Solutions to Exam 1

advertisement

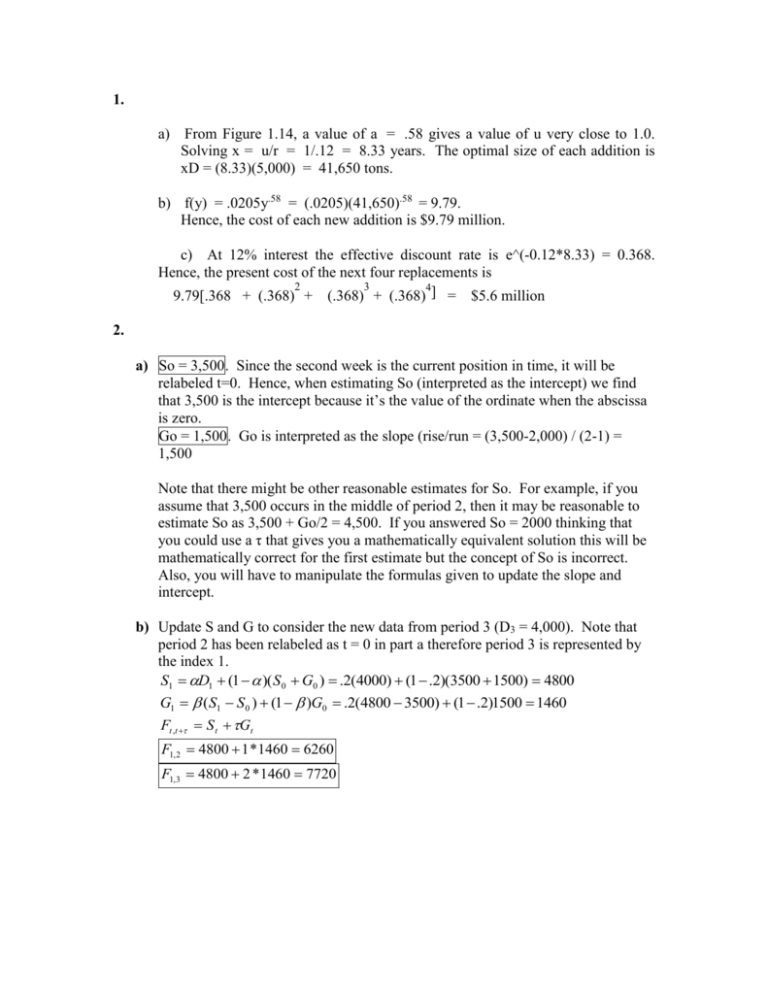

1. a) From Figure 1.14, a value of a = .58 gives a value of u very close to 1.0. Solving x = u/r = 1/.12 = 8.33 years. The optimal size of each addition is xD = (8.33)(5,000) = 41,650 tons. b) f(y) = .0205y.58 = (.0205)(41,650).58 = 9.79. Hence, the cost of each new addition is $9.79 million. c) At 12% interest the effective discount rate is e^(-0.12*8.33) = 0.368. Hence, the present cost of the next four replacements is 2 3 4 9.79[.368 + (.368) + (.368) + (.368) ] = $5.6 million 2. a) So = 3,500. Since the second week is the current position in time, it will be relabeled t=0. Hence, when estimating So (interpreted as the intercept) we find that 3,500 is the intercept because it’s the value of the ordinate when the abscissa is zero. Go = 1,500. Go is interpreted as the slope (rise/run = (3,500-2,000) / (2-1) = 1,500 Note that there might be other reasonable estimates for So. For example, if you assume that 3,500 occurs in the middle of period 2, then it may be reasonable to estimate So as 3,500 + Go/2 = 4,500. If you answered So = 2000 thinking that you could use a τ that gives you a mathematically equivalent solution this will be mathematically correct for the first estimate but the concept of So is incorrect. Also, you will have to manipulate the formulas given to update the slope and intercept. b) Update S and G to consider the new data from period 3 (D3 = 4,000). Note that period 2 has been relabeled as t = 0 in part a therefore period 3 is represented by the index 1. S1 D1 (1 )( S 0 G0 ) .2(4000) (1 .2)(3500 1500) 4800 G1 (S1 S 0 ) (1 )G0 .2(4800 3500) (1 .2)1500 1460 Ft ,t S t Gt F1, 2 4800 1 *1460 6260 F1,3 4800 2 *1460 7720 3. a) b) c) Note that the inventory holding cost per hour of production in inventory is $100 * 5%. So 90 hours of ending inventory would cost 90*100*5% = $450. The total overall cost is $62,500. 