UGsyllabus3380 - Southern Methodist University

advertisement

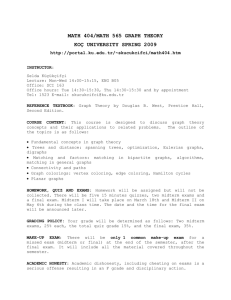

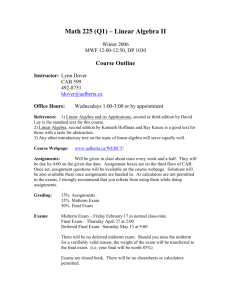

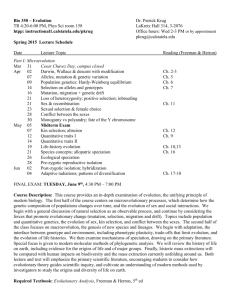

SOUTHERN METHODIST UNIVERSITY – COX SCHOOL OF BUSINESS CISB 3380 - BUSINESS DECISION MAKING Fall 2009 Professor Maria Minniti Office Hours: Thursday 3:00-4:30, or by appointment Address: Fincher 410B Telephone: 214-768-3145 E mail: mminniti@cox.smu.edu Class Hours: Tu-Th 12:30-1:50 COURSE DESCRIPTION This class will provide students with the tools needed to make better business (and personal) decisions. The course analyzes theories and practices of decision making in a variety of settings. Specifically, it focuses on understanding the processes through which individuals and firms make decisions (and mistakes) in uncertain situations. Particular emphasis will be put on how to process information effectively, when to use rules of thumb, and on how to detect biased judgments. Managers and entrepreneurs are continually barraged with information that may or may not be reliable. They must regularly choose courses of action in the face of uncertainty, often much more rapidly than they would like. Do they make optimal decisions? How do we even know what is "optimal"? The goal of this course is to compare how we (as well as managers and entrepreneurs) make decisions with how we (they) should make decisions. The course encourages students to think critically about how we interpret data and make decisions, and shows how to avoid common decision errors that occur because of faulty, ingrained mental models. “Business Decision Making” is a cross-functional course in both its theoretical grounding and its applications. A significant amount of the research to be discussed will come from economics, behavioral economics, evolutionary psychology, and social psychology. COURSE PREREQUISITES The only prerequisite is intellectual honesty and an inquisitive mind. The course is a blend of qualitative and quantitative ideas, and you will be reminded of applicable statistics principles you should have learned. We will do some modest computations, but nothing beyond basic algebra is needed. COURSE MATERIALS The format for the course will be a combination of lectures, discussions, exercises, and experiments done in class. We will also have a guest speaker. In addition to class notes, study materials used in the course consist of: 1. Reading list 1 2. “Big Pictures” and “Nuts & Bolts” (To be distributed in class) At the end of each class I will give precise reading assignments. COURSE REQUIREMENTS AND GRADING I expect all of you to uphold the University’s Honor Code. Grades will be determined as follows: 1. Preparation for class discussion and class participation will count for 10% of the course grade. Day-to-day preparation for class and participation in class discussions is essential and will show up not only in your class participation grade but also inevitably in your understanding of the subject and quality of your written work. 2. In class midterm exams will count for 50% of the course grade. There will be two midterm exams. Each will be worth 25% of your grade. The second midterm will not be cumulative. As exam questions you may expect decision problems and a combination of true/false and multiple choices questions about the topics covered in class. I will also ask you to answer a couple of essay questions. You will get the list of essay questions a few days in advance. I will also give you sample exams. 3. The final exam will count for 40% of the course grade. The final will be cumulative. Its format will resemble closely the midterm exams. I will also give you sample exams. SMU’S ACCOMODATION POLICIES Disability Accommodations: Students needing academic accommodations for a disability must first contact Ms. Rebecca Marin, Coordinator, Services for Students with Disabilities (214-768-4557) to verify the disability and establish eligibility for accommodations. They should then schedule an appointment with me to make appropriate arrangements. Religious Observance: Religiously observant students wishing to be absent on holidays that require missing class should notify me in writing at the beginning of the semester, and should discuss with me, in advance, acceptable ways of making up any work missed because of the absence. Excused Absences for University Extracurricular Activities: Students participating in an officially sanctioned, scheduled University extracurricular activity will be given the opportunity to make up class assignments or other graded assignments missed as a result of their participation. It is your responsibility to provide evidence of such activities and make arrangements with me prior to any missed scheduled examination or other missed assignment for making up the work. 2 COURSE OUTLINE (We may make some adjustments to the outline as we move along. All possible adjustments will be announced and explained in class) 1 - Introduction to Decision Making: Topics: Rationality; Bounded Rationality; Optimality; Heuristics and Mental Models 2 - Probability in Decision Making and Bayesian Updating Topics: Probability Assessment; Randomness; Base Rates and Regression to the Mean; Overuse of Casual Data; The Hot Hand and Causal Misattribution; Local Representativeness; The Conjunction Fallacy 3 – Judgment under Uncertainty, Information Integration, and Decision Making Tools Topics: Framing; Mental Accounting; Personal Risk Profiles; Prospect Theory; Timid Choices vs Bold Forecasts; The Inside vs. the Outside View; Decision Trees. 