Instructions for prices exercises

advertisement

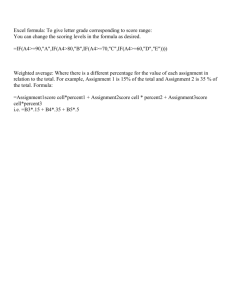

Energy Prices and Taxes: Exercises Info: Open the file Prices_Exercises.xlsb. Your boss has given you an assignment. He needs you to prepare a comparison of prices in your country versus other countries. To do this he has asked you to calculate average prices according to the IEA methodology, using the IEA energy prices and taxes questionnaire. He has given you the data that are available in your department and your task is to use this data to fill out the IEA questionnaire correctly. Fill in the cells that are highlighted in orange. If you put the correct number - or equation that gives the correct number - into a cell, the cell will be highlighted in green and in red otherwise. Exercise PRICES.1: Click on the worksheet labelled Exercise PRICES.1 Some data from the energy regulatory office are given. These data can be used to complete the table with electricity prices and taxes for 3Q2014 for both industry and households. Here are some clues to start your investigation: * What are the differences between total prices for households and for industry? * What is included in the ex-tax price? * Which units should be used? Exercise PRICES.2: Click on the worksheet labelled Exercise PRICES.2 Some data for the two major companies that sell electricity in STATISLAND is given, together with the taxes applying in that year. You should use these data to complete the table with the average electricity prices and taxes for 2014. Here are some clues to start your investigation: * Calculate the average prices of the two companies. * Calculate a weighted average of the VAT rate to account for the rate change during the year. February 2015 Exercise PRICES.3: Click on the worksheet labelled Exercise PRICES.3 At the top you will find some information about petrol pump prices, as well as taxes and consumption data. You should use this to complete the table with prices and taxes for 4Q2014 and 2014. Here are some clues to start your investigation: * Start with the total price for non-commercial users and work backwards to get the ex-tax price (follow the “road map” if you need extra help). * Consider rebates when calculating taxes for commercial users. * The customs data will allow you to calculate a weighted average price for 2014 for commercial users. Remember that weights should have the same units. * Use the hints! Exercise PRICES.4: Click on the worksheet labelled Exercise PRICES.4 In this sheet you will find information about natural gas consumption and spending by households, industry and power plants. You should use this information to complete the table with prices and taxes for the four quarters of 2014 for households and for the year 2014 for households, industry and electricity generation. Here are some clues to start your investigation: * For natural gas it is important to consider the units and gross/net calorific values. * Use rows 27 to 35 for your workings to convert everything to the standard units. * Follow the road map if you need extra help. * Use the hints! February 2015 Exercise basics: Relationship between the measures • Total Price = Extax Price + Total Tax • Total Tax = Excise Tax + Vat Amount • VAT Amount = (ExtaxPrice+Excise Tax)*(VAT Rate) • Total Price = Extax Price + Excise Tax + [(ExtaxPrice+Excise Tax)*(VAT Rate)] Please note: • Ex-tax price = wholesale price + profit margin + charges • Excise tax = all taxes except VAT • VAT is usually given in % and • Industry does not pay VAT • Sometimes households do not pay Excise Tax (in one exercise here...) If only the Total price is surveyed, you need to work backwards • Extax Price = [Total Price / (1 + VAT%)] – Excise Tax • VAT = [Total Price – (Total Price / (1 + VAT%)] Average prices (weighted and unweighted) • Basic end-use prices: Total average prices = Sum (all revenues) / Sum (all quantities sold) (or equally) = Sum (expenditures) / Sum (all quantities consumed) February 2015 Dealing with cyclical demand: For example, heating oil is used more commonly during winter months Solution: Base the annual average price on a weighted average (by quarterly consumption) of the quarterly prices • Weighted average end-use prices: Weighted average prices = Sum (prices x quantities) / Sum (quantities) (e.g. annual from quarterly data) • Weighted average quantities: Weighted average calorific values = Sum (calorific values x consumption) / Sum (consumption) Weighted average VAT % = Sum (% x time periods) / Number of time periods (e.g. Jan.+Feb. at 15%, Mar. at 18% is calculated as [(15x2)+(18x1)] / 3) Pay attention to units!! • Mass = Volume (m3) x Density (kg/m3) • Standard m3 = Normal m3 x 1.055 • GCV amount = NCV amount / 0.9 (for natural gas) • 1 kWh = 3600 kJ • 1 MWh = 1000 kWh • 1 GWh = 1000 MWh • 1 000 litre = 1 m3 • 1 billion of currency (€) = 109 € Calculate quarterly results before calculating weighted average annual price from quarterly results. February 2015

![[Total Price / (1 + VAT%)] – Excise Tax VAT](http://s2.studylib.net/store/data/010217459_1-0decb076d9bc0b1d85948f57317150e0-300x300.png)