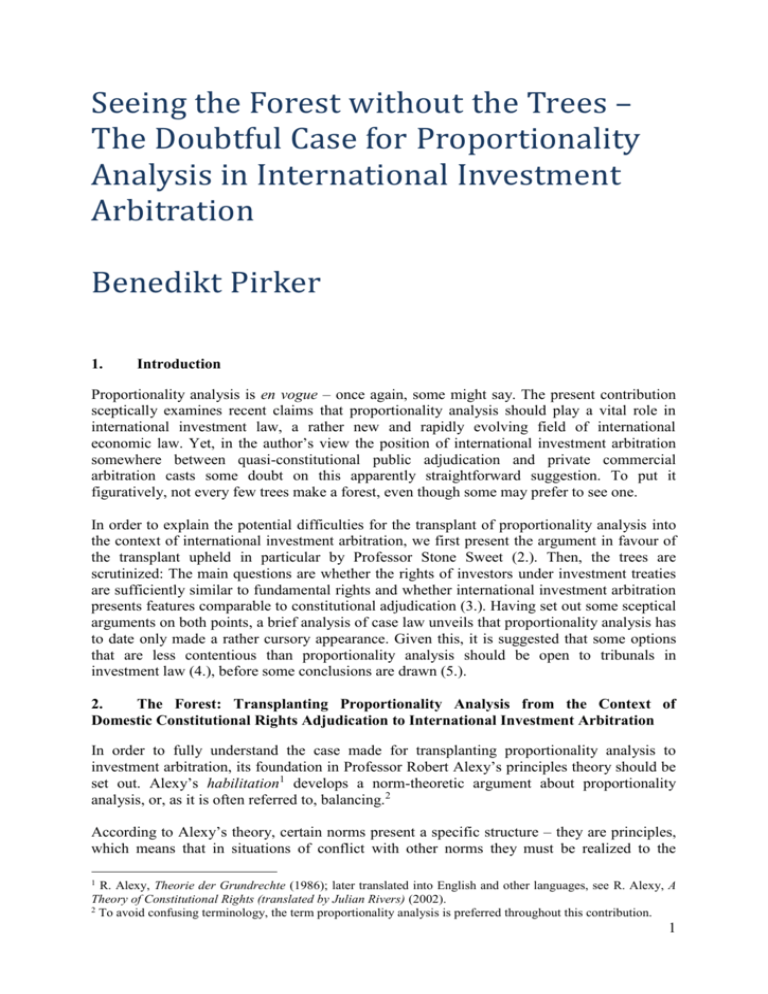

Seeing the Forest without the Trees –

The Doubtful Case for Proportionality

Analysis in International Investment

Arbitration

Benedikt Pirker

1.

Introduction

Proportionality analysis is en vogue – once again, some might say. The present contribution

sceptically examines recent claims that proportionality analysis should play a vital role in

international investment law, a rather new and rapidly evolving field of international

economic law. Yet, in the author’s view the position of international investment arbitration

somewhere between quasi-constitutional public adjudication and private commercial

arbitration casts some doubt on this apparently straightforward suggestion. To put it

figuratively, not every few trees make a forest, even though some may prefer to see one.

In order to explain the potential difficulties for the transplant of proportionality analysis into

the context of international investment arbitration, we first present the argument in favour of

the transplant upheld in particular by Professor Stone Sweet (2.). Then, the trees are

scrutinized: The main questions are whether the rights of investors under investment treaties

are sufficiently similar to fundamental rights and whether international investment arbitration

presents features comparable to constitutional adjudication (3.). Having set out some sceptical

arguments on both points, a brief analysis of case law unveils that proportionality analysis has

to date only made a rather cursory appearance. Given this, it is suggested that some options

that are less contentious than proportionality analysis should be open to tribunals in

investment law (4.), before some conclusions are drawn (5.).

2.

The Forest: Transplanting Proportionality Analysis from the Context of

Domestic Constitutional Rights Adjudication to International Investment Arbitration

In order to fully understand the case made for transplanting proportionality analysis to

investment arbitration, its foundation in Professor Robert Alexy’s principles theory should be

set out. Alexy’s habilitation1 develops a norm-theoretic argument about proportionality

analysis, or, as it is often referred to, balancing.2

According to Alexy’s theory, certain norms present a specific structure – they are principles,

which means that in situations of conflict with other norms they must be realized to the

1

R. Alexy, Theorie der Grundrechte (1986); later translated into English and other languages, see R. Alexy, A

Theory of Constitutional Rights (translated by Julian Rivers) (2002).

2

To avoid confusing terminology, the term proportionality analysis is preferred throughout this contribution.

1

highest degree possible.3 This is the process of ‘optimization’ which requires balancing taking

the shape of proportionality analysis. The opposing category of norms are so-called rules,

which are applied by the classic legal methodological tool of subsumption. They do not

operate according to the logic of optimization, but simply apply in a yes-or-no fashion.4 In

the case of subsumption, simple deduction operates: if a factual situation can be brought under

the conditions set out in the legal terms a norm, the legal consequences of the norm are

triggered. The balancing of principles, however, operates according to the scheme presented

by the principle of proportionality as developed in particular in German administrative and

constitutional law. This proportionality analysis encompasses three sub-tests: a first test of

suitability, a second test of necessity and a third test of proportionality stricto sensu.5 For

Alexy, constitutional rights typically enshrine a principle, which means that adjudication of

such claims implies necessarily the use of proportionality analysis, as can be seen in the vast

case law of the German Federal Constitutional Court.6

As other authors have provided highly accurate accounts of the characteristics of the

individual sub-tests, we can leave things at this rather basic stage. It suffices to state that a

vast literature has found that proportionality analysis offers both advantages and risks.

