E307 9 New Perspecti..

advertisement

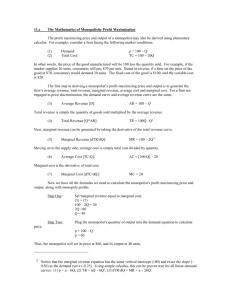

HISTORY OF ECONOMIC THOUGHT LECTURE 9 New Perspectives in Marginalism The marginalist revolution began with the one-sided emphasis on the role of diminishing marginal utility, that is, consumer preferences, in determining prices. With Marshal’s introduction of the Marshalian Cross to the picture, there was a renewed emphasis on the supply side. This required a clear formulation of the theory of behavior of the firm. The initial theory of the firm was built on the assumption of perfect competition among the producers, which required the existence of large number of firms who can exercise no market power in both product and factor markets. This implies that each individual firm must take the price of the product it produces as dictated by the market, and pay the prevailing price for the factor inputs it uses in the production process. 1. The Production Function The theory of the firm starts with the so called production function, which relates the firm’s level of output to the amount of variable inputs it employs. In mathematical symbols, this relationship is expressed as 𝑄 = 𝑓(𝐿, 𝐾), where 𝑄 is the firm’s output, 𝐿 the amount of variable input, mainly labor, and 𝐾 the physical capital employed by the firm. In the short-run, a term introduced by Marshal, the firm must operate with a given fixed physical capital, the plant and machinery. To increase output the firm is thus compelled to use more variable input with the fixed input. The interaction between the various levels of variable inputs with the fixed input in the production process gives rise to specific shape of the production function shown in Figure 1-a, where the amount of variable input is shown on the horizontal axis and the level of output on the vertical axis. E304 Lecture 9 Page 1 of 18 Figure 1 (a) 𝑄 = 𝑓(𝐿) Short-Run Production Function The short-run production function 𝑄 = 𝑓(𝐿) shows that for a given level of fixed input (𝐾) output rises, at first, at an increasing rate, where each additional worker (𝐿) adds more to total output than the previous worker. But after the fifth worker output begins to rise at a decreasing rate, where each addition worker adds less to total output than the previous worker. This is the diminishing returns. (b) Marginal Product and Diminishing Returns When in panel (a) output rises at an increasing rate marginal product is increasing. After the fifth worker, when output rises at a decreasing rate, marginal product begins to decrease. 1.1. Marginal Product and Diminishing Returns The behavior, the shape, of the production function is described as follows. At first, as extra units of labor are added, total output Q rises at an increasing rate, which means that marginal product of each additional unit of labor rises. This is due to better specialization and division of labor. But after a certain point—in the above diagram, after the fifth unit of labor—marginal product of the additional worker begins to decrease. Output rises at a decreasing rate. This is known as the diminishing returns to input. Figure 1-b shows the behavior of the marginal product of labor. E304 Lecture 9 Page 2 of 18 Note that the firm does not stop hiring more workers when marginal product begins to decline. As long as using an extra worker adds to the total output the firm will hire that worker, even if his marginal product is decreasing. The addition to the work force will stop when marginal product becomes negative. In Figure 1, adding the eleventh worker would cause the firm’s output to decrease. In Figure 2 adding the eleventh worker would make marginal product negative. The firm would never enter that territory! 2. From Production Function to Cost Function The competitive firm is a price taker in the factor market. Therefore each worker hired is paid the going market wage rate. If the going wage rate is, say, $100 per production period, and the firm hires five workers, to produce the output determined by the production function (in Figure 1, for example, when 𝐿 = 5, 𝑄 = 250), then total (variable) cost of that output level is $100 × L. Therefore, the firm’s cost, in the short run, is a function of its level of output. And since the firm’s output is affected by the diminishing returns to labor, then the behavior of the cost is also determined by the diminishing returns. When output rises at an increasing rate, costs will rise at a decreasing rate. Note that when output rises at an increasing rate, then each additional unit “embodies” less input, that is, it costs fewer resources