The Company`s Producing Areas Include

advertisement

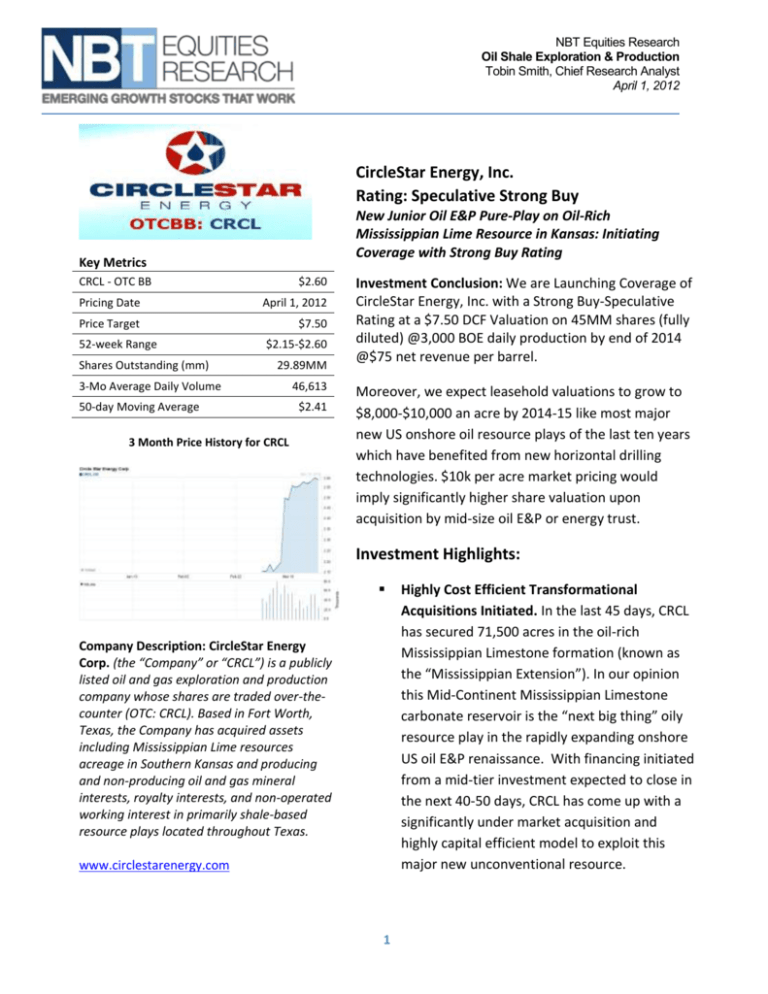

NBT Equities Research Oil Shale Exploration & Production Tobin Smith, Chief Research Analyst April 1, 2012 CircleStar Energy, Inc. Rating: Speculative Strong Buy New Junior Oil E&P Pure-Play on Oil-Rich Mississippian Lime Resource in Kansas: Initiating Coverage with Strong Buy Rating Key Metrics CRCL - OTC BB $2.60 Pricing Date April 1, 2012 Price Target $7.50 52-week Range Shares Outstanding (mm) $2.15-$2.60 29.89MM 3-Mo Average Daily Volume 50-day Moving Average 46,613 $2.41 3 Month Price History for CRCL Investment Conclusion: We are Launching Coverage of CircleStar Energy, Inc. with a Strong Buy-Speculative Rating at a $7.50 DCF Valuation on 45MM shares (fully diluted) @3,000 BOE daily production by end of 2014 @$75 net revenue per barrel. Moreover, we expect leasehold valuations to grow to $8,000-$10,000 an acre by 2014-15 like most major new US onshore oil resource plays of the last ten years which have benefited from new horizontal drilling technologies. $10k per acre market pricing would imply significantly higher share valuation upon acquisition by mid-size oil E&P or energy trust. Investment Highlights: Company Description: CircleStar Energy Corp. (the “Company” or “CRCL”) is a publicly listed oil and gas exploration and production company whose shares are traded over-thecounter (OTC: CRCL). Based in Fort Worth, Texas, the Company has acquired assets including Mississippian Lime resources acreage in Southern Kansas and producing and non-producing oil and gas mineral interests, royalty interests, and non-operated working interest in primarily shale-based resource plays located throughout Texas. www.circlestarenergy.com 1 Highly Cost Efficient Transformational Acquisitions Initiated. In the last 45 days, CRCL has secured 71,500 acres in the oil-rich Mississippian Limestone formation (known as the “Mississippian Extension”). In our opinion this Mid-Continent Mississippian Limestone carbonate reservoir is the “next big thing” oily resource play in the rapidly expanding onshore US oil E&P renaissance. With financing initiated from a mid-tier investment expected to close in the next 40-50 days, CRCL has come up with a significantly under market acquisition and highly capital efficient model to exploit this major new unconventional resource. Attractive Valuation/Highly Cost Effective Acquisition Prices: The 64,000 Northwest Kansas leasehold encompasses lands in both Trego and Gove counties and is structured to deliver effective Net Revenue Interests ("NRI") of approximately 81% to the Company. The transaction is for both Company common stock and cash valued at approximately $110 per acre. Recent lease valuations for the leading E&P company in the resource (SandRidge Energy SD) in the area have been >$2000 an acre. This lease transaction joins with an outright land purchase of approximately 7,500 acres prospective for the "Original Mississippian" formation in Southern Kansas at $1200 an acre purchase price. The implied lease valuations of similar transactions in the area range from $2000-$4000 an acre. Upon completion of these transactions, and assuming traditional success rates of their drilling programs, the implied value of their Mississippian Limestone leaseholds exceed $300,000,000 or @$7.50 a share DPV with 45,000,000 shares fully diluted. Low Risk “Kansas Lansing/Mississippian Lime” Two-Step Vertical and Horizontal Drilling Technology Strategy: CRCL’s exploitation strategy is unique and highly efficient: first they will drill low-cost ($400k-$500k) shallow vertical wells using state-of-the-art stacked drilling site selection technology (i.e., the combined effect of 2D/3D seismic/Radiometrics/Telluric technolgies) in the Kansas Lansing carbonate sitting ABOVE the Mississippian Lime. With the high 80%-90% success rates and low cost of these shallow vertical wells, CRCL will use the rapid cost recovery (<120 day) and resulting cash flow to build additional acreage and “land bank” the Mississippian Lime horizontal play underneath the Kansas Lansing. The next step is to “cash and carry” JV or farm out the highly valuable Mississippian reserves underneath the KC-Lansing pay zones beginning in 2013 as these resource leases grow scarcer and prices