equation (1) for the two dry bulk vessels – Capesize and Panamax – are presented in Table 4. Diagnostic tests of the residuals, including the Breusch and Godfry test for serial correlation and the White test for heteroscedasticity, suggest that the residuals of all models are nonspherical. Therefore, the Newey-West (1987) method is applied to correct the standard errors of estimated coefficients. The results suggest that in both the Capesize and Panamax markets, the dependent variable, which is the difference between the freight rate for individual fixtures and the Baltic Indices (market rate), can be explained by the laycan period of the contract as well as by the size and age of the vessel. The significant and positive coefficients of the laycan and vessel size variables suggest that there exist a positive relationship between these two variables and the freight differential (dfri,t). Estimated coefficients of vessel age and vessel age-squared in the model suggest that there is a negative and nonlinear relationship between the age of the vessel and hire rate for dry bulk vessels. Moreover, coefficients measuring the impact of market volatility on freight rate differential are not significant in both the Capesize and Panamax markets. Moreover, in the model for Capsize freight rates, significant and positive estimated coefficient of the route dummy variable, 2, indicate that on average freight rates in route C9_03 (European Continent to Far East) is 26.85% higher than the Baltic Capeszie Average 4TC Rate, while significant and negative coefficients of route dummy variables, 4, indicate that freight rates in route C11_03 (Far East to the European Continent) on average are 32.3% lower than the Baltic Capeszie 4TC Rate. This is expected because routes C9_03 is considered to be a front-haul route, while C11_03 is considered to be back-haul route, and in general back-haul routes trade at a discount to front-haul routes. In the Panamax market, estimated coefficients for all route dummy variables are significant, which means that there are significant differences in freight rates amongst the routes. For instance, the results reveal that Panamax vessels operating in routes P1A and P2A tend to earn on average 3.68% and 14.94% higher than the Baltic Panamax Average 4TC Rate, respectively. On the other hand, vessels trading in route P3A and P4 tend to earn on average 9.1% and 17.09% lower than the Baltic Panamax Average 4TC Rate, respectively. Furthermore, vessels operating in routes 5 (Mediterranean to the Far East), 6 (PGIndian Ocean to the Far East), and 8 (Continent to PG-Indian Ocean) earn on average 24.74%, 8.09%, and 19.0% higher than the Baltic Panamax Average 4TC Rate, respectively. Whereas, vessels operating in routes 7 (the Far East to PG-Indian Ocean) and 9 (PG-Indian Ocean to Continent) earn on average 7.57% and 15.04% lower than the Baltic Panamax Average 4TC Rate, respectively. Therefore, considering that these routes are pairs and generally represent round trips, it can be observed that while vessels trading on routes to the Far East demand a premium, vessels trading in routes out of the Far East and back to the European continent (routes 7 and 9) are generally traded at a discount. Finally, the coefficient of goodness of fit, measured by R-bar-squared of the regression model, indicates that 58.07% and 34.6% of the difference in fixture freight rates and Baltic Average 4TC Indices for the Capesize and Panamax vessels, respectively, can be explained through vessel and voyage specific factors such as laycan period, vessel size, age and the trading route. 