GUIDANCE: DISPOSAL OF PROPERTY APPLICATION AND

advertisement

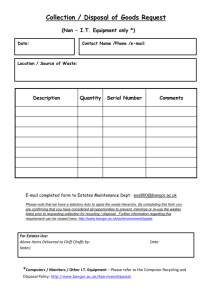

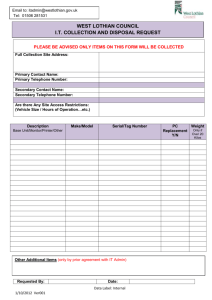

GUIDANCE: DISPOSAL OF PROPERTY APPLICATION AND INTERPRETATION 1. This Guidance is intended to be read alongside Property: Acquisition, Disposal and Management and is designed to provide further information on the disposal of property, plant and equipment i.e. property rights in land and buildings, plant and machinery and vehicles. 2. Any queries on the application or interpretation of this Guidance should be referred to Property Division. Property Division is also happy to advise on any specific points arising from any of the Guidance, including appointment of professional advisers, disposal at less than market value and use of the Guidelines on Transfer of Property in the Scottish Public Sector. Contact PropertyDivision@scotland.gsi.gov.uk or telephone on 0131 244 4523. BACKGROUND 3. A property disposal involves a number of steps which are needed to conclude to a satisfactory sale. Some steps are particular to the Scottish public sector. The following is not a definitive guide but highlights some of the points that disposing bodies must consider. IDENTIFYING ASSETS FOR DISPOSAL 4. Holdings of property, plant and equipment should be regularly reviewed in line with the organisation’s strategic plan. Once assets have been identified as surplus they should be sold as quickly as possible, usually within 3 years, subject to the need to obtain the best price reasonably achievable and reflecting any conditions imposed by the disposing body. Residential property should be sold within 6 months of becoming vacant. To achieve value for money for surplus assets organisations should either: a. b. c. obtain the best possible price on the open market, or dispose of an asset at less than Market Value to deliver wider public benefit, consistent with Best Value principles, or transfer under the Guidelines for the Transfer of Property within the Scottish Public Sector. 5. When evaluating options for the treatment of surplus assets, consideration of the acquisition of assets by community bodies should be included, where appropriate. This consideration should be consistent with the principles of Best Value, where wider public benefits may be achieved. 6. Any work to make the property more attractive to purchasers e.g. repairs, masterplanning or seeking an improved planning consent, should be undertaken to enable the disposal to proceed within this timescale. If no sale is in progress within these time scales, the disposal strategy should be reviewed and alternative methods of disposal considered. 7. Where a property forms part of a larger property or estate and greater benefit would accrue from its being managed or disposed of as a single asset, advice should be sought from Property Division. 1 REQUIREMENT TO SEEK PROFESSIONAL ADVICE Requirement to consult Property Division 8. When the disposal of an asset is being considered, business areas within the Scottish Administration (core SG, Crown Office and Procurator Fiscal Service, SG Executive Agencies and non-ministerial departments) must seek advice from the SG's Property Division. Other organisations to which the SPFM is directly applicable may seek advice from Property Division on a voluntary basis or, in the case of bodies sponsored by the SG, where required to do so under the terms of their framework document. There are specific exceptions to this requirement. [Link to appendix detailing the exceptions to scope]) Legal Advisers 9. The SG Legal Directorate (SGLD) does not undertake conveyancing work. External solicitors must, therefore, be appointed to deal with any disposals, except in the case of Transport Scotland and such other bodies as have their own arrangements. In all cases, suitably qualified and experienced solicitors must be used. Property Division can assist with making an appropriate appointment under the SGLD Framework Agreement for the provision of Property Legal Services. 10. Transfers of property between separate accounting entities where ownership remains with the Scottish Ministers do not, however, entail the transfer of title and the involvement of any appointed solicitors should cease as soon as such a transfer is set in motion. Valuation Advice 11. Prior to any disposal, it is important to obtain professional advice covering valuation and negotiation for all but the smallest and non-contentious disposals, i.e. where Property Division estimates the value to be less than £20,000. 12. The valuer used must be a professional member of an appropriate body, such as the Royal Institution of Chartered Surveyors or the Institute of Revenues Rating and Valuation, and suitably qualified with sufficient current local and national knowledge of the particular market, and with the skills and understanding to undertake the valuation competently. Selection of the valuer is to be guided by value for money considerations, weighing the expertise and service offered against the cost. There may be circumstances in which a valuer (external or internal to the organisation) may be unable to act in a particular case. In any event, where a matter is deemed by the Accountable Officer to be novel or contentious, a suitably qualified and experienced external Valuer should be used to provide valuation advice. Marketing Agent 13. It is normal to appoint a marketing agent in open market sales. The agent must be a firm with specialist knowledge of the market for the particular type of property involved and its locality. The expertise of agency firms varies considerably and Property Division can advise on a range of appropriate firms. In some cases such as house sales in localities where the bulk of such sales are carried out by solicitors then a solicitor estate agent with wide and appropriate experience of the property market concerned may be employed. 