DRAFT This ICC working document is provided to you on condition

advertisement

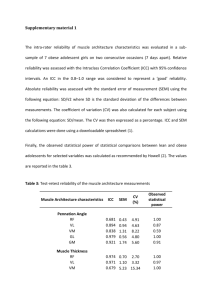

ICC policy statement – WORKING DRAFT This ICC working document is provided to you on condition that its contents remain confidential. Distribution is restricted to ICC commission members and other experts designated by ICC National Committees and Groups. Reproduction and/or dissemination in any form and by any means are strictly prohibited. Foreign Direct Investment – Promoting and Protecting a Key Pillar for Development and Growth Executive Summary Investment, including Foreign Direct Investment (FDI), plays a vital role in determining a country’s economic fate. Countries that have consistently welcomed, nurtured and supported foreign investors have consistently out-performed those either hostile to FDI or those that have tried to extract maximum short-term benefits by squeezing foreign investors and rewriting the rules at every turn. Investment, and FDI in particular, can be a unique resource which host governments need to value, protect and nourish to build long-term “win-win” partnerships. ICC strongly supports FDI as an effective tool to maximize economic growth and development, and calls on governments to both maintain and strengthen investment protection agreements. In the short and medium term, that can be done through highstandard bilateral and regional investment agreements, and in the longer term, through a high-standard global investment agreement. Any investment agreement must continue to include robust dispute resolution and enforcement provisions through strong investor-state dispute settlement (ISDS), with independent arbitration proceedings to settle the handful of investment disputes that prove intractable fairly. Introduction Investment drives economic growth, job creation and competitiveness, and thereby economic development, improving lives in countries at all levels of development. Without investment, economies stagnate and families suffer. Most investment in almost every economy is private investment, and most private investment in almost any country – developed or developing, large or small, agriculture, industry, or services-based – comes from the domestic private sector. Governments increasingly recognize that most or all sectors of an economy function best when the government focuses on infrastructure and getting the policies right, and the private sector allocates the investment in productive sectors. Foreign direct investment (FDI) can play an important supportive role in any economy. Successful economies at any level of development tend to be those that get fundamental economic policies “right,” and both welcome and are attractive to foreign investors. FDI is a competitive game in today’s global value chain economy, and can significantly affect an economy’s competitiveness in that global system. Foreign investors have multiple options and will seek the best investment opportunities – those with best prospects for returns on investment, and the lowest perceptions of risk. Businesses, large and small, based in OECD nations or in emerging and developing countries, all realize that investing globally is critical for growth and competitiveness, even survival, in today’s (and even more so, tomorrow’s) global economy. Many governments recognize the same realities – that no country, at whatever level of development, has sufficient domestic resources to go it alone. FDI is “win-win”, benefitting the economies of both the investing and the host nations. FDI flows take many 1 24 September 2015 Document 103/329 This ICC working document is provided to you on condition that its contents remain confidential. Distribution is restricted to ICC commission members and other experts designated by ICC National Committees and Groups. Reproduction and/or dissemination in any form and by any means are strictly prohibited. forms, touch every sector in our globalized economy, and today’s FDI flows and patterns are far different from those of only a decade or so ago. Importantly, FDI is no longer one-way, from the OECD “North” to the developing “South.” Countries like China, India and other emerging markets are major investors around the world. According to data collected by the United Nations Conference on Trade and Development (UNCTAD) in their 2015 World Investment Report, in 2014, 9 of the 20 largest investor countries were from developing or transition economies – Hong Kong (China), China, Russian Federation, Singapore, Republic of Korea, Malaysia, Kuwait, Chile, and Chinese Taipei. In fact, developing Asia now invests abroad more than any other region, having invested $432 billion in the period of 2012 to 2014. FDI from developing economies, which have grown to make up over a third of global FDI flows also include increasing amounts of South-South FDI flows. The International Chamber of Commerce, as the voice of global business, believes that investment broadly, and specifically FDI, can play a critical role in the development process. ICC has adopted the following fundamental policy positions enumerated below which, if implemented on a global basis, can help provide much-needed impetus to economic growth, job-creation, and better lives around the world. Good Investment Policies Attract Good Investors Nations, as well as sub-central governmental units, with clear and well-implemented policies on taxation, protection of property (including intellectual property) rights, common sense laws and regulations (including labor and liability issues), and clean government, create a climate that nurtures private investment, including FDI. A strong investment climate is much more important than investment incentives in attracting FDI. Unfortunately, countries which fail to adopt sound proinvestment policies risk being left behind in today’s, and tomorrow’s, competitive global economy. Strong Investment Protection Agreements Are More Important than Ever International investment agreements provide essential protections for investors putting their capital, intellectual property, management resources, and reputation at risk outside the comforts and security of their home markets. Strong Bilateral Investment Treaties (BITs) and Investment chapters in bilateral or regional Free Trade Agreements (FTAs) are very important tools to facilitate and protect FDI flows. We strongly support the network of BITs and FTA Investment Chapters that the U.S. Government has negotiated and brought into force, as well as comparable “gold standard” investment agreements around the world. In the Long Run, a Single ‘Gold-standard” Multilateral Agreement Could Be the Optimal Solution ICC has long been a leading advocate for, and supporter of, the multilateral system. A high-standard global investment protection agreement, perhaps a “WTO for Investment” wherever located, could provide one clear set of rules for investors, governments and other stake-holders. These would be high standard rules of the road. However, ICC would insist that such a global investment protection regime be high standard in terms of coverage, definitions, scope of protections, market-opening provisions, and strong dispute settlement provisions. A global investment protection regime is only worth doing if it can be done right, able to provide investors protections significantly beyond those 2 24 September 2015 Document 103/329 This ICC working document is provided to you on condition