to produce. In Figure 3 total cost is rising at a decreasing rate until the output level of about 250 is reached, when the fifth worker is added. Thus, when output is rising at an increasing rate, marginal cost is decreasing. When output rises at a decreasing rate, cost will rise an increasing rate. Now each additional output embodies more resources, and hence it costs more to produce: when marginal product is falling, marginal cost is rising. Panels (c) and (d) show the relationship between marginal product and marginal cost curves. Marginal cost reaches a minimum at Q = 250, which corresponds to the maximum point on the marginal product curve. Marginal cost rises after 𝑄 = 250. E304 Lecture 9 Page 3 of 18 Figure 3 From Production Function to Cost Function (a) (b) 𝑄 = 𝑓(𝐿) 𝐶 = 𝑓(𝑄) (c) (d) Marginal Product Marginal Cost The data for output 𝑄, as the dependent variable from the vertical axis in (a), is used as the data for the independent variable 𝑄 on the horizontal axis in (b). In (a) when output is rising at an increasing rate until the output level of 𝑄 = 250 is reached, total cost in (b) is rising at a decreasing rate. When marginal product is rising in (c), marginal cost is falling in (d). And when marginal product begins to fall after the fifth worker in (c), marginal cost begins to rise after 𝑄 = 250 in (d). E304 Lecture 9 Page 4 of 18 2.1. Marginal Cost and Average Cost Figure 4 includes the average cost curve (𝐴𝐶) with the marginal cost curve. This curve is included in the picture because the firm’s profit (or loss) is determined by its average cost schedule, as will be shown below. Figure 4 Marginal Cost and Average Cost When 𝑀𝐶 is below 𝐴𝐶, marginal cost pulls the average cost down. When 𝑀𝐶 exceeds 𝐴𝐶, marginal cost pulls the average cost up. What determines the shape of AC? The answer lies in the mathematical relationship between any average and marginal quantities. Here is a simple example: Suppose you are taking a class which has five tests as the course requirement. Your average score for the first three tests is 80 from the scale of 100. If your score on the fourth (the marginal) test is less than the average 80, then your average will decline further. On the other hand, you would raise your average if the score on the fourth test is more than 80. Thus, as long as the marginal quantity is less than the average, the average will fall. This is regardless of whether the marginal quantity is rising or falling. In Figure 4 𝑀𝐶 crosses 𝐴𝐶 at 𝑄 = 375. Before that output 𝑀𝐶 < 𝐴𝐶, and after that, 𝑀𝐶 > 𝐴𝐶. Thus, when 𝑀𝐶 is below 𝐴𝐶, it will pull 𝐴𝐶 down, and when it is above 𝐴𝐶, it will pull 𝐴𝐶 up with it. 3. Profit Maximization by Perfectly Competitive Firm 3.1. Price and Marginal Revenue The hallmark of the marginal analysis of any economic activity is that the optimal level of that activity, where the net benefit is maximized, occurs when marginal cost is equal to marginal benefit. When this criterion of optimality is applied to the actions of the firm, the optimal, the profit maximizing, level of output is where marginal cost is equal to marginal revenue. For a perfectly competitive firm marginal revenue, the revenue earned from producing and selling the marginal unit, is always equal to the prevailing market price. This is so because the perfectly competitive firm, who operates among large number of similarly situated producers, is a price-taker. The firm can sell any quantity it produces at the going market price. Expanding its output will have no, or an imperceptible, impact on the market price. The individual firm therefore faces an infinitely E304 Lecture 9 Page 5 of 18 elastic demand, a horizontal demand curve, for its product.1 Marginal revenue thus coincides with the price. For example if the market price is 𝑃 = $10 and the firm is selling 𝑄1 = 200 units, then its total revenue is 𝑇𝑅1 = $10 × 200 = $2,000. If the firm increases its output to 𝑄2 = 210 units, then the new total revenue is 𝑇𝑅2 = $10 × $210 = $2,100. The firm’s marginal revenue is then calculated as, 𝑀𝑅 = ∆𝑇𝑅 $2.100 − $2,000 = = $10 = 𝑃 ∆𝑄 210 − 200 3.2. Profit Maximization Criterion: 𝑴𝑪 = 𝑷 Thus, a the perfectly competitive firm would maximize profit by expanding its output to the point where marginal cost is equal to price. In Figure 5-a, the competitive firm is facing the price shown by the horizontal line 𝑃 = 𝑀𝑅. The optimum output is determined where this line intersects 𝑀𝐶 at point 𝑀. Since the price equals 𝑀𝐶 at a point which is higher than the per unit, or average, cost (point 𝐴 on the 𝐴𝐶 curve), then the firm is earning a profit. The