increase as per the historic pattern of major oil resource reservoirs (i.e. Bakken, Eagle Ford, and Permian). Highly Attractive Drilling and Well Economics: In the Kansas Landsing, $250k dry hole costs and $500k completed well cost compare with >$5 million per well drilling costs in the oil shale resource plays (e.g. the Bakken/Eagle Ford resources). Existing infrastructure and low transport costs from legacy E&P in the area combined with relative low depth/lower horsepower rigs make finding and development costs (“F&D) significantly below the other hot onshore “oily” resource plays. Each well we expect to average 50 BOD first year results with <120 day cost recovery. Averaging one well every two weeks with a single rig gets CRCL to 250 barrels a day by year end with less than $2.5M total drilling/completion costs. 2 NBT EQUITIES RESEARCH © 2012 April 1, 2012 CircleStar Energy, Inc. April 1, 2012 CircleStar Energy, Inc. Extremely Low Cost Geologic/Drilling/G&A Cost Structure & Business Model With $1M in annual cash flow from CRCL’s non-operated participations in mostly Texas shale oil locations, and drilling/operating management/geological costs borne by their operating partners, CRCL expects TOTAL annual G&A costs under $1 million for the foreseeable future. Fast growing E&P companies typically incur significant and fast growing G&A costs that CRCL has structurally eliminated from its business model. Experienced E&P Management Team and Geologic/Drilling Management Partners Jeff Johnson, Chairman & CEO, is a 30 year oil E&P entrepreneur and CEO who most recently founded and built NYSE/AMEX listed Cano Petroleum, Inc. (CANO) before leaving in early 2011. The geologists and operating partners have over 30 years of E&P success in many regions but specialize in Mid-Continent and Kansas/Oklahoma. Likely Up-Listing to NYSE-Amex Exchange With the completion of the expected $15,000,000 equity/debt financing round by end of April, 2012, CRCL will have the necessary requirements to apply for and qualify for listing on the NYSE-AMEX exchange. In our opinion this move will add potential investors and improve liquidity and visibility for the company. Multiple Catalysts with Significant Near-Term Upside: We believe CRCL has significant upside potential in the near term from multiple catalysts inherent in their strategy. Conclusion of a resource-based credit/equity financing is imminent. Vertical drilling starts in August with one drilling rig drilling 5-6 wells producing at least 4 good wells given the stacked technology well location techniques. With the activity of major players in the area like Sand Ridge, Chesapeake Energy, Petro Quest and multiple private E&P organizations news and comparable valuation research will increase significantly. 3 NBT EQUITIES RESEARCH © 2012 In the Mississippian Lime play, the leading E&P player in the resource (SandRidge Energy) estimates average well at internal rates of return of 96% and a PV-10 net present value of $5.6 million using the NYMEX strip as of January 2012. SandRidge expects its finding and development costs in the Mississippian oil play to be $8.47 per barrel of oil equivalent (BOE). Using well metrics from SandRidge, NBT expects the average horizontal Mississippian well to have an estimated ultimate recovery (EUR) of 456,000 barrels of oil equivalent (BOE), with 45%-55% of the production composed of light sweet crude. We believe those economics to be highly attractive to JV partners and drilling prospect buyers. April 1, 2012 NBT EQUITIES RESEARCH © 2012 CircleStar Energy, Inc. 4 April 1, 2012 NBT EQUITIES RESEARCH © 2012 CircleStar Energy, Inc. 5 April 1, 2012 CircleStar Energy, Inc. Macro Mid-Continent E&P Investment Thesis The development of oil-and-NGL rich plays carbonate resource (vs. natural gas shales) is THE next big trend in the high-tech oil and gas industry as long as natural gas is under $6mcf. Companies are pulling out of mostly methane or “dry gas” plays like the Barnett Shale and have moved to oil-and-NGL-rich plays like the Permian Basin and Eagle Ford field instead. It’s a natural transition to use shale drilling and fracking technology in the “oily” Mississippian carbonate resources which have been exploited for 100 years via conventional vertical drilling. Most geologists with