9 5.2 Determinants of Laycan Period Separate OLS estimates of Laycan equation (2) for Capesize and Panamax vessels are found in Table 5. In both equations, estimated standard errors of parameters are corrected for the presence of heteroscedasticity and serial correlation using the Newey and West (1987) method. Starting with the Capesize estimate, it can be seen that there is no significant difference between the laycan periods of the Capesize charter contracts since coefficients of all dummy variables are not significantly different from zero. The only exception is the estimated coefficient for the transpacific route in which the laycan period is on average 1.38 days shorter than other routes. The estimated coefficients of other explanatory variables in equation (2) reveal that laycan period of trip-charter contracts are positively related to the freight differential (dfri,t) and log of Capesize Baltic 4TC average, bfit. This is expected because a higher freight rate level is an indication that there is shortage of supply. As a result, charterers tend to hire ships earlier with longer laycan period in order to avoid future freight rate increases and the possibility of incurring extra cost due to unavailability of tonnage. Negative and significant coefficients of vessel size and age in the laycan equation for capsize vessels indicate that there is negative relationship between the duration of the laycan and vessel size as well as vessel age. In other words, larger vessels and older vessels tend to be hired later than smaller and newer Capsize vessels, everything else being equal. This is also expected, because if the charterers have a choice between a modern and an old ship with similar freight rates, the newer vessel will be preferred to the older ship; at the same time, a smaller Capsize vessel is preferred to larger one, since the daily freight rate of the former will be less than that of the latter. Of course, the size of the cargo to be loaded on the vessel is the most important factor in determing the size of the vessel chosen for hire by the charter. Finally, the results reveal a negative and significant relationship between the duration of the laycan period of tripcharter contracts and the volatility of capsize freight rates. Such a relationship can be attributed to the fact that everything else being equal, the greater the uncertainty in the market the later the charterer would like to fix tonnage (ships) for their transportation requirements. This can be explained through the option valuation theory in the sense that higher uncertainty will increase the value of the option to wait or delay fixing a ship. Consequently, charterers realize such a value and try to find the optimum time for execution of the contract, which means longer delay or waiting time and a shorter laycan period when the freight market is volatile. Turning to the estimation results of (2) for determinants of the laycan period of charter contracts for Panamax vessels reported in Table 5, it can be seen that there are significant differences amongst the laycan periods of the Panamax charter contracts as indicated by the estimated coefficients of the route dummy variables. For instance, the laycan period for contracts in routes P1A_03, P2A_03 and P3A_03 of the Baltic as well as routes 7 (Far East to PG-Indian Ocean) and 8 (Continent to PG-Indian Ocean) are on average shorter than fixture in other routes. At the same time, the duration of the laycan period of charter contracts in routes 6 (PG-Indian Ocean to Far East) is on average marginally longer than other routes by almost a quarter of a day. Finally, the duration of the laycan periods of charter contracts in routes P4_03 (Far East to the Continent), 5 (Meditranean to Far East), 6 (PG-Indian Ocean to Far East), and 9 (PGIndian Ocean to the Continent) are not significantly different from the average of the laycan period of the contract in the sample. 10 The estimated coefficients of other explanatory variables in equation (2) reveal that the laycan period of trip-charter contracts in the Panamax market are also positively related to the freight differential (dfri,t) as well as the log of the benchmark Baltic Panamax 4TC average, bfit. As explained earlier, charterers tend to hire ships earlier when a longer laycan period exists in order to avoid future freight increases, when they expect a shortage of supply and higher freight rates due to unavailability of vessel tonnage. In contracts to what was observed in the Capesize model, insignificant coefficients of size and age in the laycan equation for Panamax vessels suggest that there is no relationship between the duration of the laycan and vessel size as well as vessel age. Moreover, in line with what was observed in the Capesize market, the results reveal a negative and significant relationship between the duration of the laycan period of trip-charter contracts and the volatility of Panamax freight rates. Finally, the estimated coefficients of goodness of fit of 5.77% and 3.41% for Capesize and Panamax laycan equations, respectively, suggest that only small proportion of the variation of laycan period can be explained by variables such as the freight rate level, volatility, size and age of the vessel. 