firm’s total profit is shown as the area of the rectangle 𝑃𝑀𝐴𝐶. 3.3. Profit and Quasi Rent This profit in economic theory is considered an excess or above-normal profit because the representative firm in this industry is earning more than what the representative firms in alternative markets is earning. Marshal called this profit as quasi rent. It is a rent because it is determined by the high price of the product. Recall that in Ricardo’s model the rent earned by the landowner is determined by the high price of corn. It is quasi because the excess profit is not permanent. The excess profit will attract other firms to this industry, increasing the supply of the product and pushing the price down until it is equal to minimum average cost, shown as point 𝐴 in Figure 5-b. When the price equals average cost, then the industry or market is in its longrun equilibrium state. According to the classical economics competitive market criterion, the price is now at its natural level. The rent is eliminated and the firm is earning a normal profit. Normal profit is thus considered a cost of production which must be paid to attract and hold resources, including capital, in the firm. Price, then, in the long run is determined by the cost of production, as Smith, Ricardo, and Mills had maintained. The market demand curve, the demand for the product of all producers in this market is downward sloping. But the demand faced by each individual firm is perfectly elastic because that firm has a negligible market share and its product has perfect substitutes offered by numerous other firms. 1 E304 Lecture 9 Page 6 of 18 Figure 5 (a) (b) Competitive Firm’s Profit Maximization Long-Run Competitive Equilibrium (Natural Price) MC MC AC AC M P P = MR M C A P Q P = MR Q When the price line intersects the 𝑀𝐶 curve at a point above the minimum 𝐴𝐶 the firm is earning an above-normal profit (or economic profit). This is shown in Panel (a). The economic profit will attract other firms, expanding the industry supply and pushing the price down to the average cost or natural price level, as shown in (b). The firm will earn a normal profit in the long-run. 3.4. Economic Efficiency Under Perfect Competition Since a perfectly competitive firm produces the optimum output where price is equal to marginal cost, the competitive outcome is said to be economically efficient. The combined effort of all firms in a competitive market leads to the output level that is economically optimal. It is optimal for all participants in the market. At the competitive market equilibrium, the equilibrium quantity is reached where the price of the economic good is equal to its marginal cost. The price that consumers are willing to pay for the final unit of the good, the demand price, is equal to the value of economic resources that are used up to produce that final unit. In the Pigovian marginal cost marginal/marginal benefit framework, ignoring the external benefits and costs, socially optimal amount of that good is produced. And in the Marshalian Cross context, total surplus is maximized. E304 Lecture 9 Page 7 of 18 4. Monopoly 4.1. The Monopoly Marginal Revenue Curve Monopoly describes a single seller which dominates the entire market. As such, it faces the entire downward sloping market demand curve. Since the monopoly dominates the market, then it has the market power to set its own price. The profit maximization criterion is, however, the same for the monopoly as for any other type of firm. Profit is maximized when marginal cost is equal to marginal revenue. But, the condition imposed by the law of demand, the inverse relationship between price and quantity demanded, affects the monopoly’s decision in choosing a price that will maximize its profit. To increase its sales, the firm must lower its price. But when price is lowered, marginal revenue declines faster than price because the firm must sell all units, not just the additional unit, at the lower price. The relationship between demand price and marginal revenue is shown the in table below and in Figure 6. Figure 6 Monopoly Demand and Marginal Revenue P MR 80 70 60 40 𝑄 𝑃 = 100 − 10𝑄 0 1 2 3 4 5 100 90 80 70 60 50 𝑇𝑅 = 100𝑄 − 10𝑄2 𝑀𝑅 = 100 − 20𝑄 0 90 160 210 240 250 100 80 60 40 20 0 𝑃 = 100 − 10𝑄 is the demand equation. MR 2 3 D Q 𝑇𝑅 = 𝑃 × 𝑄 = 100𝑄 − 10𝑄 2 is total revenue. 𝑀𝑅 = To increase 𝑄 from to 2 to 3, while price is reduced from $80 to $70, marginal revenue decreases from $60 to $40 4.2. 