significant expertise in the Mississippian resource conclude that vertical only drilling has left hundreds of billions of barrels of oil/NGL reserves untapped. The liquids-rich region of carbonate limestone formations in northern Oklahoma and southern Kansas, considered tapped out by vertical drilling decades ago, has been yielding significant reservoirs to horizontal operators such as SandRidge, Chesapeake, Devon and Tulsa-based Eagle Energy LLC during the past two years. The Mississippi Lime's ratio is often 52 to 55 percent oil, according to Kansas royalty reports. Economics still matter in energy exploration and production. The cost of acreage and horizontal drilling the hottest carbonate Eagle Ford and Permian resources plays has skyrocketed. $10,000 an acre lease deals and $5 million per well drilling costs the norm. These economics make the Mississippian Lime’s low sulfur “sweet crude” one of the most cost efficient resource plays onshore. Tom Ward from SandRidge Energy, the largest Mississippian leaseholder, said in his last analyst call “We believe the Mississippian Lime is the most capital-efficient play in the U.S., and we continue to evaluate our rig allocation and make the best decisions going forward to maximize production and return on invested capital. He also was quoted in World Oil magazine (DEC) of the Mississippian Lime” “We compare the scope of this play to the Bakken and believe it will be transformational to the Mid-Continental oil industry.” NBT agrees. Even though estimated ultimate recovery of oil per well may be less than say a Bakken or Eagle Ford shale well, carbonate plays in Kansas/Oklahoma have key economic advantages: Thanks to decades of vertical drilling, the Mississippi Lime's existing infrastructure is already in place. Oil producing strata is relatively shallow at 4-6,000 feet deep (Bakken wells are about twice as deep). Less pressure is required to fracture carbonate rocks than shale. Less transport costs: Mississippian Resource is close to Cushing in Oklahoma, the largest oil storage facility in the U.S. with pipeline extensions being constructed from Kansas to Cushing. Pre-existing vertical wells can be utilized for laterals to ramp up production from formerly "depleted" wells. 6 NBT EQUITIES RESEARCH © 2012 In contrast, CircleStar is acquiring over 71,500 acres of Mississippian Lime for @$120 an acre and initially drilling $400k/$500k vertical wells into the shallow Lansing-Kansas City carbonates (using advanced stacked pay technologies) to generate significant cash flow BEFORE exploiting the Mississippian Lime underneath via sale/JV. April 1, 2012 CircleStar Energy, Inc. Circle Star’s “Kansas 2-Step” Drill and Mississippian Lime Land-Banking Strategy CRCL’s “Kansas 2-Step” plan is to use its’ Landsing oil/NGLs cash flow to acquire significantly more acreage and reserves in Kansas while essentially “land banking” the more valuable/much higher cost-to drill Mississippian underneath the Lansing-Kansas City carbonate for “cash and carry” joint ventures/farm-outs. In Kansas, the Lansing-Kansas City oil reservoirs sits right on top of top quality Mississippian Lime reservoirs. With modern “Stacked Pay” technologies (combined geometrics/3D seismic mapping/tellurics) CRCL anticipates 80-90% accuracy in low-cost ($400-$500k) vertical wells with very high EUR reserves (up to 200,000 boe per well) in Lansing-Kansas carbonates. Roughly speaking, for every $3.5 million in Lansing-Kansas vertical drilling programs at 75% success rates (i.e., 6 wells at $500k average with two dry wells at $250k per) NBT pro-formas @ $25 million in CRCL cash flow at <120 day full pay-back and PV 10 of $2.1M value per well. Add in many dozens of “cash and carry” JV Mississippian Lime wells with $2500 per acre lease payments and 25% net interests, valuation for CRCL proven and PUD reserves explode with the activity of Mississippian E&P management expects to generate. Said another way, for the cost of drilling ONE horizontal/hydro-fractured Eagle Ford well, CRCL drills TEN vertical wells with roughly $25 million in cash flow at $75 net oil. Finally…CRCL will cover its G&A overhead with the $100,000+ monthly cash flow it receives from its non-operated participations energy acquisition within 6 Texas-based shale oil basins last year. The