2 Planning and Other Professional Advice 14. Normally, advice should be sought on development potential to obtain the best use and value. In cases where planning consent is not sought the need for a Planning Gain Sharing Agreement (PGSA) or Overage clause in the sale agreement must be considered and the professional adviser’s views formally recorded. The PGSA or Overage clause should be highlighted in the marketing strategy. 15. Consideration must also be given to the most cost effective method of procuring additional services e.g. Home Report and Energy Performance Certificates, which may be required before the property can be offered for sale. Appointing Advisers 16. Normally appointments of professional advisers will be by way of Framework Agreements with professional firms that have been pre-tendered, existing Service Level Agreements or by competitive tendering. Property Division can assist in selecting a firm or undertaking a procurement exercise in order to make an appointment. Supervision of Advisers 17. To ensure that value for money is achieved and that high standards of propriety and transparency are maintained, staff and advisers must be carefully supervised and clear separation of responsibilities kept between the valuation and disposal processes. Disposal of Assets 18. Where there are wider public benefits, consistent with the principles of Best Value, to be gained from a transaction, disposing bodies should consider disposal of assets at less than Market Value. This includes supporting the acquisition of assets by community bodies, where appropriate. Otherwise, assets are to be disposed of at Market Value, as defined in the International Valuation Standards (as used in the Royal Institution of Chartered Surveyors Valuation Professional Standards) but reflecting any special value and the effect of any voluntary conditions imposed by the seller. 19. Where an asset is being disposed at less than Market Value, a market valuation is needed as part of the process of considering the wider public benefits alongside any financial implications. A market valuation will enable accurate accounting and reporting. 20. Guidance and support is available to ensure options appraisals are comprehensive and appropriate budgetary provision is in place. When an asset is being transferred at less than Market Value, it must be approved in advance by Ministers, taking into account advice from the SG’s Finance Directorate/Health Finance, SG’s State Aid Unit and, where appropriate, the SG’s Property Division. SG will assist with examining any affordability issues, accounting and reporting requirements where a disposal may constitute a Gift, and any potential State Aid implications. 21. Consideration should be given to where anticipated receipts from the disposal of an asset are part of an agreed funding package to support approved projects, including those in procurement. Any VAT consequences should also be considered. All such disposals should be supported by analysis that demonstrates clearly that the transaction represents value for money. 3 Disposal of tied houses and sales to other sitting tenants 22. Scottish Ministers are not bound by the Right to Buy legislation i.e. the Tenants’ Rights Etc. (Scotland) Act 1980, the Housing (Scotland) Act 2001 and subsequent enactments. However, the same principles should be applied administratively in cases where a house which is occupied as a condition of employment, is declared surplus. However, in certain circumstances the normal presumption that sitting tenants of such a tied house will be offered the house in which they live on Right to Buy terms can be overturned with Ministerial agreement. This might occur where the disposal of the dwelling might prejudice the value of land retained by compromising an access, or if it needs services to be maintained over neighbouring ground. 23. Where a tenant is not occupying the property as a condition of employment, they may be offered the opportunity to purchase their home, but not at discount. If the property is not offered on the market, such a sale may be regarded as potentially concessionary. Advice on procedures, discounts etc. is available from Housing Supply Division. Any discount would qualify as a Gift and be subject to the procedures described in the section of the SPFM on Gifts. 