To view this press release as a file

advertisement

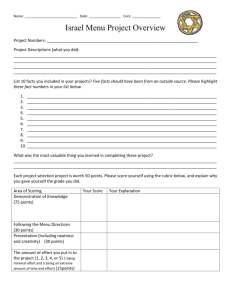

BANK OF ISRAEL Office of the Spokesperson and Economic Information December 15, 2014 Press Release New Research: The Effects of Legislated Tax Changes on Tax Revenues in Israel A change in tax rates changes tax revenues in the long term by about 70 percent of the amount forecast by simple multiplication of the rate of the change by the amount of the tax collected before the change; the offsetting effect derives from the effect on economic activity of the change in tax. Activity’s offsetting effect on tax revenues reaches its peak in the second year that the change is in effect, and declines afterward. This finding is important in formulating policy during periods of tax rate changes. The research’s findings disprove the claim that the economy (during the period studied) is on the “wrong side” of the Laffer curve and that a reduction in tax rates leads to an increase in tax revenues. Following an interim period of about two years, the share of tax revenues relative to the static forecast, resulting from changes in corporate income taxes, is about 90 percent, higher than the share of collection due to changes in personal income tax (65 percent) or in indirect taxes (53 percent). This is in contrast to the short term, when a change in corporate income tax has the smallest effect on revenue, apparently due to the effect of timing differences in tax collection, and due to tax planning that involves shifting activity and payments around the change. A reduction in personal income taxes, over time, has a negative impact on average real (gross) wages in the economy, so that employees’ net wages increase by about half the value of the tax reduction, while the other half reduces employers’ labor costs. The research did not find evidence that changes in tax rates had, in the long term, a marked impact on the scope of tax evasion. Bank of Israel - Research - The Effects of Legislated Tax Changes on Tax Revenues in Israel (December 2014) Page 1 Of4 Changes in tax rates1 have a significant impact on economic activity, which affects actual tax revenues as well following the change. New research by Dr. Adi Brender and Eran Politzer from the Bank of Israel’s Research Department finds that the effect on revenue of an increase in tax rates is not fully achieved, because of the negative effects of a tax increase on economic activity: the increase in tax collection in the long term, beginning from two years after the change, is about 70 percent of the amount predicted by simply multiplying the rate of the change by the amount of tax collected before the change (a static prediction).2 In the first two years after a tax increase, the additional tax revenue is lower, and reaches a trough in the second year after the change (similarly, the loss in revenue due to a tax rate reduction is lower than the forecast). These findings may assist the government in planning the budget, in that they help to assess the required size of tax changes, and to reduce tax revenue forecast errors that are liable to derive from the dynamics of the effect of tax changes on revenue. Despite the offsetting effects, the research found that in Israel, in the past two decades, tax reductions did in fact lead to declines in collection, and tax increases led to higher revenues. Therefore, the “magic” that supposedly occurs due to a tax reduction on the “wrong side” of the Laffer curve and leads to an increase in tax revenues following a reduction in tax rates, is not relevant in Israel. This conclusion is valid whether examining overall taxes or whether examining on an individual basis the types of taxes that were studied in the research. The research also found that when excluding the effect of changes in taxes on economic activity, the simple (static) prediction of the effect of the change in tax revenues is accurate, and in the long term there is no evidence of excess effects on revenue—evidence that may have signaled that changes in taxes affect the scope of tax evasion and the scope of tax avoidance. The research examined three types of taxes separately and found that in the first year of a tax change coming into effect, increases in the rate of personal income taxes or increases Changes in tax rates include changes in definitions that impact on the population’s tax obligation (such as cancelling or implementing a tax exemption for a specific population group or for specific products). 2 This finding (collection of about 70 percent) was also affected by the composition of tax changes during the period examined—the years 1991 to 2012—including the types of taxes that were changed. A separate examination was conducted for each of several types of taxes (corporate income tax, personal income tax, and indirect taxes), but it is emphasized that the taxes that were studied separately do not cover all the tax changes during the sample period (which included, for example, real estate and capital gains tax changes as well). 1 Bank of Israel - Research - The Effects of Legislated Tax Changes on Tax Revenues in Israel (December 2014) Page 2 Of4 in indirect taxes yield the highest revenue relative to the static forecast (about 75 percent). In contrast, an increase in corporate income taxes has almost no effect at all on revenue in the first year it is in effect. After two or more years from a tax change going into effect, the order between the different tax types reverses, and changes in corporate income taxes yield the greatest revenue (about 90 percent of the static prediction). (See Figure 1.) The research further finds that a reduction in income tax on individuals has a negative effect on real gross wages (and similarly, a tax increase has a positive effect). Thus, in effect, employees and employers divide the benefit inherent in a tax reduction—the net salary of employees increases by about half the amount intended for the tax reduction, and the remainder allows employers to reduce labor costs (gross salary payments). To conduct the research, a comprehensive database was built, containing data on tax changes by Israel’s government from 1991 through 2012—a period in which there were 218 unique changes in taxation, of which 111 were tax increases and 107 were tax reductions. In addition, the research made use (for the first time in such type of research) of Ministry of Finance tax revenue forecasts, in order to reflect the data that policy makers had at the time that the tax changes were legislated, and in order to deal with the difficulty in identifying the unique effect of tax changes on collection. The research finds that errors in revenue forecasts derived from unexpected fluctuations in the Israeli and global economies, from extraordinary transactions that yielded one-off tax revenues, and from mistaken assessments of the effect of tax changes in the current year and in the past on activity and receipts. Since no evidence was found of manipulative use of the revenue forecast in order to convince policy makers or the public of the need for a change in taxes, the use of forecasts for identifying the changes’ effect is valid. Bank of Israel - Research - The Effects of Legislated Tax Changes on Tax Revenues in Israel (December 2014) Page 3 Of4 Figure 1: Actual tax revenue following changes in tax rates, as percent of static forecast Bank of Israel - Research - The Effects of Legislated Tax Changes on Tax Revenues in Israel (December 2014) Page 4 Of4