4. = 40 (pounds/day)*30(days/month) = 1200 pounds/month NOTE: - I assumed 30 working days in a month. - The holding cost is 2% which in this particular problem is the cost of opportunity. Therefore, h = 2%*c. You hold 2% of the cost of each pound. Part a) Mark’s offer computations: Step 1) Compute EOQ for each quantity discount price, and check feasibility: Note: The formula for EOQ was recomputed to account for h=ic. 2 *150 *1200 3721.04 lbs > 500 lbs (NOT FEASIBLE) 0.02 *1.3 2 *150 *1200 3872.98 lbs > 1000 lbs (NOT FEASIBLE) 0.02 *1.2 2 *150 *1200 4045.20 > 3000 lbs (FEASIBLE) 0.02 *1.1 Q (1) Q ( 2) Q ( 3) The largest discount is feasible -> 4045 is optimal. Step 3) Compute the cost per unit time: K Q (i )* ( i )* Gi Q (i )* ci ic i 2 Q G3 4045.2 150 * 1200 1.1 * 4045.2 1.1 *1200 0.02 1409 4045.2 2 If Gary is going to order from Mark he should order 4045 lbs. Anne’s offer computations: Step 1) Obtain average price for each order level: C1ave = 1.25 C1ave = [1.25*700 + 1.05*(Q-700)] / Q Step 1) Determine Gi(Q): G1 Q 150 *1200 1.25Q 1.25 *1200 0.02 Q 2 1.25 * 700 1.05 * (Q 700) *Q 150 *1200 1.25 * 700 1.05 * (Q 700) Q G2 Q [ ] *1200 0.02 Q Q 2 Step 2) Find Q* for each order level: For incremental level 1 we use the EOQ formula for h=ic derived earlier. Q (1) 2 *150 *1200 3794.73 lbs > 700 lbs (NOT FEASIBLE) 0.02 *1.25 For the second incremental level we must derive the EOQ formula: 1.25 * 700 1.05 * (Q 700) *Q 150 *1200 1.25 * 700 1.05 * (Q 700) Q G2 Q [ ] *1200 0.02 Q Q 2 150 875 1.05Q 735) [ ] *1200 0.01 * (875 1.05Q 735) Q 290 *1200 1.05 *1200 1.4 .0105Q Q G2 (Q) 1 * (290 *1200) 0 .0105 Q Q2 (290 *1200) .0105 Q2 Q ( 2)* 290 *1200 , alternatively .0105 Q ( 2)* 2 *1200 * (150 700 *1.25 700 *1.05) 5756.98 5757 (FEASIBLE) .02 *1.05 Step 3) Compute cost of each quantity for feasible quantities: 150 *1200 1.25 * 700 1.05 * (5757 700) G2 5757 [ ] *1200 0.02 5757 5757 1.25 * 700 1.05 * (5757 700) * 5757 5757 2 G2 5757 31.26 1289.18 61.85 1382.30 Note that this cost is lower than Mark’s cost. So Gary should order from Anne. Part c) As shown in part a and b, Gary will order large amounts at once, and thus order very infrequently. Given this frequency of ordering, I would probably not eat a hamburger at his restaurant. The importance of this question is to determine the frequency of the orders, not to figure out who’s vegetarian in our class.