24. It is the intention of the Scottish Government to end Right to Buy and so, this provision will also come to an end. It is anticipated that the Right to Buy will come to an end around summer/autumn 2017. DISPOSAL OF HISTORIC BUILDINGS 25. A historic building is a listed building, a scheduled ancient monument, or any building in a designated conservation area. Historic Scotland should be contacted for advice on the status of buildings, the degree of permissible alteration for re-use, and the likely grant situation a purchaser may face. 26. The standard principles of disposal apply to historic buildings in that normally the property should be sold on the open market, for the best price reasonably available after securing the benefit of any more valuable planning permission and, where appropriate, listed building consent for alternative use. However, in considering offers it is legitimate to consider the wider costs and benefits of a proposal including the on-going costs of maintenance, costs to the Scottish Ministers of grants to future owners and any benefits accruing. If, taking these issues into account, an offer provides the highest Net Present Value (or lowest Net Present Cost) after a "Green Book" appraisal, the offer may be accepted even though it is not the highest offer. Property Division can assist with the appraisal. The approval of the relevant Finance Business Partner (or equivalent) should be obtained before accepting such offers. 27. Where it will increase the chances of securing appropriate ownership and use of historic buildings a method of disposal other than by competitive tender or public auction (e.g. private treaty sale) may be considered. The approval of the relevant Finance Business Partner (or equivalent) should be obtained before accepting such offers. DEFINITION OF PROPERTY TO BE SOLD 28. It is essential that there is clarity on what exactly is to be sold, including any rights, burdens or conditions. 4 29. When only part of a property is to be sold it is vital that proposed boundaries, accesses and rights over other land are carefully established both to safeguard the value of the property to be retained and to maximise the value of the surplus property. Property Division will advise on the creation of new boundaries, rights and accesses. The appointed solicitors should be required to confirm existing boundaries, rights and accesses. 30. In PPP projects the disposal of the land and buildings may be a subordinate component of the whole. Nevertheless the extent of the property to be disposed by sale or lease needs to be carefully defined and professional advice from Property Division and the appointed solicitors is essential. Development Potential / Mineral Rights 31. Explicit professional advice should be obtained on whether or not there is any potential for development which would maximise sale proceeds and identify any particularly sensitive planning issues. Consideration should be given to any appropriate pre-sale investment in improving the property for sale, which will increase the disposal proceeds. Advice should be obtained from Property Division in any cases where development potential might arise. 32. Professional advice should be taken before demolition as this is likely to constitute "development" and need planning or listed building consent. Planning Gain Sharing Agreements (PGSA) and Overage 33. If there are uncertainties about the planning position of a property or doubts about the planning use which would achieve the best price, subject to obtaining such written recommendation from the professional adviser, disposal may proceed without planning permission being sought. However in such circumstances consideration should be given to including a PGSA/Overage clause in the terms of sale. The PGSA/Overage are usually subject to negotiation and the prevailing market conditions. However, it should cover the whole or at least a substantial part of any increase in value attributable to the grant of planning permission for an alternative use during a specified period of time after the disposal terms have been agreed. In this case, missives of sale should include a PGSA/Overage clause requiring further payment by the purchaser if circumstances occur which trigger such a payment. 34. PGSA/Overage has the potential disadvantage that a purchaser may not be prepared to pay as high an initial price as in a straightforward sale. There may also be practical difficulties in monitoring and enforcing the arrangement if the purchaser subsequently becomes unwilling or unable to honour the obligations imposed. The appointed solicitors should be consulted on the appropriate legal arrangements and Property Division should be consulted on all other terms of sale. In all such cases the sales particulars should indicate that a PGSA/Overage clause may be required. METHOD OF DISPOSAL Internal Advertising / Guidelines for Transfer of Property in the Scottish Public Sector 35. Prior to offering land and property assets for sale elsewhere, all disposing bodies to which the SPFM or NHS Property Transactions Handbook is applicable, including bodies 5 sponsored by SG, must notify Property Division of the surplus asset in order that it may be internally advertised; a process known as The Trawl. An Internal Advertisement form must be completed and submitted. This procedure provides a mechanism for the transfer, at Market Value, of property held within the Scottish public sector. Where another body which is party to The Trawl expresses an interest to acquire the asset, the transfer should be undertaken following the Guidelines for the Transfer of Property within the Scottish Public Sector. The Trawl takes one month and must be completed before commencing marketing or entering into a commitment to sell elsewhere. 