5.3 Simultaneous-Equation Determinants of freight rate and laycan period The estimated coefficients of the simultaneous system of equations (3) for Capesize and Pananax freight (charter) rates and laycan periods using the 3SLS estimation method are reported in Table 6 and Table 7, respectively. The results are qualitatively similar to those for the single equation models of the freight rate and the laycan period -- although estimation of the two equations as a system of simultaneous equations allows interaction between the dependent variables and yield more efficient estimates of parameters due to higher degrees of freedom. Estimated coefficients of route dummy variables in the freight rate equation reveal that only 2 of the 4 route dummy variables are statistically significant at the 1% level – Continent to Far East (route C9_03) and Far East to Continent (route C11_03). The freight rate in route C9_03 is 26.75% higher than for Capesize 4TC capsize vessels, while the freight rate in route C11_03 is 32.13% lower than that for Capesize 4TC. These results are similar to those observed in the single equation models and signify the argument that freight rates in the back-haul route from the Far East to the Europe are significantly lower than front haul routes from Europe to the Far East. The coefficients of route dummy variable for routes C8_03 (transatlantic round voyage) and C10_03 (transpacific round voyage) are not significantly different from zero at the 5% level. There is a significant between the freight rate and vessel size and age. A positive relationship exists between freight rate and vessel size, while a negative and quadratic relationship exists between the freight rate and vessel age, similar to what was observed in the single equation model. The positive coefficient for the laycan period suggests that the freight (charter) rates increases as the laycan period increases. The coefficient of the laycan period indicates that for every one day increase in the laycan period, the freight rate increases by 0.47%. The estimated coefficient of freight market volatility is not significant. The estimated coefficients of the route dummy variables in the laycan equation are all negative, but only the coefficient for route C9_03 (Continent to Far East) is statistically significant, indicating a relatively shorter laycan period for capsize fixtures in this route compared to other routes. The coefficient of freight rate, dfri,t , is positive and significant, suggesting that the laycan period increases when the 11 freight rate increases. The positive and significant coefficient of the Baltic 4TC Rate suggest that charterers tend to hire vessels earlier when freight rates are high. The estimated coefficient of freight market volatility is negative and significant. Furthermore, the coefficients of vessel size and age are both negative and significant in the laycan equation, suggesting that the laycan period for larger and older Capesize vessels is shorter than for smaller and newer vessels. This is to be expected as noted by the fact that newer and more modern vessels are fixed earlier than older vessels. The estimation results of the Panamax freight rate and laycan period simultaneous equations also reveal similar results to those of the single equation models. Once again, freight rates differ among Panamax routes. Vessel age and size are significant determinants of freight rates, Larger panamax vessels command higher freight rates than smaller Panamax vessels and freight rates decrease non-linearly in relation to vessel age. The laycan period is also a significant determinant of the Panamax freight rate; the freight rate is higher when the vessel is