𝑑𝑇𝑅 𝑑𝑄 = 100 − 20𝑄 is marginal revenue. Note that the slope of the marginal revenue curve, -20, is twice as much as the slope of the demand curve, -10. The Monopoly Profit Maximization Criterion In Figure 7 the demand and marginal revenue curves are superimposed on the monopoly cost curves to determine the optimum level of output and the monopoly profit. The monopoly, following the rational 𝑀𝑅 = 𝑀𝐶 profit maximization criterion, will produce the output level at which 𝑀𝐶 intersects 𝑀𝑅 (point 𝑀) and produce 𝑄𝑀 . Now, given the market demand curve 𝐷, the price at which 𝑄𝑀 is sold is shown by the point 𝑃′ on the demand curve, which is above the marginal cost. The monopoly profit is shown by area of the rectangle 𝑃𝑃′𝐶𝐴. Since there are no competitors, this profit is permanent, as long as the demand for the good remains intact. The monopoly profit is thus considered as rent because, like Ricardo’s owner of inframarginal land, the monopoly pockets the difference between the price and the cost of producing the marginal unit. It is the higher price charged by the monopoly that determines the monopoly profit. Therefore, by definition, monopoly profit is rent. E304 Lecture 9 Page 8 of 18 Figure 7 Monopoly Profit Maximization MC AC P P' The monopoly firm maximizes its profit where 𝑀𝑅 = 𝑀𝐶 (at point 𝑀) by producing 𝑄𝑀 and charging price 𝑃, point 𝑃′ on the demand curve. Its profit per unit is 𝑃𝐶 = 𝑃′𝐴, and total profit is 𝑃𝑃′𝐴𝐶. The monopoly profit is also considered a rent because it’s an excess earning above the cost of production. This earning is permanent as long demand does not change. A C CM M MR D O QM 4.3. Welfare Impact of Monopoly Smith provided a very clear statement of the welfare impact of monopoly in the Wealth of Nations: The price of monopoly is upon every occasion the highest that can be got. The natural price, or the price of free competition, on the contrary, is the lowest which can be taken, not upon every occasion, indeed, but for any considerable time together. The one is upon every occasion the highest which can be squeezed out of the buyers, or which, it is supposed, they will consent to give. The other is the lowest which the sellers can commonly afford to take, and at the same time continue their business. Smith’s statement, translated into the modern economic terms, is shown in Figure 8. In Panel (a), the curve labeled 𝑇𝐵𝐶 represents total benefit in a competitive market, where all producers are price takers. The price they receive for their products to cover the cost of production also reflects the price the consumers are willing to pay for the benefit or utility they enjoy from consuming that product. At the equilibrium, the price paid for the benefit of the final unit is exactly equal to the cost of producing that final unit. Total net benefit of the competitive market, the gap shown in panel (a) between 𝑇𝐵𝐶 and 𝑇𝐶 at 𝑄𝐶∗ (the competitive output) is equal to the Marshalian total surplus (sum of consumer and producer surplus). In Panel (b) the competitive market output is shown as the output at the intersection of 𝑀𝐶 and 𝑀𝐵𝐶 (marginal benefit-competition). Because a monopoly determines the price it charges the consumer, the crucial issue is how much extra (marginal) revenue additional sales, motivated by lowering the price, will generate. But lowering the price also causes marginal revenue not only to fall, but fall twice as fast as the price. Thus, under monopoly expansion of output is severely restrained by the rapidly falling marginal revenue. For consumers the price of E304 Lecture 9 Page 9 of 18 the commodity is always the guide to measure the benefit or utility of consuming a product. But for a monopoly it is the marginal revenue that guides it to action. Thus, unlike a competitive market, where consumers and producers welfare converge via price, under monopoly the welfare of the consumers and the monopoly diverge. Monopoly restricts output and charges a higher price, a price which covers more than just the cost of production (Figure 8-b). Figure 8 Economic Welfare under Monopoly A Comparison to Welfare under Competition (a) 𝑇𝐵𝐶 is total benefit under competition, it covers the benefit for all the participant in the competitive market: the benefits of the price received by producers, and benefits or utility of consuming the product reflected in the price paid by the consumers. At the optimum output 𝑄𝐶∗ the total benefit exceeds total cost by the highest amount. At that output the tangents to 𝑇𝐵𝐶 and 𝑇𝐶 are parallel, which means marginal cost is equal to marginal benefit. TC TBC TBM 𝑇𝐵𝑀 represents total benefit under monopoly, which covers the benefit from monopolist’s perspective. ∗ The monopoly optimum output 𝑄𝑀 maximizes the monopolist’s benefit. The monopoly optimum output is far less than the competitive output (b) At output marginal cost is equal to marginal benefit, which also implies the price paid by consumers and received by producers just covers the cost of production. 