36. Notification to Property Division of surplus land of less than 0.1 hectares is optional, but should be considered on a case by case basis taking account of the likely interest in such properties from potential transferees. 37. If two or more bodies seek to acquire a property under the Guidelines, the matter should be resolved by discussion between them. If agreement cannot be reached, the matter should be referred to the Scottish Ministers for decision. To assist with the Ministers' decision-making, the Chief Surveyor must be asked to comment on the property aspects of the respective proposals. The price that individual parties might be prepared to pay for the property will not be a factor in the decision making process. The price paid will be decided by the independent valuer. 38. Once the Trawl process has been completed with no other bodies having expressed an interest in acquiring the asset, other methods of disposal may be pursued. 39. Detailed information is available from Property Division. Crichel Down Rules 40. The Crichel Down rules apply, with a limited number of exceptions, to the disposal of surplus Government land acquired by, or under the threat of, compulsory purchase including acquisitions under the Blight provisions of Section 101 of the Town and Country Planning (Scotland) Act 1997. A threat of compulsion will be assumed in the case of a voluntary sale where the power to acquire the property compulsorily existed, even though it was not used at the time, unless there is evidence that the property was publicly or privately offered for sale immediately before the acquisition. The Rules exist to protect the interests of former owners of property. The Rules may also apply where a property has been acquired from another public body as the obligation may not have been extinguished. Property Division and the appointed solicitors should be consulted on the disposal of all such property. Traditional Marketing and Sale 41. It is anticipated that the majority of disposals will be undertaken using the traditional method of appointing a marketing agent, advertising the property on the open market and then on receipt of offers, concluding a sale. This well-tested route to disposal still has a number of steps to be undertaken. Valuation 42. Before property is offered for sale on the open market a pre-sale valuation must be obtained to establish a guide price. However, in major disposals or potentially difficult or contentious cases an independent valuer should be appointed in addition to the marketing 6 agents. The basis of valuation for the guide price is the market value of the property in accordance with International Valuation Standards, but reflecting "special value" and the effect of any voluntary conditions imposed by the seller. "Special value" reflects any additional value accruing from a potential bid by a purchaser with a special interest such as a sitting tenant, a neighbouring owner or an owner with a property, physically, functionally, legally or economically associated with the property to be sold. Appointment of Independent Valuer 43. Property Division can advise if an independent valuer should be appointed, which firms should be approached and on the terms of the appointment. A brief must be prepared in consultation with Property Division and the appointed solicitors and a detailed plan showing boundaries, access, servitudes and services crossing the site must be provided. It should be made clear to the valuer in the brief that he/she is to consider potential alternative uses or development values, and to consider whether or not there are likely to be bids from special purchasers such as neighbours, or sitting tenants. 44. The functions of the independent valuer should include: establishing the initial guide price. advising on whether the property should be offered for sale as a whole or in separate lots. advising on the range of offers which may be expected. advising on the acceptability of any offers received. advising on any authentic late or revised bids received, before the sale has become legally binding. 45. Where a sale is proposed at a price below the initial guide price, the independent valuer should certify, jointly with the selling agent, that it is the best offer reasonably obtainable. Appointment of a Marketing Agent and Marketing of the Property 46. The SG normally uses marketing and valuation services that have been subject to competitive tender. The SG has access to a number of framework agreements from which services may be procured, including frameworks for valuation, estate agency, auction, planning advice and property legal services. If a special tendering exercise is required Property Division can advise on the specification, assist in drawing up a short-list, liaise with Scottish Procurement and Commercial Directorate and assist in interviews and analysis of tenders. 47. The marketing agent, in consultation with the business area responsible for the disposal, will normally: undertake a full appraisal of the property, clarify legal matters with the appointed solicitors, analyse the appropriate markets and advise on the type, extent and cost of advertising. for residential property, to procure or provide a Home Report, prior to putting the property on the market. prepare an advertisement and place it in appropriate websites, newspapers and property journals. The advertisement and its cost must be agreed in advance with the business area concerned. 