Advantages, because it gives great leeway to courts to assess, weigh and balance all

arguments on an equal footage without strict limitation by the text to be interpreted. 7 Risks,

because it calls for complex evaluations. In particular the third sub-test of proportionality

stricto sensu requires a determination of the abstract value of the principles at issue, their

concrete value in the specific setting of the case and a subsequent comparison between the

two mentioned variables determined for the two conflicting principles.8

More recent accounts have suggested that proportionality analysis is and should continue to

be used increasingly beyond the framework of adjudication of constitutional rights through

constitutional courts. Stone Sweet and Mathews have presented a broad comparative study

and identified various situations in which domestic, but also international adjudicative bodies

have adopted reasoning resembling proportionality analysis.9 Their understanding of

proportionality analysis appears quite pragmatic, as they consider it a useful ‘argumentation

framework’,10 a sort of legal test which allows courts to weigh arguments on an equal footing

against each other. Consequently, for Stone Sweet it should be the preferred option to resolve

3

Alexy, Theorie der Grundrechte, supra note 1, at 75.

See closer on the distinction ibid., at 88 ff.

5

See for a detailed account Alexy, ‘On Balancing and Subsumption. A Structural Comparison’, 16 Ratio Juris

(2003) 433, passim.

6

For more sceptical accounts of Alexy’s norm-theoretic account and the separation between rules and principles

see Poscher, ‘The Principles Theory: How Many Theories and What is Their Merit?’, in: M. Klatt,

Institutionalized Reason. Perspectives on the Legal Philosophy of Robert Alexy (forthcoming 2011), paper

available at http://ssrn.com/abstract=1411181, and Jestaedt, ‘Die Abwägungslehre – ihre Stärken und ihre

Schwächen’, in: O. Depenheuerand others (eds), Staat im Wort: Festschrift für Josef Isensee (2007) 253.

7

Alexy deems proportionality analysis thus a particularly rational legal procedure well-suited for constitutional

review of legislation in the light of constitutional rights, see Alexy, ‘The Construction of Constitutional Rights’,

4 Law & Ethics of Human Rights (2010) 19, at 26 ff.

8

See for a powerful criticism of proportionality analysis in the context of United States constitutional law

Aleinikoff, ‘Constitutional Law in the Age of Balancing’, 96 Yale Law Journal (1987) 943, at 972, who

emphasizes the difficulty of finding a ‘scale’ of comparison between competing values which would be

‘external’ to individual judges subjective convictions. See also closer on the problems of incommensurability

and valuation Sunstein, ‘Incommensurability and Valuation in Law’, 92 Michigan Law Review (1993-94) 779

and Schauer, ‘Commensurability and Its Constitutional Consequences’. 45 Hastings Law Journal (1994) 785.

9

See Stone Sweet and Mathews, ‘Proportionality Balancing and Global Constitutionalism’, 47 Columbia

Journal of Transnational Law (2008) 73.

10

Ibid., at 87.

4

2

rights conflicts also in international investment arbitration.11 A substantial part of the

argument is based on the potential of proportionality analysis to improve the often rather poor

reasoning which investment tribunals provide for their decisions.12 Other observers of the case

law have also welcomed this potential effect of proportionality analysis.13

At this point, we suggest that a more powerful justification for proportionality analysis is

needed than merely its potentially positive effect. One may already wonder whether the cure

for unsatisfactory reasoning and incoherent legal tests must necessarily be one specific legal

test, here proportionality analysis – other sophisticated legal tests may also do a better job

without entailing the difficulties connected with proportionality analysis. Linked to this are

also doubts on the strict separation between proportionality analysis and tests based on

subsumption suggested in Alexy’s account mirrored by Stone Sweet. In adjudicative reality,

there is probably rather a continuum of interpretative solutions between the two poles rather

than a sharp dividing line.14

Furthermore, from a separation of powers perspective proportionality analysis constitutes a

shift of power away from the legislative, norm-setting power towards the judiciary. It allows

the latter to reassess whether the former has found the appropriate balance between competing

claims. Why courts with their limited resources should be entitled to this exercise of power

has already been questioned in the context of domestic constitutional law.15 The argument

applies all the more in the context of international investment arbitration where a tribunal is

not part of an institutional setting based on a specific form of checks and balances, i.e. a

historically grown separation of powers. Such a tribunal’s decisions stand on its own and no

easy ‘reversal’ by means of legislation is possible if an erroneous judicial decision is taken.16

As a consequence, it is suggested that in order to justify the use of proportionality analysis

with its potentially far-reaching consequences in international investment arbitration, a close

look is needed as to whether the field of international investment law truly is framed as a

‘rights’ regime and as to whether international investment arbitration as the mechanism of

adjudication corresponds sufficiently in its rationale to constitutional systems of adjudication.

Only if the justification of proportionality analysis in the context of domestic constitutional

adjudication can be transferred to investment arbitration, its use can be considered justified.

To put it differently, only if we find a certain number of trees, we can legitimately speak of a

forest. The picture of the forest is appealing in the present context, because the inquiry can of

course only deliver a weighing of arguments and no sharp conclusion such as the full

Stone Sweet, ‘Investor-State Arbitration: Proportionality's New Frontier’, 4 Law & Ethics of Human Rights

(2010) 46, at 24.

12

Stone Sweet and Grisel, ‘Transnational Investment Arbitration: From Delegation to Constitutionalization?’, in:

P.-M. Dupuy, F. Francioni and E.-U. Petersmann (eds), Human Rights in International Investment Law and

Arbitration (2009) 118, at 131.

13

See e.g. Xiuli, ‘The Application of the Principle of Proportionality in Tecmed v. Mexico’, 6 Chinese Journal of

International Law (2007) 635, at 642 or Krommendijk and Morijn, ‘'Proportional' by What Measure(s)?

Balancing Investor Interests and Human Rights by Way of Applying the Proportionality Principle in InvestorState Arbitration’, in: P.-M. Dupuy, F. Francioni and E.-U. Petersmann (eds), Human rights in international

investment law and arbitration (2009) 422, at 442.

