here

advertisement

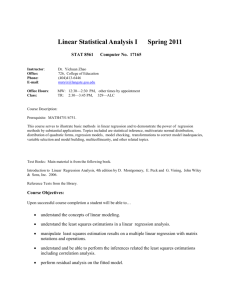

Jordan Woods Michael Cahill Brandon Medeiros Joseph Dougherty Understanding Market Fluctuations What does a good investor attempt to accomplish in his career? The answer to that fundamental question underlying modern business strategies is to understand the future outcome of an investment and make intelligent decisions based upon their beliefs. The investor attempts to quantify the ebbs and flows of the market and determine the motivations for these movements. The complex modern stock market is based upon years of understanding and the build-up of these ideas into what is quintessentially a “science.” For our project, we attempted to explain both the magnitude and direction of changes in the marketplace as they pertain to fluctuating interest rates. Basing our regression on basic economic and investment theories, we endeavored to ascertain how closely historical data followed these theories. If successful, we will be able to understand the future value of the market based upon changes in inputs and factors that affect the market. Everyday on Wall Street thousands of people choose to buy or sell a stock depending on whether they believe it to be over or under-valued. As market conditions change, so does the market’s perception of each company. One of the conditions that plays a major role in investors’ decisions is the domestic interest rate. This underlying input is constantly being analyzed by agents in the economy and its determinant is the interest rate at which banks can borrow from the Federal Reserve, the Federal Funds Rate. “The federal funds rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight (www.federalreserve.gov).” The Federal Open Market Committee meets eight times per year to determine if it should make any changes to this rate. The Federal Funds Rate is one tool the FOMC uses to create a sustainable environment for investment. The Federal Reserve Board’s mandate is to “influence the availability and cost of money and credit to help promote national economic goals (www.federalreserve.gov).” As the cost of money changes, a company’s current debt becomes relatively more or less expensive and its ability to finance future operations based upon its debt levels changes accordingly. This will in effect alter Wall Street’s perception of the value of the company. If one can understand how a change in the Fed Funds Rate will affect the Street’s perceptions of a particular stock, he will be able to hypothesize about not only the direction of the stock price, but also the magnitude of the resulting change. For various reasons, certain companies are forced to finance a large portion of their operating activities by incurring debt. When the interest rate increases, debt becomes relatively more expensive, and vice versa. Therefore, we believe that companies with a significant amount of leverage will be strongly affected by any change to the interest rate. Because so much of their company’s health depends on their ability to pay back this debt and remain trustworthy borrowers, if this debt becomes relatively more or less expensive intelligent agents will immediately reevaluate the company (Smith 97). Conversely, some companies for various reasons choose to operate with very little long-term debt. They prefer to finance their future activities with income from their operating revenues. Therefore, we believe that a change in interest rates would not significantly affect investors’ perceptions of these companies on a firm-by-firm level. However, if the rest of a company’s financial sector is highly leveraged by debt, a change in interest rates would change investors’ view of this company relative to its sector. For the most part, these strategies are determined not only by management preferences, but also by market conditions and new firm initiatives. Often, as firms expand the scope of their business, their current operating activities cannot finance this expansion and they are forced to finance through loans and other forms of debt. When market conditions change, it may become more appealing for management to choose different forms of debt through in-house analysis. Therefore, it is our belief that a firm’s stock price will have a direct correlation with its level of debt as the interest rate changes. More specifically, we believe that firms with either a very high or very low debt-to-equity ratio (or similar debt metrics) will be affected most by these interest rate changes respectively. Consequently, we believe that firms in these “tails” of the distribution of D/E ratios will have the strongest correlation between interest rates and stock price, as this becomes a major factor in the firm’s performance. In other words intelligent agents will move from “riskier” investments, stocks with higher D/E ratios, to safer investments such as bonds and firms with lower D/E ratios. For firms in the middle of the distribution, we do not believe the correlation will be as strong because too many other factors will be affecting the stock’s value (the stochastic error term in the regression will contain too many other variables). Our regression analysis will measure the change in stock price on dates when the FOMC issues an announcement that they are changing the Fed Funds Target Rate focusing on specific .25% increases. The regression will have intercept B0, and dependent variables Debt-to-Equity (B1tdebt), Current Ratio (B2cratio), Total Long Term Debt-to-Equity (B3Tldebt) and Total