4 – Heuristics and Biases Topics: Cognitive Dissonance; Availability; Anchoring; Attribution; Fairness; Confirmation; Hindsight Bias; Reciprocation; Overconfidence; Good Decisions vs. Good Outcomes. 5 – Group Decision Making & Incentives’ Alignment Topics: Groupthinking; Cohersion, Persuasion and Incentives; Optimal Group Decision Making; Centralized vs Decentralized Decision Making; Rules versus Discretion. 6 – Interdependent Decisions and Strategic Behavior Topics: Game Theory; Nash Equilibrium; Prisoners’ Dilemma; Battle of the Sexes; Retaliation versus Collusion; Advertising Decisions, Pricing Decisions, Product Development; Patent Races. IMPORTANT DATES Oct. 8, Th. - MIDTERM 1 Nov. 12, Th. - GUEST SPEAKER: Dr. R. G. Koppl – Biases in Forensics Nov. 19, Th. - MIDTERM 2 3 COURSE READING LIST 1) Angler N. Route to Creativity: Following Bliss or Dots? The New York Times Sep 7, 1999 p. F1 2) Anonymous. Science and Technology: Look and feel; Irrational economics. The Economist. London: Apr 5, 2008. Vol. 387, Iss. 8574; pg. 97 3) Anonymous. Christmas special: Rethinking thinking. The Economist. London: Dec 18, 1999. Vol. 353, Iss. 8150; pg. 63, 3 pgs 4) Ariely, Dan. The End Of Rational Economics. Harvard Business Review. Boston:Jul 2009. Vol. 87, Iss. 7, p. 78-84 5) Belkin, L. The odds of that. The New York Times August 11, 2002, Sunday Late Edition. 6) Carley, W. M. Smoke Alarm: Crash of Swissair 111 Stirs Debate on When To Stick to Procedure Wall Street Journal, Dec 16, 1998, p. A1 7) Crovitz, L. Gordon. Information Age: Seeking Rational Exuberance, Wall Street Journal. (Eastern edition). New York, N.Y.: Oct 6, 2008. pg. A.17 8) Dreazen, Y.J. Behind the Fiber Glut - Telecom Carriers Were Driven By Wildly Optimistic Data on Internet's Growth Rate. Wall Street Journal Sep 26, 2002 p. B1 9) Eisenhardt, K. Speed and Strategic Choice: How Managers Accelerate Decision Making. California Management Review, Spring 1990, 32(3). 10) Farrell, Christopher. Is `Irrational' Exuberance Perfectly Rational? Business Week. New York: May 29, 2000. , Iss. 3683; pg. 172 11) Gladwell, M. The new-boy network: What do job interviews really tell us? The New Yorker, May 29, 2000. http://www.gladwell.com/2000/2000_05_29_a_interview.htm 12) Gladwell, M. Connecting the Dots: The paradoxes of intelligence reform. The New Yorker, March 10, 2003. http://www.gladwell.com/2003/2003_03_10_a_dots.html 13) Gleick, J. Prisoner's Dilemma Has Unexpected Applications. New York Times, Jun 17, 1986. p. C1 (2 pages) 14) Gilbert, D. I'm O.K., You're Biased, New York Times; Apr 16, 2006; pg. C12 15) Groopman, J. What’s the Trouble? The New Yorker, January 29, 2007. http://www.newyorker.com/reporting/2007/01/29/070129fa_fact_groopman 16) Hayashi A. When to trust your gut. Harvard Business Review, Feb. 2001 pp.59-65 17) Hilts, P.J. In Forecasting Their Emotions, Most People Flunk Out. The New York Times, Feb 16, 1999, p. F2 4 18) Hotz, R. L. Testosterone May Fuel Stock-Market Success, Or Make Traders Tipsy. Wall Street Journal, April 18, 2008, p. B1. 19) Klayman, J. Not Beyond Repair: How Organizational Practices Can Compensate for Individual Shortcomings. The University of Chicago graduate School of Business, September 2004. https://www.chicagobooth.edu/capideas/sept04/notbeyondrepair.html 20) Lo, Andrew W. Survival of the Richest, Harvard Business Review. Boston:Mar 2006. Vol. 84, Iss. 3, p. 20-22 21) Lovallo, D., Kahneman, D. Delusions of Success: How Optimism Undermines Executives' Decisions. Harvard Business Review, July 2003, 56-63 Exuberance Is Rational; Or at least human. 22) Lowenstein, Roger. Exuberance is rational or at least human. New York Times. New York, N.Y.: Feb 11, 2001. p. SM68 23) McCartney, S. The Middle Seat: Pilots Go to `the Box' to Avoid Midair Collisions. Wall Street Journal, Jul 18, 2002, p. D3 24) Neel, Eric. “How Do You Know This Game Isn’t Rocket Science?” ESPN Conversation, Oct 22, 2008 http://myespn.go.com/s/conversations/show/story/3658571 25) NYTimes, Editorial. The Social Security Fear Factor. Jan 3, 2005; The New York Times pg. A14 26) NYTimes, Editorial. How to Retire Rich; Jan 16, 2005; The New York Times pg. C10 27) Russo, J. E., Schoemaker, P. J. Managing Overconfidence. Sloan Management Review, Winter 1992, 33(2) 28) Sharpe, P., Keelin, T. How Smithkline Beecham makes better resource-allocation decisions. Harvard Business Review, March April 1998, 45-57. 29) Schoemaker, Paul J H, Scenario Planning: A Tool for Strategic Thinking, Sloan Management Review; Winter 1995; 36, 2 30) Tversky, A., Kahneman, D. Judgment under Uncertainty: Heuristics and Biases. Science 185(4157), Sep. 27, 1974, pp. 1124-1131 31) Waldholz, Michael. Computer 'Brain' Outperforms Doctors in Diagnosing Heart Attack Patients Wall Street Journal. (Eastern Edition). New York, N.Y.:Dec 2, 1991. p. PAGE B6B 32) Wayne, Angell. Rational exuberance. Wall Street Journal. (Eastern edition). New York, N.Y.: Jun 3, 1997. pg. A.22 5