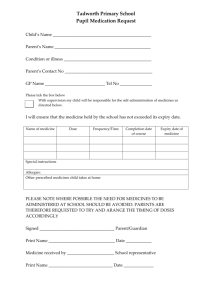

Dept of Health submission - Senate Inquiry into cancer medicines for

advertisement