wrcr21618-sup-0001-2015WR017089-SupInfo

advertisement

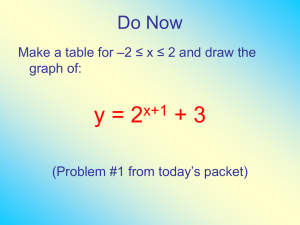

1 2 Water Resources Research 3 Supporting Information for 4 Reliability, Return Periods, and Risk under Nonstationarity 5 Laura K. Read1 and Richard M. Vogel1 6 1Department of Civil and Environmental Engineering, Tufts University, Medford, MA, USA 7 8 9 10 11 12 13 Contents of this file 14 Introduction 15 16 17 This supporting information provides the derivation and details of the coefficient of variation of the nonstationary flood series resulting from nonstationary 2-parameter lognormal model presented in the paper. 18 19 20 21 Derivation of Coefficient of Variation of X in nonstationary trend model Figure S1 Derivation of Coefficient of Variation of X in nonstationary lognormal model. The nonstationary LN2 flood hazard model employed in this paper assumes a linear trend in the 22 mean of logarithms of the annual maximum flood series Y=ln(X). . Interestingly, this single trend 23 model of Y implies a trend in both the mean and the variance of the annual maximum floods X. 24 Importantly, although the coefficient of variation of the flood series X, denoted Cx, is assumed 25 fixed, the nonstationary LN2 model implies a different coefficient of variation of X which we 26 term the conditional coefficient of variation and denote as Cx|t and for which we derive an 27 expression below. Recall from equation (13b) the well-known relationship between the stationary 28 standard deviation of Y=ln(X) and Cx: 1 29 y ln(1 C x2 ) 30 31 32 The nonstationary LN2 model introduces a trend in the mean of Y so that the variance of Y, 33 conditioned on the time t, is obtained by simply taking the variance of Y, given in (15), assuming 34 , and t are constants which leads to: (S1) 35 36 37 38 2y |t 2 y 2 2 t2 (S2) This is equivalent to y|t y (1 2 ) 39 t y (S3) 40 because ρ is the Pearson correlation coefficient defined as 41 strength of the linear relationship between the flood series Y and the covariate time, t. Consider 42 two extreme cases. If the regression model has perfect explanatory power, then =1 and the 43 conditional variance of Y in (S3) is equal to zero. If the regression model has no explanatory 44 power, then =0 and the conditional variance in (S3) is exactly equal to the unconditional 45 variance of Y. Of course the unconditional variance of Y is always the same, regardless of the 46 explanatory power of the regression. Since the residuals are assumed to be normally distributed, 47 the values of exp(ε) are lognormal, thus analogous to (S1) : 48 49 50 51 which measures the y|t 2 ln( 1 C x|t 2 ) (S4) 52 where C x|t is the coefficient of variation of the nonstationary variable X. 53 Combining equations (S1), (S3) and (S4) leads to a relationship between the coefficient of 54 variation of the stationary series Cx and the coefficient of variation of the nonstationary series, 55 C x |t given by 56 2 2 C x |t (C x 2 1) (1 ) 1 57 58 59 (S5) For a reasonable range of ρ, we explore the relationship between Cx and C x|t in Figure 60 S1. As expected, there is a reduction in the coefficient of variation of the nonstationary series Cx|t 61 as ρ increases, i.e. as the trend increases. Since the true value of ρ is unknown, is generally quite 62 small in practice, and will depend on the level of sophistication of the trend model employed, we 63 assume that 64 (S5) be used in any particular application of the nonstationary lognormal model. C x C x |t for all trends analyzed in this paper, but we recommend that in practice 65 66 67 68 Figure S1. Relationship between coefficient of variation of the stationary series Cx and the 69 70 71 72 coefficient of variation of the nonstationary series x|t for a feasible range of correlation coefficients, ρ (grey lines). Note that the black solid line represents the 1:1 line for stationary conditions where ρ=β=0. C 3