Common Debt-to-Equity (B4tdebtc). The stochastic variable will measure a number of other variables, including political climate and media coverage, and any other events that pertain to an individual firm on a micro level, such as earnings reports, sector performance and product development. Model Adj RSquared F-value 0.0007 Parameter Est. Cur Ratio D/E Long Term Debt Common D/E 2.03 SE t-value Prvalue 0.087 Prvalue -0.00031721 0.0001566 0.00000158 0.00000426 -2.03 0.37 0.0429 0.7104 0.00000505 0.00000645 -0.0000062 0.00000395 0.78 -1.57 0.434 0.1166 After running the regression our original hypothesis was proved wanting in that results provided only one significant value in our regressors. The R-Squared value was less than .1, indicating that we had failed to find any real pattern to our data. Essentially, we believe that too many factors were included in our stochastic error term. In today’s stock market, it is impossible to account for every movement in an individual stock price. Additionally and most importantly, due to the futures market, the probability of a Federal Funds Target Rate change is already factored into the stock price; we cannot expect to see any significant, correlated movements on the day of the rate change. While our hypothesis was debunked, it is significant to note that no change can be observed. Future regressions must take into account analysts’ expectation of the action that will be taken by the central banking authority. However, we still believe that our economic theory remains correct. The regression should work. Consequently, we devised a new regression that essentially held the same beliefs, but tried to explain the movements of the S&P 500 on a macro level, rather than trying to track each individual stock price. To avoid the issue of the futures market, we would need to take regular “snapshots” of the S&P rather than look on specific days. In other words, we would need to use a different interest rate measure than the Federal Funds Target Rate, which changes in a step function; we needed to use a rate that changes on a constant or “floating” basis. In addition, we now knew that we would have to account for macroeconomic issues besides the interest rate in our analysis. When creating a portfolio using modern Portfolio Theory, it is important to attempt to achieve your required return while also minimizing risk. In general, the more variance in your expected return (the riskier the portfolio), the higher the potential return can be. Each investor will diversify his portfolio in order to have both his optimal level of risk and the corresponding level of expected return. As prefaced earlier, stocks are influenced by a great many different factors on a macro level. For example, political unrest can cause a general increase in the cost of inputs and consequently the expected profits of every company will be adversely affected. Conversely, factors such as a technological improvement can raise the productivity of firms and improve the outlook for the market in general. As the stock market becomes more volatile and declines in overall value, investors will move their portfolios toward more guaranteed returns. However, in a general growth cycle, investors will move their portfolios towards stocks and away from a position that has a lower potential return. In addition to movements in the stock market, changes in the interest rate will affect the expected return from a low-risk investment, such as a bond. As agents seek safer investments, primarily in risk-free investments (treasuries), the price level will increase (Graham 138). As yields and bond prices are inversely related, investors compete for the guaranteed return. The reverse is also true. Investors operate with a relatively fixed level of funds, and therefore they must adjust their mix of low and highrisk positions accordingly. This relationship is most accurately portrayed in the Capital Market Line formula (Bodie, Kane and Marcus 141): μp = μf + [(μr − μf )(σp)]/ σr This formula mathematically demonstrates the relationship between an intelligent agent’s allocation of his portfolio between “risk-free” investments, such as treasury notes, and “risky” investments, such as stocks. As shown, as the variance (or risk) of a risky investment increases, an agent will move his portfolio towards risk-free positions in order to achieve the same expected (or required) return of his portfolio (μp) (Greenspan 177). As with any other investment strategy, knowing how the market will move enables one to maximize his returns. Given the above assumptions, we have developed a regression that attempts to explain the movements in the S&P 500 by analyzing the changes in the interest rate. Our model uses the overall level of the S&P 500 as the Y value (the dependent, or explained, variable) and the yield on the ten year Treasury note (which is indirectly correlated with the interest rate) as the independent variables. The function is as follows: S&P500 = b0 + b1(ten year) + b2(industrial production) + b3(CPI) + b4 (unemployment) + ei We expect there to be a direct positive correlation between the yield on the tenyear note and the S&P. In other words, as the market becomes more volatile or risky, investors will leave their positions in our chosen market indicator: the S&P, for guaranteed returns until their portfolio once again maximizes return and minimizes risk according to their individual preferences. We included these other macroeconomic indicators to account for investors moving