73376 The World Bank Programmatic Non

advertisement

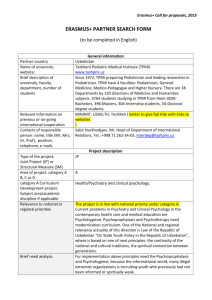

73376 The World Bank Programmatic Non-Lending Technical Assistance in Macroeconomic Analysis and Forecasting (TA-P117694-TAS-BB) For Republic of Uzbekistan 1. Objective 1. The programmatic non-lending technical assistance is aimed at strengthening the capacity of the experts and officials of the Government of Uzbekistan, specifically the Institute of Forecasting and Macroeconomic Research (IFMR), the Ministry of Economy (MOE), and other interested stakeholders in Uzbekistan (e.g. Center for Economic Research, CER), in economic analysis, forecasting, impact assessment of external shocks and anti-crisis policies and measures to address such impact so that economic development of Uzbekistan can be sustained. This is a follow-up to similar non-lending support for capacity building in the above areas delivered in FY09. 2. Context and Issues: 2. The global economy continues to weather the most difficult climate in generations. What began as a financial crisis in the United States and the United Kingdom quickly turned into the largest global recession in decades. There was a sharp decline in global growth and rise in unemployment with the external environment facing developing countries like Uzbekistan worsened. Uzbekistan faced slumping demand for its export products, both raw materials and manufacturing products, coupled with falling commodity prices and significant reductions in remittances, foreign direct investment, and generally more difficult access to finance for both companies and government. 3. Most governments have three objectives in their responses to the adverse impact from the global crisis: first, to protect growth by compensating for a reduction in demand especially from the private sector (consumers, investors and external) leading to declining outputs employment and income; second to provide social protection, income and employment creating support to the poor and most vulnerable group; and third to promote recovery and stronger economic growth. The Uzbekistan central authorities responded swiftly to the global developments by announcing a package of stimulus measures equivalent to about 4% of GDP that was adopted in phases in November 2008 through June 2009. The broad categories of Uzbekistan anti-crisis measures include: (i) Offer 100% government guarantees on all types of banking deposits of population; (ii) Directed credit on preferential rates to local enterprises via commercial banks; (iii) Tax cuts to SMEs; (iv) Stimulate housing construction and repair in rural areas, including for returning labor migrants; (v) Launch state program of rural development to increase agricultural (food stuffs) production for local and export markets in 2009-2011; (vi) Stimulate increase of production of non-food consumer goods for local market in 2009-2011; (vii) Public works on construction of new national roads; (viii) Mandatory cost cuts of local enterprises to increase international competitiveness; (ix) Widening of localization (import-substitution) program for 2009-2014; (x) Creation of Special Economic Zone "Navoi" to create new jobs and build export potential; (xi) Improve regulation of booming insurance services for businesses. 4. Towards this end, this proposed technical assistance will help the government to increase capacity of its staff for analyzing potential for external shocks and Uzbekistan’s vulnerability, understanding transmission mechanisms and likely impact, making forecasts that help to anticipate the problems ahead of time and to develop appropriate policies to deal with those impacts. In particular, the government wants to understand the channels that the global crisis is transmitted to Uzbekistan and to have analytical, modeling and forecasting tools to assess the impact of the global crisis on Uzbekistan’s economy, as well as to assess the impact of its anti-crisis measures. Given the gradual recovery projected for the global and regional economy, and the high degree of uncertainty about that recovery, the Government is keen to continue receiving non-lending technical support from the Bank in the above areas. 3. Audience: 5. The main clients/audiences for this TA are the Institute of Forecasting and Macroeconomic Research (IFMR) under the Cabinet of Ministers, and the Ministry of Economy (MoE) of Uzbekistan and possibly key stakeholders like the Center of Economic Research (CER). 6. This proposed technical assistance is a continuation of activities already completed in FY09.1 The IFMR and MoE requested the Bank to assist in introduction of analytical, modeling and forecasting tools to Uzbekistan officials and experts to enable them in better understanding the countries vulnerabilities to external shocks and assessing the impacts as well as devising and preparing for responses to such shocks as was experienced recently. The Bank staff and external consultants will work closely with counterparts in Uzbekistan to transfer relevant knowledge and tools to not only examine how vulnerable Uzbek economy is, but also offer concrete options and recommendations on “how to” move away from such vulnerability and how to sustain growth in the long-run. 4. Scope of Activities and Results Indicators: 7. According to the government’s request, the main activities of the TA will include three components/outputs: a. Analysis of transmission channels and effects of the external shocks to the Uzbekistan economy. The consultant will develop analytical tools