14

Poscher, supra note 6, at 29, demonstrates this point by examining closer the examples given by Alexy for

rules and principles, suggesting that both are rather extreme norms, while more typical norms expose both rulelike and principle-like elements.

15

See in United States constitutional law Aleinikoff, supra note 8, at 985-986.

16

See on this last point of errors in adjudication Kingsbury and Schill, ‘Investor-State Arbitration as

Governance: Fair and Equitable Treatment, Proportionality and the Emerging Global Administrative Law’, New

York University School of Law Public Law & Legal Theory Research Paper Series Working Paper (2009) No 946 1, at 39.

11

3

exclusion of proportionality analysis from the context of investment arbitration. Rather, the

arguments set out in the subsequent sections should serve as indicators for adjudicators

whether to lean towards one or the other side of the continuum between pure normsubsumption and full scale proportionality analysis.17

3.

The Trees: the Features of International Investment Arbitration

In order to make the subsequently uttered doubts on constitutional explanations of investment

arbitration more transparent, we provide a brief historical insight which shows that the

development of investment arbitration oscillates between two conflicting narratives (I.).

Before this background, the arguments on international investment arbitration as rights

adjudication (II.) and as constitutional adjudication (III.) become easier to understand.

A. A Brief History of International Investment Arbitration

The history of international investment law can be read in various ways. A first narrative

suggests a progressive development.18 The starting point is always a foreign investor suffering

undue treatment in a host state, often resulting in expropriation. In the old days of

international law, only the tool of diplomatic protection was available in such a situation. The

home state thus had to espouse the investor’s claim of violation to bring it before international

arbitration or the International Court of Justice. A wave of expropriations in the era of

decolonization provoked fear among investors and prompted capital-exporting states to the

increased conclusion of international treaties which should protect investments and ensure

that compensation had to be paid in cases of expropriation.19 These emerging ‘bilateral

investment treaties’ (BITs) such as the 1959 treaty between Germany and Pakistan still did

not contain provisions on investor-State dispute settlement, but served rather as political

documents providing for the continuation of diplomatic protection by means of a treaty. 20 The

subsequent increase of conclusions of bilateral investment treaties has been constant until the

early 2000s and has led to the impressive number of about 2676 BITs by the end of 2008.21

Later, as the second crucial development in a paradigmatic change the introduction of dispute

settlement provisions gave teeth to such treaties which were not necessarily initially foreseen

for the purpose of adjudication and interpretation.22 As central elements of the

institutionalization of international investment arbitration, BITs typically provided for the

general and prospective consent of the host state to arbitration and excluded the need to

exhaust local remedies.23 As a consequence, an investor protected by the provisions of a BIT

17

Conceptually, the picture of the number of trees for a forest is also appealing because it reminds us of the

concept of vagueness underlying the rather fictitious boundary between proportionality analysis and

subsumption. No one can say from what number of trees onwards exactly we may speak of a forest, as much as

no one can fully exclude or always prescribe proportionality analysis as a legal test. For conceptual insights on

vagueness and so-called sorites paradoxes see T. Williamson, Vagueness (1994), at 22 ff.

18

See for an opposition of the ‘progressive’ against the ‘conflictual’ account highly insightful Mills,

‘Antinomies of Public and Private at the Foundations of International Investment Law and Arbitration’, 14

Journal of International Economic Law (2011) 469, at 471 ff.

19

See on these expropriations Vandevelde, ‘A Brief History of International Investment Agreements’ 12

UCDavis Journal of International Law and Policy (2005-2006) 157, at 166, in particular footnote 52.

20

Waelde, ‘Interpreting Investment Treaties: Experiences and Examples’, in: C. Binder and others (eds),

International Investment Law for the 21st Century - Essays in Honour of Christoph Schreuer (2009) 724, at 748.

21

United Nations Conference on Trade and Development, ‘Recent Developments in International Investment

Agreements (2008-June 2009)’ UN Doc UNCTAD/WEB/DIAE/IA/2009/8 (2009), at 2.

22

Waelde, supra note 20, at 749.

23

Wouters and Hachez, ‘The Institutionalization of Investment Arbitration and Sustainable Development’, in:

M.-C. Cordonier Segger, M.W. Gehring and A. Newcombe (eds), Sustainable Development in World Investment

Law (2011) 615, at 618-619.

4

can – by consenting to arbitration – directly bring a claim against the host state before an

international arbitral tribunal assembled ad hoc for the dispute, without having to turn to local

courts or to ask for diplomatic protection of his or her home state.

This institutionalization was coupled with the increasing breadth of claims brought in

arbitration against host states and the increasing amount of case law which has more recently

seen a tendency of tribunals to rely on precedent. Following the ‘progressive’ narrative,

scholars have thus suggested that investment arbitration has undergone a process of

‘judicialization’24 and that it has gained a quasi-constitutional character because it subjects

host states’ power to regulate to the disciplines of investment law. 25 Investment law as a

discipline is, according to this first narrative, on a continuous path towards coherent, universal

standards of investment protection and the strengthening of the rule of law, enforced in this

process by the increasingly self-stabilizing mechanism of investment arbitration.26

Yet, a less straightforward reading is also possible. The development of BITs and investment

arbitration can also be understood as the entrenchment of one legal point of view against an

opposing position. The latter would not grant generous protection for international

investment, but instead foresee that states may very well provide for expropriation without

compensation and similar potentially harmful treatment for foreign investors based on their

national interest and economic sovereignty.27 Multilateral attempts to create norms of

investment protection have not without reason constantly failed, which is a testimony to the

opposition of such rather sovereignty-focused and more investor-friendly points of view.28

While the initial conflict setting could be described as North vs. South,29 more recently also

developed countries have started to reconsider their investment law policies in the light of the

constraints that are imposed on their regulatory sovereignty.30 The system of investment

arbitration is thus denounced in the second narrative as problematic because of its private

commercial arbitration features which are not suitable for the adjudication of public law

issues.31

To conclude, these two conflicting narratives suggest that also the topic of proportionality

analysis can be read in fundamentally two ways, depending on how the system of

international investment law with its fragmented regime of bilateral treaties and powerful ad

hoc arbitration is understood. A straightforward claim to use proportionality analysis in

investment arbitration as a quasi-constitutional system of adjudication must therefore be read

Schill, ‘System-Building in Investment Treaty Arbitration and Lawmaking’, 12 German Law Journal (2011)

1083, at 1088.