resulting cash flows can be leveraged to rapidly acquire significant additional acreage in Kansas and build significant proven reserve value. Mississippian Lime Resource Players 7 NBT EQUITIES RESEARCH © 2012 NBT Conclusion: with a $15 million debt/equity raise, CRCL has come up with a HIGHLY capital and technology efficient way to quickly build a significant 71,000 acre+ position in the Mississippian Lime resource located mid-continent Kansas and Oklahoma. CRCL’s drilling partners understanding and use of the latest “stacked pay” technology, and especially telluric data, creates a competitive advantage in acquiring and exploiting Lansing Kansas carbonates at very low cost/high cash flow rates. April 1, 2012 CircleStar Energy, Inc. Kansas Geological Summary Circle Star has contracted to acquire two regional land assets encompassing interests in approximately 71,500 total acres of land considered prospective for oil & gas Kansas Acquisition I is an outright land and mineral rights purchase of 7,500 acres in the “original Mississippian” play with an effective Net Revenue Interest (‘NRI’) of approximately 93% Kansas Acquisition II is an oil & gas lease of 64,000 acres in the “Mississippian extension” prospect lands with an effective NRI of approximately 81% to the company Geologically, five (5) primary targets lay within the KC-Lansing prospect areas at an estimated Total Depth of approximately 4,200 feet. The A,B,I,J and K horizons all produce within a 300 feet thick Kansas City-Lansing targeted Formation. The KC-Lansing’s A, B, and I production zones are the most prolific in the study area. The Kansas City-Lansing is an unspaced formation and stratigraphically trapped from approximately 3,800 to 4,100 feet below ground level. The KC-Lansing is a carbonate “Limestone” reservoir with stacked lenses of porosity averaging 8-16 feet of porosity greater than 10% percent. The study shows these lenses of increased porosity and permeability characteristics develop and produce on the flanks of deep basement structures. The KCLansing formation has produced 1 billion barrels of oil, roughly 20% of the 5 billion barrels of oil produced in Kansas. NBT EQUITIES RESEARCH © 2012 Drilling & completion costs average about $500M per well and take less than 10 days to drill. Estimated recovery rates (“EUR”) generally range from 50MBO to 150MBO per well. Utilizing modern drilling & completion techniques in association with “stacked technological data” - seismic, radiometrics and tellurics – anticipated results are at the higher end of the EUR range. 8 April 1, 2012 NBT EQUITIES RESEARCH © 2012 CircleStar Energy, Inc. 9 The Texas Non-Operated Participations: $100k a month in cash flow and growing The Company’s producing areas include: Hilltop Bossier Field (Robertson County, Texas) – Deep Bossier; Madisonville Woodbine Field (Madison/Grimes, County, Texas) – Woodbine; Pearsall Field (Dimmit/Zavala County, Texas) – Austin Chalk , Eagle Ford Shale; Permian Basin (Scurry/Crane/Glasscock et. al. County, Texas) – Wolfcamp, Clearfork, Spraberry, Fusselman, Cline Shale The Company’s asset operators are: Apache Corp. - NYSE: APA Chesapeake Energy – NYSE: CHK CML Exploration (formerly Patterson Exploration) – Private company EnCana – NYSE: ECA Leexus Oil & Gas– Private company; Newfield Exploration – NYSE: NFX 10 NBT EQUITIES RESEARCH © 2012 April 1, 2012 CircleStar Energy, Inc. April 1, 2012 CircleStar Energy, Inc. Woodbine Acquisition Corp.- Private company Texas Asset Overview Texas Well Count Acquisition I Operator Area Counties Gross Acreage Chesapeake Energy Eagle Ford Dimmit, Zavala 28,200 80 353 3 350 CML Exploration Austin Chalk Dimmit, Zavala 22,430 N/A 50 20 30 120 40 3 2 1 1,310 160 8 3 5 3,184 80 40 10 30 1,628 160 10 5 5 Gulf Coast Victoria Madisonville Grimes, Woodbine Madison Unitex Oil & Gas, Permian LLC Scurry Encana Oil & Gas Deep Bossier Robertson 11 Drill Potential Current Additional Spacing Locations Producers Wells NBT EQUITIES RESEARCH © 2012 April 1, 2012 CircleStar Energy, Inc. Leexus Oil, LLC II Austin Chalk Fayette, Lee 1,766 N/A 22 7 15 Woodbine Madisonville Grimes, Acquisition Corp. Woodbine Madison 1,357 160 8 3 5 Apache Corp. Fusselman Glasscock 1,280 40 32 - 32 Cline Shale Glasscock 1,280 40 32 - 32 Spraberry Glasscock 1,280 20 64 4 60 622 57 