student assistance fund “investing in your future”

advertisement

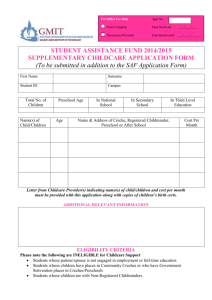

STUDENT ASSISTANCE FUND “INVESTING IN YOUR FUTURE” The Student Assistance Fund (SAF) is designed to support students from socio-economically disadvantaged backgrounds with ongoing needs for financial support and students with other circumstances giving rise to short or longer-term financial difficulties. The Student Assistance Fund in GMIT is assessed on income. This refers to: Parental Income in relation to students who are under 23 years of age, or Household income where the student is 23 years of age or over Additional funding may, however, be approved in exceptional circumstances Applications for funding will be approved where: Net Income less a deduction of €3,000 for each relevant access indicator (max 3), is equal to, or less than, €35,000 per annum, or Gross income less a deduction of €3,000 for each relevant access indicator (max 3), is equal to, or less than, €47,000 One or more of the following as appropriate, referring to Household Income for 2013, must be submitted, along with the application form, before the application can be assessed: P21 of the parents of the applicant where he/she is under 23 years of age P21 of the applicant and/or cohabiting partner where he/she is 23 years of age or over Notice of Assessment if self-employed/farmer Statement from Social Welfare indicating ALL entitlements Access Indicators: Where a student lives 45km or more from the campus Where sibling(s), parent(s) or partner of the applicant is/are in third level education Where four or more dependents in a family are in full-time education Where the applicants for SAF Funding has a dependent child/children Where the applicant has a sibling, parent or partner in full-time Third-Level Education, proof of registration of same must be provided. Where the applicant has a dependent child/children, copies of birth certificates must be provided. Applicants for the Student Assistance Fund must be full-time registered students on programmes leading to undergraduate or postgraduate awards. The Student Assistance Fund cannot be used to cover Tuition Fees, Capitation Fees or Student Loans but can provide funding for day-to-day participation in higher education to eligible applicants under the following cost headings: Rent, Essential Transport, Books/Class Materials, Utilities, Food, Medical Costs, Childcare costs Students wishing to apply for a contribution towards childcare costs associated with attending college must complete a Supplementary Childcare Form. The general contribution to eligible applicants will be 25% of childcare costs over 8 months plus the base rate which all eligible students will receive. Special consideration may however be given in the case of non-mature students (under 23 years of age) on an individual basis. 100% receipts for childcare must be provided in order to have the 25% released. Please note the following are INELIGIBLE for Childcare Support Students whose partner/spouse is not engaged in employment or full-time education Students whose children have places in Community Creches or who have Government Subvention places in Creches/Preschools Students whose children are with Non-Registered Childminders. Receipts must be provided under the relevant headings for all funding approved. Students are advised to retain relevant eligible receipts from the start of the academic year and to provide these either at the application stage or when notified that the application has been successful. Funding cannot be released to students until sufficient eligible receipts have been provided under the appropriate cost headings SAF application forms & information are available from the Student Services Office in Galway & Mayo campuses, or the CCAM/Letterfrack offices or can be downloaded from the Student Portal. Supplementary Forms include: Supplementary HEA statistic form to be completed online: https://www.surveymonkey.com/s/SAF-HEA-Statistics Supplementary Childcare Application Forms Supplementary Landlord Registration Form The closing date is 31st October, 2014. Late applications may be considered subject to the availability of funding. Payments will not be processed for eligible candidates until at least December 2014. The level of support any individual receives will be dependent upon the overall level of student assistance fund available in any year and the number of eligible applicants. Please note that the level of funding received for 2014-2015 is substantially lower than that received for 2013-2014 so this in turn will be reflected in the level of funding awarded to eligible applicants. Following a decision on an application for funding, should a student wish to have additional information considered by the committee, an additional information sheet can be submitted. A student has the right to appeal any decision made by the SAF committee in relation to his/her application for funding. A formal request for an appeal shall be made by a student using the appropriate application form available from the Student Services Office. Such a request must be made within two weeks of notification of the decision made by the SAF Committee with regard to an application for SAF Funding. A request for an appeal must clearly identify the grounds on which the appeal is being sought and contain all the information the student requires to be taken into account. Requests for appeal will be considered on the following grounds: An application for funding was not assessed according to the process outlined above The HEA Student Assistance Fund Guidelines were not followed Exceptional circumstances outlined in the application for funding were not adequately considered No member of the SAF Appeals Committee shall have been party to the original assessment of the student’s application for funding. A decision on a request for appeal will normally be made within four weeks of receipt of such request. The decisions of the SAF Appeals Committee will be final. Should a student by paid SAF funding in error, the student will be required to refund all of the payment. Students who abuse the fund, or intentionally falsify information, will be the subject of disciplinary proceedings as outlined in the GMIT Code of Student Conduct Eligible Receipts include: (must not predate 08/09/14 except in relation to rent for college) Rent: Receipts from a Landlord or copies of rent book where the Landlord registration section of the SAF form has been completed by the Landlord, receipts from a Student Village or a Letting Agent. Transport: Petrol/Diesel receipts, bus or train tickets related to attendance at college. Utilities: Household bills accompanied by proof of payment; phone credit; oil/coal receipts Medical: Doctors/Dentists/Specialist Bills, Medical Treatment Bills, Prescription Costs Groceries: Food, Toiletries, Household Cleaning Products Books/Materials: College Books, Materials for Projects or Class, Stationery, Binding/Photocopying Childcare: Receipts from Registered Childminders/Creches/After-School Providers Ineligible Receipts include: Laser/Debit/Credit Card receipts, Mortgage payments, Insurance, Car Repairs/Parts, NCT, Tax/Insurance, Parking Fees/Fines/Tolls/Clamping Fees, Household bills with no proof of payment, Medical Insurance, Vet Bills, Medical Bills for other family members, Non-essential equipment/materials/books; Receipts from Unregistered Childminders, Homework Clubs, Sports Activities, Clothes/Jewellery, Gym memberships etc.