25

Newcombe, ‘Sustainable Development and Investment Treaty Law’, 8 Journal of World Investment & Trade

(2007) 357, at 366. An even stronger claim on the constitutionalization of investment law can be found in

Behrens, ‘Towards the Constitutionalization of International Investment Protection’, 45 Archiv des Völkerrechts

(2007) 153, passim.

26

See also for an account based on the concept of global administrative law Kingsbury and Schill, supra note 16,

passim.

27

See on these conflicting opinions concisely M. Sornarajah, The International Law on Foreign Investment

(2010), at 18. See also on the famous Calvo doctrine ibid., at 21.

28

E.g. the proposed International Law Commission project to codify a minimum standard of treatment for

foreign nationals in the 1950s, the failed 1967 OECD Draft Convention on the Protection of Foreign Property or

the collapsed negotiations of a Multilateral Agreement on Investment in the 1990s, see Mills, supra note 18, at

474.

29

As a powerful statement on the views of the newly independent countries after decolonization often the norms

enshrined in the New International Economic Order is referred to.

30

Mills, supra note 18, at 489.

31

G. Van Harten, Investment Treaty Arbitration and Public Law (2007), at 180 ff., has even gone as far as to

request the abandonment of the current system of investment arbitration and a return to permanent, public courts.

24

5

with caution. It operates well if we adopt the first narrative on the continuous development of

international investment law towards global standards ensured by an ever-better

institutionalized judiciary. Taking aboard the second narrative, however, a more

comprehensive and detailed assessment of the individual features of the system is needed to

give appropriate consideration to potential inconsistencies in that story.

B. The Nature of Investors’ Rights and Rights Conflicts in International Investment

Arbitration: Towards Property Rights Protection?

To assess the number of trees as initially set out, as a first step we must test the assertion that

the system of international investment arbitration serves to adjudicate rights claims

comparable to a domestic constitutional or international system of protection of human rights.

The crucial point of justification for proportionality analysis in such a system lies in the

argument of ‘virtual representation’. A priori there is no specific reason why courts should be

called to reassess a question of competing rights claims after the legislature or an

administrative decision maker has taken a measure. There can, however, be value to that

claim if certain important interests have been overheard in the legislative or administrative

decision-making process. A court would thus, through judicial review by means of

proportionality analysis, give such interests a second opportunity to be heard and taken into

account, at worst striking down the measure under review because it fails to consider certain

claims in an appropriate manner.32 The typical situation of constitutional law or international

human rights law would see a minority of persons suffering a violation of fundamental or

human rights because of a decision taken by a majority. The system of protection offered by

such virtual representation for certain highly important claims operates, however, by

definition in a subsidiary manner. If we take the example of the European Convention on

Human Rights (ECHR), judicial protection by the European Court of Human Rights (ECtHR)

is only granted as an additional, subsidiary check: Domestic remedies have to be exhausted

before an individual can turn to the (ECtHR),33 and the underlying rationale of the Convention

also points towards the subsidiary character of the system.34 The ECHR system appears thus

vested with a rather strong mandate for virtual representation of the rights it enshrines.

The tribunal in Tecmed has put international investment arbitration on similar conceptual

grounds when it referred to ECtHR case law and stated in the perhaps most explicit reference

to proportionality analysis in investment case law to date:

‘[I]n addition to the negative financial impact of such actions or measures, the Arbitral

Tribunal will consider, in order to determine if they are to be characterized as

expropriatory, whether such actions or measures are proportional to the public interest

presumably protected thereby and to the protection legally granted to investments,

taking into account that the significance of such impact has a key role upon deciding the

proportionality [...] On the basis of a number of legal and practical factors, it should be

also considered that the foreign investor has a reduced or nil participation in the taking

of the decisions that affect it, partly because the investors are not entitle [sic] to exercise

See e.g. Waldron, ‘The Core of the Case against Judicial Review’, 115 Yale Law Journal (2005) 1347, at

1402, who defends this function of judicial review in case of a failure of the democratic process of decisionmaking.

33

See Article 35(1) ECHR.

34

See the preamble of the ECHR which states that the rights enshrined in the Convention ‘are best maintained on

the one hand by an effective political democracy and on the other by a common understanding and observance of

the Human Rights upon which they depend’.

32

6

political rights reserved to the nationals of the State, such as voting for the authorities

that will issue the decisions that affect such investors.’35

At a practical level, one may already wonder whether investors as often locally influential

companies could only influence the decision-making process if they had the right to vote. But

even at a more conceptual level, there remain serious difficulties with the equation between

investors’ rights and human rights that seems to be established in Tecmed.

As a starting point, the very standards enshrined in BITs do not necessarily reach as far as

corresponding human rights provisions. Typical obligations on host states are national

treatment or fair and equitable treatment towards foreign investors, the latter constituting a

sort of international minimum standard of treatment and due process that should be respected

in all situations by host states. The corresponding provisions are typically broadly worded and

their interpretation requires the demarcation of a careful balance between investor protection

and legitimate regulation by the host state, but based on the text of BITs and not necessarily

on an assumption of proportionality analysis.36 BIT provisions on expropriation, on the other

hand, perhaps come closest to the content of a right to property, as they typically prescribe

compensation in the case of expropriation.37 Scholars have identified that a veritable ‘property

discourse’ has developed among investment tribunals.38

Yet, even if it is accepted that the latter standard could qualify as an equivalent to the right to

property, other difficulties remain.