565 TOTAL 63,835 NBT EQUITIES RESEARCH © 2012 The Company owns royalty, non-operated working interests and mineral interests in certain oil and gas properties in Texas. The Oil and Gas Properties include producing wells in the TXL Extension, Crane County, TX (1.00% working interest and 0.75% revenue interest in two wells); Bullard Prospect, Scurry County, TX (1.25% – 2.50% working interest and 0.94% – 2.08% revenue interest in eight wells); Nursery Prospect, Victoria County, TX (2.75% working interest and 2.00% – 2.10% revenue interest in 2 wells); Pearsall Prospect, Dimmit and Zavala Counties, TX (0.24% - 5.00% working interest and 0.17% – 3.75% revenue interest in 23 wells); Madison Woodbine, Grimes and Madison Counties, TX (0.00% 2.90% working interest and 0.0190% – 2.90% revenue interest in six wells); EnCana Hilltop Bossier Field, Robertson County, TX (0.4146% – 3.7640% working interest, 0.3192% – 2.7265% net revenue interest, and 0.00% – 0.5906% mineral interest in 5 wells) and Giddings Field, Fayette and Lee Counties, TX (0.00% - 3.00% working interest and 0.76% – 2.28% revenue interest in 7 wells). 12 April 1, 2012 CircleStar Energy, Inc. The Mississippian Formation The Mississippian Limestone of northern Oklahoma and southern Kansas is comprised of four basic depositional environments. These are the Mississippi “Chat”, Chester, Meramec and Osage. The top of the Mississippi is a major erosional unconformity across Kansas. As a result, Mississippi production in this area is from an Osage chart section at the top of the Mississippian and from a sand lens in the Mississippi section, which is usually referred to as the Kinderhook sand. Mississippian rocks produce oil in several hundred fields in Kansas from combination structuralstratigraphic traps in which porous chat and overlying conglomerates change to nonporous chat or limestone in an updip directions. The widespread distribution of Upper and Lower Mississippian production in both large and small fields makes it a potential target horizon in virtually all wildcat wells drilled where Mississippian rocks are present. The Mississippi Lime underlies the “Chat” and is comprised of the Mississippi Chester, Manning, Meramec and Osage. It is a deep water to shallow marine limestone sequence with interbedded dolomite facies enhancing porosity and permeability. This zone is also productive in the prospect area in addition to the Chat. Porosities range from 5 to 15% with water saturations ranging from 25 to 60%. Net porosity thickness greater than 5% ranges from 10 to 100’ with an average of 30 to 50’. Due to the heterogenic porosity development within the Mississippian formations it is advantageous to drill horizontal wells to interconnect a larger percentage of porosity with one well bore. Fracture treatment of the formation during completion in addition to the horizontal placement of the well bore will add significant conduits for production of hydrocarbons adding significant recoverable reserves. These reserves would not be recovered with a conventional vertical well. EMC 1 Track Record CRCL’s primary geology and drilling program partner EMC1 is very experienced in the KC-Lansing and Mississippian Lime resource play. 80% success rate as stand-alone technology 13 NBT EQUITIES RESEARCH © 2012 The Mississippi “Chat” is the uppermost member at the unconformity between the Pennsylvanian and Mississippian aged rocks and is considered to be a very good hydrocarbon reservoir. These “Chat” reservoirs are very wide spread, vary in gross thickness from a few feet to 80’ thick and are heterogeneous in nature. Net porosity thicknesses greater than 5% range from a few feet to greater than 40 feet. This is caused in part through uplift, alteration, erosion and deposition of the original limestone commonly referred to as Mississippi Lime. The “Chat” is comprised of varying amounts of weathered chert, limestone and dolomite. Porosities range from 3 to 35%. The resistivities are generally low due to the amount of weathered chert and appear to be wet on logs by conventional petrophysical analysis. These reservoirs are in fact not wet but do produce some water associated with the production of hydrocarbons. Water rates vary between wells depending on the actual mineral composition of the formation being