To view this press release as a file

advertisement

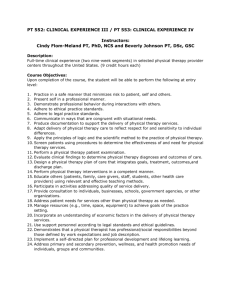

BANK OF ISRAEL Office of the Spokesperson and Economic Information July 29, 2015 Press Release Research: Through what channels does the exchange rate impact on inflation? Imported goods and services make up 27.5 percent of the consumption basket used to calculate the Consumer Price Index (CPI)—16.6 percent of the basket is made up of imported final products and 10.9 percent is made up of imported production inputs. The share of the tradable component of the CPI in the overall index is around 35 percent, and—as it is calculated in the research—serves as an estimate of the total impact of the exchange rate on the CPI (the transmission from the exchange rate to the CPI). The share of imported components varies between industries. For example, their share in the clothing industry is 87 percent, while it is 32 percent in the food industry. The per-industry data may, for example, help to understand how imposing customs duties affects different industries. The calculations noted are carried out in Israel for the first time, made possible by the adoption of a unique methodology. This method is based on input-output tables and aligning them with the CPI components. New research by Dana Orfaig of the Bank of Israel Research Department examines the transmission from the exchange rate to the Consumer Price Index (CPI) through a precise calculation of the tradable component in the various industries and its contribution to the overall CPI. The method used in the research allows the calculation, for the first time in Israel, of the share of the imported component of the CPI. The study’s findings indicate Bank of Israel - Research-Exchange rate impact on inflation (Dana Orfaig 2015) Page1 Of3 that the share is 27.5 percent, of which 16.6 percent is made up of final products and 10.9 percent are made up of imported production inputs. As Table 1 shows, the methodology developed in the current research also allows the calculation of those shares in the various industries. To illustrate, the share of imported products in the clothing industry is 87 percent, and in the food industry it is 32 percent. The exchange rate does not only impact on prices of imported products in the CPI but also on other products that can be traded between countries, including items that are not imported but that serve as substitutes for imported products, and items that are sold to the domestic market but that can be exported. Such products, together with the imported products, form the tradable component of the CPI, and according to the research its share in the overall CPI is around 35 percent. The share of the CPI’s tradable component, as calculated in the research, serves as an estimate of the extent of the transmission from the exchange rate to the CPI—assuming that in the long term there is full transmission from the exchange rate to the prices of tradable products. The research calculates the share of the tradable component with a high level of precision relative to previous research. The calculation method takes into account that each product in the final consumption basket is made up of a tradable component and a nontradable component—the price of an imported product incorporates domestic components, such as marketing and storage, and the price of a domestically produced item incorporates imported production inputs. The research makes use of detailed quantitative data from input-output tables published by the Central Bureau of Statistics. The tables provide information on the production inputs and the various uses of 159 industries. Those industries were classified in the current research into CPI components. This method is different from those used in previous research, among other things because those studies analyze the transmission by estimating inflation equations, or alternatively by dividing the CPI into tradable and nontradable components through a method that is not based on quantitative data. Bank of Israel - Research-Exchange rate impact on inflation (Dana Orfaig 2015) Page2 Of3 The research may contribute to the formulation of monetary and fiscal policy. For monetary policy, which primarily aims to maintain the inflation target, there is considerable importance to a fundamental and structural understanding of the manner in which monetary policy impacts on inflation through the exchange rate. In addition, the research allows analysis of the sources of inflation, due to the precise distinction between its domestic component and its external component (which is affected by foreign factors). With regard to fiscal policy, the per-industry data will be able to assist in understanding how imposing customs duties impacts each industry. Table 1 The share of the tradable component and its constituent parts in industries 1 Agricultural output Food, drink, and tobacco Wood and wood products Clothing and textile products Footwear and leather, rubber and plastic products Chemical products and petroleum products Metal products, machinery, transport equipment and electrical items Imported final products Imported production inputs Total imported component of industry Import substitutes Goods that can be exported Total tradable component of industry Industry’s share in overall CPI Contribution of tradable component in industry to overall CPI 6 5 11 5 14 27 3 0.8 16 19 32 6 0 36 12 4.3 30 30 51 4 0 53 1 0.7 79 40 87 100 79 100 3 2.9 87 35 92 100 25 100 1 1.4 47 52 75 39 51 92 7 6.5 69 29 78 71 79 99 7 6.5 Various industries Construction and housing services 38 65 78 20 71 95 2 2.2 1 4 5 2 0 7 25 1.8 Water and electricity Communications, travel, etc. 0 22 22 0 0 22 4 0.8 12 21 30 21 25 59 9 5.0 Taxes and insurance 3 9 12 0 0 12 6 0.7 Public services 3 7 10 0 0 10 9 0.9 Personal services 0 3 3 0 0 3 7 0.2 Hospitality services 0 4 4 0 0 4 3 0.1 Business services Total shares of the tradable component in overall CPI 1 7 8 0 7 15 1 0.2 35.10 1 The figures in each row are not combined using simple addition. The specific method used is discussed in the research paper itself. Bank of Israel - Research-Exchange rate impact on inflation (Dana Orfaig 2015) Page3 Of3