Crucially, international investment arbitration does not offer access to justice in a way

comparable to human rights or constitutional rights adjudication. Individuals only may bring

claims before tribunals because of their capacity as investors, which requires them to have an

investment. While in substance claims may resemble human rights claims, in practice only a

small minority of economic actors enjoys additional protection and virtual representation of

their interests under a BIT.39 With this in mind, the justification for proportionality analysis as

virtual representation of minority interests ignored in a domestic legislative or administrative

process is significantly weakened.

Furthermore, also the rationale of subsidiarity of virtual representation set out for example in

the ECHR does not find its match in international investment protection. First, as mentioned

BITs frequently do not require the exhaustion of domestic legal remedies. They provide rather

for a shortcut to avoid the domestic judicial system altogether than for an additional safeguard

for particular rights claims.40

35

Tecnicas Medioambientales TECMED, SA v. United Mexican States, ICSID Case No ARB/AF/00/2, Award

(29 May 2003), at para 122. For references to ECtHR case law see the footnotes 140 and 141.

36

See on the difficulty to strike this balance with the mentioned two examples Miles, ‘Sustainable Development,

National Treatment and Like Circumstances in Investment Law’ and Kläger, ‘“Fair and Equitable Treatment”

and Sustainable Development’, in: M.-C. Cordonier Segger, M.W. Gehring and A. Newcombe (eds), Sustainable

Development in World Investment Law (2011), 265 and 241, respectively.

37

See also, though with mild reservations Paparinskis, ‘Regulatory Expropriation and Sustainable Development’

in M.-C. Cordonier Segger, M.W. Gehring and A. Newcombe (eds), Sustainable Development in World

Investment Law (2011) 299, at 323.

38

Lehavi and Licht, ‘BITs and Pieces of Property’, 36 Yale Journal of International Law (2011) 115, at 131.

39

Taillant and Bonnitcha, ‘International Investment Law and Human Rights’ in M.-C. Cordonier Segger, M.W.

Gehring and A. Newcombe (eds), Sustainable Development in World Investment Law (2011) 57, at 76-77.

40

See also Wouters and Hachez, supra note 23, at 635.

7

Second, the rationale of subsidiarity of instruments such as the ECHR is based on the

development of common standards of protection coupled with a project of political integration

which should emerge and be fostered by the judicial activity of the ECtHR.41 There is no

conceptual parallel in international investment law. BITs do not seem to aim for a minimum

standard of protection of political rights of investors or some political integration among the

various host states. On the contrary, the very fragmentation of international investment law in

a multitude of BITs and the ad hoc setting of dispute settlement institutions demonstrate that

international investment law is caught in the middle somewhere between claims for the

development of universal standards of investor protection by some states and disagreement

from other states, with the lines of the conflict continuously evolving, as has been discussed in

the previous historical section.

To sum up, some of the standards in BITs could thus at least conceptually be read in a similar

way to property rights as classic human and constitutional rights. However, the argument of

virtual representation that justifies the claim for judicial review by means of proportionality

analysis in the human rights and constitutional rights context is difficult to transpose to the

setting of international investment law. The latter only provides access to justice for some

privileged few in order to evade the domestic judicial system, and in addition there is hardly

any project of political integration visible which could justify subsidiary protection of

important interests as in the human rights context. If proportionality analysis were used in this

light, the resulting risk is an overemphasis on standards of investor protection without a

visible justification for such far-reaching protection as is granted to human or constitutional

rights.

C. The Nature of International Investment Arbitration: Caught Between QuasiConstitutional Adjudication and Commercial Arbitration

Having discovered rather thin vegetation testing the rights enshrined in BITs, we now turn to

the comparability of international investment arbitration with constitutional adjudication. The

most immediately striking feature is the setting of private commercial arbitration which

investment arbitration still exhibits, although the public law features of its substance have

already been highlighted. Many authors thus denounce that these features are inappropriate. In

particular, the confidential setting is criticized and more transparency during the proceedings

is called for.42 An even more problematic aspect is the low security of tenure that arbitrators

as adjudicators possess. They are chosen by the parties for each individual dispute, the

tribunal disappearing after an award has been rendered. Parties could of course choose

arbitrators based on their familiarity with the normative and factual situation surrounding a

particular dispute. In practice, however, the choice of arbitrators is heavily conditioned upon

the positions which the latter have taken earlier in their judicial activity or academic writings,

i.e. whether they have sided with host states or investors in the past. 43 Even ignoring issues of

independence of adjudicators,44 the problem arising for the use of proportionality analysis by

the arbitrators is a lack of ‘embeddedness’, of knowledge of the legal, political and social

41

This argument is also used by scholars to reject all too easy inspiration from ECtHR case law by investment

tribunals, see Alvarez and Khamsi, ‘The Argentine Crisis and Foreign Investors: A Glimpse into the Heart of the

Investment Regime’, in: K.P. Sauvant (ed), Yearbook on International Investment Law & Policy (2008-2009)

379, at 444-445, or Ratner, ‘Regulatory Takings in Institutional Context: Beyond the Fear of Fragmented

International Law’, 102 American Journal of International Law (2008) 475, at 500.

42

See e.g. Mills, supra note 18, at 485, or Wouters and Hachez, supra note 23, at 630.

43

Wouters and Hachez, supra note 23, at 628.

44

See concisely on this point Van Harten, ‘Five Justifications for Investment Treaties: A Critical Discussion’, 2

Trade, Law and Development (2010) 14, at 36-37.