completed. April 1, 2012 CircleStar Energy, Inc. NBT EQUITIES RESEARCH © 2012 90% success rate utilizing “stacked” technology Australia ◦ BP Gulf of Mexico ◦ Shell Oil On shore U.S. ◦ NY, KS, TX, OK ◦ Shell, Chesapeake, Credo, Murfin drilling 38 successful wells out of 41 drilled in NY (Marcellus Shale) 9 successful wells out of 10 drilled in Kansas (KS Lansing/Miss/Arbuckle) ◦ 1 “failure” producing 26 barrels of oil per hour when well “blew out” 35 successful wells out of 38 drilled in Texas (King Sand) 14 April 1, 2012 CircleStar Energy, Inc. Stacked-Pay Technology Overview 1. Geology ◦ “Oil is where oil was” 2. Seismic ◦ Records structures via sound waves 3. Radiometrics ◦ Records structures & hydrocarbons via radiation 4. Tellurics ◦ Records structures and hydrocarbons via resistivity Tellurics Means applying computerized interpretations measuring the variances as the electro-magnetic wavelengths as they pass through the Earth’s crust. In other words, telluric technology can read hydrocarbon bearing rock below the earth’s surface at an incredible rate of accuracy utilizing the same principle of electric logs. Just like seismic, the interpretation of telluric data is the key to success. Executive Management Founder, Chairman and CEO of Cano Petroleum, Inc. (CANA) from 2004-2011, initially OTC listed, moved to NYSE/Amex in 2005. CEO of Scope Operating Company from 1998-2004 Founder and CEO of Acumen Resources, Inc. from 1993-1998. Vice President of Touchstone Capital from 1989-1993. Managing member of High Plains Oil, LLC (“High Plains”), a private oil and gas company he founded in April 2011. Currently serves on the Advisory Board of Planet Resource Recovery, an EOR service company and on the Board of Directors of Y2M (Young Men Moving), a non-profit organization established to mentor young men who may not have positive male role models in their daily life. Previously served on the NYSE/Amex Listed Company Counsel. Has served as a director on the Board of the Company since June 16, 2011 and as Chairman of the Board of the Company since July 6, 2011. G. Jonathon Pina Chief Financial Officer Former Managing Partner of Pimuro Capital Partners Former Vice President of E&P Investment Banking, Chiron Financial Advisors Former Project Manager – Randall & Dewey/Jefferies 2008 Emerging Businessman of the Year (Pimuro Capital Partners) awarded by the Houston Hispanic Chamber of Commerce 15 NBT EQUITIES RESEARCH © 2012 Jeff Johnson CEO April 1, 2012 CircleStar Energy, Inc. Board of Directors Jeff Johnson Thomas M. Richards--Director Founder and President of Redco, Inc., Oil & Gas Exploration Company. Managing Partner and Owner of Richards Cattle Company. Formerly Land and Lease Manager of Cano Petroleum, Inc., Fort Worth based Oil & Gas Enhanced Recovery Company. Member of the Presidents Council at Texas Tech University and a practicing oil and gas attorney. Graduated with a B.A. in Finance at Texas Tech University and Doctorate of Law at Baylor University. Founder and President of "Books for Belize," a Texas based organization that provides children's books to Central America Countries. Morris B. “Sam” Smith--Director Woodbine Acquisition Corporation, CEO, Officer & Director (2011) Consultant for four private entities, two oil & gas companies and one oilfield services company Cano Petroleum, CFO ( 2005 - 2008) RBI International, Consultant (2004 - 2005) Encore Acquisition Company, Exec VP, CFO, Treasurer (2000 to 2003). Union Pacific Resources, VP of Finance and CFO (1996 - 2000). Union Pacific Corporation, Controller (1990 - 1996) Bachelor of Business Administration, McMurry University Advanced Management Program & International Studies, Harvard School of Business General Risk Factors Following are some general risk factors: (1) Industry fundamentals with respect to customer demand or product/service pricing could change and adversely impact expected revenues and earnings; (2) Issues relating to major competitors or market shares or new product expectations could change investor attitudes toward the sector or this stock; (3) Unforeseen developments with respect to the management, financial condition or accounting policies or practices could alter the prospective valuation; or (4) External factors that affect the U.S. economy, interest rates, the U.S. dollar