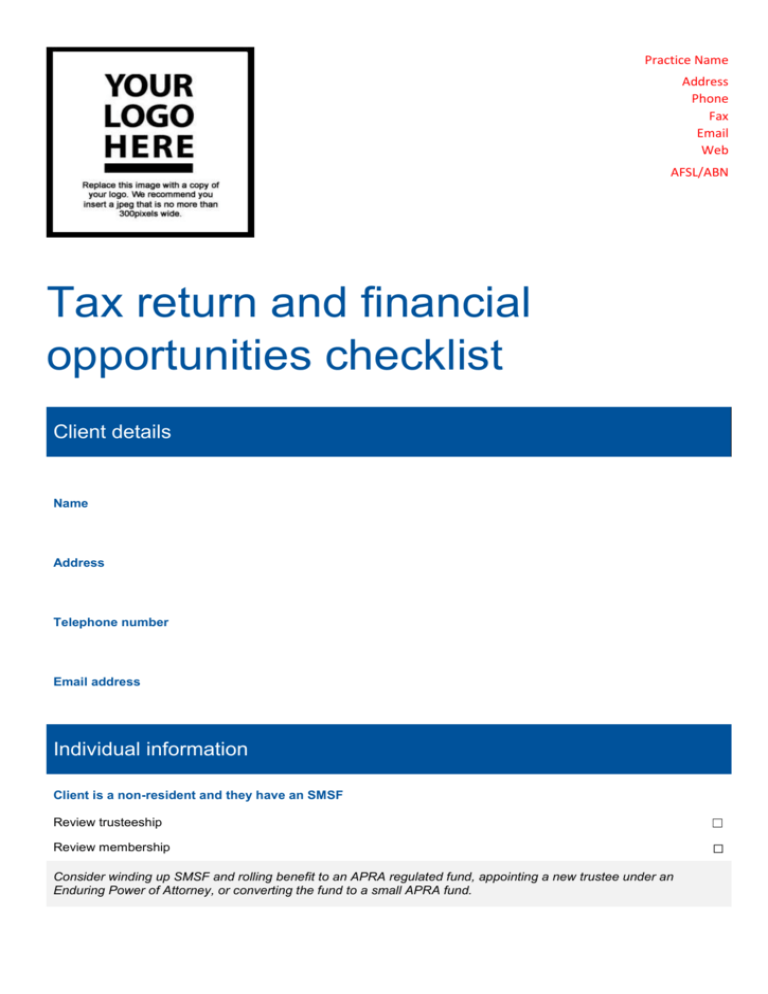

Tax return and financial opportunities checklist

advertisement

Practice Name Address Phone Fax Email Web AFSL/ABN Tax return and financial opportunities checklist Client details Name Address Telephone number Email address Individual information Client is a non-resident and they have an SMSF Review trusteeship ☐ Review membership ☐ Consider winding up SMSF and rolling benefit to an APRA regulated fund, appointing a new trustee under an Enduring Power of Attorney, or converting the fund to a small APRA fund. Client’s name has changed and/ or their marital status Review insurances ☐ Review investments ☐ Review estate planning ☐ Client has reached a milestone birthday, for example 50, 60, 65 or superannuation preservation age Increased cap for non-concessional contributions on reaching 50 ☐ Consider accessing tax free super benefits from age 60 ☐ Apply for a state government Seniors Card, if eligible, from age 60 ☐ Access super from age 65 ☐ Apply for age pension from 65, or Commonwealth Seniors Health Card from age 60 ☐ Commence transition to retirement superannuation pension from preservation age ☐ Access superannuation benefits from preservation age, if eligible ☐ Consider or review business succession planning ☐ Consider or review retirement planning ☐ Review estate planning ☐ Review insurances ☐ Consider investments outside super if unable to contribute from age 65. Income – salary and wages Client receives a salary or wage Review superannuation including choice of fund, superannuation consolidation and insurance in existing superannuation fund/s ☐ Ensure correct Superannuation Guarantee (SG) contributions are being made ☐ Establish or review salary sacrifice arrangement ☐ Establish or review salary packaging arrangement ☐ Client’s income is less than $49,488 Review superannuation ☐ Consider making a personal non-concessional contribution to obtain a Government co-contribution. Client is self-employed or is a partner in a partnership Review insurances ☐ Review succession planning, including buy-sell agreements ☐ Review business planning including cash-flow management and budgeting ☐ Review business ownership structure to maximise entitlement to small business capital gains concessions ☐ Client has retired or is unemployed Apply for Government income support benefits, such as age pension or Newstart, if eligible ☐ Apply for Pensioner Health Card or Commonwealth Seniors Heath Card, if eligible ☐ Review current income stream arrangements ☐ If client is elderly, consider initiating a conversation regarding their future aged care needs. Income – lump sum payments Client has received a lump sum payment for termination of employment or disablement Review insurances, particularly the continuation option under employer superannuation arrangements ☐ Review investment opportunities ☐ Review income stream structure and debt reduction ☐ Determine feasibility of non-concessional contribution to super ☐ Inform client to seek redundancy advice ☐ It might be worth exploring whether to make a non-concessional contribution to super. Income – Australian Government pensions and allowances Client is receiving an Australian Government pension or allowance Review finances to optimise benefit entitlement ☐ Income – Australian annuities and superannuation income streams Client is receiving a superannuation pension of annuity Determine preferred