𝑄𝐶∗ MC ∗ At output 𝑄𝑀 the price consumers are willing to pay exceeds the (marginal) cost of production. The monopoly thus under-allocates resources; it does not produce enough to satisfy the consumer demand. The shaded area represents the loss of welfare under monopoly, known as the “deadweight loss”. E304 Lecture 9 MBM MBC Page 10 of 18 5. Imperfect or Monopolistic Competition The economic model of the perfectly competitive firm and monopoly addressed the two extremes of market structures or industrial organizations. However, economists clearly recognized the fact that most market structures conformed to neither of these two extremes. The requirements for a perfectly competitive market model are so restrictive that only some limited number of markets come even close to satisfying all the requirements: one requirement being the nature of the goods produced, that they all be undifferentiated or identical. An example being corn. Two economists, one on each side of the pond, both in two cities with identical names, Cambridge, and in the same year, 1933, published almost identical theories of the behavior of firms that had elements of both competitive markets and monopoly. One (Edward Chamberlin, Harvard University) called it monopolistic competition, the other (Joan Robinson, Cambridge University) imperfect competition. The basic components of monopolistic/imperfect competition model are: there are large number of firms (a characteristic of perfectly competitive market) producing similar, but not identical products, products that can be differentiated according to the producer or brand name, but have close substitutes. The fact that the products are differentiated allows the producer a certain degree of market power, the ability to charge its own price. The market power is a characteristic of the monopoly. But here the market power is limited because each firm’s product, although differentiated, has a close substitute. The main factor that distinguishes the three models of the behavior of the firm is elasticity of demand for each firm’s product. A perfectly competitive firm faces an infinitely elastic demand (a horizontal demand curve) for its product because that firm’s product (say, corn) has a perfect substitute produced by any of the numerous firms that populate the market for this product. If the firm raises its price slightly, its sales will fall to zero, because buyers can buy what they need from hundreds of other firms. The demand for a monopoly’s product is highly inelastic because the good has no close substitute. This allows the monopoly a great latitude in charging as high a price that the market would bear. The demand for an imperfectly competitive firm is not infinitely elastic, but it is highly elastic because the product has close substitutes. The firm has some, but limited, latitude to set the price for its product. 5.1. The Model of an Imperfectly Competitive Firm Figure 9 shows the model for an imperfectly competitive firm. The demand for the monopolistically competitive firm slopes downward but is very elastic because the product has close substitutes. However, when demand slopes downward, the marginal revenue curve, as shown above, lies below the demand curve and is twice as steep. The profit maximizing criterion is still 𝑀𝑅 = 𝑀𝐶. Using this criterion, the profit maximizing output is determined, like a monopoly, at the intersection of the 𝑀𝐶 and 𝑀𝑅 curves, as shown in Figure 9-a. The price for the optimum output is shown as point 𝑃′ on the demand curve. As long as the price is above the average cost, that is, as long as the demand curve intersects the 𝐴𝐶 curve, the firm makes an economic (excess) profit. In Figure 9-a the firm’s total economic profit is the area of the rectangle 𝑃𝑃′𝐴𝐶. So far the situation of the imperfectly competitive firm is nearly the same as that of a monopoly, the only difference being the greater demand elasticity for the imperfectly competitive firm. The more significant difference between monopolistically competitive industry and a monopoly is the lower barriers to entry of other firms to the former. If there is economic profit, other firms will enter the industry. With each entry the market share of each of the existing firms will decrease, lowering the individual demand curves. The new entry, and the attendant decrease in the