8

context of a dispute. For an informed use of proportionality analysis, however, the

determination of abstract values of the rights concerned as well as the concrete determination

of the contribution brought towards a right or the negative impact upon it require a contextsensitive determination.45

Another point of concern frequently addressed by scholars who deny constitutional character

to the investment arbitration system is the potential fragmentation of the case law by a myriad

of independent tribunals deciding cases ad hoc without any coordinating instance. This setting

appears particularly troubling in light of the nature of the disputes which potentially limit host

states’ regulatory autonomy combined with the broadly phrased standards of most BITs,

which effectively lend to the activity of tribunals a ‘law-making’ quality.46

More recent contributions have, however, suggested that this effect is to some extent off-set

by the increasing role that precedent plays in the argumentation of investment tribunals. The

increasing amount of case law can exercise a stabilizing effect which supports the creation of

a system of international investment law.47 Simultaneously, based on this case law tribunals

rely more and more on precedent, citing each others’ awards and deviating from it only based

on a different argumentation, but not because of the fundamentally bilateral nature of the

underlying disputes.48 This shift in the ‘burden of argumentation’ encourages tribunals to

engage with each others’ case law49 and can lead to the formation of ‘normative expectations’

of how the case law will deal with future cases.50

Still, the equation with constitutional adjudication remains difficult, even if these claims of an

increasing consolidation of international investment arbitration are accepted.

The fact remains that there is both space for a perspective on investment law as a process of

‘global harmonization and systematization’, as well as an account which perceives the system

of BITs and arbitration rather as ‘essentially bilateral’ and ‘quasi-contractual’.51 The second

argument can be fleshed out by some additional features of international investment

arbitrations which defy the first perspective and simultaneously cast doubt on comparisons

between investment arbitration and constitutional adjudication.

The differing rationale of investment arbitration in comparison to constitutional or human

rights adjudication can be shown by a closer look at the consequences of a finding of violation

of a norm. If we take again the example of the ECHR, Article 41 of the ECHR prescribes that

in case of a violation, ‘if the internal law of the High Contracting Party concerned allows only

partial reparation to be made, the Court shall, if necessary, afford just satisfaction to the

injured party’. The range of possible consequences is large; first, it depends on the internal

law of the concerned state whether for example restitutio in integrum should be granted. Only

if internal law does not grant full reparation, the ECtHR will speak an award of damages,

which must, however, be shown to have been directly caused by the violation at issue.52 In

See on this point Burke-White and von Staden, ‘Private Litigation in a Public Sphere: The Standard of Review

in Investor-State Arbitrations’, 35 Yale Journal of International Law (2010) 283, at 336.

46

See on this point Schill, supra note 24, at 1092, and Burke-White and von Staden, supra note 44, at 336.

47

Wouters and Hachez, supra note 23, at 634.

48

Schill, supra note 24, at 1104.

49

Kleinlein, ‘Judicial Lawmaking by Judicial Restraint? The Potential of Balancing in International Economic

Law’, 12 German Law Journal (2011) 1141, at 1143.

50

Schill, supra note 24, at 1106.

51

Mills, supra note 18, at 480.

52

See instructive on this topic F.G. Jacobs, R.C.A. White and C. Ovey, The European Convention on Human

Rights (2010), at 44-45.

45

9

practice, thus, often a judgment contains mainly the declaration of violation and only awards

compensation for the cost of proceedings to the applicant. This feature points towards the

rationale of the ECtHR as a standard setter for the future, which should partly compensate

individuals for their losses, but simultaneously through its case law guide states behaviour for

the future.

In contrast, in international investment arbitration compensation is key to understand the

system’s political economy. The setting of investment arbitration is based on an ex post

declaration of a violation which then typically leads to an award of compensation for the

damages suffered. It is instructive to note that the question of whether investment tribunals

may prescribe other remedies than compensation has not met much interest. 53 In practice, BIT

violations are in most cases detrimental to the investment at issue and the investor usually

brings its claims before a tribunal after the termination of business activities in the host

country, which renders other remedies obsolete and of rather theoretical interest. This setting

can best be explained by the often cited obsolescing bargaining theory as an important

underlying economic rationale for the emergence of BITs. According to this theory most

prominently developed by Vernon there are conflicts of interest between the national interest

of the host state and the global interests of investors, typically multinational companies. Over

time, the power balance between the two parties shifts: Before the investment the company is

in a strong bargaining position, as the host state needs its investment of capital, technology,

expertise or other resources. After its investment the regulatory power of the host states gives

the latter a strong position which could lead to deteriorating regulatory conditions for the

company to the benefit of the rent-seeking host state.54 To reduce the latter risk for the

investor and sweeten the initial deal, BITs are added to the package of investment conditions.

They operate thus as a sort of insurance which strengthens the host state’s credible

commitment for future fair treatment of the investor.55 This insight helps to understand the ex

post perspective of international investment arbitration. In case of a breach of a BIT

obligation, investors do not aim for restitutio in integrum or are ask for guarantees of nonrepetition. They simply want to cash in the insurance premium granted to them by the BIT

and investment arbitration. This rationale is, however, difficult to compare to constitutional or

human rights adjudication, where the element of possible individual compensation is typically

combined with the development of generally applicable minimum standards of treatment,

which is again reflected in the mentioned characteristics of the remedies provided in such

legal regimes.

A further argument reinforces this point. As previously mentioned, a large number of BITs

remove the requirement to exhaust domestic legal remedies before turning to international

investment arbitration. This has been denounced as an over-inclusive standard: While the

usual justification advanced for such treaty clauses is that the allegedly biased domestic

judiciary of the host state should be avoided, in practice such a clause applies for both states

party to a BIT, thus including developed countries with high standards of administration of

justice.56 If we understand BITs, however, through the ‘insurance’ lens just suggested, one

could also read the relevant clauses as simply removing cumbersome obligations before a

claim for the insurance premium can be filed. This makes also sense taking into account the

53

See e.g. Sornarajah, supra note 27, at 412 ff., who dedicates a comprehensive chapter to the topic of

compensation for the nationalisation of foreign investments without paying similar attention to alternative

remedies for breaches of BIT obligations.

