posted

advertisement

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

Final Examination

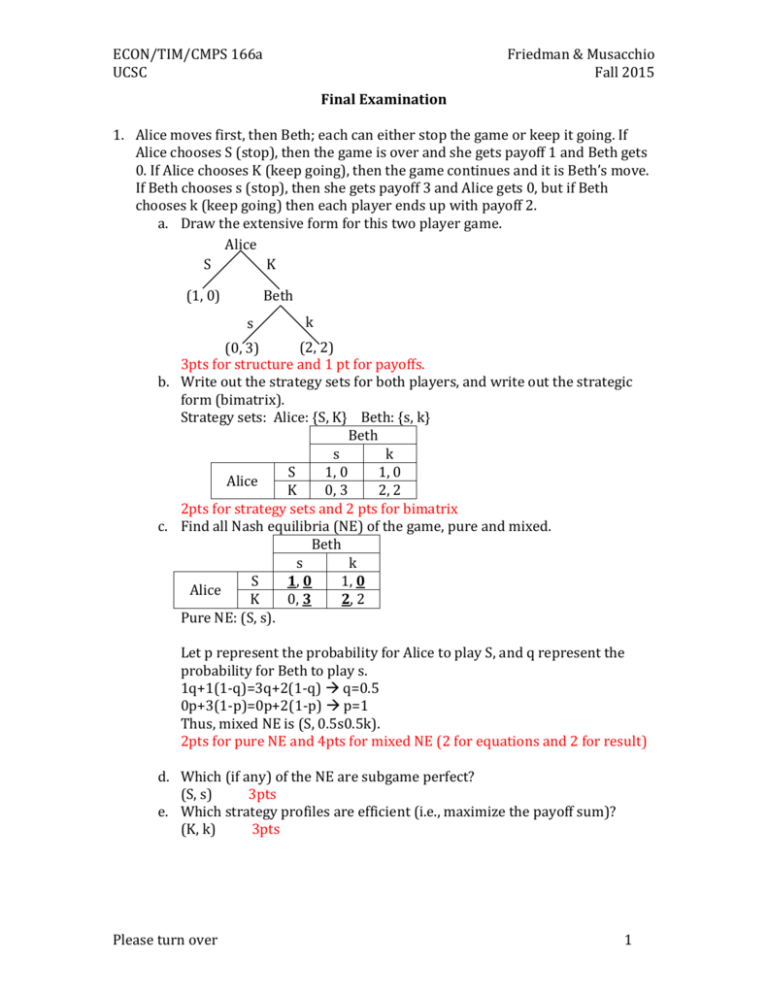

1. Alice moves first, then Beth; each can either stop the game or keep it going. If

Alice chooses S (stop), then the game is over and she gets payoff 1 and Beth gets

0. If Alice chooses K (keep going), then the game continues and it is Beth’s move.

If Beth chooses s (stop), then she gets payoff 3 and Alice gets 0, but if Beth

chooses k (keep going) then each player ends up with payoff 2.

a. Draw the extensive form for this two player game.

Alice

S

K

(1, 0)

Beth

s

k

(2, 2)

(0, 3)

3pts for structure and 1 pt for payoffs.

b. Write out the strategy sets for both players, and write out the strategic

form (bimatrix).

Strategy sets: Alice: {S, K} Beth: {s, k}

Beth

s

k

S

1, 0

1, 0

Alice

K

0, 3

2, 2

2pts for strategy sets and 2 pts for bimatrix

c. Find all Nash equilibria (NE) of the game, pure and mixed.

Beth

s

k

S

1, 0

1, 0

Alice

K

0, 3

2, 2

Pure NE: (S, s).

Let p represent the probability for Alice to play S, and q represent the

probability for Beth to play s.

1q+1(1-q)=3q+2(1-q) q=0.5

0p+3(1-p)=0p+2(1-p) p=1

Thus, mixed NE is (S, 0.5s0.5k).

2pts for pure NE and 4pts for mixed NE (2 for equations and 2 for result)

d. Which (if any) of the NE are subgame perfect?

(S, s)

3pts

e. Which strategy profiles are efficient (i.e., maximize the payoff sum)?

