view comments - Cardiff Business School

advertisement

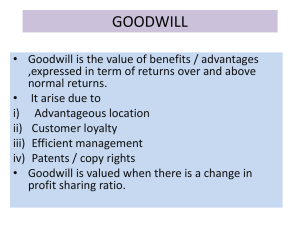

/ipa2012/prodNumFutdisc.doc 1.7.12 wordcount: 2792 The 10th Interdisciplinary Perspectives on Accounting Conference, 11-13 July 2012 Commentary on The Production of Numbers about the Future: The Case of Impairment Testing of Goodwill By JARI HUIKKU, JAN MOURITSEN and HANNA SILVOLA Discussant: Richard Macve, LSE Presentation: This paper gives a detailed account of the collective nature of the construction of the number for the ‘recoverable amount’ of the value of a Cash Generating Unit (CGU) that is needed under IAS 36 in order to determine whether, and if so by how much, the consolidated goodwill arising on an acquisition has subsequently become impaired, requiring a corresponding write-off against profits. Previous research has focussed (mainly quantitatively) on the association between goodwill impairment in accounts and stock price behaviour (before and /or after the write-down) and on analysing the incentives (including agency theory based motivations) for and against ‘truthful’ reporting vs. ‘earnings manipulation’, and the opportunities for the latter. But the value of goodwill must be an estimate about the future: so the production of a truthful number cannot be tested by comparison against any independently available reality—as its realization will only be in the future. Its authority as a reported number therefore relies instead on the process by which it is produced which the authors analyse as a process where [a] network of human and non-human actors produce numbers about the future. This process is a collective assemblage where many actors and many mediators (e.g. budgets, strategic plans, institutional analyses and guidelines) develop a process that is not understood as individual and subjective but as collective. No individual is responsible for the number’s production, except in the formal legal sense of the signatories to the accounts and the audit report (p.22). Individuals (who are often described as ‘bewildered’ in the face of the future uncertainties) gain their confidence in the final number from their participation in the network of surrounding actors, each contributing their own perspectives and (interests) to producing the final consensus outcome: and it is this process that then imbues the number with the ‘reliability’ and objectivity that external users of the accounts seek (albeit that analysts and the financial media may continue to challenge it----as may potential takeover bidders). The paper therefore draws on the sociology of the construction of ‘truths’ in markets and public life (e.g. Callon 1998; Latour 2005; Porter1996) and its main contribution 1 results from the access it has had to various of the participant actors in Finland (including senior academics, senior auditors, the Finnish Financial Supervisory Authority, senior company managers (especially CFOs), financial analysts and investors, and those in the financial media). This has resulted in recorded data from 44 semi-structured interviews with 48 interviewees and 10 follow-up interviews with 11 interviewees (51 hours in total). The findings are not subjected to any quantitative analysis but key quotations from interviewees are provided to illustrate the nature of the process at its various stages, through identification of CGUs, cash flow forecasts, estimates of WACC and the final reported valuation / impairment charge and how users /regulators assess and understand it. Discussion of Research Issues 1. In order to interpret the wider significance of these interesting reported views / experiences one needs to ask how far these are likely to be representative of other countries and companies, and of their organizational, institutional, regulatory, market and economic situations. Is Finland unique or even special? Its recent accession to the IFRS ‘goodwill impairment’ regime in 2005 (fn.1) may perhaps have made its actors more ‘bewildered’ than those with longer experience? But this would be a useful insight when considering ‘translation’ of IFRS to countries with even less experience of this kind of ‘Anglo-American’ accounting and auditing (e.g. Russia: Mennicken, 2008; China: Deng & Macve, 2012).1 Are certain types of companies excluded from the survey? Financial institutions such as insurance companies and banks have other significant uncertainties about the future that need to be estimated in respect of e.g. insurance liabilities and loan-loss provisioning. But they also have some specialist expertises available