in and out of the S&P as the market environment changes in ways that are not related to the interest rate. Consequently, we expect agents to move into the S&P as the other macroeconomic indicators inputs improve. We have included these three in the regression as they all provide insight into various areas of the economy. Unfortunately, because they are all indicators for the same economy, there will be some multicollinearity in the model which we will soon discuss. Model Adj RSquared F-value 0.9608 Parameter Est. Ten Year Ind Prod CPI Unemp Prvalue 2203.55 <.0001 SE t-value 11.47957 3.6 31.72873 -2.99716 14.1483 1.19 0.55 6.04 3.19 Prvalue 0.0016 26.59 <.0001 -5.5 <.0001 2.34 0.0197 When run monthly over the past 30 years, the regression has an Adjusted RSquared value of approximately .96. This gives the approximate amount of the change in the level of the S&P 500 that we could explain with our regression. Unfortunately, this model is not perfect; it contains several violations of the assumptions of the Classical Linear Regression Model. As this regression is a time series, we can expect our stochastic error terms to be correlated. This is known as autocorrelation. Intuitively, we understand this to be an issue because the level of the S&P 500 in one month will be related to the level of the previous month because it will be a measure of essentially the same companies. This violation leads to inflated t-values, which would render our hypothesis testing unreliable. However, our coefficients are so far from zero that we do not anticipate that correcting for autocorrelation would effect the significance of any of our variables (Gujarati 432). Another issue we predicted our model would have is multicollinearity. Naturally, as we have several regressors that measure the same economy, we can expect this to be an issue. For example, we can anticipate that as unemployment decreases, firms’ output will decrease and we will see an indirect correlation between unemployment and industrial production. In addition, as unemployment decreases agents in the economy will have more money and the general price level will increase. More money will “chase” the same amount of goods; unemployment and CPI are indirectly correlated as well. Statistically, we tested the model to verify our prediction and did indeed find evidence of multicollinearity. Any large correlation between two variables supports the theory that multicollinearity exists (Gujarati 378). As one can see from the resulting correlation matrix, we did find this to be an issue. However, we believe this to be a situation where the fit of the regression and its regressors are still statistically significant because their true values are so far from zero (Gujarati 377). Ten Year CPI IP Unemp Ten Year CPI IP Unemp 1 -0.86 -0.8562 0.68538 -0.86 1 0.96137 0.63477 -0.8563 0.96137 1 -0.7458 0.68538 -0.6348 -0.7458 1 Finally, we tested for a violation of the assumption of homoscedasticity. Because this regression was conducted over the course of 30 years, and there were many changes in both market conditions and the S&P composition, we can expect this to be an issue. After running White’s test, we discovered there was indeed evidence of heteroscadasticity. We then used the corrected standard errors to test the significance of each variable. As with the other violations, our regressors were so drastically different than zero that even the corrected standard errors did not change the significance of our regressors. Cov. Sq Rt Parameter Est New t-value 10yr 10.60816535 3.257017862 IP 11.47957 3.524564644 1.485890042 1.218970895 CPI 0.256538326 0.506496126 Unemp 47.962737 6.925513483 31.72873 26.02911205 -2.99716 -5.917439136 14.1483 2.042924331 As we discussed above there are many factors on a macro level that will affect investors’ decisions beyond simply the interest rate. As previously stated, we accounted for the most pertinent macro indicators that would affect investor choice in the marketplace. When the market becomes relatively more or less stable, investors will move their portfolios accordingly, and become less influenced by the interest rate. We cannot expect to capture every movement of the index by only looking at the interest rate and ignoring these other factors. The endgame of modern economics is to accurately define the “why” of business decisions; while the important (and relatively new) field in economics, econometrics, seeks to quantify the “how much” or magnitude of those possible choices. Eventually, investors do follow a certain pattern when determining their portfolio composition. Using this information can help any investor as he/she attempts to “value” the S&P index. In the short run, an investor gains no helpful incite when studying interest rates and short term stock price movements. However in the long run studying interest rates is a helpful predictor to gauge future performance of the largest 500 domestic stocks. Works Cited 1. Board of Governors of the Federal Reserve System. June 6, 2008. Federal Reserve Board. June 6, 2008 www.federalreserve.gov. 2. Bodie, Zvi, Alex Kane, and Alan J. Marcus. Essentials of Investments. Boston: McGraw-Hill Irwin, 2008. 3. Graham, Benjamin. The Intelligent Investor. New York: Harper Collins Publishers, Inc, 1949. 4. Greenspan, Alan. The Age of Turbulence. New York: The Penguin Group, 2007. 5. Gujrati, Damodar N. Essentials of Economics. New York: McGraw-Hill Irwin, 2006. 6. Smith, Adam. Wealth of Nations. Amherst, New York: Prometheus Books, 1991.