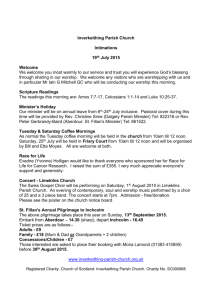

LA Land Title Association Tracked Bills Report

advertisement

LA Land Title Association Tracked Bills Report Provided by: Adams and Reese LLP Click on any bill number below to view the most recent version of the bill and to see where it is in the legislative process. HB 16, Dixon Provides for transfer of certain state property in Rapides Parish to the city of Pineville HB 17, Guillory Provides relative to permits for off-road equipment HB 69, Brossett Provides relative to the inspection of assessment lists and the notification and review of property tax assessments by the board of review in Orleans Parish HB 76, Hoffmann Extends the sunset date for real estate appraisal management company licensing application assessments HB 113, Schexnayder Provides relative to sale of adjudicated property to adjoining landowners HB 122, Thibaut Authorizes an assessor to make separate assessments of undivided interests in tax parcels under certain circumstances HB 125, Shadoin Provides with respect to usufruct of a surviving spouse HB 142, Dove Provides for an exemption from the requirement that crab traps have escape rings HB 162, Pearson Provides with respect to maximum authorized millage rates and provisions authorizing increases in certain millage rates without voter approval HB 166, Anders Provides relative to determining the market value of trees, timber, and pulpwood for purposes of levying the severance taxes HB 190, Schexnayder Provides relative to the Private Works Act HB 192, Edwards Provides for the continuous revision of the Code of Civil Procedure HB 223, Burns, H Provides relative to the timely payment of royalties to a mineral lessor HB 246, Gisclair Provides for the transfer of certain state property in Lafourche Parish HB 254, Fannin Makes changes to the oversight and adoption of updates to the state uniform construction code HB 256, Williams, P. Provides for the redemption period for blighted, abandoned, uninhabitable, or hazardous property sold at tax sale HB 274, Talbot Provides for the time period in which a homestead exemption may be claimed under certain circumstances HB 282, Willmott Provides relative to appeals of certain administrative adjudication hearings in Jefferson Parish HB 292, Jefferson Provides relative to the transfer of a certain parcel of land from La. Tech University to the city of Ruston HB 293, Foil Allows certain certified records to be used as evidence HB 306, Morris, Jay Provides relative to the bidding process in judicial sales HB 307, Lambert Provides for stays during appeals of certain decisions of the Department of Environmental Quality HB 327, Arnold Provides relative to the powers and duties of the Algiers Development District HB 330, Greene Reduces the homestead exemption HB 331, Greene Provides with respect to the amount of assessed valuation at which the homestead exemption applies HB 362, Guillory Provides relative to filing a statement of claim or privilege under the Private Works Act HB 363, Huval Provides for the transfer of certain state property in St. Martin Parish HB 369, Kleckley Provides relative to information included in certain taxpayer notifications from assessors HB 386, Leopold Provides relative to sponsorship of signs on certain state assets HB 388, Abramson Provides relative to the inspection of assessment lists and the notification and review of property tax assessments by the board of review in Orleans Parish HB 433, Badon Provides relative to surrogacy contracts HB 493, St. Germain Provides for solution mining injection wells and solution mined caverns HB 494, St. Germain Requires notification of the proximity of property to a salt dome containing solution mining and storage caverns HB 514, Kleckley Limits increases in ad valorem taxation under certain circumstances HB 521, Leger Increases the amount of the homestead exemption and the level of a homestead's assessed valuation at which the homestead exemption applies HB 539, Harris Authorizes the Avoyelles Parish School Board to exchange certain sixteenth section lands HB 546, Moreno Provides for the authority to transfer or lease certain state property in Orleans Parish to Children's Hospital, New Orleans HB 564, Morris, Jim Provides relative to drilling units HB 595, Abramson Provides for the transfer or lease of state property in Orleans Parish and St. Martin Parish 4/25/2013 Substitute bill adopted: HB 720 HB 622, Burns, T. Provides requirements for public hearings for purposes of certain millage increases 4/30/2013 Substitute bill adopted: HB 723 HB 720, Abramson Provides for the authority to transfer or lease certain state property in Orleans Parish and St. Martin Parish HB 723, Burns, T. Provides requirements for constitutionally authorized millage increases in certain parishes HCR 18, Abramson Establishes the Title Insurance Committee to study title search periods relative to the required periods of mortgage and conveyance records for the issuance of title insurance property HCR 107, Morris, Jay Directs the Louisiana State Law Institute to study the feasibility of creating a central database for testaments SB 5, LaFleur Removes the mandatory retirement age of judges SB 12, Murray Grants a refundable individual income tax credit for up to $600 of deposits made in a tax