to them (e.g. actuarial) that may not be relevant to ‘ordinary companies’. On the other hand at the very least all companies are likely to need advice on key industry (including regulatory) and marketing factors, e.g. of their major competitors. Are all the relevant actors there: e.g. company NEDs and chairs of Audit Committees? (e.g. Beattie et al 2008)? (They are mentioned at p.18 but have not been interviewed.) Recognised goodwill (as contrasted with the ‘full value of the whole firm’— e.g. Bromwich et al 2010)) only arises in M&A. The likely need for and impact of any goodwill impairment is likely to be contingent on how long ago a group’s takeovers were made and whether they were made in boom or bust. [And if they were made before adopting IFRS those companies may not have needed to reinstate the goodwill on previous acquisitions leaving more scope for manoeuvre now.] So the empirical findings would be richer if they were analysed according to these and other potentially relevant differences. 2. Are all the named actors actually involved in the process of reaching the impairment number? No academics’ or journalists’ views are reported and those of analysts / investors are reported only as ‘readers’ of the numbers. That leaves corporate managers, auditors and the FIVA. The last also only really comes into 1 Mainland China (but not Hong Kong) still diverges from IRFS in respect of fair values, treatment of impairments and disclosures of ‘related party’ transactions (Deng & Macve, 2012). 2 the picture after the published numbers are scrutinised (p.18) although clearly they may thereby influence the process for future years (as may the comments of other ‘non-involved’ parties). Are we surprised, in such a difficult area where there are great uncertainties and potentially great conflicts of interest, that some ‘committee’ process, involving various levels of managers and of audit team members is undertaken to produce the reported numbers rather than it being the responsibility of any particular individual manager/auditor? ‘Committees’ are a universal solution to such problems. 3. ‘Non-human actors’ are identified as including ‘reports, surveys, calculations, regulations, and guidelines’ (p.23). But these are all produced in turn by other networks of humans; the difference is rather that to the reporting company they are already ‘objective’ and not available to be negotiated with as are those who identified as the ‘human actors’. So surely they are also human but ‘at a distance’. And even if the primary actors were acting wholly as individuals (e.g. just the CEO and the audit partner), rather than as the named representatives of the networks involved, they would surely also call on such disembodied sources in order to inform, or at least provide a defence for, their estimations. 4. The process by which the ‘network’ enables the individual actors to overcome their ‘bewilderment’ in the face of the uncertainties is clearly illuminated by the quotations reported. These include the need to draw on numbers already being used for making major decisions (p.12: cf. Macve, 2010a) and the need to ‘navigate around’ the accounting arbitrage opportunities provided by the standard’s definitions of CGUs (p.16). But given that there must not only be differences of views among, but also differences of interest between, the actors, including whose and how much reputation is to be put at stake by a potential impairment charge, there is a perhaps surprising absence of discussion (in the reports of the interviews) of conflicts and how they are resolved. Where is the illumination of how the final negotiation is arrived at, both among the managers and with the auditors, over how much the write-down should be? (As I understand it Beattie et al (2001) and Gill (2009) do address such issues generally in relation to audited accounts). Given the potential for such disagreements, and the significance of their consequences, the key practical issue for ‘actors’ must be ‘how does one get to have a place in this ‘network’, whose decision may determine the fate (and in particular the access to future capital and expansion opportunities) of one’s division, one’s company and of course oneself?’. 