hired early as opposed to being hired later. As for the single equation model, the results for the determinants of the Panamax laycan period for the simultaneous equation model reveal that the laycan period varies among routes. and these differences are consistent with those observed in single equation model of laycan period. Furthermore, the laycan period for Panamax vessels is positively related to the freight rate, the Baltic 4TC freight rate, and age of the vessel. Among these three determinants of the laycan period, only the coefficient sign for vessel age is not consistent with what was found for Capesize laycan period. The positive coefficient for vessel age suggest that older Panamax vessels have a longer laycan period than newer panamax vessels. The negative and significant coefficient of freight market volatility once again confirms that there is an inverse relationship between market volatility and laycan period for charter contracts. This result is consistent with real option valuation theory in the sense that as volatility increases the value of the option to wait increases, i.e., charterers tend to delay fixing vessels. On the other hand, as freight rates (or the value of the underlying asset) increase, the value of the option to wait decreases and charterers tend to enter the market earlier to hire vessels. 6. Conclusions The purpose of this paper has been to investigate vessel and voyage determinants (e.g., vessel age, size, and the fixture route) of individual shipping freight (charter) rates and laycan periods for dry bulk charter contracts as well as to investigate the relationship between these rates and the laycan periods for these contracts. Data for the investigation were obtained from Clarkson’s Research Studies website and comprise information on dry bulk trip-charter fixtures for the period January 2006 to April 2009 for Capesize and Panamax vessels. The investigation reveals several important findings: First, freight (charter) rates are positively related to the length of the laycan period and the size of the vessel (dwt). Second, a simultaneous relationship exists between freight (charter) rates and lengths of laycan periods. Third, dry bulk freight rates and laycan periods vary across shipping routes. Fourth, the laycan periods of freight contracts vary directly with freight (charter) rates and indirectly with freight rate volatility. This is expected, since higher freight rates generally reflect a lower availability of dry bulk tonnage – therefore, vessel charterers anticipating 12 shortages will seek to enter the charter market earlier, i.e., to fix their transportation requirements well in advance. When the volatility and uncertainty of freight rates increase, charterers are expected to delay their hiring of vessels as long as it is feasible to wait for the market to stabilize and avoid paying a premium to fix a vessel. Finally, laycan periods for trip-charter contracts in the dry bulk market are negatively related to the age of vessels, i.e., newer ships have longer laycans than older ones. Appendix In the capsize market, route C8_03 is a transatlantic route with delivery and redelivery in Europe (Gibraltar to Hamburg range). Route C9_03 is a trip from Europe to the Far East with delivery in Europe or Mediterranean and redelivery in the Far East. Route C10_03 is a transpacific round trip with delivery and redelivery in the Far East for trips to Australia, North Pacific, or even South Africa or India. Route C11_03 is a trip from Far East to the Continent Europe via South Africa or Australia. The Baltic Exchange also reports the average of these four routes as the Average 4TC, which is used for Forward Freight Trading. The four main Baltic routes represent 95% of the trip-charter fixtures, which shows how concentrated the capsize market is. It should be noted that there are other active Capesize routes such as Bolivar to Rotterdam (C7) and Richards Bay to Rotterdam (C4), amongst others, where vessels are hired on a voyage charter basis. These fixtures are not considered in our sample of trip-charter contracts. In the Panamax sector, the Baltic Exchange compiles and reports more or less the same four main routes, which again cover a large proportion of activities and fixtures. These routes are numbered as: P1A_03, transatlantic route with delivery and redelivery in Europe; P2A_03, Europe to the Far East; P3A_03, transpacific round trip with delivery and redelivery in the Far East for trips to Australia, North Pacific, or even South Africa or India; and P4_03, Far East to the Continent. The equally weighted average of these four routes is reported as the average Panamax 4TC. The average Panamax 4TC rate is also believed to convey the general earnings of Panamax vessels that are actively used for FFA trading. 