7 draft marketing particulars in consultation with the business area, and circulate them to interested parties. handle all contact with potential purchasers, including telephone enquiries, meetings and correspondence. arrange for the land and buildings to be inspected by or on behalf of potential purchasers. Where appropriate, agree a closing date for offers with the business area and the independent valuer, if appointed, and advise all potential purchasers of the date and time fixed for the receipt of formal offers. receive open and assess offers. Where a closing date is set, a clear process must be followed to ensure offers are only opened after the closing date. For sales of substantial value, or special sensitivity, arrangements should be made for offers to be opened by the business area or in the presence of their representative. Business areas can ask for offers to be sent to their appointed solicitors for formal opening. after discussion with the business area make a recommendation in writing as to which offer to accept. 48. Property Division and the appointed solicitors can provide advice to business areas on all aspects of the agent/client relationship. This includes the handling of the disposal or the arrangements for fees. Property Division will assist with monitoring the performance of the marketing agent to avoid unnecessary delay and compliance with the SPFM. 49. Once the property is on the market, all enquiries from prospective purchasers or their agents should be directed to the marketing agent/solicitor handling the sale. If enquirers approach the business area directly before the property is put on the market business areas must not offer any advice on price, asking price or closing date. The onus is on the purchaser to inform himself/herself about the property and make up his/her own mind. On-line advertising 50. Any surplus property that is being disposed of on the open market or leased by bodies to which the SPFM (or NHS PTHB) is directly applicable should be advertised on www.novaloca.com This website includes details of properties identified for disposal or lease by both public and private bodies. There is currently a contract between Scottish Enterprise and Nova Loca to allow a basic listing of properties for disposal in Scotland at no charge. The marketing agent may also suggest other websites and these should be considered on a value for money basis. Sale by Auction 51. In Scotland sale by auction can help where the planning situation is unclear, the property is unusual or a swift open and transparent disposal is required. While sometimes perceived as a last resort for difficult to sell properties, it can introduce a property to a different group of buyers. Property Division have put in place a framework agreement with a Scottish auction firm, and can assist bodies who wish to explore the auction route for disposal. 52. A property may be submitted to auction either as a first choice, or after a period of marketing by alternative channels which has been unsuccessful. However, the marketing strategy must be properly considered and it may be appropriate to consider the fee 8 structure of any marketing agents to facilitate joint agency, if an auctioneer may be appointed. 53. Business areas selling at auction must seek professional legal and valuation advice beforehand, as legal documentation is needed well before the auction date, and a reserve price must be fixed, and approved by the business area. The auctioneer will advise on reserve and guide prices. Formal valuation advice must be obtained from a Valuer. If an independent valuer has been appointed he/she should be consulted by the auctioneer/selling agent before a reserve price is fixed. Auction without reserve is not normally recommended. The bargain is concluded on the fall of the hammer. 54. Sale prior to the auction is not normal, and would only be done with the written recommendation of the auctioneer and an independent valuer that this would secure the best price, and potential bidders had been informed in enough time to avoid travel costs. 55. In an auction, the auction firm will perform a similar role to a marketing agent, but due to the nature of auctions, the procedure for obtaining and accepting offers is quite different. They will also advise on reserve and guide prices, conduct the auction and handle deposits. 56. The auctioneer will: undertake a full appraisal of the property, clarify legal matters with the appointed solicitors, analyse the appropriate markets and advise on the type, extent and cost of advertising. prepare an advertisement and insert it in appropriate websites, e-media, newspapers and property journals. The advertisement and its cost must be beforehand with the business area concerned. draft a catalogue entry in consultation with the business area, and circulate the catalogue to interested parties. handle all contact with potential purchasers, including telephone enquiries, meetings and correspondence. arrange for the land and buildings to be inspected by or on behalf of potential purchasers. conduct the auction and handle collection and subsequent release of deposits on settlement. Deal with any post-auction offers, on auction terms. 