(K, k)

3pts

Please turn over

1

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

2. Suppose that two player game just described is repeated indefinitely, and each

player’s payoffs in that repeated game is the discounted sum of the stage game

payoffs; the discount factor d is somewhere between 0 and 1.

a. What aspects of the repeated game tend to make the discount factor d

closer to 1?

(1) Higher survival probability to the next period, and

(2) Lower interest rate/ present preference

2pts for each reasoning. 3pts max.

b. Describe a strategy profile for the repeated game that might promote

efficiency.

Example: grim trigger strategy: Initially, both of them play K/k in every

round. If someone is playing S/s, then the other will play s/S forever. TFT

or other reasonable strategy is acceptable.

4pts. Must specify the complete strategy (initial and continuing with

cooperative or non-cooperative). Otherwise, you get 2

c. Suppose that d=0.6. Show whether your strategy profile can indeed

support efficient play as a NE of the repeated game.

Note that in this case, Alice has no incentive to deviate first. We only

consider about Beth’s decision. If comply, she gets

2+2d+2d2+2d3+…= 2/(1-d)=2/(1-0.6)=5

If deviate, she gets

3+0+0+0+…=3

Therefore, under d=0.6, grim trigger strategy can indeed support

efficiency play as NE of the repeated game.

6pts. 4 for reasoning and 2 for conclusion

3. Consider the payoff matrix

A

B

A

0, 2

3, 3

B

2, 0

2, 2

a. Find all NE of the game, including mixed (if any).

Pure NE: (A, A) and (B, B). Best responses are shown above.

Let p be the probability of playing A. 3p+0(1-p)=2 p=2/3

Mixed NE: (2/3A 1/3B, 2/3A 1/3B)

2pts for each NE. Notes: the game is symmetric so we need only 1

equation to determine the probability mix.

b. Which (if any) of these NE are payoff dominant? Risk dominant?

(A, A) is payoff dominant and (B, B) is risk dominant. 1pt for each.

Please turn over

2

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

c. According to evolutionary game theory, which NE (if any) are stable?

The two pure NE are ESS, but the mixed NE is not ESS.

3pts. 1 for each statement

Note: this problem does not ask you the reason. In case you want to know

that, you may either show by definition, or compare using the expected

values of payoff

d. Which NE is most likely to approximate the outcome of an evolutionary

game if played for a long time? Explain your reasoning very briefly.

(B, B).The convergence depends on the initial probabilities of population

playing each strategy. When it starts with initial population p<2/3, it will

converge to (B, B), and when it starts with p>2/3, it converges to (A, A).

Therefore, (B, B) is more likely to be the long-run outcome of

evolutionary game.

3pts. If you have some other reasonable explanation, you can get up to 2.

4. Imagine two firms have to choose prices for related products. Firm 1 chooses its

price x, and firm 2 chooses its price y. The sales firm 1 sees go down with the

price it charges, but increase with the price firm 2 charges. In particular the

quantities sold by firms 1 and 2 are respectively

Q1 = 120 – x + (½) y and Q2 = 120 – y + (½) x.

The cost per unit for firm 1 and 2 are 10 and 40 respectively, so their payoff

functions are

V1 = Q1 (x - 10) and V2 = Q2 (y - 40).

Compute the values of x and y in Nash equilibrium.

Firm 1 chooses x to maximize V1 = Q1 (x - 10) = (120 – x +½ y)(x-10)

F.O.C. w.r.t. x implies 120-x+½ y-x+10=0, i.e., 130+½ y-2x=0 …(1)

Firm 2 chooses y to maximize V2 = Q2 (y - 40) = (120 – y + ½x) (y-40)

F.O.C. w.r.t. x implies 120-y+½ x-y+40=0, i.e., 160+½ x-2y=0 …(2)

Solving the system of equations (1) and (2), we get the NE quantities

x=272/3≈90.67,

y=308/3≈102.67

4pts for maximization problem, 4pts for FOCs, 3pts for solving the system and

3pts for getting the answer

5. Consider a routing game in which a population (size normalized to 1) chooses

whether to take route 0 or route 1 to a destination. Route 0 has a delay of x

hours, where x is the fraction of the population that takes route 0. Route 1 has a

fixed delay of 1 hour. Each player in the population represents a negligibly small

fraction of the total population, and each player wants to minimize his delay.

a. Find the Wardrop (or Nash) equilibrium of the game.