13 References Adland, R. and Cullinane, K. (2005) “A Time-Varying Risk Premium in the Term Structure of Bulk Shipping Freight Rates.” Journal of Transport Economics & Policy, Vol. 39, pp. 191-208. Adland, R. and Cullinane, K. (2006) “The non-linear dynamics of spot freight rates in tanker markets.” Transportation Research: Part E, Vol. 42, No 3, pp. 211-224. Alizadeh, A. H. , and Nomikos, K. N. (2009): “Shipping Derivatives and Risk Management,” Palgrave Macmillan,London Batchelor, R., Alizadeh, A. H. and Visvikis, I. (2007) “Forecasting spot and forward prices in the international freight market” International Journal of Forecasting, Vol. 23 Issue 1, p101-114 Beenstock, M. and Vergottis, A . R. (1989) “An econometric model of the world tanker market” Journal of Transport Economics and Policy, 23 (2), 263- 280. Beenstock, M. and Vergottis, A. (1993) “Econometric Modelling of World Shipping” London, Chapmann &Hall. Bera, A. K. and Jarque, C. M. (1980) Efficient tests for normality, heteroskedasticity, and serial independence of regression residuals, Economic Letters, 6, 255-259. Brown, G. G., Graves, G. W.; Ronen, D. (1987) “Scheduling ocean transportation of crude oil.” Management Science, Vol. 33, No 3, pp. 335-346. Davidson, R. and Mackinnon, J. (1993) Estimation and Inference in Econometrics. Oxford, Oxford University Press. Dikos, G., Markos, H. S., Papadatos, M. P., and Papakonstantinou, V., (2006) “Niver Lines: A SystemDynamics Approach to Tanker Freight Modeling” Interfaces, Vol. 36, No. 4, pp. 326–341. Glen, D. R. and Martin, B. T. (1998) “Conditional modelling of tanker market risk using route specific freight rates” Maritime Policy & Management, Vo. 25, No 2, pp. 117-128. Gujarati, D. N. (2002) “Baisc Econometric” McGraw Hill Higher Education. Hausman, J.A. (1978) “Specification Tests in Econometrics”, Econometrica, Vol. 46 Issue 6, p12511271. Hawdon, D. (1978) “Tanker freight rates in the short and long run” Applied Economics, 10, 203- 217. Jarque, C.M and Bera, A.K. (1980) “Efficient test for normality, homoscedasticity and serial dependence of regression residuals,” Economics Letters, Vol. 6, pp. 255-259. Kavussanos, M.G. (1996) “Comparisons of volatility in the dry-cargo ship sector: Spot versus time charters, and small versus larger vessels,” Journal of Transport Economics and policy, January, pp. 67-82. Kavussanos, M.G. and Alizadeh, A.H. (2001) “Seasonality patterns in the dry bulk shipping spot and time-charter freight rates,” Transportation Research Part E, Vol. 37, pp. 443-467. Kavussanos, M. G. and Alizadeh, A. (2002): The Expectations Hypothesis of the Term Structure and Risk Premia in Dry Bulk Shipping Freight Markets; An EGARCH-M Approach’, Journal of Transport Economics and Policy, Vol. 36, Part 2, 267-304. Koopmans, T. C. (1939) Tanker Freight Rates and Tankship Building, Haarlem, Holland. Laulajainen, R. (2007) “Dry bulk shipping market inefficiency, the wide perspective” Journal of Transport Geography,Vol. 15 Issue 3, pp. 217-224. 