market share and demand for each firm, will continue until economic profit disappears, where price is equal to the average cost. In Figure 9-b this situation is depicted as the demand curve being tangent to the average cost curve. The theoretical absence of E304 Lecture 9 Page 11 of 18 economic profit in the long run is a feature that a monopolistically competitive and a perfectly competitive firm have in common. However, even though economic profit tends toward zero, the imperfectly competitive market suffers from the inefficiency arising from the divergence of price from marginal cost. The demand price, a reflection of marginal benefit to consumers exceed marginal cost, which indicates under-allocation of resources. Furthermore, the imperfectly competitive price also exceeds the minimum average cost, the natural price which is achieved under a perfectly competitive industry. Figure 9 Monopolistic/Imperfect Competition (a) (b) MC MC AC AC P' P A C A P M MR M D MR Q D Q The optimum output in both panels is obtained at the point of intersection of 𝑀𝐶 and 𝑀𝑅 (point 𝑀). In Panel (a) the profit maximizing quantity is sold at the 𝑃, or the point 𝑃′ on the demand curve. The firm’s economic profit is 𝑃𝑃′𝐴𝐶. Panel (b) shows the impact of the entry of new firms and resulting reduction in this firm’ market share. The demand has decreased and now it is tangent to 𝐴𝐶 at point 𝐴. Economic profit is zero. But, even with zero economic profit, price, point 𝑃′ on the demand curve, still exceeds 𝑀𝐶 (point 𝑀) and is also is above the minimum average cost. 6. Marginal Productivity and Wage Determination The application of marginalism to explanation of economic phenomena first began with the application marginal utility to explain the value or price of final goods, then, with Marshal, was extended to production and supply. All rational economic decision making process, according the marginalist theory, takes place at the margin. The marginalist decision-making process thus can also be applied to the firm’s employment of all factors of production, including labor. The logic is simple. A perfectly competitive firm maximizes profit by determining the optimum quantity of output for a given market-dictated product price. To produce this optimum output, in the short-run, the firm must determine how many workers it must hire. To increase output, the firm must hire additional workers. But, in the short-run, according to law of diminishing returns, each additional worker contributes diminishing amount to the total product. Thus, in deciding whether to hire an additional worker, the firm must consider how much that worker adds to total product (marginal product), how much revenue the additional worker contributes to total (value of marginal product) and how much the firm must pay the additional worker (wage rate). Logically, as long as the value of marginal product exceeds the wage rate, the firm will expand E304 Lecture 9 Page 12 of 18 output by hiring the additional worker. The optimum number of workers hired is when the value of marginal product equals the wage rate. Figure 10 (a) Total Product Total product Q Panel (a) shows the firm’s total product curve. Only the portion that is subject the diminishing returns, where output rises at a decreasing rate, is shown Number of workers (L) (c) Marginal Revenue Product Marginal product Marginal Revenue Product (b) Marginal Product 𝑀𝑅𝑃 = 𝑀𝑅 × 𝑀𝑃 MRP w MP Number of workers (L) The graph shows the marginal product of labor, which is downward sloping due to diminishing returns. L This panel shows the firm’s marginal revenue product curve. 𝑀𝑅𝑃 is obtained by multiplying marginal product by marginal revenue. Since for a perfectly competitive firm 𝑀𝑅 = 𝑃, then 𝑀𝑅𝑃 = 𝑀𝑅 × 𝑀𝑃 = 𝑃 × 𝑀𝑃 Thus, for a perfectly competitive firm 𝑀𝑅𝑃 is the same as the Value of Marginal Product E304 Lecture 9 Page 13 of 18 The horizontal line graph in Figure 10-c shows the market-dictated wage rate. When 𝑀𝑅𝑃 > 𝑤, then the value of the marginal product labor exceeds the cost of hiring the additional worker. Therefore, it pays for the firm to hire the extra worker. But when 𝑀𝑅𝑃 < 𝑤, then the firm would not hire the extra worker, Therefore, from the firm’s point of view, the optimum number of workers employed is when 𝑀𝑅𝑃 = 𝑤. 6.1. The Competitive Firm’s Demand for Labor The diagram shows clearly that 𝑀𝑅𝑃 is the firm’s labor demand curve. It shows the various number of workers the firm would hire at different wage rates, ceteris paribus. For example, as shown in Figure 11, when the market wage rate falls from 𝑤1 to 𝑤2 , the firm will increase its workforce from 𝐿1 to 𝐿2 . Figure 11 w ($) When the wage rate falls from 𝑤1 to 𝑤2 , the number of workers hired increases from 𝐿1 to 𝐿2 . 