54

R. Vernon, Sovereignty at Bay: The Multinational Spread of U.S. Enterprises (1971); often also cited T.

Moran, Multinational Corporations and the Politics of Dependence: Copper in Chile (1974).

55

Lehavi and Licht, supra note 37, at 125.

56

Van Harten, supra note 43, at 34.

10

‘one way’ setting of investment arbitration, where only the investor can bring a claim, while

the host state is limited to a passive role.57

As a last point, observations on the effects of investment arbitration on domestic institutions

and the rule of law in the host state strengthen the ‘insurance’ perspective. It is often claimed

that the decisions of investment tribunals and the monetary sanctions imposed by them have

an impact on domestic decision-making at the legislative, administrative and judicial level,

i.e. that they create an incentive to improve domestic governance. 58 However, a dissenting

scholar draws a different picture, as far as judicial reform is concerned: The evasion from

domestic justice facilitated by BITs and their exclusion of the requirement to exhaust local

remedies in fact leads to a situation where improvement of domestic justice becomes much

less of a necessity. Judicial quality in a host state does not improve simply because courts are

less frequented, it even has less incentive to do so if investors as some of the most influential

players are offered alternative dispute settlement mechanisms and local political forces

accordingly see no need to engage in judicial reform.59

To conclude, a closer look at the institutional features of investment arbitration reinforces the

impression that comparisons to systems of constitutional or human rights adjudication are illsuited. With the economic features of investment arbitration prevailing, the system instead

seems to follow the logic of an insurance policy scheme which provides for ex post

compensation of investors in cases of BIT violations. These features of commercial arbitration

are admittedly to some extent countered by recent attempts at system-building by tribunals

relying on precedent. Yet, the focus of remedies on compensation and the rule excluding the

need to exhaust local remedies have been shown to support a reading of investment arbitration

as a system for the remediation of contractual breach situations rather than a system of

permanent adjudication aimed both at the remedial of concrete violations and the creation of

minimum standards for the future comparable for example to the ECHR.

4.

If not Proportionality Analysis, What Else? A Stroll Through the Grove

The previous two sections have reinforced the doubts on the use of proportionality analysis in

international investment arbitration. Neither the substantive obligations for host states

contained in BITs nor the system of investment arbitration seem to support it. If

proportionality analysis should thus be rejected, what could be an alternative test for

tribunals?

Looking at the case law, to date arbitral tribunals have not yet extensively engaged in

proportionality analysis. The previous quote taken from Tecmed, a case concerning an

expropriation measure for regulatory purposes, continues to be the most explicit reference.

But not only under the standard of expropriation has the case law at some points vaguely

pointed in the direction of various sub-tests of proportionality analysis.

The last years have seen less claims on expropriation and brought a new focus on the very

broadly phrased obligation of host states to grant ‘fair and equitable treatment’ to investors.60

Some elements of proportionality analysis seemed to appear at least between the lines when

57

Ibid., at 37.

See e.g. Schill, supra note 24, at 1085.

59

Ginsburg, ‘International Substitutes for Domestic Institutions: Bilateral Investment Treaties and Governance’,

25 International Review of Law and Economics (2005) 107, at 119.

60

A development already recognized by Schill, ‘Fair and Equitable Treatment under Investment Treaties as an

Embodiment of the Rule of Law’, 6 International Law and Justice Working Papers (2006) 1, at 2.

58

11

tribunals discussed the ‘reasonableness’ of the conduct of an administrative agency61 or the

weighing exercise undertaken between a host state’s interest in the stability of the financial

sector and an investor’s legitimate expectations in a stable regulatory environment.62

Under the obligation to grant national treatment to foreign investors, tribunals have generally

been open to examine whether less favourable treatment for foreign investors is based on

general regulatory policy or undue discrimination.63 To distinguish between the two cases,

tribunals have examined the difference in treatment as to whether it bears a ‘rational

relationship’ to legitimate government policies,64 in one instance even expressly using the

term of ‘proportionality’ for this relationship.65

Ultimately, some vague references to proportionality analysis can be found in the

interpretations of non-precluded measures clauses by arbitral tribunals. Typically, such

clauses permit emergency measures ‘necessary’ to tackle some urgent threat, which mainly

consisted in the case law of the economic crisis which Argentina faced in the early 2000s.

While many tribunals have opted for a restrictive interpretation based on the condition that

measures must be the ‘only means’ at disposal,66 one tribunal opted for a more relaxed

interpretation following a somewhat blurred necessity test,67 while another one even imported

the rather obscure ‘weighing and balancing’ formula adopted by the WTO Appellate Body.68

If tribunals thus have not yet fully opted for proportionality analysis and it is argued that they

should not do so, alternative approaches ought now to be scrutinized as to their suitability.

In a recent contribution, Burke White and von Staden have offered a comparative overview on

legal tests which could be applied by investment tribunals apart from proportionality analysis,

having uttered doubts on the latter because of the ill-suited position of investment tribunals

for such far-reaching balancing exercise.69

Reviewing WTO and ECHR law as well as United States and German constitutional and

administrative law, they find three other potentially applicable interpretative solutions: First,

tribunals could opt for a least restrictive means test as in WTO law.70 Second, a test based on

61

Pope & Talbot Inc. v. Government of Canada Merits, Phase 2, Award (10 April 2001) UNCITRAL (NAFTA),

at paras 123 ff.

62

Saluka Investments BV v. Czech Republic Partial Award (UNCITRAL Rules, 17 March 2006) 18(3) World

Trade and Arbitration Materials 166, at paras 304 ff.