14 Ljung, G.M. and Box, G.E.P. (1978) “On a measure of lack of fit in time series models,” Biometrika, Vol. 65, pp. 297-303. Lyridis D.V., Zacharioudakis P., Mitrou P, Mylonas A., (2004) “Forecasting Tanker Market Using Artificial Neural Networks”, Maritime Economics & Logistics, Vol. 6, Number 2, June 2004 , pp. 93-108. Newey, W. K. and West, K. D. (1987) “A simple positive definite heteroskedasticity and autocorrelation consistent covariance matrix,” Econometrica, Vol 55, pp. 703-708. Randers, J. and Göluke, U. (2007) “Forecasting turning points in shipping freight rates: lessons from 30 years of practical effort.” System Dynamics Review, Vol. 23, No. 2/3, pp. 253–284 Stopford, M. (2009) “Maritime Economics” Routledge, London. Strandenes, S. P. (1984) “Price determination in the time-charter and second-hand markets,” Working paper No 06, Centre for Applied Research, Norwegian School of Economics and Business Administration. Strandenes, S. P. (1999) “Is there potential for a two-tier tanker market?” Maritime Policy and Management, VOL. 26, NO. 3, pp. 249-264 Tamvakis, M. N. and Thanopoulou H. A. (2000) “Does quality pay? The case of the dry bulk market”, Transportation Research Part E: Logistics and Transportation Review, Volume 36, Issue 4, Pages 297-307. Tamvakis, M. N. (1995), An investigation into the existence of a two-tier spot freight market for crude oil tankers. Maritime Management and Policy, Vol. 22, No 1, pp. 81- 90. Tinbergen, J. (1934) “ Scheepsruimte en vrachten” De Nederlandsche Conjunctuur, March, pp. 2335.Tsolakis, S.D. (2005). ‘Econometric analysis of bulk shipping markets implications for investment strategies and financial decision-making’. Unpublished PhD Thesis. Department of Econometrics, Erasmus School of Economics, Erasmus University Rotterdam, The Netherlands. Veenstra, A. W., Franses, P. H. (1997) “A co-integration approach to forecasting freight rates in the dry bulk shipping sector” Transportation Research Part A: Policy & Practice, Vol. 31A, Issue 6, pp. 447-459. White, H. (1980): “A heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity,” Econometrica, Vol. 48, pp 55-68. Zannetos,Z.S. (1966) The Theory of Oil Tankship Rates, Massachusetts: MIT Press. 15 Table 1: Components of the Baltic Average 4TC Rates (Indices) for Capsize and Panamax Dry Bulk Ships Route Size (dwt) C8_03 C9_03 C10_03 172,000 172,000 172,000 C11_03 172,000 Size (dwt) P1A_03 P2A_03 P3A_03 Capesize Description Delivery Gibraltar to Hamburg range for Transatlantic round voyage Delivery Continent Europe to Mediterranean for a trip to the Far East Delivery China to Japan range for a Transpacific round voyage Delivery China to Japan range for a trip to European Continent and Mediterranean Panamax Description 74,000 74,000 74,000 Weighting 25% 25% 25% 25% Weighting Delivery Gibraltar to Hamburg range for Transatlantic round voyage 25% Delivery Skaw to Gibraltar range for trip to the Far East via US Gulf 25% Delivery Japan to South Korea for a Transpacific round voyage 25% Delivery Far East for a Trip to Europe (Skaw to Cape Passero range) via 74,000 P4_03 25% North Pacific or Australia Route C8_03 to C11_03 are based on a standard Baltic Capesize vessel of the following specification: 172,000 mt dwt, not over 10 years of age, 190,000 cbm grain, max LOA 289m, max beam 45m, draft 17.75m, 14.5 knots laden, 15 knots ballast on 56 mts fuel oil, no diesel at sea Routes P1A_03, P2A_03, P3A_03 and P4_03 are based on a standard Baltic Panamax vessel of the following specifications: 74,000 mt dwt , not aged over 7 years with 89,000 cbm grain, max LOA 225 m, draft 13.95 m, capable of about 14 knots on 32 mts fuel oil laden, 28 mts fuel oil ballast and no diesel at sea. 16 Table 2: Descriptive Statistics for Routes and Laycan Periods for Dry Bulk Ships Route Capesize 1 2 3 4 5 1 2 3 4 5 6 7 8 9 10 Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent Other routes Total Fixtures Panamax Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent Mediterranean to Far East PG - Indian Ocean to Far East Far East to PG-Indian Ocean Continent to PG-Indian Ocean PG - Indian Ocean to Continent Other routes Total Fixtures Number of Fixtures No Percentage Mean Laycan Period (days) Median Min Max SD 366 492 1642 391 148 3039 12.0% 16.2% 54.0% 12.9% 4.9% 8.6 9.0 6.7 7.7 8.2 7.5 8.0 8.0 6.0 7.0 7.0 6.0 0.0 0.0 0.0 0.0 0.0 0.0 39.0 35.0 77.0 31.0 42.0 77.0 7.0 7.2 6.3 6.5 7.7 6.7 1397 1033 3174 503 104 865 376 218 208 1198 9076 15.4% 11.4% 35.0% 5.5% 1.1% 9.5% 4.1% 2.4% 2.3% 13.2% 3.7 4.1 4.2 4.8 5.5 5.7 3.7 3.3 5.2 4.8 4.4 3.0 3.0 3.0 4.0 5.0 4.0 3.0 3.0 4.0 3.0 3.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 40.0 38.0 61.0 34.0 27.0 32.0 30.0 17.0 30.0 47.0 61.0 4.4 4.5 4.2 4.5 5.2 5.5 3.9 3.6 5.5 5.3 4.6 Sample period: 1st January 2003 to 31 July 2009. 