or major segments of the economy could alter investor confidence and investment prospects. International investments involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. Investment risks Commodity price swings could impact CRCL. If oil prices fall below the $40/bbl level, the economics for its projects would be stressed. CRCL is a growth company and it will need to raise money to sustain its drilling program. Despite the company's best planning, logistical delays could occur and the production projections could be negatively impacted. The Company is exposed to regulatory and environmental delays in some of its operating areas. Industry Risk The crude oil and natural gas markets are very volatile and unpredictable. The price the Company 16 NBT EQUITIES RESEARCH © 2012 Investment Risks April 1, 2012 CircleStar Energy, Inc. receives for its crude oil and natural gas production heavily influences its revenue, profitability, access to capital and future rate of growth. The prices it receives for production and the levels of production depend on numerous factors beyond the Company’s control. These factors include, but are not limited to, the following: • Changes in global supply and demand for crude oil and natural gas; • The actions of the Organization of Petroleum Exporting Countries; • The price and quantity of imports of foreign crude oil and natural gas; • Political and economic conditions, including embargoes, in crude oil-producing countries or affecting other crude oil-producing activity; • The level of global crude oil and natural gas exploration and production activity; • The level of global crude oil and natural gas inventories; • Weather conditions; • Technological advances affecting energy consumption; • Domestic and foreign governmental regulations; • Proximity and capacity of crude oil and natural gas pipelines and other transportation facilities; • The price and availability of competitors’ supplies of crude oil and natural gas in captive market areas; and • The price and availability of alternative fuels Execution Risk As with any early stage company implementing an aggressive growth plan, Ante5’ success or failure will depend on management’s ability to execute their business plan in an efficient and timely manner. Financial Risk The Company is dependent on continued financing from outside investors due to recurring operating Losses until positive cash flow is achieved, if ever. As a result, the Company’s ability to continue as a going concern could depend upon its ability to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due and to generate profitable operations in the future. There can be no assurance that any funding would be attainable or attainable on favorable terms, thus investors should be financially capable of losing all or a portion of their investment. Key Management Risk Management’s skill and experience is a key determinant of success. CRCL, like most small companies, is heavily dependent on key management, the loss of any of which could seriously, adversely affect the company. 17 NBT EQUITIES RESEARCH © 2012 Competition Risk Oil and natural gas exploration is intensely competitive and involves a high degree of risk. In its efforts to acquire oil and natural gas producing properties, CRCL competes with other companies that have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also conduct refining and petroleum marketing operations on a worldwide basis. The Company’s ability to compete for oil and natural gas producing properties will be affected by the available capital and available information. The Company will also face competition from alternative fuel sources and technologies. April 1, 2012 CircleStar Energy, Inc. Micro-capital Investment Risk Micro-capital investing involves inherent risk and investors should carefully research any company considered for investment. Micro-capital companies are usually early in their market cycle and vulnerable to significant price volatility. Non-Specific Market Risks (Liquidity, trading rules & BD restrictions) CRCL’s common stock is quoted on the Over-the-Counter (“OTCBB”) as such; there is only a limited trading market for its common stock. As a result, the Company’s common stock is subject to the penny stock rules by the Securities and Exchange Commission