that identify possible transmission channels of external shocks (global financial and economic crisis) and their impact to 1 Under this TA in FY09, the Bank supported the strengthening of business processes of IFMR, provided assessment of the current economic models used by IFMR and MoE in macroeconomic analyses and forecasting, familiarized the staffs with various models developed in World Bank to analyze long-term fiscal sustainability, created a unified cross-units database framework in IFMR for economic analysis and modeling, and established IFMR website. The Bank’s PREM team also prepared a paper “Uzbekistan Economic Report” in May 2009 to assess the impact of crisis on Uzbekistan and discuss Uzbekistan anti-crisis measures, and some emerging policy challenges and trade-offs. This paper, though, was not delivered to the government of Uzbekistan as in FY09 the government did not request from the Bank the assessment of economic vulnerabilities of Uzbekistan per se. 2 Uzbekistan’s economy. This could be (but not necessarily) built upon improving existing macroeconomic econometric models in IFMR. A draft Manual for IFMR staff on impact assessment techniques of macroeconomic shocks (crises) should be prepared. Finally, the consultant will conduct on-job training and round table discussions on “how to” use, maintain, update and adapt relevant economic models and tools. b. Assessment of the effectiveness of the government’s anti-crisis measures. The consultant will assist in developing and adapting general tools for assessment of effectiveness of Uzbekistan’s anti-crisis program. A draft Manual for IFMR staff on effectiveness assessment of government interventions into economy (e.g. anti-crisis measures of Uzbekistan) should be prepared. Finally, the consultant will conduct on-job training and round table discussions on “how to” use, maintain, update and adapt relevant economic models and tools. c. Facilitation of knowledge transfer of ‘Foresight’ Methodology tools of forecasting and programming of the transition to the innovation-driven economy and development of relevant policy measures to sustain the long-run growth. This component include: (i) transfer to IFMR of adapted Foresight Methodology, including “how to” tools for establishing expert panels, creation of initial list of technologies, selection of criteria for technologies assessment, conducting their assessment by experts based on selected criteria, and creation of final list of critical technologies; and (ii) on-job training and round table discussions for IFMR and MoE staff on the Foresight Methodology. 8. The following indicators can be used to evaluate the results of the TA: - - Increased capacity of IFMR to assess impact of crisis, including progress towards a draft Manuals for IFMR staff on impact assessment of macroeconomic shocks (crises) and anti-crisis measures are prepared and on-job training and discussions conducted. All training presentations/outputs from this non-lending TA are available in local languages and posted on the IFMR website that was earlier developed under this TA in FY09 with easy access to all officials and experts in the Government. 5. Consultations with Client and Other Stakeholders: 9. The scope of activities described above is based on the Bank’s recent consultations about the most desirable focus for Bank’s TA program for FY10 with the IFMR, MoE, and with development partners supporting the IFMR in these areas. 10. The general thrust of advice received during these consultations was to focus the Bank technical assistance on the most urgent practical policy issues that not covered by development partners, i.e. drafting Manuals for IFMR staff on impact assessment of macroeconomic shocks (crises) and on effectiveness assessment of government anti-crisis measures; and knowledge transfer of Foresight Methodology and tools to IFMR for identifying priority technology development to sustain the long-run growth in Uzbekistan. 3 11. During the consultations with development partners it was generally agreed to organize joint training activities, where possible and relevant, to share costs and achieve synergy effects of the technical assistance programs among the Bank, UNDP, and GTZ. 12. Client ownership of the proposed activities is evident in the close collaboration the Bank has had with IFMR and MoE experts during the last year, and during discussion of activities for under this TA for this year. It has the full support by First Deputy Minister of Economy that is interested in TA outputs. 6. Resources and Team: 13. The IFMR has planned some research activities under components 13 a, b, and c as outlined in its research plan for 2010-11, and has a budget grant financing for this research. Developing partners (UNDP and GTZ) do not envisage resources for these particular tasks as formulated in components 13 a, b, and c. That is why this TA is planned to hire international consultants for these TA components. The Bank’s task leader will pursue general management of this TA and oversight of consulting activities. 14. The administrative budget (BB) for this technical assistance is approximately 100,000 USD for FY2010. No trust fund financing is envisaged for this TA. 15. The team will comprise of mainly the TTL and consultants. The peer reviewer will be Christos Kostopoulos, Senior Economist, EPOLPS. 7. Timetable: Discussion of concept TA with IFMR, MoE, and development partners: February-March, 2010 Concept Note date: April 12, 2010 Phased Delivery to client: April – Sept, 2010 4