17 Table 3: Descriptive Statistics of Explanatory Variables years Size Dwt 000 mt Laycan period days Freight Rate $/day Baltic Ave 4TC $/day Diff FR and Baltic % 9.9 9.0 36.0 0.0 7.1 0.6 2.5 215.9 0.000 165.1 170.2 301.8 101.7 14.9 -0.1 6.6 1652 0.000 7.5 6.0 77.0 0.0 6.7 1.4 8.7 5175 0.000 66,964 55,000 303,000 1,000 47,611 1.5 5.2 1747 0.000 72,451 63,235 233,988 2,320 46,378 1.3 4.2 1039 0.000 -0.0307 -0.017 1.058 -1.957 0.227 -0.38 6.39 4554 0.000 9.6 8.0 33.0 0.0 7.0 0.85 2.83 1100 0.000 72.3 73.6 79.9 50.3 3.9 -1.05 3.48 1745 0.000 4.4 3.0 61.0 0.0 4.6 2.07 12.09 37726 0.000 32,001 26,500 125,000 1,000 20,877 1.22 4.14 2758 0.000 32,506 27,642 94,977 3,537 20,189 1.02 3.35 1636 0.000 0.0003 0.000 2.394 -2.295 0.373 0.096 6.42 1488.8 0.000 Age Capesize Mean Median Maximum Minimum Std. Dev. Skewness Kurtosis JB test P-value Panamax Mean Median Maximum Minimum Std. Dev. Skewness Kurtosis JB test Probability Sample period: 1st January 2003 to 31 March 2009, consist of 3039 Capsize Trip-charter fixtures, and 9079 of Panamax trip-charter fixtures. JB is the Bera and Jarque (1980) test for normality which follows (22) . The 5% critical value for this test is 5.991. 18 Table 4: Determinants of Capsize and Panamax Trip-Charter Freight Rates K dfri ,t 0 1LCi ,t 2 SZi 3 AGi 4 AGi2 5VOLt j RTi , j vi ; j 1 vi ~ iid(0, 2 ) Capesize α0 α1 α2 α3 α4 α5 Constant Laycan Size Age LCi,t SZi AGi AG2i VOLt Volatility Route Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent 1 2 3 4 Panamax Coeff P-val -0.7242 0.0024 0.0039 0.0084 -0.0008 -0.0233 0.000 0.000 0.000 0.001 0.000 0.154 α0 α1 α2 α3 α4 α5 0.0298 0.2685 -0.0301 -0.3230 0.319 0.000 0.263 0.000 1 2 3 4 5 6 7 8 9 R2 0.5807 BG test White test JB test 37.054 208.10 2.15*105 0.000 0.000 0.000 Constant Laycan Size Age LCi,t SZi AGi AG2i VOLt Volatility Route Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent Mediterranean to Far East PG – Indian Ocean to Far East Far East to PG-Indian Ocean Continent to PG-Indian Ocean PG – Indian Ocean to Continent Coeff P-val -0.4435 0.0035 0.0060 0.0066 -0.0006 0.0020 0.000 0.000 0.000 0.000 0.000 0.878 0.0368 0.1494 -0.0910 -0.1709 0.2474 0.0809 -0.0757 0.1900 -0.1504 0.346 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 111.44 801.53 1.4*104 0.000 0.000 0.000 BG test is the Breusch and Godfrey LM test for 10th order serial correlation in residuals, which follows Chi-squared distribution with 10 degrees of freedom. White Test is the White (1980) the F-test for heteroscedasticity. This is an LM test which follows Chi-squared distribution with 4 degrees of freedom. JB the Jarque and Bera test for normality of residuals, which follows a Chi-squared distribution with 2 degrees of freedom. Standard Errors are corrected for hetreoscedasticity and Serial Correlation using Newey and West (1987) method. 19 Table 5: Determinants of the Laycan Period of Trip-Charters Contracts K LCi ,t 0 1 dfri ,t 2 bfit 3 SZ i 4 AGi 5VOLt j RTi , j i ; j 1 i ~ iid(0, 2 ) Capesize β0 β1 β2 β3 β4 β5 Constant Diff Freight Rate Baltic 4TC Rate Size Age Volatility dfri,t bfit SZi AGi VOLt Panamax Coeff 11.0116 3.3320 0.4027 -0.0273 -0.0849 -3.2349 P-val 0.000 0.000 0.046 0.007 0.000 0.000 β0 β1 β2 β3 β4 β5 Route 1 2 3 4 Constant Diff Freight Rate Baltic 4TC Rate Size Age Volatility dfri,t bfit SZi AGi VOLt Coeff -0.9773 2.1310 0.4602 0.0205 0.0139 -1.0252 P-val 0.659 0.000 0.000 0.456 0.364 0.000 -1.2121 -1.1709 -0.5197 0.1840 0.2333 0.7599 -1.0153 -1.9339 0.6261 0.0341 0.000 0.000 0.005 0.480 0.662 0.003 0.000 0.000 0.126 65.15 63.28 4.17*104 0.000 0.000 0.000 Route Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent 0.1386 -0.3820 -1.3851 0.1803 R2 0.0577 BG test White test JB test 44.27 26.53 6283 0.846 0.614 0.033 0.816 1 2 3 4 5 6 7 8 9 0.000 0.055 0.000 Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent Mediterranean to Far East PG - Indian Ocean to Far East Far East to PG-Indian Ocean Continent to PG-Indian Ocean PG - Indian Ocean to Continent BG test is the Breusch and Godfrey LM test for 10th order serial correlation in residuals, which follows Chi-squared distribution with 10 degrees of freedom. White Test is the White (1980) the F-test for heteroscedasticity. This is an LM test which follows Chi-squared distribution with 4 degrees of freedom. JB the Jarque and Bera (1980) test for normality of residuals, which follows a Chi-squared distribution with 2 degrees of freedom. Standard Errors are corrected for hetreoscedasticity and Serial Correlation using Newey and West (1987) method. 