Notes to Study for Unit 1.01 Test

advertisement

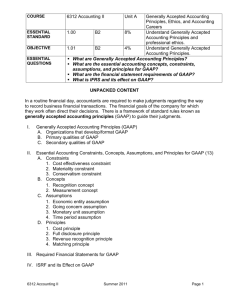

COURSE ESSENTIAL STANDARD OBJECTIVE ESSENTIAL QUESTIONS 6312 Accounting II Unit A Generally Accepted Accounting Principles, Ethics, and Accounting Careers 1.00 B2 8% Understand Generally Accepted Accounting Principles and professional ethics. 1.01 B2 4% Understand Generally Accepted Accounting Principles. What are Generally Accepted Accounting Principles? What are the essential accounting concepts, constraints, assumptions, and principles for GAAP? What are the financial statement requirements of GAAP? What is IFRS and its effect on GAAP? Notes to Study for Unit 1.01 Test In a routine financial day, accountants are required to make judgments regarding the way to record business financial transactions. The financial goals of the company for which they work often direct their decisions. There is a framework of standard rules known as generally accepted accounting principles (GAAP) to guide their judgments. I. Generally Accepted Accounting Principles (GAAP) A. Organizations that develop/format GAAP B. Primary qualities of GAAP C. Secondary qualities of GAAP II. Essential Accounting Constraints, Concepts, Assumptions, and Principles for GAAP (13) A. Constraints 1. Cost effectiveness constraint 2. Materiality constraint 3. Conservatism constraint B. Concepts 1. Recognition concept 2. Measurement concept C. Assumptions 1. Economic entity assumption 2. Going concern assumption 3. Monetary unit assumption 4. Time period assumption D. Principles 1. Cost principle 2. Full disclosure principle 3. Revenue recognition principle 4. Matching principle III. Required Financial Statements for GAAP IV. ISRF and its Effect on GAAP 6312 Accounting II Summer 2011 Version 2 Page 1 STUDENT NOTES I. Generally Accepted Accounting Principles (GAAP) is defined as the set of accepted industry rules, practices, and guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. A. Governing organizations behind Generally Accepted Accounting Principles 1. American Institute of Certified Public Accountants (AICPA) 2. The Financial Accounting Standards Board (FASB) 3. The Securities and Exchange Commission (SEC) a. Two laws, the Securities Act of 1933 and the Securities Exchange Act of 1934, give the SEC authority to establish reporting and disclosure requirements. b. Holds primary responsibility for: (1) Enforcing federal securities laws (2) Regulating the securities industry (3) Regulating the stock market (4) Preventing corporate abuse of investors c. Given enforcement authority by Congress to: (1) Bring civil enforcement actions against individuals and companies who: (a) Commit accounting fraud (b) Provide false information (c) Engage in insider trading (d) Violate securities laws (2) Bring criminal enforcement actions against individuals and companies for criminal offenses. 4. The SEC usually operates in an oversight capacity, allowing the FASB and the Governmental Accounting Standards Board (GASB) to establish these requirements. B. Primary qualities that make accounting information useful for decision making 1. Relevance – The information is capable of making a difference in a decision. Information should have predictive or feedback value, and it must be presented on a timely basis. 2. Reliability - Information must be verifiable, a faithful representation, and reasonably free of error and bias (neutral). C. Secondary qualities that make accounting information useful for decision making 1. Comparability - Information has been measured and reported in a similar manner for different enterprises. 2. Consistency - Information is created and reported using the same accounting treatment to similar events from period to period. II. There are thirteen basic accounting constraints, concepts, assumptions, and principles that GAAP is founded upon. 6312 Accounting II Summer 2011 Version 2 Page 2 A. Constraints: 1. Cost Effectiveness Constraint: The cost of providing accounting information should not exceed the benefit of the information it is reporting. 2. Materiality Constraint: The requirements of any accounting principle may be ignored when there is no effect on the decisions of users of financial information (immaterial). 3. Conservatism Constraint: Accountants must use their judgment to record transactions that require estimation. This concept helps accountants choose between 2 equally likely alternatives. Therefore, the less optimistic estimate will be chosen when two estimates are judged to be equally likely. B. Concepts: 1. Recognition Concept: An item should be recognized (recorded) in the financial statements when: a. It can be defined by GAAP assumptions and principles. b. It can be measured. c. It is relevant to decision making by users. d. It is reliable. 