5. Accounting issues that merit further analysis include: how far is goodwill unique? The overall basis of so called ‘historical cost accounting’ is actually ‘recoverable cost accounting’ (e.g. Solomons, 1961) so the need to check for impairment (i.e. that the balance sheet amount is not greater than the value to be recovered through use or sale) applies all the way up from current assets (such as NRV of inventory and receivables); through tangible fixed assets; through other intangibles; as well as on the other side of the balance sheet to provisions; including e.g. pension liabilities, insurance liabilities and environmental liabilities which also involve very large amounts and great uncertainties over very long time-frames. Almost all of these are controversial. They all increasingly require estimates of present value 3 of future cash flows and, as has long been recognised, thereby all accounting involves ‘the future’ (e.g. Edey, 1970).2 So by what degree is goodwill ‘more uncertain’, remembering that in all cases one is only testing ‘one side’ by asking ‘is the value (for assets) still at least as much as in the balance sheet and (for liabilities) still no more than what is in the balance sheet?’? In the case of intangibles, if ‘new’ ones are being internally generated [but of course not allowed to be recognised as such] they can contribute to the value now being estimated for the previously purchased ones (including goodwill). Moreover, as the recorded goodwill only relates to companies acquired, judicious co-mingling of CGUs subsequently can also effectively allow the goodwill of the acquirer [unrecognised in the accounts] and of fellow-subsidiaries to become indistinguishable, thereby contributing to the valuation of the bit that is recognised. So perhaps impairment testing for recognised goodwill is actually easier than for some of the other individually identified assets and liabilities (especially where the stock-market is already indicating its concern about the company’s future and its overall value)? 6. One would therefore question the paper’s introductory framing of this issue as resulting from the IASB’s supposed drive towards ‘fair value’. FV may be particularly important for financial institutions, as well as having entered the standard setters’ conceptual discourse (Power 2010), but in practice, apart from financial instruments, FV is only applied to the allocation of the cost of an M&A takeover to the acquired subsidiary’s constituent assets (tangible and intangible) with the residual of this cost being labelled ‘goodwill’. In IFRS practice it may not even be the whole goodwill of the whole of the subsidiary as (diverging from the recent US standard) capitalisation of the goodwill relating to the non-controlling interest in a subsidiary is not required (although now optional under IFRS3). 7. The question that then arises here is ‘what is the value (to investors let alone to society) of the very resource-intensive (and therefore expensive) process to produce the one number for the value of goodwill and any impairment write-down that, as this paper documents, requires the participation of a large and everincreasing number of highly-paid professionals in their various roles?’. Why should investors and others rely on managers’ estimates (however well but necessarily subjectively ‘audited’ and ‘supervised’) of a ‘value’ which depends entirely on how successful their company will be in future? There is increasing doubt about the ‘decision usefulness of such one-number estimates (e.g. Blake et al; Penman). If so there must be other reasons why they have to be produced. This may be for contracting purposes where a single number is needed for ‘settling up’ on bonuses, dividends, covenants etc. More plausible is the increasing pressure, ever since the establishment of the SEC in the 1930s, to find a ‘sound’ conceptual basis for determining ‘profit’ via changes in ‘properly measured’ balance sheet equity (e.g. Macve, 2010b). But to whose advantage is it? The interviewed auditors may seek sympathy for the complexity and difficulty of their task (e.g. p.18): but that is what allows them to earn high fees from undertaking it, as well as allowing the regulatory supervisors, analysts, journalists and us academics to earn comfortable 2 And, at least in the UK, auditing firms have long been familiar with explicit calculations of the future through the profit forecasts published with IPO offerings. 