that its contents remain confidential. Distribution is restricted to ICC commission members and other experts designated by ICC National Committees and Groups. Reproduction and/or dissemination in any form and by any means are strictly prohibited. routinely found in most current investment agreements. No one should mislead themselves, or others, into thinking that negotiating, ratifying and implementing such a gold standard global investment regime would be easy or quick. By definition, it must be seen as a long-term effort. If done right, now could be the time for serious and detailed initial discussions on what such a global investment regime might look like, and how one might go about achieving it. In the medium term, strong bilateral, regional, and plurilateral agreements with high-standard investment provisions can be useful stepping-stones toward a possible global investment regime down the road. In this regard, the Trans Pacific Partnership (TPP), Transatlantic Trade and Investment Partnership (TTIP), and the Regional Comprehensive Economic Partnership (RCEP), can be particularly constructive. ICC endorses these and similar efforts to negotiate high-standard bilateral, regional and plurilateral investment agreements. Independent, Effective Dispute Settlement is Critical to Any Successful Investment Agreement, from Today’s BITs to a Potential Global Investment Regime Unfortunately, it is a reality that a small percentage of foreign investments result in serious disputes between the investor and the host government. It is critical for those investors to have direct access to independent and effective dispute settlement, outside of host government–controlled bodies, to resolve those disputes. These disputes cannot be allowed to fester for years, even decades, stuck deep in host government–controlled judicial or regulatory processes. Typically, investment agreements have included ISDS provisions to ensure such independent arbitration to resolve these key disputes. ICC strongly endorses the inclusion of effective and independent dispute resolution mechanisms in all investment agreements. Sectoral Restrictions or “Carve-Outs” Make Bad Investment Policy A disturbing trend among some governments is the proposal of sectoral limitations on substantive protections or access to dispute settlement arbitration. Some of these proposals seem blatantly politically motivated. The idea that governments might decide, on whatever basis, that certain legal products are somehow problematic and should be denied coverage under investment agreements is both very troubling and setting a terrible precedent. Discrimination against certain products or sectors is never a good idea. ICC calls on governments to avoid sectoral discriminations in the negotiation or implementation of investment treaties or investment chapters in free trade agreements. Emerging SOE Investment Issues Deserve Greater Attention As in trade and other broad policy areas, State-Owned Enterprises (SOEs) raise several important issues in the investment area. SOEs, and more broadly state-championed enterprises, can enjoy a range of preferential benefits, which give them clear advantages when competing with private firms, domestic or international, for investment opportunities. SOEs may receive direct or indirect subsidies, favorable tax treatment, preferential treatment, or even exemption from regulations applied to private investors. In some cases, SOEs even act as the government regulator within a sector, granted regulatory oversight of themselves as well as their private competitors. Operations invested in SOEs can also indirectly benefit from government directed procurement. Large, powerful SOEs may even gain from monopoly or oligopoly power and/or favorable treatment in their home markets, generating excess profits they can use to subsidize investment in foreign markets. For all these reasons, we encourage governments around the world, at all levels of development, as well as relevant 3 24 September 2015 Document 103/329 This ICC working document is provided to you on condition that its contents remain confidential. Distribution is restricted to ICC commission members and other experts designated by ICC National Committees and Groups. Reproduction and/or dissemination in any form and by any means are strictly prohibited. international organizations, to devote greater attention and resources to the emerging issues of SOEs. It is important to ensure level playing fields when SOEs compete with the private sector, including in investment and trade areas. National Security Reviews of FDI Are a Fact of Life but Must be Disciplined One feature of most BITs and FTA investment chapters is a broad “national security” or “essential security” exception, allowing each partner government to invoke security provisions to trump open investment commitments. It is long-established standard practice for governments to have various essential security procedures in their trade and investment agreements. While these exceptions may be inevitable, their use needs to be limited. International businesses have seen signs that some governments may be tempted to abuse the “security” provisions for blatantly protectionist purposes, simply to block or discriminate against foreign investors. Business groups, as well as many economists, have complained that abuses of the national security FDI reviews in some countries can interfere with market efficiencies, deny companies legitimate investment opportunities, and can be abused for protectionist purposes. ICC highlights this serious challenge to the global investment system and calls upon all governments to refrain from abusing these security provisions. National security exceptions should be the exception, used in extremely rare circumstances where the relationship to real national security concerns is clear and obvious to any neutral observer. “Forced Localization” Provisions Must Be Resisted One particularly troubling trend businesses are increasingly confronting around the world is governments attempting to condition investment approvals on localization commitments such as local procurement, research and development commitments, export quotas or similar requirements, sometimes referred to as “performance requirements.” While the temptation for a government to try to extract maximum local benefit out of a foreign investor may seem understandable, this practice has serious negative repercussions on both the investor and on the host country’s competitiveness and reputation as an investment destination. By imposing extravagant or extraneous conditions on foreign investors, governments risk killing the proverbial golden-egg laying goose, and forgoing beneficial future FDI because of a perceived poor investment climate. ICC Policy Work on Investment ICC’s Commission on Trade and Investment Policy has long been a strong voice for international business on the full range of investment policy issues. The Commission will continue to be the locus of ICC work on investment policy. We encourage all ICC member national commissions and member companies to participate in the investment policy work of the Commission. ICC’s “Guidelines for International Investment” (available here) provides an excellent checklist of the responsibilities of key players in the FDI process – host government, home governments, investors, and other stakeholders. :-:-:-:-:-:-:-:-:-: 4 24 September 2015 Document 103/329