2. Measurement Concept a. Every transaction is measured by the stated unit of measurement, such as the dollar b. The stated procedure of valuing assets, liabilities, equity, revenue and expenses as defined by GAAP C. Assumptions: 1. Economic Business Entity Assumption: All of the business transactions are separate from the business owner’s personal transactions. 2. Going Concern Assumption: Financial statements are prepared under the assumption that the company will remain in business indefinitely unless there is sufficient evidence otherwise. 3. Monetary Unit Assumption: The accountant assumes a stable currency is going to be the unit of record. The FASB accepts the nominal value of the U.S. dollar unadjusted for inflation as the monetary unit of record. 4. Time Period Assumption: The entity's activities are separated into periods of time, i.e.: months, quarters or years. D. Principles: 1. Cost Principle: Assets are recorded at historical cost, which equals the value exchanged at the time of their acquisition, not at Fair Market Value. 2. Full Disclosure Principle: All information pertaining to the operations and financial position of the entity must be reported within the period of time in question. 3. Revenue Recognition Principle: Revenue is earned and recognized upon product delivery or service completion, without regard to the timing of cash flow. This is also called accrual basis accounting. 6312 Accounting II Summer 2011 Version 2 Page 3 4. Matching Principle: The costs of doing business are recorded in the same period as the revenue they help to generate. III. Statements Required by GAAP A. Balance Sheet: shows information about the organization’s resources at one given time. 1. Shows Assets, Liabilities, and Equity 2. Details about cash including cash in the bank, amount owed to creditors, and the value of the company’s assets. B. Income Statement: Shows the flow of revenues over a given period of time, typically a month, quarter, or year. 1. Shows revenue and expenses 2. Shows profit or loss of a company C. Statement of Cash Flow: shows the movement of cash in and out of the business over a specified period. 1. Details cash flows from operating activities, investing activities, and financing activities 2. Shows how changes in the balance sheet and income statement affect cash and cash equivalents D. Statement of Stockholders Equity: shows the changes in the company’s equity throughout the reporting period. 1. Reports profit or loss from the company 2. Reports dividends paid 3. Reports other items that are debited/credited to retained earnings IV. International Financial Reporting Standards (IFRS) A. Principles-based standards, interpretations, and the framework adopted by the International Accounting Standards Board (IASB) B. Due to numerous companies operating globally, standards that are applicable to all countries need to be developed. C. Framework of IFRS 1. States the basic principles of IFRS 2. Currently being updated and converged with the IASB and FASB 3. The objective is to create a sound foundation for future accounting standards. D. US GAAP becoming IFRS 1. In February 2010, the SEC voted unanimously to publish a statement to reaffirm its longstanding commitment to the goal of a single set of highquality global accounting standards. Additionally, the SEC expressed its continued support for the convergence of US GAAP and IFRS. 2. Beginning in October 2010, the SEC will begin to work on a plan to combine GAAP and IFRS. 3. U.S. companies may move to IFRS in approximately 2015 or 2016 6312 Accounting II Summer 2011 Version 2 Page 4 6312 Accounting II Summer 2011 Version 2 Page 5 KEY TERMS GAAP AICPA FASB SEC Securities Securities Act of 1933 Securities Act of 1934 GASB Relevance Reliability Comparability Consistency Cost effectiveness constraint Materiality constraint Conservatism constraint Recognition concept Measurement concept Economic business entity assumption Going concern assumption Monetary unit assumption Time period assumption Cost principle assumption Full disclosure principle Revenue recognition principle Matching principle Objectivity IFRS IASB APB 6312 Accounting II Summer 2011 Version 2 Page 6 6312 Accounting II Summer 2011 Version 2 Page 7