20 Table 6: Determinants of Freight Rates and Laycan Periods of Capeszie Ship Trip-Charter contracts: A Simultaneous Equation Estimation K dfri ,t 0 1 LC i ,t 2 SZ i 3 AGi 4 AGi2 5VOLt 1, j RTi , j 1,i j 1 LC i ,t 0 1dfri ,t 2 bfit 3 SZ i 4 AGi 5VOLt K j 1 2, j RTi , j 2,i dfri,t Equation Variables α0 α1 α2 α3 α4 α5 Constant Laycan Size LCi,t SZi Age AGi AGi2 VOLt Volatility LCi,t Equation Coeff p-val Variables -0.7532 0.0047 0.0039 0.0084 -0.0008 -0.0150 0.000 0.000 0.000 0.000 0.000 0.238 β0 β1 β2 β3 β4 β5 0.083 0.000 0.074 0.000 2,1 2,2 2,3 2,4 Routes 1,1 1,2 1,3 1,4 Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent BG test White test JB test Constant Diff Freight Rate Baltic 4TC Rate Size Age Volatility dfri,t bfit SZi AGi VOLt Coeff p-val 11.921 6.4483 0.4878 -0.0386 -0.0518 -3.1427 0.000 0.000 0.021 0.000 0.012 0.000 -0.0010 -1.2539 -1.3085 1.1686 0.0507 62.65 35.10 6223 0.999 0.048 0.019 0.076 Routes R2 1,i ε i ~ (0, Σ) 2 ,i 0.0293 0.2675 -0.0266 -0.3213 0.5777 58.93 71.94 20.9*104 0.000 0.000 0.000 Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent 0.000 0.000 0.000 BG test is the Breusch and Godfrey LM test for 10th order serial correlation in residuals, which follows Chi-squared distribution with 10 degrees of freedom. White Test is the White (1980) the F-test for heteroscedasticity. This is an LM test which follows Chi-squared distribution with 4 degrees of freedom. JB the Jarque and Bera test for normality of residuals, which follows a Chi-squared distribution with 2 degrees of freedom. Standard Errors are corrected for hetreoscedasticity and Serial Correlation using Newey and West (1987) method. 21 Table 7: Determinants of Freight Rates and Laycan Periods of Panamax Ship Trip-Charter Contracts: A System of Simultaneous Equations K dfri ,t 0 1 LC i ,t 2 SZ i 3 AGi 4 AGi2 5VOLt 1, j RTi , j 1,i j 1 LC i ,t 0 1dfri ,t 2 bfit 3 SZ i 4 AGi 5VOLt dfri,t Equation α0 α1 α2 α3 α4 α5 1,1 1,2 1,3 1,4 1,5 1,6 1,7 1,8 1,9 Variables Constant Laycan Size Age Volatility Routes Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent Mediterranean to Far East PG - Indian Ocean to Far East Far East to PG-Indian Ocean Continent to PG-Indian Ocean PG - Indian Ocean to Continent R2 BG test White test JB test j 1 2, j RTi , j 2,i LCi,t Equation Coeff LCi,t SZi AGi AGi2 VOLt K 1,i ε i ~ (0, Σ) 2 ,i p-val -0.4487 0.0067 0.0058 0.0064 -0.0006 0.0074 0.000 0.000 0.000 0.000 0.000 0.346 β0 β1 β2 β3 β4 β5 0.0404 0.1522 -0.0887 -0.1703 0.2450 0.0778 -0.0720 0.1950 -0.1514 0.3412 167.18 799.29 13495 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 2,1 2,2 2,3 2,4 2,5 2,6 2,7 2,8 2,9 0.000 0.000 0.000 Variables Constant Diff Freight Rate dfri,t Baltic 4TC Rate bfit Size SZi Age AGi Volatility VOLt Routes Trans Atlantic Round Voyage Continent to Far East Trans Pacific Round Voyage Far East to Continent Mediterranean to Far East PG - Indian Ocean to Far East Far East to PG-Indian Ocean Continent to PG-Indian Ocean PG - Indian Ocean to Continent Coeff -0.2105 4.0890 0.4508 0.0093 0.0329 -1.0504 0.902 0.000 0.000 0.653 0.005 0.000 -1.2722 -1.4568 -0.3438 0.5248 -0.2508 0.6009 -0.8621 -2.2912 0.9270 0.0278 122.35 60.479 41000 0.000 0.000 0.028 0.034 0.595 0.003 0.001 0.000 0.007 BG test is the Breusch and Godfrey LM test for 10th order serial correlation in residuals, which follows Chi-squared distribution with 10 degrees of freedom. White Test is the White (1980) the F-test for heteroscedasticity. This is an LM test which follows Chi-squared distribution with 4 degrees of freedom. JB the Jarque and Bera (1980) test for normality of residuals, which follows a Chi-squared distribution with 2 degrees of freedom. Standard Errors are corrected for hetreoscedasticity and Serial Correlation using Newey and West (1987) method. 22 p-val 0.000 0.000 0.000