57. Attendance at an auction by legal advisers is necessary to answer potential bidders’ questions and afterwards to oversee signing of documents. Similarly Property Division (or in-house property team) should attend in case the reserve prices are not reached and the auctioneer receives post auction offers on auction terms. This enables Property Division and the appointed solicitors to advise on the spot. Private Treaty Sales 58. Within the SPFM, the transfer of property under the Guidelines for the Transfer of Property within the Scottish Public Sector is not classed as a private treaty sale. 59. Sale by private treaty (i.e. between two parties without competitive bidding) should be exceptional other than for sales to sitting tenants or where the relevant Accountable Officer, in consultation with the relevant Finance Business Partner (or equivalent), is 9 prepared to defend it as a deliberate concession. The following guidance applies to those exceptional cases: in opting for a private treaty method of sale professional advice, in writing, must be taken. the private treaty approach should normally only be adopted when written professional advice indicates a clear advantage over an open market sale. Examples may include a tenant prepared to pay above the market value or an adjoining proprietor requiring the property for expansion. In such circumstances the sale should only be concluded where the professional adviser states in writing that the price finally agreed is at least equal to the best price achievable on the open market. it may be necessary or desirable to break off negotiations even at an advanced stage. Discussions should always avoid moral commitment and make it clear that the Scottish Ministers retain the right to resile from the negotiations until the bargain is formally concluded. All correspondence should contain a disclaimer compliant with the Requirements of Writing (Scotland) Act 1995. 60. The sale of a property to a selected purchaser by private treaty based solely on a market valuation where the professional advice is that the sale might not have a financial advantage over open market sale should be regarded as potentially concessionary. This is because in the absence of a test of the market it is possible that the best price will not be realised. Any such sale or scheme of sales should therefore only proceed if the relevant Accountable Officer is prepared to defend it as a deliberate concession and with the approval of the relevant Finance Business Partner (or equivalent). Joint Development Vehicles 61. Where unfavourable market conditions militate against conventional methods of disposal, or there is a clear financial advantage to the disposing body, other disposal structures may be considered, such as joint development vehicles. Any such approach would, however, have to provide the best value for money option and meet standard requirements with regard to propriety and safeguarding the public interest. 62. Proposals for the disposal of property held by the Scottish Ministers by means of a joint development vehicle must be approved by Property Division and the relevant Finance Business Partner (or equivalent). The Finance Business Partner (or equivalent) should be engaged to advise on value for money and to assess the prospective accounting and budgeting implications. Any such proposals must also comply with the guidance of Borrowing, Lending and Investment. DISPOSAL OF LEASEHOLD INTERESTS 63. Where the disposing body holds surplus property on a lease there are a number of options which should be considered including the exercise of a break option, assignation, surrender and sub-letting. Potential claims for dilapidations may arise. Advice on such proposals should always be obtained from Property Division and, where appropriate, the appointed solicitors. 64. Because surplus property is to be disposed of as soon as possible, there are few circumstances in which disposal by lease is appropriate. However, where property or part of a property will be vacant for a significant period before it is either sold or returned to operational use, then leasing the premises as an interim measure should be considered. 10 Similarly, where disposal of part of a larger property may adversely affect the future use or disposal of the remaining property, leasing may be considered. Advice should be obtained from Property Division who will help the body prepare Heads of Terms for the solicitors acting for the body and establish the market rent. 11 DISPOSAL OF ASSETS: PROCESS Delayed Disposal 65. The Scottish Government does not hold land speculatively to await changes in the market. In exceptional circumstances it may be preferable to delay disposal of a property beyond the recommended period because the local market is overloaded, or because a phased disposal would produce greater overall receipts. A decision to delay must be based on clear advice from the professional adviser, normally the marketing agent and agreed by Property Division. If a sale is likely to be delayed, a short term lease may be considered as a strictly temporary measure. If the circumstances are novel or contentious, the relevant Finance Business Partner (or equivalent) should be consulted. Consideration of Offers 66. Normally the highest offer will be accepted unless it is significantly less than the guide price (or rent). An offer is particularly attractive if it is unconditional. Bids offering a certain sum over and above the highest tender must not be accepted. 