online supplement - Palgrave Macmillan Journals

advertisement

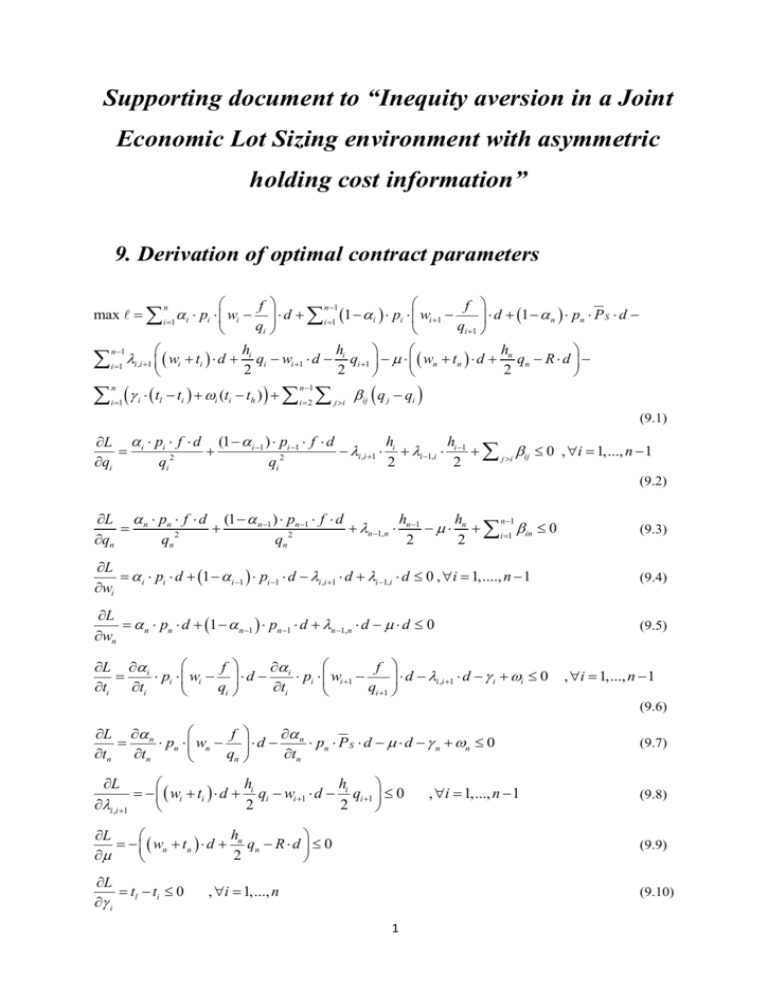

Supporting document to “Inequity aversion in a Joint Economic Lot Sizing environment with asymmetric holding cost information” 9. Derivation of optimal contract parameters Formelabschnitt 9 n f n 1 f max i 1 i pi wi d i 1 1 i pi wi 1 d 1 n pn P S d qi qi 1 h h h n 1 i1 i,i 1 wi ti d 2i qi wi 1 d 2i qi 1 wn tn d 2n qn R d t n i 1 i l ti i (ti th ) i 2 j i ij q j qi n 1 (9.1) h h L i pi f d (1 i 1 ) pi 1 f d i ,i 1 i i 1,i i 1 j i ij 0 , i 1,..., n 1 2 2 qi qi qi 2 2 (9.2) h h L n pn f d (1 n 1 ) pn 1 f d n 1 n 1,n n 1 n i 1 in 0 2 2 qn qn qn 2 2 (9.3) L i pi d 1 i 1 pi 1 d i ,i 1 d i 1,i d 0 , i 1,...., n 1 wi (9.4) L n pn d 1 n 1 pn 1 d n 1,n d d 0 wn (9.5) L i f f pi wi d i pi wi 1 d i ,i 1 d i i 0 ti ti qi ti qi 1 , i 1,..., n 1 (9.6) L n f pn wn d n pn P S d d n n 0 tn tn qn tn L i ,i 1 h h wi ti d i qi wi 1 d i qi 1 0 2 2 , i 1,..., n 1 (9.7) (9.8) h L wn tn d n qn R d 0 2 (9.9) L tl t i 0 i (9.10) , i 1,..., n 1 L ti t h 0 i , i 1,..., n (9.11) L q j qi 0 ij (9.12) L L L L L ij , qi 0, wi 0, ti 0, i.i 1 0, ij qi wi ti i ,i 1 L L L L 0, i 0, i 0, ij i i ij (9.13) Let pˆ i denote the probability that contract Ai is chosen, i.e. pˆ i (ti ) pi (1 i 1 ) pi 1 , i 2,..., n pˆ1 (t1 ) p1 From (9.5) follows pˆ n d n 1,n d d 0 (9.14) And it follows directly that pˆ n n 1,n (9.15) From (9.4) follows i ,i 1 pˆ i i 1,i (9.16) Inserting (9.16) into (9.15) for all i 1,..., n 1 gives pˆ n pˆ n1 ... pˆ1 p1 p2 ... n pn 1 (1 (tn )) pn (9.17) Inserting (9.17) into (9.15) gives n1,n 1 pn 1 n1 pn1 (9.18) And it follows from (9.16) that 2 n 2,n 1 n 1,n pˆ n 1 1 (1 n ) pn pˆ n pˆ n 1 .... i 1,i k 1 pk (ti 1 ) pi 1 i 2 (9.19) i ,i 1 1 (1 n ) pn pˆ n ... pˆ i 1 k 1 pk i pi k 1 pˆ k i 1 i 1,2 1 p1 Inserting (9.17) and (9.19) into (9.3) and (9.2) gives qi (ti , ti 1 ) hi 2 f d k 1 pk i 1 pi 1 hi hi 1 j i ij i 2 1 p i 1 i 1 (9.20) i pi If the implementability condition is not binding in the optimal menu of contracts, then ij 0 and the optimal order sizes result from qi hi 2 f d k 1 pk i1 pi1 hi hi1 i2 1 p i 1 i 1 i 1,..., n (9.21) i pi Yet, if bunching occurs in the optimal menu of contracts, then at least one i , j 0 . We define qij as the order sizes that are bunched, i.e., qij qi qi 1 ... q j j i . In this case, the necessary KKT condition (9.2) changes to: (1 z 1 ) pz 1 f d h h L j p f d z i z z 2 z , z 1 z z 1, z z 1 0 , i 1,..., n 1 2 qij qij qij 2 2 Inserting (9.19) and rearranging gives qij hj 2 fd (9.23) k 1 pk i 1 pi 1 h j hi 1 i 2 j 1 k i pk 1 i 1 pi 1 j p j Given the optimal contract parameters that can be determined via the algorithm stated in Section 3m the optimal wholesale prices result from (9.9) wn AI R tn hn qn AI (tn ) 2d (9.24) and (9.8) 3 (9.22) wi wi 1 ti hi qi 1 qi 2d (9.25) As long as the additional incentive is an interior solution (i.e., as long as i , i 0 ), the optimal value for ti can be obtained by solving the equation system resulting from inserting (9.19) into (9.6), i.e., f i f pi wi wi 1 ti qi 1 qi i 1 k 1 pk i pi 0 i 1,..., n 1 (9.26) And for inserting (9.24) and (9.25) gives li which denotes the marginal revenues/costs of increasing ti . li i pi h i 1 ti d i qi qi 1 fdqi 1 fdqi 11 i pi k 1 pk 0 i 1,..., n 1 (9.27) ti d 2 Respectively, t n can be obtained by inserting (9.17) into (9.7) n h f pn R tn n qn P S n pn 1 pn tn 2d qn (9.28) Note, that the equations (9.26)/(9.27) are uni-modular and have therefore at most two roots. Proof: 2 i The first derivative w.r.t. ti while considering 2 0 gives: ti h q p q h q q l i i d i pi fdqi 12 i 1 i i 1 i i fdqi 2 i ti ti d ti ti 2 ti 2 ti ti (9.29) Let the first term, x1 i pi d i pi 2 i pi 0 ti d ti ti (9.30) denote the effect of changing ti if the order sizes are not adjusted (e.g., the order sizes are calculated with ), where li x1 x2 . (9.30) is constant and negative, i.e., (9.27) would be strictly monotonically decreasing if the order sizes were not adjusted. However, in the optimal solution, the order sizes qi and qi 1 will only be adjusted, if the marginal revenues of increasing the order size are 4 larger than the marginal cost. Thus, it follows that adjusting the order sizes can only have a positive contribution in (9.27) and it follows that there can be at most one maximum. Let x2 denote the effect of the order size adjustment, i.e., x2 fdqi 12 qi 1 hi qi 1 hi qi q fdqi 2 i ti 2 ti 2 ti ti 0 (9.31) The effect of the order size adjustment is positive (which follows directly from fd hi fd hi qi 1 qi 0 ) and this positive effect becomes larger with increasing ti which q 2 q i 1 i 2 follows directly from (9.31). Thus, it follows that (9.27) is unimodular (a monotonically increasing positive term, (9.31), is added to a constant negative term, (9.30), and thus there are at most two roots for each equation in (9.29) satisfying the necessary KKT conditions. If there are exactly two roots, then the first necessary condition is a local maximum (the marginal revenues of increasing ti are larger than the marginal costs), and the second root is necessarily a local minimum. Assume the case with two roots (y1 and y2). For ti < y1 the marginal revenues (i.e., incentivizing choosing a larger order size) are larger than the marginal costs (i.e., the informational rent to the buyer). Thus, for a local maximum the supplier should increase t i to y1. For y1<ti<y2, the marginal costs are higher than the marginal benefits, and increasing t i to y2 will yield a local maximium. Increasing ti further contributes positively to the objective function. Thus, if the additional benefits gained by increasing ti from y2 to th offset the cost occurred from increasing ti from y1 to y2, then the global optimum will be th, otherwise it will be y1. 5