year to Wind and Hail Deductible Savings Accounts which provide reimbursement to the account holder for damages or losses not covered because of a deductible SB 20, Allain Provides certain requirements for meetings at which consideration of or action upon proposals by political subdivisions to levy, increase, renew, or continue property or sales taxes, or authorize the calling of an election for submittal of such question to voters are scheduled SB 27, Broome Provides for the Louisiana Home Protection Act SB 28, Murray Provides relative to the inspection of assessment lists and the notification and review of property tax assessments by the board of review in Orleans Parish SB 30, Morrell Creates a justice services commission to analyze, study, and recommend improved methods for managing and coordinating such services in Orleans Parish SB 39, Long Provides that a nonexclusive geophysical permittee will pay the permit fee to the office of mineral resources SB 42, Morrell Provides relative to the New Orleans Regional Business Park SB 62, Murray Provides relative to small tutorship procedures SB 71, Broome Authorizes and provides for mental health courts SB 85, Johns Exempts the Sabine River Authority from the requirement that property acquired by the state or a political subdivision which is to be transferred to a third party must first be offered to the person from whom it was originally transferred SB 91, Peacock Provides relative to certain unsolicited offers for lease or purchase of mineral rights SB 96, Adley Constitutional amendment to provide for eligibility for disabled veterans and their spouses for certain exemptions from ad valorem taxes SB 104, Crowe Constitutional amendment to authorize homeowners, ages sixty-five years or older with financial hardship, to postpone the payment of ad valorem taxes on their homestead until death SB 105, Crowe Constitutional amendment to provide an exemption from ad valorem taxes levied on property which tax increases more than 10% than the previous year when due to required reassessment SB 137, Appel Provides relative to certain lien and escrow account procedures for certain construction contracts SB 139, Ward Provides relative to fines levied by the commissioner of conservation for certain violations SB 140, Morrell Provides for legislation which increases the maximum fine and imprisonment for a violation of an Orleans Parish ordinance SB 145, Crowe Provides relative to the Oil Spill Prevention and Response Act SB 154, Murray Authorizes a cooperative endeavor agreement for use of certain state property situated in Orleans Parish SB 170, Donahue Authorizes and provides for the transfer of certain state property in St. Tammany Parish SB 183, Cortez Provides relative to liens SB 200, Mills Prohibits the issuance of certain permits to construct or operate salt dome caverns until certain conditions are met SB 214, Brown Provides for a moratorium on permits allowing underground storage of hazardous wastes, natural gas, liquid hydrocarbons, carbon dioxide, Class III brine extraction from or near a salt dome drilling through or into such underground storage reservoirs near salt domes or adjacent caverns, and to expand the requirements for such operations near moderate and catastrophic disasters such as sinkholes and collapses in salt dome caverns SB 216, Walsworth Authorizes the transfer of certain state property in Ouachita Parish SB 228, Crowe Authorize homeowners, aged 65 years or older with financial hardship, to postpone payment of ad valorem taxes on their homestead until death Adams and Reese LLP Louisiana Governmental Relations Team E. L. Henry, Esq. E.L.Henry@arlaw.com Robert L. Rieger, Jr., Esq. Robert.Rieger@arlaw.com C. Kevin Hayes, Esq. Kevin.Hayes@arlaw.com Christopher P. Coulon Chris.Coulon@arlaw.com J. Robert Wooley, Esq. James.Wooley@arlaw.com Alisha M. Duhon Alisha.Duhon@arlaw.com V. Thomas Clark, Jr., Esq. Tom.Clark@arlaw.com Charles Castille, Esq. Charles.Castille@arlaw.com Clarissa A. Preston Clarissa.Preston@arlaw.com Lee C. Reid, Esq. Lee.Reid@arlaw.com Renee C. Crasto, Esq. Renee.Crasto@arlaw.com This is not an advertisement. The information in this newsletter does not constitute legal advice or opinion and should not be viewed as a substitute for legal advice. The information provided is based on laws and regulations in effect at the time of creation and is subject to change. Adams and Reese is a multidisciplinary law firm with over 300 lawyers and advisors. The firm has offices in New Orleans, LA; Baton Rouge, LA; Birmingham, AL; Mobile, AL; Memphis, TN; Nashville, TN; Houston, TX; Jackson, MS; Jacksonville, FL; Sarasota, FL; St. Petersburg, FL; Tallahassee, FL; Tampa, FL; and Washington, DC. For additional information, please see the firm website at www.adamsandreese.com. This newsletter is a periodic publication of Adams and Reese LLP and is intended for general purposes only. This newsletter is sent to friends and clients of Adams and Reese LLP. The sending of this newsletter is not a privileged communication and does not create a lawyer/client relationship. No representation is made that the quality of the legal services to be performed is greater than the quality of legal services performed by other lawyers. FREE BACKGROUND INFORMATION IS AVAILABLE UPON REQUEST.