Given x=1, individual is indifferent between Route 0 and Route 1.

However, given x<1, Route 0 is strictly preferred, and thus more people

Please turn over

3

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

will choose Route 0.

Therefore, the Wardrop equilibrium is x=1, i.e., everyone goes Route 0.

6 pts. 3 for result and 3 for explanation.

b. Is the Wardrop equilibrium also an ESS? Show that the condition for ESS

is satisfied (or not).

Yes.

Given x=1, you are indifferent between Route 0 and Route 1, this means

F(p,p)=F(q,p)

Given x≠1 (which means x<1 in this case), you are better off staying on

Route 0 than going to Route 1. That is, F(p,q)>F(q,q)

Therefore, the WE is a mild ESS.

2 pts. 1 for “Yes” and 1 for explanation.

c. The delay for route 0 is x and the delay of route 1 is 1. Since x and (1-x)

are the fractions that take each respective route, the average delay is

x2 + 1 – x .

What is the value of x that minimizes the average delay and hence is

socially optimal?

F.O.C implies that 2x-1=0, so x=0.5

4 pts. 2 for FOC and 2 for result.

d. What is the ratio between the social optimal average delay and the

Wardrop equilibrium average delay?

The social optimal average delay is 0.52+1-0.5=0.75

The NE average delay is 1.

Therefore, the ratio is 0.75/1=0.75

2 pts

e. Imagine you could charge a fixed toll for route 0. Also suppose that whole

population values their time at $50 per hour. (e.g. it’s worth spending $50

to reduce delay by 1 hour.) What toll would you charge on route 0 to

induce the socially optimal traffic pattern?

Suppose you can charge “time” on Route 0, say, t. Individual is indifferent

between Route 0 and Route 1, which indicates x+t=1. Plugging in x=0.5,

we get t=0.5. Therefore, the equivalent toll is 0.5X$50= $25.

5 pts. 3 for the indifference equation (“x+t=1”) and 2 for result

6. Consider a game between an (I)ncumbent firm and a potential new entrant

(S)tart-up firm in the market for widgets. Nature endows the incumbent firm

with one of 2 possible “types” of costs for producing widgets. Specifically, the

incumbent has (L)ow costs with probability p or (H)igh costs with probability 1p. The incumbent knows the actual type, while the potential start-up only knows

the probabilities. The incumbent chooses whether to price their widgets

(M)oderately or (P)ricey. Observing this pricing, the start-up decides whether to

Please turn over

4

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

(E)nter or (N)ot enter the market. Entering the market when the incumbent has

low costs always results in the start-up losing money, while entering the market

when the incumbent has high costs always results in the start-up making money.

The incumbent is always worse off when the start-up enters. The payoffs of

specific outcomes are as follows.

Incumbent Incumbent Start-up

Type

Price

Entry Decision

L

M

E

N

P

E

N

H

M

E

N

P

E

N

Payoff

(I, S)

(1, -1)

(1.5, 0)

(1, -1)

(2, 0)

(-1.5, 1)

(0, 0)

(-1, 1)

(1.5, 0)

a) Draw the extensive form game tree. Make sure to draw any information

sets correctly.

Nature

Low: p

M

High: 1-p

Incumbent

P

M

P

Start-up

E

(1,-1)

N

E

(1.5, 0) (1,-1)

N

E

N

(2, 0) (-1.5, 1) (0, 0)

E

(-1, 1)

N

(1.5, 0)

4pts Structure, info set, payoff and nature

b) Write out the incumbent’s strategy set. Which strategies are separating

and which are pooling (if any)?

Strategy set: {MLMH, MLPH, PLMH, PLPH}

where MLPH means play M if the nature chooses low, play P if nature

chooses high

Separating strategies are { MLPH, PLMH}

Pooling strategies are {MLMH, PLPH}

2pts for strategy set. 1 for separating and 1 for pooling.