67. There may be other circumstances when the highest offer is not the best offer. Considerations relevant to an offer's acceptability include: where it is subject to conditions, and whether these are acceptable or can be satisfactorily amended. the time to achieve completion of sale. the possibility of obtaining a better price by remarketing. the cost of maintaining the property if vacant. If security and maintenance costs are significant, the business area should carry out an appraisal to determine the improvement in price necessary to cover the additional costs of retaining the property. 68. Proposals to accept an offer against professional advice (i.e. Property Division, the appointed solicitors or the independent valuer) should be cleared with the relevant Accountable Officer and the relevant Finance Business Partner (or equivalent). The Finance Business Partner (or equivalent) should also be informed about any case where the disposal is of significant value and the offers are less than the independent valuer's or marketing agent's valuation or are subject to unusual conditions. The approval of the Finance Business Partner (or equivalent) should be sought before accepting any offers which are less than the market value (or market rent). 69. When considering bids for a lease of property, where factors other than rent are material considerations in determining the successful bid, the details of the criteria, and weighting of their importance, should be clearly set out in the particulars. In this case, bids should be independently assessed by two or three assessors. Advice on this can be obtained from Property Division. 70. The European Commission has published guidance for Member States on the sale of land and buildings by public authorities and it is important that these are adhered to. The guidance states that sales should be conducted after an unconditional bidding procedure, or alternatively on the basis of an independent valuation. Any disposal below market value may be State aid - advice can be found at the State Aid Unit website and by contacting the State Aid Unit. 12 71. Once it has been decided which offer to accept, the business area should instruct the appointed solicitors who will inform the successful offeror and conclude missives. Property Division is able to assist with decision making and ensuring instructions to solicitors are clear. The marketing agent will inform the unsuccessful offerors. Any direct approach made by an offeror to business areas after the appointed solicitors have been instructed to accept an offer should be referred to the marketing agent. 72. In major sales, the credit worthiness of the offeror should be examined before any bid is accepted. This can be put in hand by the appointed solicitors, Property Division can assist instructing them . Where agents are used to establish the credit worthiness of bidders, business areas should ensure that they obtain in writing the advice and the nature of the evidence on which it is based. This is particularly important for any higher bids which are recommended for rejection because of doubts about the offeror's credentials. 73. Once missives have been concluded by the acceptance of an offer, the appointed solicitors will complete the transaction by handling the conveyancing. Late Bids 74. Under certain exceptional circumstances late bids have to be considered. However, the duty to achieve the best possible price must be balanced against the risk of original bidders withdrawing their offers because of the delay, and the risk of accusation of impropriety in the marketing process. Any such bids must be discussed with Property Division, the appointed solicitors, and the relevant Finance Business Partner (or equivalent). 75. Late bids or revised bids can only be considered where missives have not been concluded and no commitment has been made to another offeror. The Scottish Ministers must be seen to be scrupulously fair in dealing with offerors. It will also be necessary to take the advice of the independent valuer (if appointed), the marketing agent, Property Division, and the appointed solicitors. It will be wholly exceptional that such a bid will be followed up and it will require the agreement of the relevant Accountable Officer. If it is decided that such a bid has to be taken into account then the following measures must be taken: all interested parties must be advised that the disposal is being reconsidered. if the exceptional bid is based on a different land use, the marketing agent must seek the opinion of the Planning Authority on the likelihood of that use being allowed. the business area should agree a revised closing date with the marketing agent that will give all interested parties a reasonable time to submit an offer. all previous offerors should be asked to submit a further offer by the revised closing date or asked to maintain their previous offer. CONCLUSION OF DISPOSAL 76. When a disposal is concluded, there are matters to attend to, including: updating the asset register (ePIMS or such other register as may be used) local authority, FRU and SG rating advisers to be notified of cessation of liability for rates utilities providers to be notified of change in ownership 13