𝑀𝑅𝑃 is the firm’s demand for labor. It shows how the firm adjusts its employment schedule in response to changes in the wage rate. MRP₁ w₁ w₂ 𝑀𝑅𝑃 L₁ L₂ Figure 12 shows how the labor-demand schedule changes in response to an increase in price of the product (Panel a) and improvement in technology (Panel b). E304 Lecture 9 Page 14 of 18 Figure 12 (a) Impact of Increase in the Price of the Product (b) Impact of Improvement in Technology w MRP₂ MRP₁ w w MRP₂ MRP₁ L₁ L₂ An increase in the price of the product will increase the firm’s demand for labor. This is shown as the shift from 𝑀𝑅𝑃1 to 𝑀𝑅𝑃2 . L₁ L₂ An improvement in technology will shift the firm’s marginal product curve, which will also shift the 𝑀𝑅𝑃. 6.2. Labor Market The labor market is represented by the demand for and supply of labor. The demand for labor is the sum of 𝑀𝑅𝑃 curves of all the firms in the industry. The supply side is the sum of the supply schedules of all workers in the market. An individual’s supply of labor shows the amount of hours the individual is willing to work, by giving up leisure time, at various wage rates. If the wage rate rises, the opportunity cost of leisure will rise accordingly, so the person is willing to work more hours. The labor market then reaches equilibrium when the quantity of labor hours offered is equal to the quantity of labor hours demanded at the equilibrium wage rate. E304 Lecture 9 Page 15 of 18 Figure 13 Labor Market MRP Wage S w MRP L Figure 14 shows the impact of the product price increase (Panel a) and improvement in technology, or labor productivity, (Panel b) on employment and wage rate. Figure 14 (a) (b) Impact of Increase in the Price of the Product Impact of Improvement in Labor Productivity MRP Wage MRP Wage MRP₂ S MRP₁ S w₂ w₂ w₁ w₁ MRP₂ MRP₁ L₁ L₂ L₁ L₂ An increase in the product price will shift the 𝑀𝑅𝑃 curve to the right. An improvement in labor productivity, a rise in the 𝑀𝑃 curve, will shift 𝑀𝑅𝑃 curve to the right. 𝑀𝑅𝑃1 = 𝑃1 × 𝑀𝑃 𝑀𝑅𝑃2 = 𝑃2 × 𝑀𝑃 𝑀𝑅𝑃1 = 𝑃 × 𝑀𝑃1 𝑀𝑅𝑃2 = 𝑃 × 𝑀𝑃2 E304 Lecture 9 𝑃2 > 𝑃1 𝑀𝑃2 > 𝑀𝑃1 Page 16 of 18 7. Monopsony in the Labor Market The theory of labor market monopsony was developed by Joan Robinson. The term monopsony means a single buyer. A monopsony in the labor market means a single employer dominating the labor market. Robinson showed that a monopsony will hire fewer workers and pay lower wages than the employment and wage rate that would prevail under competition. The monopsony theory is shown in two panels in Figure 15. Figure 15 (a) (a) Monopsony in the Labor Market Price Taker in the Commodity Market Monopsony in Labor Market Monopoly in the Commodity Market ME ME S S VMP VMP w₁ w₁ MRP = VMP w₂ w₃ L₂ MRP L₃ L₁ VMP L₁ The position of a monopsony in the labor market is the mirror image of what a monopoly faces in the commodity market. A monopoly, facing the entire market demand curve, in order to increase sales must reduce the price of its product. In the process, as was shown earlier, the monopoly marginal revenue declines twice as fast as the price. Similarly, the monopsony now is facing the entire upward sloping market supply. Thus, for each additional unit purchased from the suppliers it must offer a higher price. It must spend more on each additional unit purchased. In this process, the single buyer marginal expenditure rises twice as fast as the price paid. The following is a simple numerical example. Q 2 P 9 3 11 ΔP TE 18 2 13 52 15 17 4 23 75 2 6 4 19 2 5 ΔME 15 33 2 4 ME 4 27 102 The monopsony employer therefore must offer a higher wage for each addition worker it wants to hire. In Figure 15-a, it is assumed that the monopsony is a price taker in the product market. Therefore, its demand E304 Lecture 9 Page 17 of 18 for labor is 𝑀𝑅𝑃 = 𝑉𝑀𝑃.2 The optimum number of workers hired by the monopsony is then where 𝑀𝑅𝑃 = 𝑀𝐸. It will hire 𝐿2 units of labor and pay the wage rate of 𝑤2 . In contrast, the competitive equilibrium occurs at the higher employment level shown as 𝐿1 and a higher wage rate of 𝑤1 . With the monopsony the amount the worker receive as wages is less than the value of marginal product, the value the worker generates. Thus, the workers are “exploited” by the difference 𝑉𝑀𝑃 − 𝑤2 . In the competitive labor market, the value of marginal product of labor is equal the wage rate workers receive. 2 𝑀𝑅𝑃 = 𝑀𝑅 × 𝑀𝑃𝐿 and 𝑉𝑀𝑃 = 𝑃 × 𝑀𝑃𝐿 . Since the firm is a price taker, then 𝑀𝑅 = 𝑃. Therefore 𝑀𝑅𝑃 = 𝑉𝑀𝑃. E304 Lecture 9 Page 18 of 18