12-04-02HartleysQuickNote

advertisement

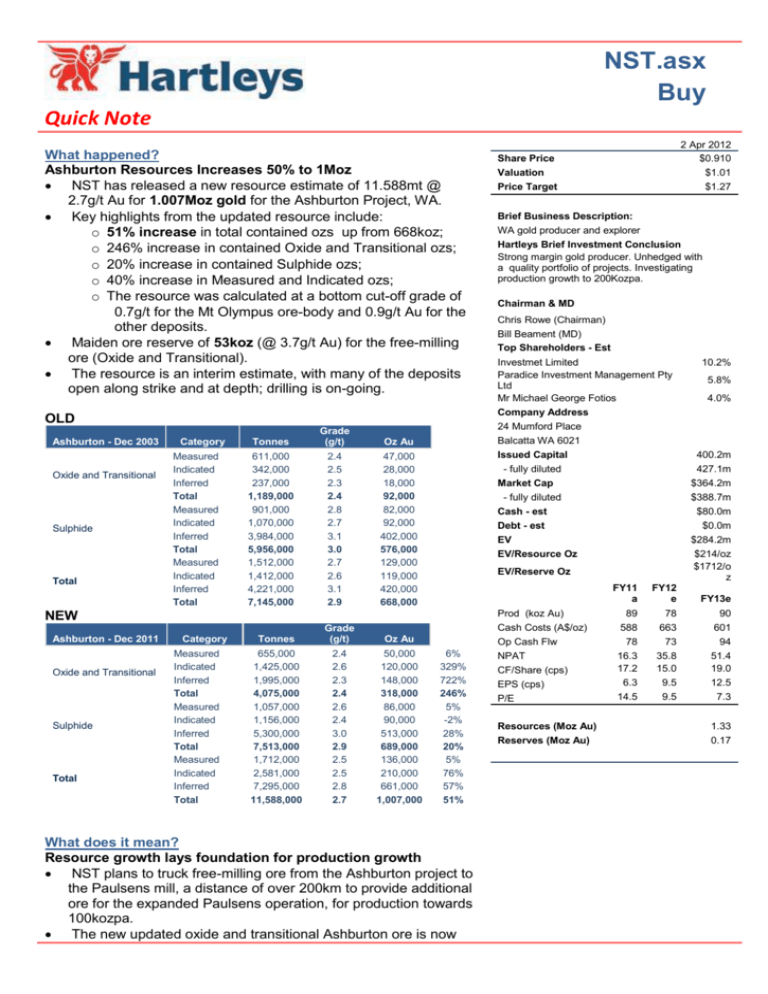

NST.asx Buy Quick Note – Hartleys Research What happened? Ashburton Resources Increases 50% to 1Moz NST has released a new resource estimate of 11.588mt @ 2.7g/t Au for 1.007Moz gold for the Ashburton Project, WA. Key highlights from the updated resource include: o 51% increase in total contained ozs up from 668koz; o 246% increase in contained Oxide and Transitional ozs; o 20% increase in contained Sulphide ozs; o 40% increase in Measured and Indicated ozs; o The resource was calculated at a bottom cut-off grade of 0.7g/t for the Mt Olympus ore-body and 0.9g/t Au for the other deposits. Maiden ore reserve of 53koz (@ 3.7g/t Au) for the free-milling ore (Oxide and Transitional). The resource is an interim estimate, with many of the deposits open along strike and at depth; drilling is on-going. OLD Ashburton - Dec 2003 Oxide and Transitional Sulphide Total Category Measured Indicated Inferred Total Measured Indicated Inferred Total Measured Indicated Inferred Total Tonnes Grade (g/t) Oz Au 611,000 342,000 237,000 1,189,000 901,000 1,070,000 3,984,000 5,956,000 1,512,000 1,412,000 4,221,000 7,145,000 2.4 2.5 2.3 2.4 2.8 2.7 3.1 3.0 2.7 2.6 3.1 2.9 47,000 28,000 18,000 92,000 82,000 92,000 402,000 576,000 129,000 119,000 420,000 668,000 Ashburton - Dec 2011 Oxide and Transitional Sulphide Total Category Measured Indicated Inferred Total Measured Indicated Inferred Total Measured Indicated Inferred Total Tonnes Oz Au 655,000 1,425,000 1,995,000 4,075,000 1,057,000 1,156,000 5,300,000 7,513,000 1,712,000 2,581,000 7,295,000 11,588,000 2.4 2.6 2.3 2.4 2.6 2.4 3.0 2.9 2.5 2.5 2.8 2.7 50,000 120,000 148,000 318,000 86,000 90,000 513,000 689,000 136,000 210,000 661,000 1,007,000 Brief Business Description: WA gold producer and explorer Hartleys Brief Investment Conclusion Strong margin gold producer. Unhedged with a quality portfolio of projects. Investigating production growth to 200Kozpa. Chairman & MD Chris Rowe (Chairman) Bill Beament (MD) Top Shareholders - Est Investmet Limited Paradice Investment Management Pty Ltd Mr Michael George Fotios Company Address 24 Mumford Place Balcatta WA 6021 Issued Capital - fully diluted Cash - est Debt - est EV EV/Resource Oz EV/Reserve Oz 6% 329% 722% 246% 5% -2% 28% 20% 5% 76% 57% 51% What does it mean? Resource growth lays foundation for production growth NST plans to truck free-milling ore from the Ashburton project to the Paulsens mill, a distance of over 200km to provide additional ore for the expanded Paulsens operation, for production towards 100kozpa. The new updated oxide and transitional Ashburton ore is now Prod (koz Au) Cash Costs (A$/oz) Op Cash Flw NPAT CF/Share (cps) EPS (cps) P/E Resources (Moz Au) Reserves (Moz Au) 10.2% 5.8% 4.0% 400.2m 427.1m $364.2m $388.7m $80.0m $0.0m $284.2m $214/oz $1712/o z - fully diluted Market Cap NEW Grade (g/t) 2 Apr 2012 $0.910 $1.01 $1.27 Share Price Valuation Price Target FY11 a FY12 e FY13e 89 588 78 16.3 17.2 6.3 14.5 78 663 73 35.8 15.0 9.5 9.5 90 601 94 51.4 19.0 12.5 7.3 1.33 0.17 318koz up from 92koz, with over 53% in the Measured and Indicated resource categories, which bodes well for increased reserves prior to mining. The Ashburton project has considerable exploration upside with many deposits open along strike and at depth, with numerous walk-up drill targets. The Sulphide ore at