MIT Community Energy Innovation Cambridge TOR Feb 6 2013

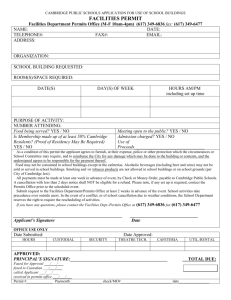

advertisement