4 livings from commenting on it. As Cicero would ask (following L. Cassius’s maxim): Cui bono? 8. This suggest that the present analysis could usefully be extended in the direction of exploring the institutional factors that have led historically to the present requirement for goodwill impairment reviews, and the involvement of related teams of expert professionals, starting with the option introduced by the ASB in FRS10 (Arnold et al., 1992) and then enforced through the subsequent (alleged) back-room deal between the SEC and leading corporates that removal of the requirement for goodwill amortization would be granted as the compensation for withdrawing ‘pooling of interests’ / ‘merger’ accounting which had allowed even rosier pictures to be painted of post- takeover ‘success’. IASB then presumably followed the FASB under the political pressures of the ‘convergence’ agenda.3 9. The paper also argues that understanding the uncertainties involved makes problematic Macintosh’s (2009) notion of the ‘Bullshitter’ as well as the literature on earnings management: managers themselves are uncertain of the numbers and so cannot play games that assume they known the ‘truth’ that they wish to conceal. But paradoxically it would seem that Bullshitting actually requires uncertainty as then one may be reasonably confident of ‘getting away with it’ and if necessary pleading ‘honest ignorance’. For example it might be useful to think about how would one decide which of the Generals on the two sides in a war were making a reliable prediction of who will win the war. Neither of them knows for sure: but neither can afford to admit they will lose. Any assessment is going to be in large part intended to motivate their own army and civilian people to support continuing the struggle—as well as to demoralize the enemy. It is similar for Governments in arguing for their economic policies. And in competitive markets top managers face similar pressures to deny ‘failure’ until it is clearly inevitable, or they want to ‘clear the decks’ of the legacy of a previous management (e.g. page 7). A large dose of such ‘organizational hypocrisy’ may be universally needed to ‘make the world go round’ (Brunsson 1989). This suggests that a widening of the scope of the paper to ask how accounting uncertainty differs (if at all) from other economic and political uncertainty would provide a stimulating framing to the empirical investigation that has been very successfully carried out. References (not already in the paper) Arnold, J., D. Egginton, L. Kirkham, R.Macve and K. Peasnell (1992) Goodwill and Other Intangibles (Research Board ICAEW: ISBN 1-85355-289-5), 93pp. Beattie, Vivien, Richard Brandt, Stella Fearnley (2001), Behind Closed Doors: What Company Audit Is Really About Palgrave 3 The UK ASB continued to argue on cost-benefit grounds that at least non-listed companies be allowed to continue ‘capitalization and amortization’ of goodwill. 5 Beattie, V. A., Fearnley, S. and Hines, T. (2008). Auditor/Company Interactions in the 2007 UK Regulatory Environment : Discussion and Negotiation on Financial Statement Issues Reported by Finance Directors, Audit Committee Chairs and Audit Engagement Partners. Technical Report. London: Centre for Business Performance (and subsequent book Reaching Key Financial Reporting Decisions: How UK Directors and Auditors Interact, (Wiley, 2011)) Blake, D. et al. (2008), An Unreal Number: How Company Pension Accounting Fosters an Illusion of Certainty, Pensions Institute. Bromwich, M., Macve, R. and Sunder, S. (2010). ‘Hicksian income in the conceptual framework’. Abacus, Vol. 46, No. 3: 348-376 Brunsson, N. (1989) The Organization of Hypocrisy: Talk, Decisions and Actions in Organizations, Chichester: Wiley. 242 pages Deng, S. and Macve, R. (2012) The origination and development of China’s audit firms: ‘translation’ meets self-determination, to be presented at 10th Interdisciplinary Perspectives On Accounting Conference, Cardiff, July 2012 Edey, H.C. (1970), ‘The Nature of Profit’, Accounting and Business Research, Vol.1, Winter, pp.50-5 Gill (2009): see e.g. Mennicken, A. (2012): Book review of Gill, Matthew (2009). Accountants’ Truth. Knowledge and Ethics in the Financial World (Oxford: Oxford University Press, 2009), British Journal of Sociology 63 (1): 189-190. Macve, R. (2010a). ‘The case for deprival value’. In ‘Wanted: foundations of accounting measurement’, EAA Symposium, Tampere 2009. Abacus, 46(1): 111-119. Macve, R. (2010b). ‘Conceptual frameworks of accounting: some brief reflections on theory and practice’. Accounting and Business Research, Vol.40. No.3: 303-308. Mennicken, A.M. 2008. ‘Connecting worlds: The translation of international auditing standards into post-Soviet audit practice’, Accounting, Organizations and Society, 33 (4/5, May-July): 384-414. Penman, S. (2010) Accounting for Value, Columbia Business School Solomons, D. (1961), ‘Economic and Accounting Concepts of Income’, The Accounting Review (July), 374-383. 6