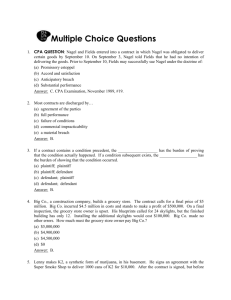

Contract Law: Representations, Warranties & Misrepresentation

advertisement