that requires brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks, and as such there may be a reduction in the trading activity of its common stock. As a result, investors may find it difficult to sell their shares of the Company’s common stock. Risk Categories NBT’s investment universe revolves around undiscovered emerging growth companies that possess higher risk profiles than established “blue chip” companies. Presently NBT maintains three risk categories including growth, aggressive growth and speculative with the later assigned to higher risk companies. Growth – Lower risk investment relative to small capital company investments with a defined revenue pattern, reasonable earnings predictability and sound balance sheet. Aggressive Growth – Average to higher risk investment relative to small capital company investments in a high growth stage or industry. May have limited history of generating revenue or be operating in a highly competitive or rapidly changing environment. Investors must have the financial capacity to lose a significant portion of his or her investment. Speculative Growth - High risk investment with short or unprofitable operating history and limited revenue or earnings predictability. Companies are typically early stage and in the process of commercializing a new and often potentially disruptive technology into a large market. Investors must have the financial capacity to lose his or her entire investment. Published in subsequent update reports DISCLAIMER This report is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. NBT Equities Research is a wholly-owned subsidiary of NBT Equity Group Inc. and/or ChangeWave Inc. The information and opinions in this report were prepared by NBT Equities Research, LLC. The information herein is believed to be reliable and has been obtained from public sources believed to be reliable. We make no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this report constitute the current judgment of the author as of the date of the report and are subject to change without notice. We have no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, 18 NBT EQUITIES RESEARCH © 2012 Financial Model and Valuation (Appendix A) April 1, 2012 CircleStar Energy, Inc. projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate, or if research on the subject company is withdrawn. This report is provided for informational purposes only. Neither NBT Equities Research nor its officers, directors, partners, employees, consultants nor anyone involved in the publication of this special report is a registered investment adviser or broker/dealer and none of the foregoing make any recommendation that the purchase of securities of any company profiled in this special report is suitable or advisable for any person or that an investment in such securities will be profitable. Past performance of profiled securities is not indicative of future results. Companies profiled in this special report may lack an active trading market for their securities and investing in such securities is highly speculative and carries a high degree of risk. Anyone investing in these companies should be able and prepared to bear a loss of his or her entire investment. The information on this special report is not designed to be used as the basis for an investment decision. You should confirm to your own satisfaction the veracity of any information prior to entering into any investment. The decision to buy or sell any security that may be featured by NBT Equities Research is done purely at the reader’s own risk. Under no circumstances will its owners, officers, or employees be held liable for any losses incurred by the use of information contained in this special report. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy in any jurisdiction. The recipients of our reports must make their own independent decisions regarding any securities mentioned in our reports. NBT EQUITIES RESEARCH © 2012 NBT Equities Research or its affiliates have received $20,000 in compensation from the company or companies mentioned in this report or agents acting on their behalf. This report may be reproduced, distributed or published by any person for any purpose without the prior written consent of NBT Equities Research. Please cite source when quoting. 19