Chapter 19 Solutions

advertisement

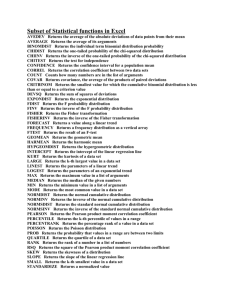

Chapter 19 Solutions 1. A call option in Black-Scholes formula needs following five variables: (1) Current price of the firm’s common stock (S); (2) Exercise price (or strike price) of the option (X); (3) Term to maturity in years (T); (4) Variance of the stock’s price ( 2 ); and (5) Risk-free rate of interest (r). and the accumulative normal distribution functions are also used in Black-Scholes call option as follows: C SN (d1 ) XR T N (d 2 ) , Where C = Price of the call option, d1 S ) Xr t 1 t , d d t , N(d) 2 1 2 t log( is the value of the cumulative standard normal distribution. On the other hand, the binomial option pricing model can be written as C S[ nT k !(nT k )! p ' (1 p ') nT ! k nT k ] k m nT X nT ! [ p k (1 p) nT k ] r (1 )Tn k m k !(nT k )! n X SB(nT , p ', m) B(nT , p, m) r Tn (1 ) n and C=0 if m>T, where n is the number of periods per year of term to maturity (T), m = minimum number of upward movements in stock price that is necessary for the option to terminate “in the money,” p Rd uR and 1 p , X = option exercise price (or strike price), R = 1 + r = 1 + riskud ud free rate of return, u = 1 + percentage of price increase, d = 1 + percentage of price decrease, nT u p ' p , and B(nT , p, m) nT Ck p k (1 p) n k . R k m By a form of the central limit theorem, when n , the cumulative binomial density function can be approximated by the cumulative normal density function as B1 (nT , p, m) N Z1 , Z1 B2 (nT , p, m) N Z 2 , Z 2 where Z1 m nTp , nTp(1 p) Z1 nT nTp nTp(1 p) Z2 m nTp , nTp(1 p) Z 2 nT nTp nTp(1 p) It can be shown that lim n Then Equation can be rewritten as 1 e rT r nT (1 ) n and lim Z1 lim Z 2 n n C SN ( Z1 ) Xe rT N ( Z 2 ) Use the definition of m and property of lognormal distribution, it can be shown that Z1=d1 and Z2=d2 C SN (Z1 ) Xe rT N (Z 2 ) SN (d1 ) XR T N (d 2 ) 2. The stock price follows a log-normal distribution under Black-Scholes model framework. That is, Sj S j 1 exp[ K j ] is a random variable with a log-normal distribution, where S j is the stock price in jth period, K j is the rate of return in jth period and is a random variable with normal distribution. Let Kt have the expected value k and variance k2 for each j. Then K1 K 2 ... K t is a normal random variable with expected value t k and variance t k2 . Thus, we can define the expected value (mean) of E( St exp[ K1 K 2 ... K t ] as S St t 2 ) exp[ t k k ] . S 2 (19.52) Under the assumption of a risk-neutral investor, the expected return E ( St ) is assumed to be S exp( rt ) (where r is the riskless rate of interest). Therefore, the relationship between the expected stock return and risk-free rate under the risk-neutral assumption is k r k2 2 . 3. The stock price follows a log-normal distribution under Black-Scholes model framework. 4. a. P(X > 1.65) = 0.0495 b. P(X < -2.38) = 0.0087 c. P(X > -1.37) = 0.9147 d. P(1.72>X > -2.43) = 0.9498 5. As the assumption in question 4, find z a. P(X < z) = 0.99 , by the inverse function of standard normal cumulative distribution, z= 2.33 b. P(X > z) = 0.05, P(X < z)=1- P(X > z)=1-0.05=0.95 by the inverse function of standard normal cumulative distribution, z= 1.64 c. P (z <X<0)=0.0130, P (z <X<0)=P (X<0)- P (X<z)=0.5- P (X<z) =0.0130 P (X<z)=0.5-0.013=0.487, by the inverse function of standard normal cumulative distribution, z= -0.0326 d. P (-z <X<z)=0.5408, P (-z <X<z)=1- P(X > z)- P(X < -z)=1-2 P(X < -z), Therefore, P(X < -z)= [1- P (-z <X<z)]/2= (1-0.5408)/2=0.2296 by the inverse function of standard normal cumulative distribution, -z = -0.74016, z=0.74016. 6. Y ~N(5, 2) , then standard normal z=(Y-5)/2 a. P(5<Y<9)= P((5-5)/2 < (Y-5)/2 < (9-5)/2 )= P(0<Z<2) =0.4772 b. P(-1<Y<3)= P((-1-5)/2 < (Y-5)/2 < (3-5)/2 )= P(-3<Z<-1)=0.15 c. P(Y>6)=P( (Y-5)/2 > (6-5)/2 )=P(Z>0.5)=0.3085 d. P(Y <10) = P( (Y-5)/2 < (10-5)/2) =P(Z<2.5) =0.9938 7. Let x= the amount withdrawn, xp= the amount of cash prepared P(x> xp)=0.001 Therefore, the standard normal value (xp-5) /1=3.08 by using the inverse function of standard normal cumulative distribution. xp=$8.08 (millions). 8. 𝑋−20.05 a. 𝑃(𝑋 > 20) = 𝑃 ( 0.05 > 20−20.05 0.05 ) = 𝑃(𝑍 > −1) = 1 − 𝑃(𝑍 < −1) = 1 − 0.1587 = 0.8413 b. 𝑃(𝑋 < 20) = 1 − 𝑃(𝑋 > 20) = 0.1587 If we define y as the number of bottles that contain less than 20 ounces of milk, then y can be approximated by a normal distribution. Y~N( np, np(1-p))=N(400(0.1587), 400 (0.1587) (1-0.1587))=N(63.48, 7.3082) 𝑃(𝑌 < 12) = 𝑃 ( 𝑌 − 63.48 12 − 63.48 < ) = 𝑃(𝑍 < −7.044) = 0% 7.308 7.308 9. By Equation (19.61), call option value is as follows 𝐶 = 𝑆𝑁(𝑑1) − 𝑋𝑒 −𝑟𝑡 𝑁(𝑑2), 𝑑1 = 𝑑1 = ln( 105 1 )+(0.05+ (0.45)2 )0.8 110 2 √0.8(0.45) 𝑆 1 ln (𝑋) + (𝑟 + 2 𝜎 2 ) 𝑡 √𝑡𝜎 , 𝑑2 = 𝑑1 − √𝑡𝜎 = 0.1850, 𝑑2 = 0.1850 − √0.8(0.45) = −0.2175 𝐶 = 105𝑁(0.1850) − 110𝑒 −0.05(0.8) 𝑁(−0.2175) = 16.46 10. When X=90, use Equation (19.61), call option value is as follows 𝐶 = 𝑆𝑁(𝑑1) − 𝑋𝑒 𝑑1 = ln( −𝑟𝑡 105 1 )+(0.05+ (0.45)2 )0.8 90 2 √0.8(0.45) 𝑁(𝑑2), 𝑑1 = 𝑆 1 ln (𝑋) + (𝑟 + 2 𝜎 2 ) 𝑡 √𝑡𝜎 , 𝑑2 = 𝑑1 − √𝑡𝜎 = 0.6836, 𝑑2 = 0.1850 − √0.8(0.45) = 0.2811 𝐶 = 105𝑁(0.6836) − 90𝑒 −0.05(0.8) 𝑁(0.2811) = 26.25