METHODS OF OPTIMIZATION Lecturer: Kirill A. Bukin Class

advertisement

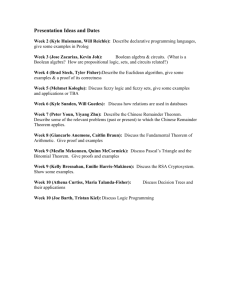

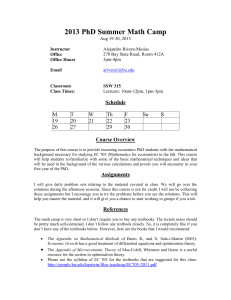

METHODS OF OPTIMIZATION Lecturer: Kirill A. Bukin Class teachers: Boris B. Demeshev, Daniil Esaulov, Artem Kalchenko Course description The course Methods of Optimization is one-semester course for Year 2 ICEF students. It is a part of the Bachelor programme in economics. The course has to give skills of implementation of mathematical knowledge and practice to both theoretical and applied economic problems. Its prerequisites are knowledge and skills of one-variable calculus, linear algebra including general theory of systems of linear equations and matrix algebra. The course covers inequality-constraints optimization, linear programming and selected topics of game theory. The contents of the course have to teach students to solve and analyze different optimization problems using developed mathematical tools. Teaching objectives By the end of semester a student should have skills of implementation of mathematical concepts to solution of microeconomic and macroeconomic problems. A student has to be able to investigate optimization problems in different economic applications. Teaching methods The course program consists of lectures, classes and regular students’ work without assistance. The latter means thinking over lectures’ material, their extension and doing of assignments given by the teacher. During the course there will be a mid-term exam. Assessment •Final exam (120 min.) •Home assignments (11) • Mid-term exam (120 min.) Grade determination The final grade is determined by: •Final exam 60% •Home assignments 20% • Mid-term exam 20% Main reading Carl P. Simon and Lawrence Blume. Mathematics for Economists, W.W. Norton and Co, 1994. A.C. Chiang. Fundamental Methods of Mathematical Economics, McGrow-Hill, 1984, 2008. Additional reading 1. Б.П. Демидович. Сборник задач и упражнений по математическому анализу, М., «Наука», 1966. 2. А.Ф. Филиппов. Сборник задач по дифференциальным уравнениям. М., «Наука», 1973. 3. Anthony M., and Biggs N., Mathematics for Economics and Finance, Cambridge University Press, UK, 1996. 4. Anthony M., Reader in Mathematics, LSE, University of London; Mathematics for Economists, Study Guide, University of London. 5. Robert Gibbons. A Primer in Game Theory. Harvester Wheatsheaf, 1992. 6. M. Anthony. Further Mathematics for Economists. University of London, 2005. Course outline 1. Homogeneous functions. Cobb-Douglas production function. Property of homogeneous functions. Euler’s theorem. (SL Section 20.1; C Section 12.6) 2. Inequality constrained maximization problem of two-variable function. Modification of the first-order necessary conditions for the Lagrangian function. The complementary slackness condition. (SL Section 18.3; C Section 21.1) 3. Several variables and several inequality constraints generalization of the first-order necessary conditions for the Lagrangian function. Constraints qualification. (SL Section 18.3; C Sections 6, 21.3-21.4) 4. Inequality constrained minimization problem of several variables function. Mixed constraints. Kuhn-Tucker formulation of the first-order necessary conditions for the Lagrangian function under non-negativity of instrumental variables. (SL Sections 18.4-18.6; C Sections 6, 21.2-21.4) 5. Economic applications of non-linear programs. Utility maximization subject to the budget constraint. Maximization of sales taking into account advertising costs. (SL Sections 18.4-1876; C Section 21.6) 6. The economic meaning of Lagrange multipliers. The envelope theorem. Smooth dependence of the optimal value on parameters. (SL Sections 19.1-19.2, 19.4; C Section 6) 7. Linear programming. The diet problem. Optimal production under re- sources constraints. Graphical solution of a linear program for two instrumental variables case. (C Section 19.1) 8. Standard formulation of a general linear program. The first order conditions for a linear program, a solution’s property. Concept of a simplex method. A dual program for a linear program. ( C Sections 6, 19.2-19.6) 9. Theorems of linear programming. Complementary slackness theorem. (C Sections 6, 20.2) Existence theorem. Duality theorem. 10. Economic interpretation of the dual program. Dual variables and shadow prices. Profits maximization and costs minimization. ( C Sections19.2-19.6) 11. Prisoners dilemma. Normal form representation of a static game. Eliminating of strictly dominated strategies. Solution of a game. (R. Gibbons, Section 1.1) 12. Nash equilibrium. Bertrand model. Cournot model. Nash theorem. Pure and mixed strategies. Searching for Nash equilibria in 2*2 games. (R. Gibbons, Sections 1.1-1.3) 13. Zero-sum games. Von Neumann equilibrium. Optimal strategies in zero- sum games and duality in linear programming. (M. Anthony. Further Mathematics for Economists. pp. 167-171) Distribution of hours № Topic Total In-class hours Self-study Lectures Seminars 9 2 1 6 1. Homogeneous functions 2. Inequality-constrained maximization of a function of two variables. Several constraints generalisation of the firstorder necessary conditions for the Lagrangian function 16 6 3 7 3. Kuhn-Tucker formulation. Economic applications of nonlinear programs 16 6 3 7 4. Economic meaning of Lagrange multipliers. Envelope theorem 9 2 1 6 5. Linear programming. Theorems of linear programming. Economic interpretation of the dual program. 31 8 4 19 6. Normal form representation of a static game. 9 2 1 6 7. Nash equilibrium 12 4 2 6 8. Zero-sum games. 6 2 2 2 Total: 108 32 17 59