Note: it is fine to say MM, MP, PM, PP. If you do so, you must have

Please turn over

5

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

consistent notation in the whole problem. Otherwise, the grader reserves

the rights to take off credits if you get messy with the notations (which

means that you might not understand the concepts here)

c) Write out the entrant’s strategy set. How many pure strategies does she

have?

Strategy set: {EMEP, EMNP, NMEP, NMNP}. Four strategies.

2pts for strategy set and 2pts for counting

d) Is there a Perfect Bayesian Nash Equilibrium (PBE) in which the

incumbent follows a separating strategy? If so, describe the strategies of

each player, and the beliefs of the start-up after observing (M)oderate or

(P)ricey being played by his opponent. If not, explain why.

Assume that the incumbent’s strategy is MLPH and the start-up’s beliefs

are P(L|M)=1 and P(L|P)=0. The corresponding best response for start-up

will be NMEP. See the following figure for visualized strategies. However,

under this circumstance, the incumbent’s best response to NMEP is MLMH,

which violates the assumption.

Nature

Low: p

M

High: 1-p

Incumbent

P

M

P

Start-up

E

(1,-1)

N

E

(1.5, 0) (1,-1)

N

E

N

(2, 0) (-1.5, 1) (0, 0)

E

(-1, 1)

N

(1.5, 0)

Alternatively, assume that the incumbent’s strategy is PLMH and the startup’s beliefs are P(L|M)=0 and P(L|P)=1. The corresponding best response

for start-up will be EMNP. See the following figure for visualized

strategies. However, under this circumstance, the incumbent’s best

response to EMNP is PLPH, which violates the assumption.

Please turn over

6

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

Nature

Low: p

M

High: 1-p

Incumbent

P

M

P

Start-up

E

(1,-1)

N

E

(1.5, 0) (1,-1)

N

E

N

(2, 0) (-1.5, 1) (0, 0)

E

N

(-1, 1)

(1.5, 0)

Therefore, there is no separating PBE.

2pts for the conclusion and 2pts for explanation.

Note: the graph is aimed for helping your understanding. Definitely you

don’t need to show them. However, the explanation in words is a must for

full credit. Also, note that it is not complete to show P dominates M,

because a weakly-dominated strategy is still able to formalize a NE. Thus,

the fact that P weakly-dominates M cannot guarantee that M cannot

appear in separating PBE.

e) Is it possible to have a Perfect Bayesian Nash Equilibrium (PBE) in which

the incumbent follows the pooling strategy of always playing (P)ricey? If

so, does this PBE exist for all values of p? If not, find the range of p values

for which this PBE exists. (4pts)

Given that the incumbent is playing PLPH, the start-up’s beliefs are

P(L|M)= P(L|P)=p.

If -1p+1(1-p)>=0, i.e., p<=1/2, the start-up’s best response is EMEP. (Red

segments in the figure. Note that, you must specify what happens to

observing M, even if this is assumed not be the case.) Then, the incumbent

has no incentive to deviate. Therefore, P(L|M)= P(L|P)= p<=1/2, (PLPH,

EMEP) is a PNE.

If -1p+1(1-p)<=0, i.e., p>=1/2, the start-up’s best response is NMNP

(Green segments in the figure). Then, the incumbent has no incentive to

deviate, either. Therefore, P(L|M)= P(L|P)= p>=1/2, (PLPH, NMNP) is a PNE.

Therefore, the PBE exists for all value of p ∈[0,1]. (However, the

equilibrium strategy varies)

Please turn over

7

ECON/TIM/CMPS 166a

UCSC

Friedman & Musacchio

Fall 2015

Nature

Low: p

M

High: 1-p

Incumbent

P

M

P

Start-up

E

(1,-1)

N

E

(1.5, 0) (1,-1)

N

E

N

(2, 0) (-1.5, 1) (0, 0)

E

(-1, 1)

N

(1.5, 0)

4pts. 2 for conclusion and 2 for reasoning. I will suggest an extra credit of

1 or 2 if you point out that at p=1/2, there also exists mixed strategy

pooling equilibrium

Please turn over

8