63

See generally for a good overview over the case law DiMascio and Pauwelyn, ‘Nondiscrimination in Trade

and Investment Treaties: Worlds Apart or Two Sides of the Same Coin?’, 102 American Journal of International

Law (2008) 48, passim.

64

Pope & Talbot v. Canada (Merits, Phase 2), at para 79.

65

Parkerings-Compagniet v. Lithuania ICSID Case No ARB/05/8, Award (11 September 2007), at para 368.

66

A concise overview of the case law emerging subsequent to the Argentinean crisis can be found in Von

Staden, ‘Towards Greater Doctrinal Clarity in Investor-State Arbitration: The CMS, Enron, and Sempra

Annulment Decisions’, in: A.J. Bělohlávek and N. Rozehnalová (eds), Czech Yearbook of International Law Rights of the Host States within the System of International Investment Protection (2011) 207.

67

LG&E Energy Corp. v. Argentine Republic ICSID Case No ARB/02/1, Decision on Liability (3 October

2006), at para 257.

68

Continental Casualty v. Argentine Republic ICSID Case no ARB/03/9, Award (5 September 2008), at para

192. See on the conceptually obscure test developed by the Appellate Body Regan, ‘The meaning of 'necessary'

in GATT Article XX and GATS Article XIV: the myth of cost-benefit balancing’, 6 World Trade Review (2007)

347.

69

See already section 3.C and corresponding footnote 45.

70

Burke-White and von Staden, supra note 44, at 302-304.

12

the margin of appreciation doctrine used by the ECtHR could be adopted. 71 Third,

adjudicators could opt for deference and only review measures based on whether the host

state has acted in good faith, a standard used in domestic constitutional law.72

Their finding that pure good faith review is a rather weak standard and may not be sufficiently

stringent to provide adequate protection to investors is persuasive. More concerns arise on the

suggested use of the concept of a margin of appreciation. 73 The application of the margin of

appreciation requires a determination of the appropriate breadth for such a margin, which is

based on a ‘magnitude calculation’ of the weight of state public interests and investor rights at

issue and a subsequent step of proportionality analysis, which is, however, merely ‘residual’,

not ‘direct’.74 It appears doubtful why the very same problems identified for proportionality

analysis – i.e. the lack of ‘embeddedness’ of investment tribunals, their lack of knowledge

about the legal, political and social context of a host state – should be less of a concern under

a margin of appreciation doctrine. The concept requires the same weighing of public interests

and private rights that is operated in the framework of proportionality analysis, with the only

difference that it serves to adjust the standard of review for a subsequent proportionality

analysis rather than constituting the analysis itself. Not much seems to be won if the term

‘balancing’ is replaced with the more objectively sounding ‘magnitude calculation’.

On the opposite, Burke White and von Staden’s rejection of the least restrictive means

analysis seems unpersuasive. In such a test, a tribunal would compare alternative measures to

the one chosen by a host state to see whether the public interest furthered by the state’s

regulation cannot be furthered to the same extent by a measure which interferes less with an

investor’s rights. In Burke White and von Staden’s eyes, this necessarily comes down to a

‘second-guessing’ of domestic policy choices for which tribunals are poorly equipped.75

Yet, it could be argued that a deferent less restrictive means test could act as a mere additional

check on domestic policies, confronting governments in something like ‘Socratic

contestation’ with alternatives of action and requiring them then to justify the concrete

measure they have taken against the background of other possibilities.76 Arguably, such a test

could be sufficiently inclusive to sort out most measures which are unduly burdensome for

investors. A carefully balanced burden of proof for such a test would have to be combined

with appropriate strictness on identifying the contribution reached by the measure at issue, so

that not an overbroad range of measures qualifies as an alternative. Such a test could thus

achieve a satisfactory outcome in most cases and as a crucial advantage it avoids the

contentious topic of attributing weight to the conflicting interests of a case. Both the margin

of appreciation and proportionality analysis necessarily entail this difficult exercise which

raises most concern in the light of the features of investment arbitration set out previously.

5.

Conclusion

When in German law the famous principle of proportionality started to proliferate into

virtually all areas of constitutional and administrative law, concerned scholars have called for

71

Ibid., at 304 ff.

Ibid., at 314 ff.

73

Ibid., at 339 and 337-338, respectively.

74

Ibid., at 337-338.

75

Ibid., at 338.

76

See on the concept of ‘Socratic contestation’ and judicial review insightful Kumm, ‘The Idea of Socratic

Contestation and the Right to Justification: The Point of Rights-Based Proportionality Review’, 4 Law & Ethics

of Human Rights (2010) 140.

72

13

a ‘re-specification’ in order not to overexploit the principle.77 In a similar spirit, the present

contribution has suggested that a closer look at international investment arbitration indeed

reveals some trees, but to speak of a forest appears inappropriate. As a consequence, a more

careful interpretative solution has been proposed in order to strike a balance between the

rather incomplete standards of protection for investors set out in BITs and the hybrid system

of international investment arbitration. Transposing proportionality from the context of

domestic constitutional or international human rights adjudication does not sufficiently take

into account these differences. Consequently, proportionality analysis should be used with

caution if at all. Of course, future reforms of the current, much debated system of

international investment arbitration may alleviate some of the identified concerns.78

The term of ‘Respezifizierung’ has been used by Schmidt-Aßmann (quoted in Ossenbühl, ‘Maßhalten mit dem

Übermaßverbot’, in: P. Badura and R. Scholz (eds), Wege und Verfahren des Verfassungslebens: Festschrift für

Peter Lerche zum 65 Geburtstag (1993) 151, at 163). See for perhaps one of the earliest and most well-known

calls for caution with proportionality analysis P. Lerche, Übermass und Verfassungsrecht (1961).

78

See in this regard the Public Statement on the International Investment Regime from August 31 2010

(available at www.osgoode.yorku.ca/public_statement), signed by a large number of scholars who call for a

complete overhaul of the current system of investment arbitration.

77

14