level of income for 2015/16 and obtain an updated Centrelink income stream schedule for Centrelink ☐ Review grandfathered pre 1 January 2015 account based pensions to preserve grandfathering for the income test ☐ Correctly record any one-off additional payments as either a lump-sum or additional income stream payment to minimise any adverse Centrelink outcomes ☐ Income – attributed personal services income Client is subject to personal services income Review insurances ☐ Review superannuation ☐ Income – dividends Client has derived income from investments Review investments ☐ Consider alternative tax effective investment structures. Client has derived a net investment loss Review investments ☐ Consider if this has an impact on adjusted taxable income (ATI) for certain Government benefits. Deductions Client is entitled to a deduction for work-related expenses Review work-related expenses ☐ Consider alternatives such as salary packaging of benefits, and/or salary sacrificing to superannuation. Client is eligible to claim a tax deduction for interest on borrowed money Review loan arrangement ☐ Review investments ☐ Review insurances to ensure that debt is covered ☐ When reviewing loan arrangements, bear in mind that it may require credit licensing. Client is claiming a tax deduction for income protection insurance Review income protection insurance needs and exiting cover ☐ Client is claiming a tax deduction for personal superannuation contributions Lodge a “Notice of intention to claim a tax deduction for personal superannuation contributions” (s.290-170 notice) within the prescribed time ☐ Medicare levy related items Client is liable to pay Medicare levy surcharge Review health insurance ☐ When reviewing health insurance requirements, bear in mind that it may require credit licensing. Client is entitled to private health insurance rebate Ensure correct rebate is being received based on client’s income ☐ Review health insurance ☐ When reviewing health insurance requirements, bear in mind that it may require credit licensing. Spouse details Client has commenced a relationship Review insurances ☐ Review investments ☐ Review superannuation ☐ Review estate planning ☐ When reviewing health insurance requirements, bear in mind that it may require credit licensing. Client has ceased a relationship Review superannuation and life insurance death benefit nominations ☐ Review estate planning ☐ Review entitlement to Centrelink benefits based on a single person ☐ Review estate planning ☐ Consider potential implications for splitting of superannuation benefits. Supplementary section Client receives income from a foreign pension or annuity Review income to determine if client is entitled to deductible amount If income is being received from a foreign pension fund, review and consider the eligibility and appropriateness of transferring to an Australian superannuation fund. ☐ Client pays rent for a property that they run their business from Review property portfolio ☐ Consider the option of purchasing a property through a SMSF and having the business rent the property back from the SMSF. Client received a bonus from a life insurance company or friendly society Review the reinvestment of the proceeds paid ☐ Client made superannuation contributions on behalf of spouse Review spouses superannuation arrangements Consider other options including superannuation contributions splitting. ☐