Ashburton is refractory and will require the development of a standalone onsite processing facility, which NST believes could provide another 100kozpa (lifting Group production to 200kozpa). With overall gold recoveries of 80% expected from the sulphide ore, NST has accelerated resource drilling and further met-testwork; development can be internally funded. Ongoing drilling is currently focused on infill and extensional resource activities at Waugh, Zeus and Mt Olympus; assays are pending. NST will have to pay a 1.75% royalty on future production in excess of 250koz. Hartleys Initial View The growing resource inventory is good news for NST, especially as the update has provided a significant increase in free-milling (oxide and transitional) ores, which can be processed through the Paulsens milling infrastructure. We expect future resource and reserve growth to come. With solid production at Paulsens (+80Koz in CY2012) at attractive cash costs, accelerated on-going exploration, cash of A$80m, we continue to rate Northern Star Resources as a Buy, with a valuation of $1.01 and 12-month price target of $1.27. Hartleys Limited ABN 33 104 195 057, its Directors and their Associates declare that they from time to time hold interests in/and earn brokerage, fees, commissions or other benefits mentioned in documents to clients. Any financial product advice contained in this document is unsolicited general information only. Do not act on advice without first consulting your Investment Adviser to determine whether the advice is appropriate for your investment objectives, financial situation and particular needs. Hartleys Limited believes that any information or advice (including any financial product advice) contained in this document is accurate when issued. Hartleys Limited however, does not warrant its accuracy or reliability. Hartleys Limited, its officers, agents and employees exclude all liability whatsoever, in negligence or otherwise, for any loss or damage relating to this document to the full extent permitted by law. Hartleys Limited may collect information from you in order to provide any services you have requested. A copy of Hartleys Limited's privacy policy is available on www.hartleys.com.au Disclaimer/Disclosure The author of this publication, Hartleys Limited ABN 33 104 195 057 (“Hartleys”), its Directors and their Associates from time to time may hold shares in the security/securities mentioned in this Research document and therefore may benefit from any increase in the price of those securities. Hartleys and its Advisers may earn brokerage, fees, commissions, other benefits or advantages as a result of a transaction arising from any advice mentioned in publications to clients. Any financial product advice contained in this document is unsolicited general information only. Do not act on this advice without first consulting your investment adviser to determine whether the advice is appropriate for your investment objectives, financial situation and particular needs. Hartleys believes that any information or advice (including any financial product advice) contained in this document is accurate when issued. Hartleys however, does not warrant its accuracy or reliability. Hartleys, its officers, agents and employees exclude all liability whatsoever, in negligence or otherwise, for any loss or damage relating to this document to the full extent permitted by law.